Fillable Florida Quitclaim Deed Document

The Florida Quitclaim Deed is a vital legal instrument that facilitates the transfer of property ownership in a straightforward manner. This form is particularly useful when the grantor, the person transferring the property, wishes to relinquish any claim to the property without making any guarantees about its title. Unlike other types of deeds, the quitclaim deed does not provide any warranties or assurances regarding the property’s condition or its title, which means that the recipient, known as the grantee, must conduct their own due diligence. This form is commonly used in situations such as transferring property between family members, clearing up title issues, or during divorce proceedings. One of the key aspects of the Florida Quitclaim Deed is that it must be executed in writing, signed by the grantor, and typically requires notarization to be legally valid. Once properly executed and recorded with the county clerk, the deed serves as public notice of the transfer, providing a clear record of ownership. Understanding the nuances of this form can help individuals navigate property transactions more effectively and ensure that their interests are adequately protected.

Dos and Don'ts

Filling out a Florida Quitclaim Deed form can seem daunting, but with the right approach, you can navigate it smoothly. Here’s a list of things you should and shouldn't do to ensure your form is completed correctly.

- Do ensure that all names are spelled correctly. Accuracy is key to prevent future legal complications.

- Do include the legal description of the property. This is essential for identifying the specific piece of real estate being transferred.

- Do have the form notarized. A notary public must witness the signing to validate the deed.

- Do file the deed with the appropriate county clerk's office. This step is crucial for public record and legal standing.

- Don't leave any sections blank. Each part of the form must be completed to avoid delays or rejections.

- Don't use outdated forms. Always check for the most current version to ensure compliance with state laws.

- Don't forget to pay any applicable filing fees. These fees vary by county and must be settled when you submit the deed.

- Don't overlook the importance of consulting a legal professional if you're unsure. It's better to seek guidance than to make costly mistakes.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership of property from one party to another without any warranties regarding the title. |

| Use | Commonly used to transfer property between family members, in divorce settlements, or to clear up title issues. |

| Governing Law | The Florida Quitclaim Deed is governed by Florida Statutes, specifically Chapter 689. |

| Signature Requirements | The grantor must sign the deed in the presence of a notary public to make it valid. |

| Recording | To provide public notice of the transfer, the quitclaim deed should be recorded with the county clerk's office. |

| Tax Implications | While no documentary stamp tax is typically required for quitclaim deeds in Florida, it’s essential to check local regulations. |

| Title Issues | A quitclaim deed does not guarantee that the grantor holds clear title; it merely transfers whatever interest the grantor has. |

| Revocation | Once executed and recorded, a quitclaim deed cannot be revoked unilaterally; both parties must agree to any changes. |

| Limitations | It is not advisable to use a quitclaim deed for sales involving third parties, as it offers no protection against claims or liens. |

Key takeaways

A Florida Quitclaim Deed transfers ownership of property from one party to another without guaranteeing the title's validity.

Both the grantor (the person transferring the property) and the grantee (the person receiving the property) must be clearly identified on the form.

The property description must be accurate and detailed. This includes the legal description of the property, which can often be found on the property’s tax record.

Signatures are required from the grantor. If the grantor is a corporation or entity, an authorized representative must sign.

Consider having the deed notarized. While not mandatory, notarization adds an extra layer of authenticity and may be required by some counties.

After completing the form, it must be filed with the county clerk’s office where the property is located. This step is crucial to officially record the transfer.

There may be fees associated with filing the Quitclaim Deed. Check with your local county clerk’s office for specific amounts.

A Quitclaim Deed does not clear any liens or encumbrances on the property. The grantee takes on any existing issues with the title.

It is advisable to consult with a real estate attorney or a qualified professional if you have questions about the process or the implications of using a Quitclaim Deed.

Popular State-specific Quitclaim Deed Forms

Massachusetts Quit Claim Deed Form - For businesses, a Quitclaim Deed can simplify internal operations by clarifying property ownership among partners.

In order to create a comprehensive understanding of the operational dynamics of a limited liability company (LLC), it is essential to utilize the Texas Operating Agreement form, which is a crucial document that outlines the management structure and operating procedures of an LLC in Texas. This agreement serves to define the rights, responsibilities, and obligations of the members involved. By establishing clear guidelines, it helps prevent disputes and ensures smooth operations within the company. For reference, you can find a valuable resource at Texas Forms Online.

Idaho Quit Claim Deed Form - For individuals transferring property under specific circumstances, a Quitclaim Deed simplifies the process.

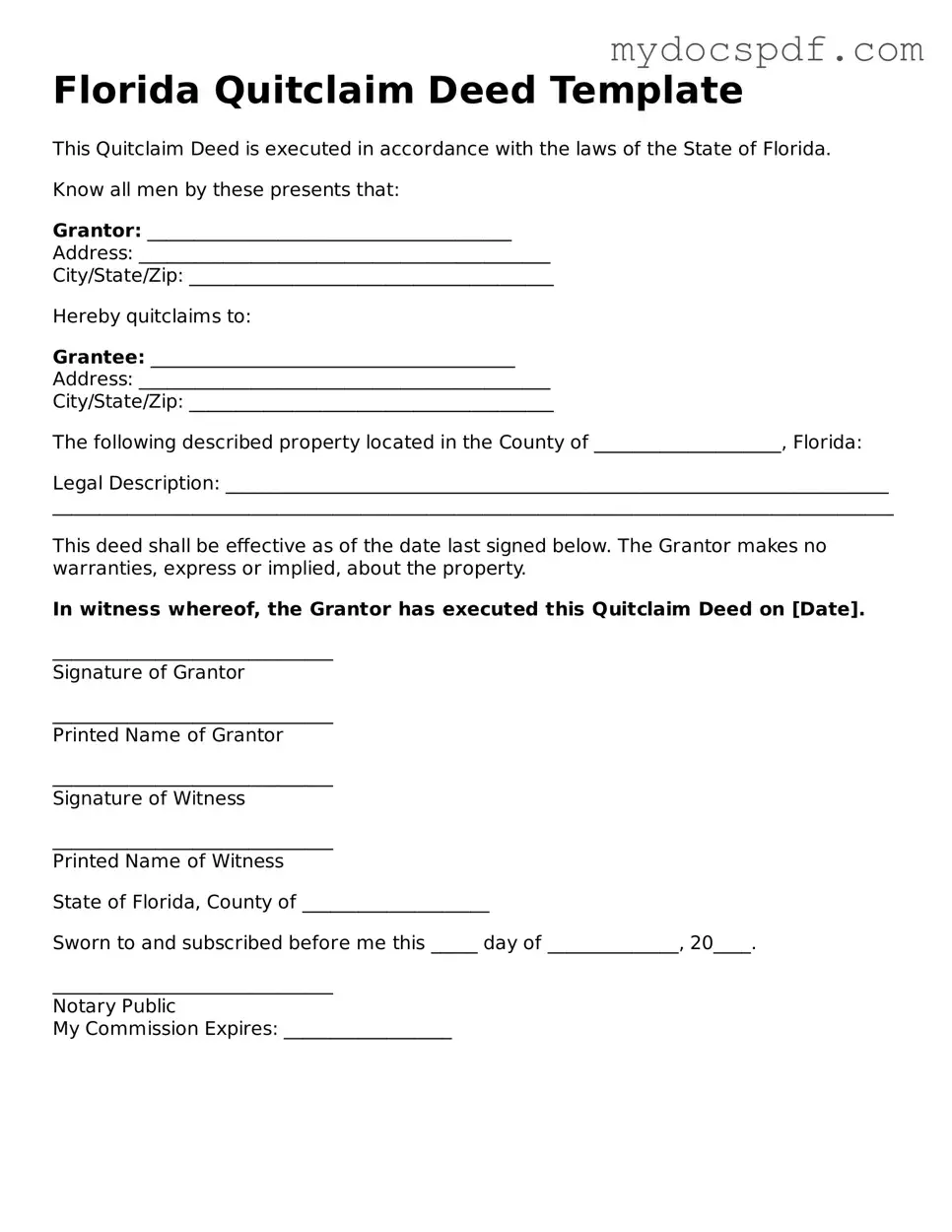

Example - Florida Quitclaim Deed Form

Florida Quitclaim Deed Template

This Quitclaim Deed is executed in accordance with the laws of the State of Florida.

Know all men by these presents that:

Grantor: _______________________________________

Address: ____________________________________________

City/State/Zip: _______________________________________

Hereby quitclaims to:

Grantee: _______________________________________

Address: ____________________________________________

City/State/Zip: _______________________________________

The following described property located in the County of ____________________, Florida:

Legal Description: _______________________________________________________________________

__________________________________________________________________________________________

This deed shall be effective as of the date last signed below. The Grantor makes no warranties, express or implied, about the property.

In witness whereof, the Grantor has executed this Quitclaim Deed on [Date].

______________________________

Signature of Grantor

______________________________

Printed Name of Grantor

______________________________

Signature of Witness

______________________________

Printed Name of Witness

State of Florida, County of ____________________

Sworn to and subscribed before me this _____ day of ______________, 20____.

______________________________

Notary Public

My Commission Expires: __________________

Detailed Instructions for Writing Florida Quitclaim Deed

Completing a Florida Quitclaim Deed form is an important step in transferring property ownership. After filling out the form correctly, it will need to be signed and notarized before being recorded with the appropriate county office. Follow these steps to ensure you complete the form accurately.

- Begin by obtaining the Florida Quitclaim Deed form. This can be found online or at your local county office.

- In the first section, provide the name of the grantor (the person transferring the property). Include their address as well.

- Next, enter the name of the grantee (the person receiving the property). Make sure to include their address as well.

- Describe the property being transferred. This typically includes the legal description, which can be found on the property’s deed or tax records.

- Indicate the consideration amount, which is the value exchanged for the property. This can be a nominal amount if the transfer is a gift.

- Sign the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- Once signed, make copies of the completed form for your records.

- Finally, file the Quitclaim Deed with the county clerk’s office where the property is located. There may be a recording fee, so check with the office for details.

Documents used along the form

The Florida Quitclaim Deed is a straightforward way to transfer property ownership. However, several other forms and documents are often used alongside it to ensure a smooth transaction. Here’s a brief overview of some of these important documents.

- Property Transfer Tax Form: This form is required to report the transfer of property and calculate any applicable taxes. It helps the county assess the value of the property for tax purposes.

- Affidavit of Title: This document confirms that the seller has the legal right to transfer the property. It provides assurance to the buyer that there are no hidden claims against the property.

- Title Insurance Policy: This policy protects the buyer from any potential issues with the property title that may arise after the purchase. It ensures that the buyer's ownership is secure.

- Sworn Affidavit & Proof of Loss Statement: This document is essential for warranty claims, ensuring that all necessary information is accurately presented; refer to the Sworn Affidavit & Proof of Loss Statement for the proper format and requirements.

- Closing Statement: Also known as a settlement statement, this document outlines all financial aspects of the transaction, including fees, taxes, and the final sale price. It provides transparency for both parties.

- Notice of Sale: This document is often filed with the county to officially announce the sale of the property. It serves as a public record of the transaction.

Using these documents alongside the Quitclaim Deed can help facilitate a clear and effective property transfer process. It’s important to ensure all necessary paperwork is completed to avoid any complications down the line.