Fillable Florida Durable Power of Attorney Document

In Florida, a Durable Power of Attorney (DPOA) is a crucial legal document that empowers an individual, known as the principal, to designate another person, referred to as the agent or attorney-in-fact, to manage their financial and legal affairs. This form remains effective even if the principal becomes incapacitated, ensuring that their wishes are honored during challenging times. The DPOA can cover a wide range of responsibilities, including managing bank accounts, paying bills, and making investment decisions. It is important to note that the principal can specify the extent of the agent's authority, allowing for tailored arrangements that suit individual needs. Additionally, the DPOA must be signed by the principal in the presence of a notary public or two witnesses to be legally valid. Understanding the implications and requirements of this form is essential for anyone considering granting power to another person, as it serves as a safeguard for personal and financial interests.

Dos and Don'ts

When filling out the Florida Durable Power of Attorney form, it’s important to keep a few key points in mind. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before you start filling it out.

- Do choose a trusted person to act as your agent.

- Do specify the powers you want to grant your agent clearly.

- Do sign the document in front of a notary public and witnesses as required.

- Don't rush through the process; take your time to ensure accuracy.

- Don't assume all agents have the same authority; clarify any limitations.

- Don't forget to keep a copy of the signed document for your records.

Following these tips will help ensure that your Durable Power of Attorney form is filled out correctly and serves its intended purpose.

PDF Properties

| Fact Name | Details |

|---|---|

| Definition | A Durable Power of Attorney allows someone to make decisions on your behalf when you are unable to do so. |

| Governing Law | The Florida Durable Power of Attorney is governed by Florida Statutes, Chapter 709. |

| Durability | This form remains effective even if you become incapacitated. |

| Agent Selection | You can choose anyone as your agent, including a family member, friend, or professional. |

| Limitations | Some powers may not be granted, such as the ability to change your will or trust. |

| Signing Requirements | The document must be signed in the presence of two witnesses and a notary public. |

| Revocation | You can revoke the Durable Power of Attorney at any time, as long as you are competent. |

| Financial Decisions | Your agent can manage your financial affairs, pay bills, and handle real estate transactions. |

| Healthcare Decisions | This form does not grant authority for healthcare decisions; a separate document is needed for that. |

| Validity | A properly executed Durable Power of Attorney is valid in all Florida counties. |

Key takeaways

When considering a Florida Durable Power of Attorney form, it is essential to understand its significance and proper usage. Here are some key takeaways:

- Definition: A Durable Power of Attorney allows you to appoint someone to manage your financial and legal affairs if you become incapacitated.

- Durability: This type of power of attorney remains effective even if you lose the ability to make decisions for yourself.

- Choosing an Agent: Select a trusted person as your agent. This individual will have significant authority over your financial matters.

- Specific Powers: Clearly outline the powers you wish to grant. You can limit or expand the authority as needed.

- Witnesses and Notarization: The form must be signed in the presence of two witnesses and a notary public to be valid in Florida.

- Review Regularly: Revisit your Durable Power of Attorney periodically to ensure it reflects your current wishes and circumstances.

Popular State-specific Durable Power of Attorney Forms

What's the Difference Between Power of Attorney and Durable Power of Attorney - A well-drafted Durable Power of Attorney can streamline healthcare decisions during emergencies.

Power of Attorney Form Idaho - Choosing the right agent is crucial, as they will have significant control.

For landlords and tenants looking to formalize their rental agreements, a reliable resource is the California Lease Agreement Document. This important legal tool clearly delineates the responsibilities and rights of each party, helping to prevent future misunderstandings.

Power of Attorney Forms California - Communicating your wishes can help avoid misunderstandings with your agent.

Massachusetts Durable Power of Attorney - This document can provide the designated agent the authority to manage business affairs if necessary.

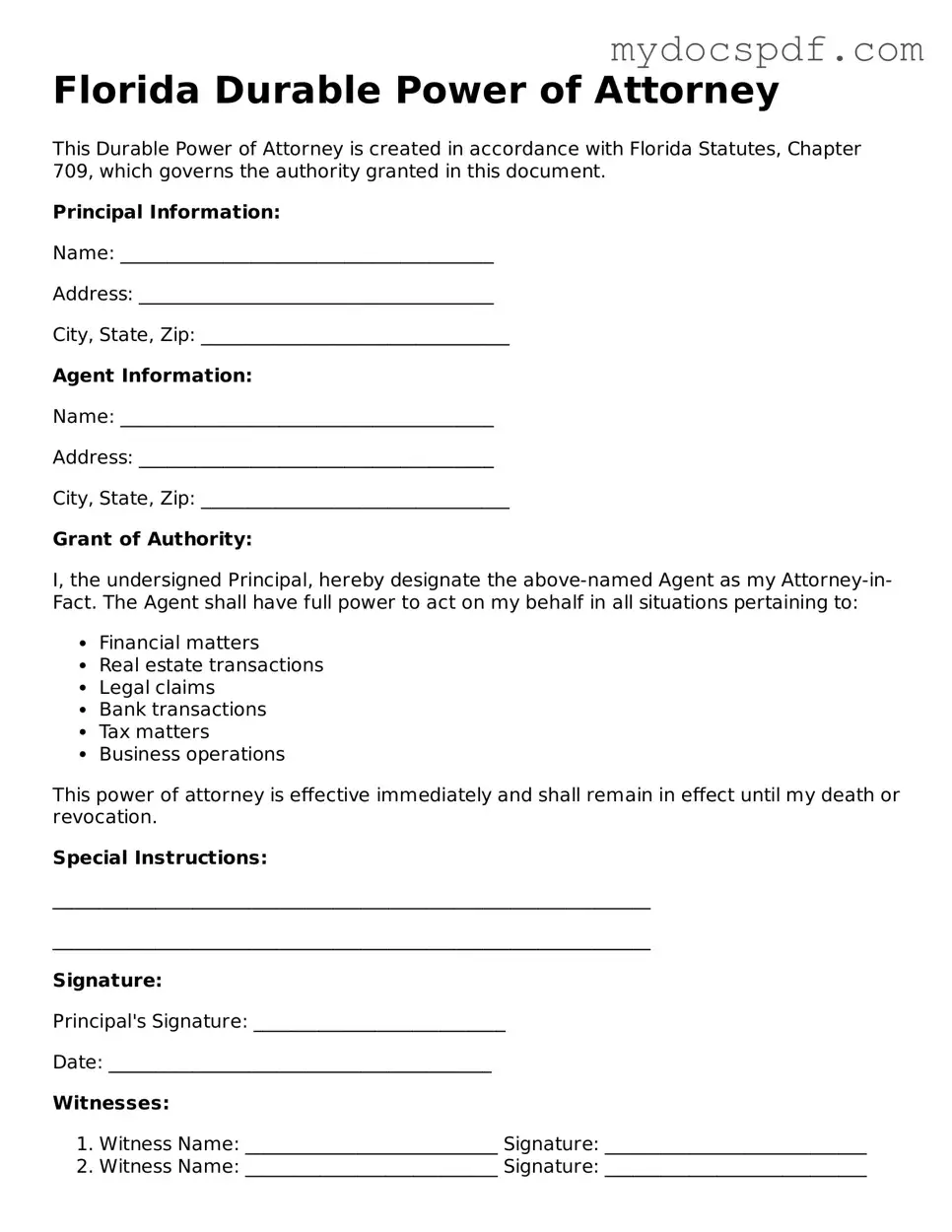

Example - Florida Durable Power of Attorney Form

Florida Durable Power of Attorney

This Durable Power of Attorney is created in accordance with Florida Statutes, Chapter 709, which governs the authority granted in this document.

Principal Information:

Name: ________________________________________

Address: ______________________________________

City, State, Zip: _________________________________

Agent Information:

Name: ________________________________________

Address: ______________________________________

City, State, Zip: _________________________________

Grant of Authority:

I, the undersigned Principal, hereby designate the above-named Agent as my Attorney-in-Fact. The Agent shall have full power to act on my behalf in all situations pertaining to:

- Financial matters

- Real estate transactions

- Legal claims

- Bank transactions

- Tax matters

- Business operations

This power of attorney is effective immediately and shall remain in effect until my death or revocation.

Special Instructions:

________________________________________________________________

________________________________________________________________

Signature:

Principal's Signature: ___________________________

Date: _________________________________________

Witnesses:

- Witness Name: ___________________________ Signature: ____________________________

- Witness Name: ___________________________ Signature: ____________________________

Notarization:

State of Florida

County of ______________

On this ____ day of ______________, 20___, before me, a Notary Public, personally appeared _____________________________, who is known to me to be the person described in this Durable Power of Attorney and who signed this instrument.

Notary Public Signature: ________________________

My Commission Expires: _______________________

Detailed Instructions for Writing Florida Durable Power of Attorney

Completing the Florida Durable Power of Attorney form is an important step in ensuring that your financial and legal affairs can be managed according to your wishes, even if you become unable to make decisions for yourself. Once you have the form filled out, you will need to sign it in the presence of a notary public and possibly witnesses, depending on your specific needs. Below are the steps to guide you through the process of filling out the form.

- Obtain the Florida Durable Power of Attorney form. This can typically be found online or through legal offices.

- Begin by entering your name and address at the top of the form. This identifies you as the principal.

- Designate an agent by writing their name and address in the designated section. This person will act on your behalf.

- Consider whether you want to name an alternate agent. If so, provide their name and address as well.

- Review the powers you wish to grant to your agent. The form will list various options; check the boxes next to the powers you wish to include.

- Specify any limitations or special instructions in the appropriate section. This ensures your agent understands your preferences.

- Sign and date the form at the bottom. This signature indicates your agreement to the terms outlined in the document.

- Have the form notarized. A notary public will verify your identity and witness your signature.

- If required, have one or two witnesses sign the form. Ensure they are not related to you or your agent.

- Keep the completed form in a safe place and provide copies to your agent and any relevant institutions.

Documents used along the form

A Florida Durable Power of Attorney is an important legal document that allows someone to act on your behalf in financial matters. It’s often used alongside other forms to ensure comprehensive management of your affairs. Here are some documents that are commonly associated with it:

- Living Will: This document outlines your wishes regarding medical treatment in case you become unable to communicate your preferences. It provides guidance to healthcare providers and family members.

- Health Care Proxy: Also known as a medical power of attorney, this form allows you to designate someone to make healthcare decisions for you if you are incapacitated.

- Last Will and Testament: This document specifies how your assets will be distributed upon your death. It can also name guardians for minor children.

- Revocable Living Trust: This trust holds your assets during your lifetime and specifies how they should be distributed after your death, often avoiding probate.

- Quitclaim Deed: A Texas Quitclaim Deed is beneficial for transferring property ownership without warranties, especially in familial situations, and can be obtained through Texas Forms Online.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document grants authority to someone to manage your financial affairs, but it may not remain effective if you become incapacitated.

- Beneficiary Designations: These are forms used to designate who will receive your assets, such as life insurance policies or retirement accounts, upon your death.

- Property Deed: This document transfers ownership of real estate. It may be important to update or create a new deed if property ownership changes.

- HIPAA Authorization: This form allows healthcare providers to share your medical information with designated individuals, ensuring they can make informed decisions on your behalf.

- Asset Inventory List: This is a detailed list of your assets, which can help your agent understand what they need to manage under the Durable Power of Attorney.

- Business Power of Attorney: If you own a business, this document allows someone to make decisions on behalf of the business if you are unable to do so.

Each of these documents plays a crucial role in ensuring that your wishes are respected and your affairs are managed according to your preferences. It’s wise to consider them carefully and discuss your options with a trusted advisor.