Fillable Florida Promissory Note Document

The Florida Promissory Note form serves as a crucial financial instrument for individuals and businesses alike, facilitating the borrowing and lending of money under clear terms. This document outlines the borrower's promise to repay a specified amount of money, including details such as the interest rate, payment schedule, and maturity date. The form also includes provisions for default, outlining the consequences if the borrower fails to meet their obligations. Additionally, it often specifies whether the note is secured or unsecured, which can significantly affect the lender's rights in case of non-payment. Understanding the structure and components of this form is essential for both parties involved, as it ensures clarity and protects their interests throughout the loan process. By adhering to the guidelines set forth in the Florida Promissory Note, individuals can navigate their financial agreements with confidence and legal assurance.

Dos and Don'ts

When filling out the Florida Promissory Note form, it is important to follow certain guidelines to ensure accuracy and legality. Here are seven essential do's and don'ts:

- Do read the entire form carefully before filling it out.

- Don't leave any required fields blank.

- Do provide accurate information regarding the borrower and lender.

- Don't use ambiguous language that could lead to confusion.

- Do specify the repayment terms clearly, including interest rates and due dates.

- Don't forget to sign and date the document.

- Do keep a copy of the completed form for your records.

Following these guidelines will help ensure that the Promissory Note is valid and enforceable.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Florida promissory note is a written promise to pay a specified amount of money to a designated party at a future date. |

| Governing Law | The Florida Uniform Commercial Code (UCC) governs promissory notes in Florida. |

| Parties Involved | The note involves two main parties: the borrower (maker) and the lender (payee). |

| Interest Rate | Promissory notes can specify an interest rate, which can be fixed or variable, as agreed by the parties. |

| Repayment Terms | Terms regarding repayment, including the schedule and method, should be clearly outlined in the note. |

| Default Clause | Many promissory notes include a default clause, detailing what happens if the borrower fails to make payments. |

| Enforceability | For a promissory note to be enforceable, it must be signed by the borrower and include all essential terms. |

Key takeaways

When filling out and using the Florida Promissory Note form, consider the following key takeaways:

- Ensure all parties' names and contact information are accurate and complete.

- Clearly state the loan amount in both numerical and written form to avoid confusion.

- Specify the interest rate, if applicable, and outline how it will be calculated.

- Include the repayment schedule, detailing due dates and payment amounts.

- Identify the consequences of late payments, including any fees or penalties.

- Consider including a section for prepayment options, if the borrower may pay off the loan early.

- Make sure to sign and date the document in the presence of a witness or notary, if required.

- Keep a copy of the signed Promissory Note for your records, as it serves as a legal document.

Popular State-specific Promissory Note Forms

Georgia Promissory Note - Interest rates can be specified in the Promissory Note, defining how much additional money will be paid back.

Filing the New York Dtf 84 form is essential for any business undergoing an address change, and resources like newyorkform.com/free-new-york-dtf-84-template can provide valuable guidance in this process, ensuring that all updates are made efficiently and in compliance with state regulations.

Idaho Promissory Note Descargar - A promissory note solidifies a borrower’s intention to meet their financial obligations.

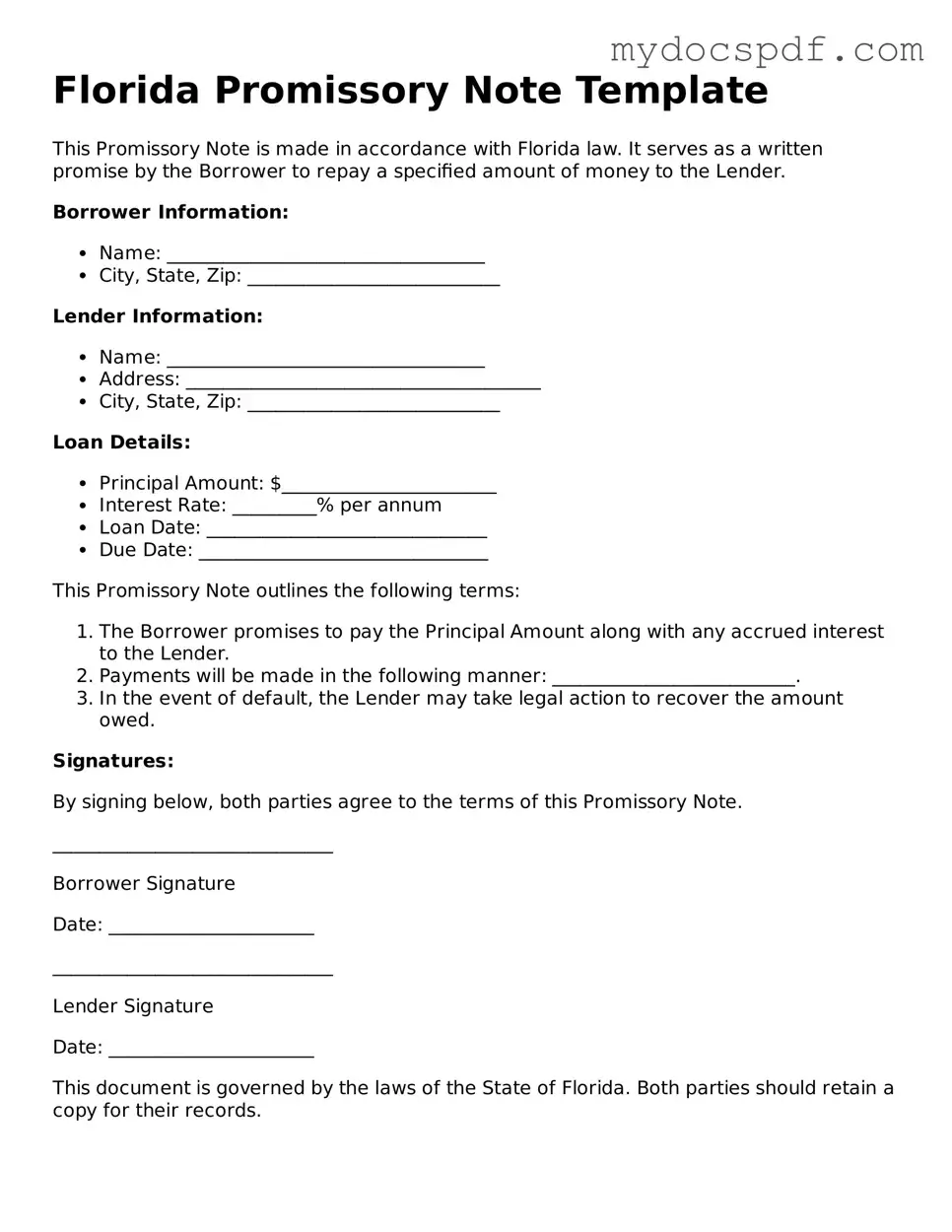

Example - Florida Promissory Note Form

Florida Promissory Note Template

This Promissory Note is made in accordance with Florida law. It serves as a written promise by the Borrower to repay a specified amount of money to the Lender.

Borrower Information:

- Name: __________________________________

- City, State, Zip: ___________________________

Lender Information:

- Name: __________________________________

- Address: ______________________________________

- City, State, Zip: ___________________________

Loan Details:

- Principal Amount: $_______________________

- Interest Rate: _________% per annum

- Loan Date: ______________________________

- Due Date: _______________________________

This Promissory Note outlines the following terms:

- The Borrower promises to pay the Principal Amount along with any accrued interest to the Lender.

- Payments will be made in the following manner: __________________________.

- In the event of default, the Lender may take legal action to recover the amount owed.

Signatures:

By signing below, both parties agree to the terms of this Promissory Note.

______________________________

Borrower Signature

Date: ______________________

______________________________

Lender Signature

Date: ______________________

This document is governed by the laws of the State of Florida. Both parties should retain a copy for their records.

Detailed Instructions for Writing Florida Promissory Note

Once you have the Florida Promissory Note form in hand, it’s time to fill it out carefully. This document serves as a written promise to repay a loan under specified terms. Completing it accurately is essential for both parties involved. Here’s how to fill it out step-by-step.

- Start with the date: Write the date on which the note is being created at the top of the form.

- Identify the borrower: Fill in the full name and address of the person or entity borrowing the money.

- List the lender: Provide the full name and address of the person or entity lending the money.

- Specify the loan amount: Clearly state the total amount of money being borrowed.

- Detail the interest rate: Indicate the annual interest rate that will be applied to the loan.

- Set the repayment terms: Outline how and when the borrower will repay the loan. Include details such as monthly payments, due dates, and the final payment date.

- Include any late fees: If applicable, specify any fees that will be charged if payments are late.

- Signatures: Both the borrower and lender must sign the document. Ensure that each party signs and dates the form in the designated areas.

- Witness or notarization: Depending on your needs, you may want to have a witness sign or the document notarized for added legal protection.

After completing the form, make copies for both the borrower and lender. This ensures that everyone has a record of the agreement. Keeping these documents organized is key to a smooth repayment process.

Documents used along the form

The Florida Promissory Note is a crucial document used in lending agreements. It outlines the terms under which a borrower agrees to repay a loan to a lender. However, several other forms and documents often accompany it to ensure clarity and protect the interests of both parties involved. Below is a list of these documents, each serving a unique purpose in the lending process.

- Loan Agreement: This document details the terms of the loan, including the amount borrowed, interest rates, repayment schedule, and any collateral involved. It serves as a comprehensive guide to the obligations of both the lender and the borrower.

- Security Agreement: When a loan is secured by collateral, a security agreement outlines the specific assets pledged by the borrower. This document provides the lender with rights to the collateral in case of default.

- Disclosure Statement: This document is required by law and provides borrowers with essential information about the loan, including the total cost, interest rates, and any fees. It ensures transparency in the lending process.

- Personal Guarantee: In some cases, a personal guarantee may be required, especially for business loans. This document holds an individual personally liable for the loan if the borrowing entity defaults.

- Amortization Schedule: This schedule breaks down each payment into principal and interest components over the life of the loan. It provides borrowers with a clear understanding of how their payments will affect the outstanding balance.

- Loan Payoff Statement: When a borrower pays off a loan, this document confirms the total amount required to settle the debt. It is essential for ensuring that all parties agree on the final payment amount.

- Default Notice: If a borrower fails to meet the terms of the promissory note, a default notice is issued. This document formally informs the borrower of their default status and outlines potential consequences.

- Release of Lien: Once a loan is fully repaid, a release of lien is issued to remove the lender’s claim on the collateral. This document is vital for the borrower to regain full ownership of the asset.

- Motorcycle Bill of Sale: This document is crucial for the sale and transfer of ownership of a motorcycle, providing evidence of the transaction and containing essential details about the buyer, seller, and the motorcycle itself. Properly completing this form can protect both parties involved in the sale, and you can find a template for it at Texas Forms Online.

- Assignment of Note: This document allows the lender to transfer their rights under the promissory note to another party. It is important for maintaining the flow of credit in the financial system.

Understanding these accompanying documents can significantly enhance the clarity and security of the lending process. Each document plays a pivotal role in protecting the rights and responsibilities of both the borrower and the lender, fostering a fair and transparent financial transaction.