Fillable Florida Lady Bird Deed Document

In the realm of estate planning, the Florida Lady Bird Deed offers a unique and effective way to manage property transfer while retaining control during one's lifetime. This specific type of deed allows property owners to transfer their real estate to beneficiaries upon their passing, all while maintaining the right to live in and manage the property until death. Unlike traditional life estates, which can complicate future property decisions, the Lady Bird Deed provides a flexible approach, enabling the original owner to sell, mortgage, or even change beneficiaries without the need for court intervention. Additionally, this deed can help avoid probate, ensuring a smoother transition of assets to heirs and potentially offering tax benefits. Understanding the nuances of this deed is crucial for anyone considering their estate planning options in Florida, as it combines the benefits of retaining ownership with the ease of transferring property to loved ones in a straightforward manner.

Dos and Don'ts

When filling out the Florida Lady Bird Deed form, it is important to follow certain guidelines. Here are some things you should and shouldn't do:

- Do ensure that all property details are accurate and complete.

- Do include the names of all parties involved in the deed.

- Do consult with a legal professional if you have any questions.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any required fields blank, as this could cause issues later.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed allows property owners in Florida to transfer their property to beneficiaries while retaining control during their lifetime. |

| Governing Law | The Lady Bird Deed is governed by Florida Statutes, specifically Chapter 731, which outlines rules regarding property transfers and estate planning. |

| Benefits | This deed helps avoid probate, allowing for a smoother transfer of property upon the owner's death. |

| Retained Rights | Property owners can sell, mortgage, or change the deed at any time, maintaining full control over the property. |

| Tax Implications | Using a Lady Bird Deed may provide tax benefits, such as a step-up in basis for beneficiaries, which can reduce capital gains taxes. |

| Eligibility | Any Florida property owner can create a Lady Bird Deed, as long as they are of sound mind and legal age. |

Key takeaways

The Florida Lady Bird Deed is a useful tool for estate planning. Here are some key takeaways to consider when filling out and using this form:

- Ownership Transfer: The Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining control during their lifetime.

- Retained Rights: The property owner can continue to live in and use the property without any restrictions.

- Automatic Transfer: Upon the owner’s death, the property automatically transfers to the designated beneficiaries without going through probate.

- Tax Benefits: This deed can help avoid capital gains taxes for beneficiaries, as they receive a step-up in basis.

- Revocability: The deed can be revoked or modified at any time by the property owner, providing flexibility.

- Clear Language: Use clear and precise language when filling out the form to avoid confusion or misinterpretation.

- Witness Requirements: The deed must be signed in the presence of two witnesses and notarized to be valid.

- State-Specific: Ensure you are using the correct form for Florida, as laws may differ in other states.

- Consultation Recommended: It is advisable to consult with an attorney to ensure the deed meets your specific needs and complies with Florida law.

Understanding these key points can help you effectively use the Florida Lady Bird Deed in your estate planning process.

Example - Florida Lady Bird Deed Form

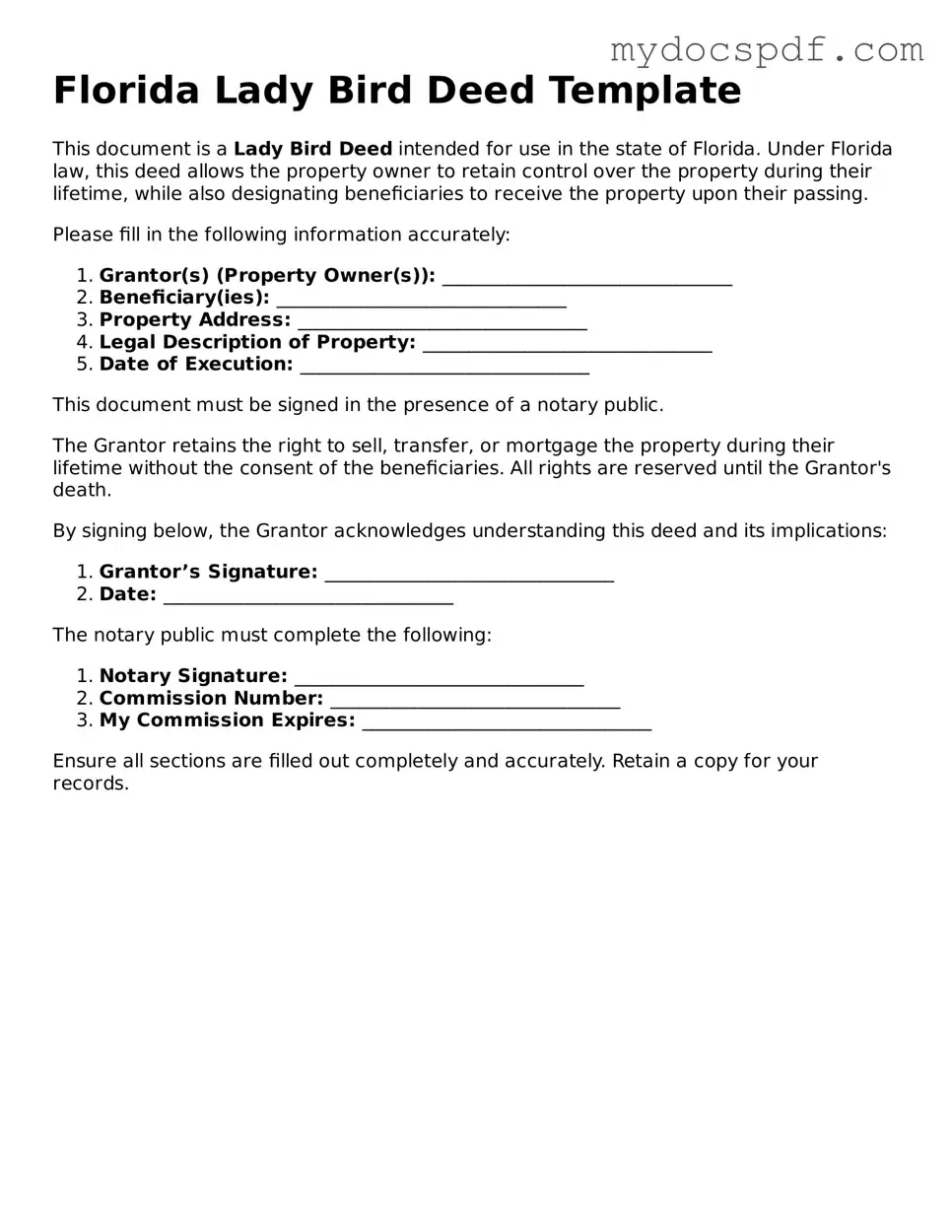

Florida Lady Bird Deed Template

This document is a Lady Bird Deed intended for use in the state of Florida. Under Florida law, this deed allows the property owner to retain control over the property during their lifetime, while also designating beneficiaries to receive the property upon their passing.

Please fill in the following information accurately:

- Grantor(s) (Property Owner(s)): _______________________________

- Beneficiary(ies): _______________________________

- Property Address: _______________________________

- Legal Description of Property: _______________________________

- Date of Execution: _______________________________

This document must be signed in the presence of a notary public.

The Grantor retains the right to sell, transfer, or mortgage the property during their lifetime without the consent of the beneficiaries. All rights are reserved until the Grantor's death.

By signing below, the Grantor acknowledges understanding this deed and its implications:

- Grantor’s Signature: _______________________________

- Date: _______________________________

The notary public must complete the following:

- Notary Signature: _______________________________

- Commission Number: _______________________________

- My Commission Expires: _______________________________

Ensure all sections are filled out completely and accurately. Retain a copy for your records.

Detailed Instructions for Writing Florida Lady Bird Deed

Filling out the Florida Lady Bird Deed form requires careful attention to detail. Once completed, this form will allow you to transfer property while retaining certain rights during your lifetime. Follow the steps below to ensure accuracy.

- Obtain the Florida Lady Bird Deed form. You can find it online or through legal stationery stores.

- At the top of the form, fill in your name as the current property owner.

- Provide your address in the designated section below your name.

- Identify the property being transferred by including the legal description. This may require a property deed or tax assessment notice.

- Specify the name(s) of the beneficiary or beneficiaries who will receive the property after your passing.

- Include the address(es) of the beneficiary or beneficiaries.

- Indicate any specific conditions or instructions regarding the transfer, if applicable.

- Sign the form in the presence of a notary public. Ensure that the notary completes their section of the form.

- Make copies of the completed form for your records and for the beneficiaries.

- File the original form with the county clerk's office where the property is located.

Documents used along the form

The Florida Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. When preparing or executing a Lady Bird Deed, several other forms and documents may be used to ensure a smooth process. Here’s a list of some common documents that often accompany the Lady Bird Deed.

- Durable Power of Attorney: This document allows someone to make financial decisions on your behalf if you become incapacitated. It’s essential for managing your affairs without court intervention.

- Health Care Surrogate Designation: This form designates a person to make medical decisions for you if you are unable to do so. It’s crucial for ensuring your health care preferences are honored.

- Living Will: A living will outlines your wishes regarding medical treatment and end-of-life care. It helps guide your family and healthcare providers in critical situations.

- Employment Verification Form: This document is essential for confirming an individual's employment status and history. For more details, you can refer to the Employment verification form form.

- Last Will and Testament: This is a legal document that specifies how your assets should be distributed after your death. It can work alongside a Lady Bird Deed to clarify your intentions.

- Beneficiary Designation Forms: Used for accounts like life insurance or retirement plans, these forms allow you to name beneficiaries directly, ensuring assets pass outside of probate.

- Quitclaim Deed: This document can transfer property ownership between parties without warranties. It may be used to remove or add names on a property title.

- Affidavit of Heirship: This sworn statement identifies heirs to an estate, often used when there is no will. It helps establish ownership of property after someone's passing.

- Property Title Search: This report provides a history of property ownership and any liens or claims against it. It’s vital for confirming clear title before transferring property.

These documents, when used in conjunction with the Lady Bird Deed, help create a comprehensive estate plan that addresses various aspects of property management and personal wishes. It's always wise to consult with a professional to ensure that all necessary forms are completed accurately and effectively.