Fillable Florida Loan Agreement Document

In Florida, the Loan Agreement form serves as a crucial document for individuals and businesses seeking to formalize a lending arrangement. This form outlines the terms and conditions of the loan, including the principal amount borrowed, the interest rate, and the repayment schedule. It also specifies any collateral that may secure the loan, providing protection for the lender in case of default. Additionally, the agreement details the responsibilities of both the borrower and the lender, ensuring that each party understands their obligations. By clearly defining these elements, the Loan Agreement helps prevent misunderstandings and disputes that may arise during the lending process. Furthermore, it often includes provisions for late payments, default consequences, and dispute resolution, making it a comprehensive tool for managing financial transactions in Florida.

Dos and Don'ts

When filling out the Florida Loan Agreement form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are some important dos and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do double-check all numbers and dates for correctness.

- Do sign and date the form in the appropriate places.

- Don't leave any required fields blank.

- Don't use abbreviations or shorthand in your responses.

- Don't rush through the process; take your time to ensure everything is correct.

Following these guidelines will help ensure that your Loan Agreement is processed smoothly and without delays.

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose | The Florida Loan Agreement form is used to outline the terms of a loan between a lender and a borrower. |

| Governing Laws | This agreement is governed by the laws of the State of Florida, specifically under Florida Statutes Chapter 687. |

| Key Components | Common elements include the loan amount, interest rate, repayment schedule, and any collateral involved. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

Key takeaways

When filling out and using the Florida Loan Agreement form, keep these key points in mind:

- Ensure all parties involved are clearly identified. This includes full names and contact information for both the lender and the borrower.

- Specify the loan amount and interest rate. Clearly state the total loan amount and the applicable interest rate to avoid misunderstandings.

- Outline repayment terms. Include details such as the repayment schedule, due dates, and any penalties for late payments.

- Include signatures. All parties must sign and date the agreement to make it legally binding.

Popular State-specific Loan Agreement Forms

Sample Promissory Note California - The loan agreement may include restrictions on additional borrowing.

For those looking to understand the nuances of ownership transfer, utilizing an informative guide about the ATV Bill of Sale can be incredibly helpful. This form serves as a vital record for all-terrain vehicle transactions and is essential for both parties involved. For more details, visit our page on the key aspects of the ATV Bill of Sale.

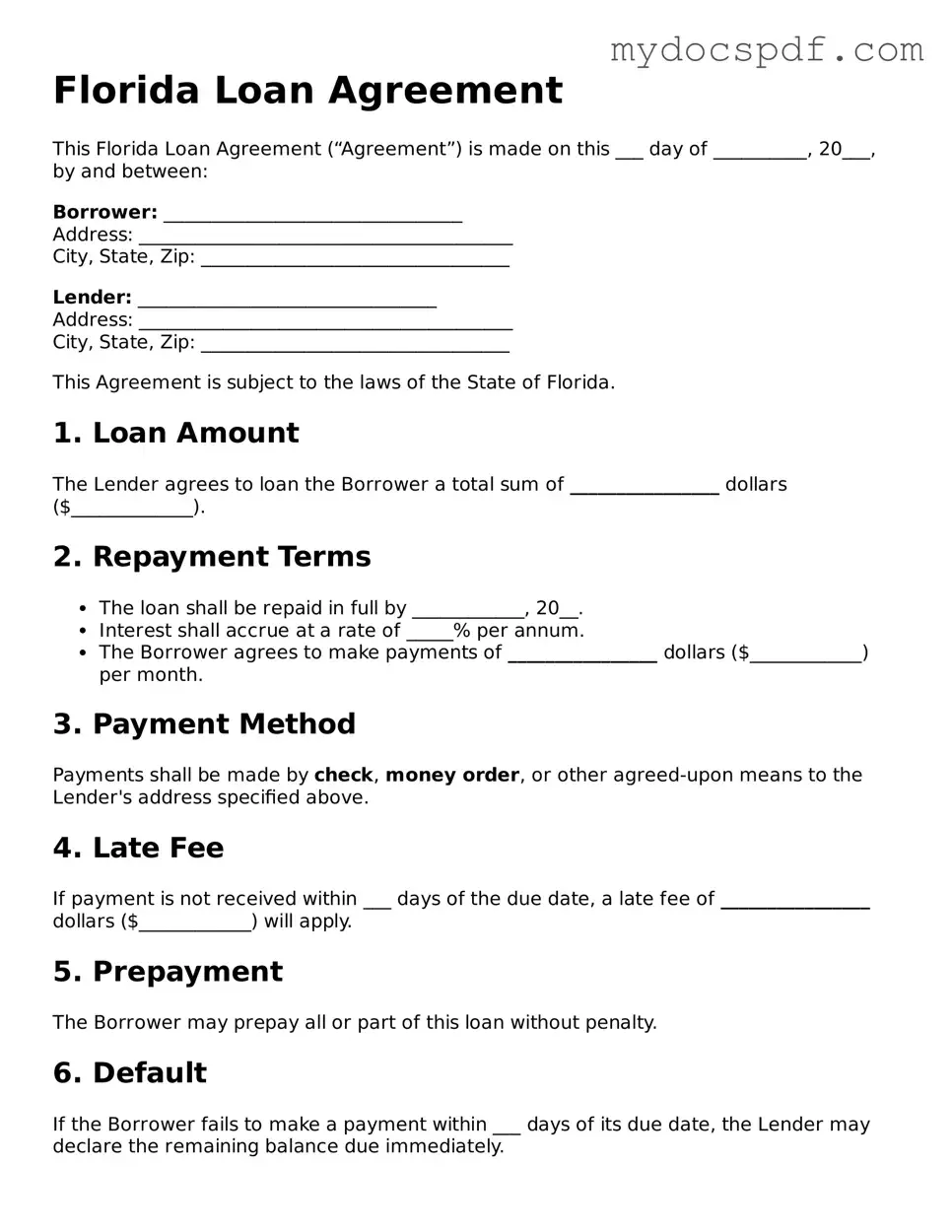

Example - Florida Loan Agreement Form

Florida Loan Agreement

This Florida Loan Agreement (“Agreement”) is made on this ___ day of __________, 20___, by and between:

Borrower: ________________________________

Address: ________________________________________

City, State, Zip: _________________________________

Lender: ________________________________

Address: ________________________________________

City, State, Zip: _________________________________

This Agreement is subject to the laws of the State of Florida.

1. Loan Amount

The Lender agrees to loan the Borrower a total sum of ________________ dollars ($_____________).

2. Repayment Terms

- The loan shall be repaid in full by ____________, 20__.

- Interest shall accrue at a rate of _____% per annum.

- The Borrower agrees to make payments of ________________ dollars ($____________) per month.

3. Payment Method

Payments shall be made by check, money order, or other agreed-upon means to the Lender's address specified above.

4. Late Fee

If payment is not received within ___ days of the due date, a late fee of ________________ dollars ($____________) will apply.

5. Prepayment

The Borrower may prepay all or part of this loan without penalty.

6. Default

If the Borrower fails to make a payment within ___ days of its due date, the Lender may declare the remaining balance due immediately.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Florida.

8. Signatures

By signing below, both parties agree to the terms outlined in this Loan Agreement.

_______________________________

Borrower Signature

Date: ________________

_______________________________

Lender Signature

Date: ________________

Detailed Instructions for Writing Florida Loan Agreement

After obtaining the Florida Loan Agreement form, you will need to complete it accurately to ensure all necessary information is provided. Follow these steps carefully to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Provide the full names and addresses of both the borrower and the lender in the designated sections.

- Specify the loan amount in numbers and words to avoid any confusion.

- Indicate the interest rate being charged on the loan.

- Fill in the repayment terms, including the payment schedule and due dates.

- State any additional fees or charges that may apply to the loan.

- Include any collateral that will secure the loan, if applicable.

- Both parties should sign and date the form at the bottom.

Once the form is completed, ensure that both parties retain a copy for their records. This will help maintain clarity regarding the terms of the loan agreement.

Documents used along the form

When entering into a loan agreement in Florida, several additional forms and documents may be necessary to ensure clarity and legality. These documents help outline the terms of the loan, protect the interests of both parties, and provide necessary disclosures. Below is a list of common forms used alongside a Florida Loan Agreement.

- Promissory Note: This document details the borrower's promise to repay the loan. It includes the loan amount, interest rate, repayment schedule, and consequences of default.

- Durable Power of Attorney: This important document allows an individual in Texas to appoint someone else to handle their legal and financial matters in case of incapacitation. For more information, you can check the Texas Forms Online.

- Loan Disclosure Statement: This statement provides borrowers with important information about the loan terms, including fees and interest rates, ensuring transparency.

- Security Agreement: If the loan is secured, this agreement outlines the collateral that the borrower offers to back the loan, protecting the lender's interests.

- Personal Guarantee: This document is signed by a third party, often a business owner, who agrees to repay the loan if the primary borrower defaults.

- Credit Application: Borrowers complete this form to provide lenders with necessary financial information, which helps assess creditworthiness.

- Loan Modification Agreement: If changes to the original loan terms are needed, this agreement outlines the new terms and conditions, ensuring both parties agree.

- Default Notice: This document is sent to the borrower if they fail to meet their repayment obligations, detailing the default and potential consequences.

- Release of Lien: Once the loan is fully paid, this document is issued to confirm that the lender no longer has a claim on the collateral.

These documents play a crucial role in the loan process. They ensure that both the lender and borrower have a clear understanding of their rights and responsibilities, which can help prevent disputes down the line.