Fillable Florida Deed in Lieu of Foreclosure Document

In the state of Florida, homeowners facing financial difficulties and the threat of foreclosure may consider a Deed in Lieu of Foreclosure as a viable option. This legal process allows a homeowner to voluntarily transfer the title of their property to the lender, effectively relinquishing ownership in exchange for relief from the mortgage obligation. By choosing this route, borrowers can often avoid the lengthy and stressful foreclosure process, which can have lasting impacts on their credit scores and financial futures. The Deed in Lieu of Foreclosure form outlines the terms of this agreement, including any potential deficiencies, which may arise if the property’s value is less than the outstanding mortgage balance. Additionally, it typically requires the homeowner to demonstrate that they are unable to continue making mortgage payments, and it may involve negotiations regarding the forgiveness of remaining debt. Understanding the implications and requirements of this form is crucial for homeowners looking to navigate their options in a challenging financial landscape.

Dos and Don'ts

When filling out the Florida Deed in Lieu of Foreclosure form, it’s important to approach the process carefully. Here’s a list of things you should and shouldn’t do:

- Do ensure all information is accurate and complete. Double-check names, addresses, and property details.

- Do consult with a legal professional if you have any questions about the form or the implications of signing it.

- Do keep a copy of the completed form for your records. This will be useful for future reference.

- Don't rush through the process. Take your time to understand each section of the form.

- Don't sign the form without fully understanding the consequences. It is a significant legal document.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Laws | This process is governed by Florida Statutes, particularly Chapter 697, which outlines the requirements and procedures for deeds in lieu of foreclosure. |

| Benefits | Borrowers may benefit from a deed in lieu of foreclosure by minimizing the damage to their credit score and potentially avoiding a lengthy foreclosure process. |

| Considerations | Before proceeding, borrowers should consider potential tax implications and ensure that any existing liens are addressed, as these may affect the transaction. |

Key takeaways

When considering the Florida Deed in Lieu of Foreclosure, it is essential to understand its implications and requirements. Here are key takeaways to keep in mind:

- Voluntary Agreement: A Deed in Lieu of Foreclosure is a voluntary transfer of property from the borrower to the lender.

- Property Condition: The property should be in good condition, as lenders may require it to be free of significant damage.

- Clear Title: The borrower must ensure that the title to the property is clear of any liens or encumbrances.

- Documentation: Proper documentation is necessary. This includes the deed itself and any additional forms required by the lender.

- Debt Forgiveness: In some cases, lenders may forgive the remaining mortgage debt, but this is not guaranteed.

- Impact on Credit: A Deed in Lieu of Foreclosure can impact your credit score, though it may be less severe than a foreclosure.

- Tax Implications: There may be tax consequences related to debt forgiveness. Consulting a tax professional is advisable.

- Legal Advice: Seeking legal advice before proceeding can help clarify your rights and obligations.

- Negotiation: Borrowers may negotiate terms with the lender, including any potential cash incentives for transferring the deed.

- Future Homeownership: A Deed in Lieu of Foreclosure may affect your ability to purchase a home in the future, depending on the lender's policies.

Understanding these points can help navigate the process more effectively. Always consider seeking professional assistance to ensure a smooth transaction.

Popular State-specific Deed in Lieu of Foreclosure Forms

Foreclosure in Georgia - This option is ideal for homeowners who wish to escape financial hardship proactively.

To ensure compliance with state regulations, parents can use resources such as https://arizonapdfs.com to find the necessary guidelines and templates for the Arizona Homeschool Letter of Intent form, facilitating a smoother transition to homeschooling.

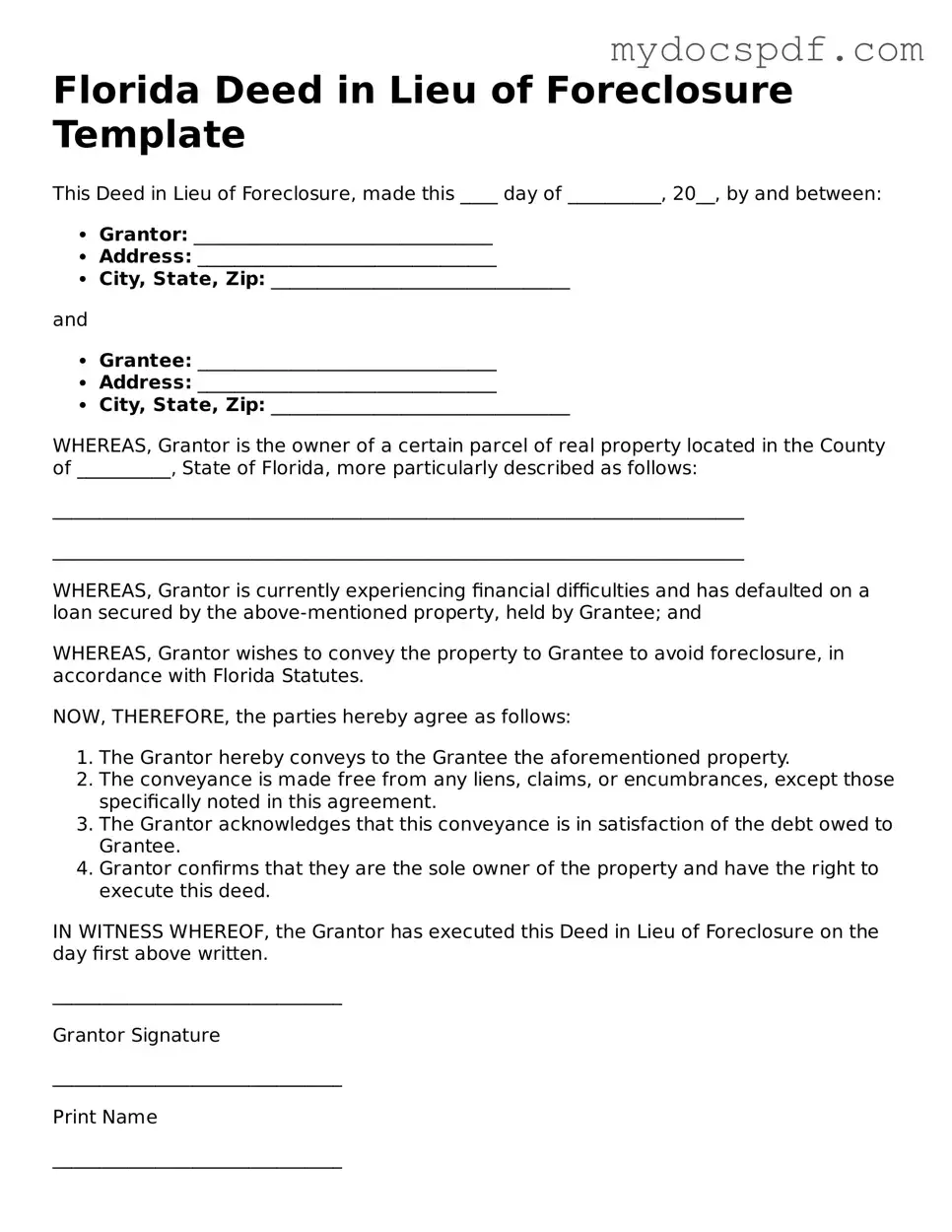

Example - Florida Deed in Lieu of Foreclosure Form

Florida Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure, made this ____ day of __________, 20__, by and between:

- Grantor: ________________________________

- Address: ________________________________

- City, State, Zip: ________________________________

and

- Grantee: ________________________________

- Address: ________________________________

- City, State, Zip: ________________________________

WHEREAS, Grantor is the owner of a certain parcel of real property located in the County of __________, State of Florida, more particularly described as follows:

__________________________________________________________________________

__________________________________________________________________________

WHEREAS, Grantor is currently experiencing financial difficulties and has defaulted on a loan secured by the above-mentioned property, held by Grantee; and

WHEREAS, Grantor wishes to convey the property to Grantee to avoid foreclosure, in accordance with Florida Statutes.

NOW, THEREFORE, the parties hereby agree as follows:

- The Grantor hereby conveys to the Grantee the aforementioned property.

- The conveyance is made free from any liens, claims, or encumbrances, except those specifically noted in this agreement.

- The Grantor acknowledges that this conveyance is in satisfaction of the debt owed to Grantee.

- Grantor confirms that they are the sole owner of the property and have the right to execute this deed.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure on the day first above written.

_______________________________

Grantor Signature

_______________________________

Print Name

_______________________________

Notary Public

My commission expires: ________________

This document is executed under and governed by the laws of the State of Florida.

Detailed Instructions for Writing Florida Deed in Lieu of Foreclosure

Once you have the Florida Deed in Lieu of Foreclosure form ready, it’s important to fill it out accurately to ensure a smooth process. This document is a formal agreement between the homeowner and the lender, allowing the homeowner to transfer their property to the lender in exchange for the cancellation of the mortgage debt. Follow these steps carefully to complete the form.

- Begin by entering the date at the top of the form. Make sure to use the correct format, typically month/day/year.

- In the section labeled “Grantor,” provide the full legal name(s) of the property owner(s). If there are multiple owners, list all names as they appear on the title.

- Next, in the “Grantee” section, write the name of the lender or financial institution that is accepting the deed.

- Locate the “Property Description” section. Here, you will need to include the legal description of the property. This can often be found on the property deed or tax records.

- In the designated area, indicate the county where the property is located. This helps in identifying the jurisdiction.

- Provide the property address, including the street number, street name, city, and zip code.

- Review the statement regarding any liens or encumbrances on the property. Confirm whether there are any additional claims against the property that need to be disclosed.

- Sign the form in the “Grantor’s Signature” section. If there are multiple owners, each must sign the document.

- Have the signatures notarized. A notary public will verify the identities of the signers and witness the signing of the document.

- Finally, make copies of the completed and notarized form for your records and for the lender.

After filling out the form, you will need to submit it to your lender. They will review the document and proceed with the necessary steps to finalize the transfer of the property. Be sure to keep a copy for your personal records as well.

Documents used along the form

A Deed in Lieu of Foreclosure can be a useful tool for homeowners facing financial difficulties. Along with this document, several other forms and documents may be necessary to complete the process. Below is a list of commonly used forms that may accompany a Deed in Lieu of Foreclosure in Florida.

- Loan Modification Agreement: This document outlines changes to the original loan terms, such as interest rates or repayment schedules, which can help the borrower avoid foreclosure.

- Notice of Default: A formal notification from the lender to the borrower indicating that they have defaulted on the loan, which often precedes foreclosure proceedings.

- Authorization to Release Information: This form allows the lender to obtain necessary financial information from third parties, such as credit bureaus or other financial institutions.

- Financial Hardship Letter: A letter from the borrower explaining their financial situation and the reasons for their inability to continue making mortgage payments.

- Quitclaim Deed: This document allows a property owner to transfer their interest in a property to another individual without guaranteeing the title, making it suitable for personal transactions. For more information, visit NY Templates.

- Title Search Report: A document that verifies the ownership of the property and identifies any liens or encumbrances that may affect the transfer of the property.

- Property Inspection Report: A report detailing the condition of the property, which may be required by the lender before accepting the deed.

- Release of Liability: This document releases the borrower from any further obligations related to the mortgage once the deed is transferred to the lender.

- Settlement Statement: A detailed account of all financial transactions related to the deed transfer, including any costs or fees that must be paid.

- Affidavit of Title: A sworn statement by the borrower confirming that they hold clear title to the property and that there are no undisclosed liens or claims.

- Quitclaim Deed: A legal document that allows the borrower to transfer their interest in the property to the lender, often used in conjunction with the Deed in Lieu of Foreclosure.

Understanding these documents can help homeowners navigate the Deed in Lieu of Foreclosure process more effectively. It’s important to review each form carefully and seek guidance if needed to ensure a smooth transaction.