Fillable Florida Deed Document

When it comes to transferring property ownership in Florida, the Florida Deed form plays a crucial role in ensuring that the process is both clear and legally binding. This essential document outlines the specifics of the transaction, including the names of the parties involved, a detailed description of the property, and the terms of the transfer. Whether you are selling, buying, or gifting real estate, understanding the components of this form is vital. It serves not only as a record of ownership but also protects the interests of all parties by providing a clear trail of the transaction. In Florida, there are several types of deeds, such as warranty deeds, quitclaim deeds, and special purpose deeds, each serving a unique purpose based on the circumstances of the transfer. Familiarity with these variations can help individuals choose the right form for their needs, ensuring a smooth transition of property rights. Additionally, the execution of the deed must adhere to specific legal requirements, including signatures, notarization, and proper filing with the county clerk, to be effective. By understanding the Florida Deed form and its nuances, property owners can navigate the complexities of real estate transactions with confidence.

Dos and Don'ts

When filling out the Florida Deed form, it's important to be careful and thorough. Here are some guidelines to help you navigate the process.

- Do ensure that all names are spelled correctly and match the official identification.

- Do include a legal description of the property. This is crucial for clarity.

- Do sign the deed in the presence of a notary public. This step adds validity.

- Do keep a copy of the completed deed for your records.

- Don't leave any blank spaces on the form. Fill in all required fields.

- Don't forget to check for any local requirements that may apply.

Following these steps can help ensure that your deed is completed correctly and legally binding. Take your time and double-check your work.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Florida Deed form is a legal document used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include warranty deeds, quitclaim deeds, and special warranty deeds. |

| Governing Law | Florida Statutes, Chapter 689, governs the execution and validity of deeds in Florida. |

| Signing Requirements | The deed must be signed by the grantor (the seller) and, in some cases, by the grantee (the buyer). |

| Witnesses | Florida law requires that the deed be witnessed by two individuals who are not parties to the transaction. |

| Notarization | While notarization is not mandatory for all deeds, it is highly recommended to prevent disputes. |

| Recording | To provide public notice of the transfer, the deed should be recorded with the county clerk's office. |

| Tax Implications | Transfer taxes may apply when a property is sold, and the seller is typically responsible for these fees. |

| Legal Description | The deed must include a legal description of the property, detailing its exact boundaries. |

| Revocation | Once executed and delivered, a deed is generally irrevocable unless specific legal conditions are met. |

Key takeaways

Filling out and using the Florida Deed form is an important step in transferring property ownership. Here are some key takeaways to keep in mind:

- Understand the Types of Deeds: Florida offers different types of deeds, such as warranty deeds and quitclaim deeds. Each serves a different purpose, so choose the right one for your situation.

- Gather Necessary Information: Before filling out the form, collect all relevant information. This includes the names of the parties involved, the property description, and any applicable legal descriptions.

- Accurate Property Description: Ensure that the property description is detailed and accurate. This helps prevent future disputes about property boundaries.

- Signatures Required: All parties involved in the transfer must sign the deed. Make sure that signatures are notarized to validate the document.

- File with the County: After completing the deed, it must be filed with the county clerk's office where the property is located. This step is crucial for making the transfer official.

- Consider Tax Implications: Transferring property may have tax consequences. Consult a tax professional to understand any potential liabilities.

- Keep Copies: Always keep copies of the signed deed for your records. This documentation can be important for future reference or legal matters.

By following these key points, you can navigate the process of filling out and using the Florida Deed form with confidence.

Popular State-specific Deed Forms

Grant Deed California - A deed is often required when securing financing for a property purchase.

How to Get House Deed - The form serves as a historical record of ownership changes.

For those looking to simplify their estate planning, the Transfer-on-Death Deed offers a practical option to transfer assets seamlessly. This form enables Arizona property owners to direct their real estate to beneficiaries efficiently, thus bypassing the often lengthy probate process. Learn more about how this Transfer-on-Death Deed works by visiting this informative resource.

Warranty Deed Form Idaho - Ensuring accurate information on a Deed is essential to avoid legal issues.

Georgia Quit Claim Deed - Deeds can be subject to revision or challenges in court.

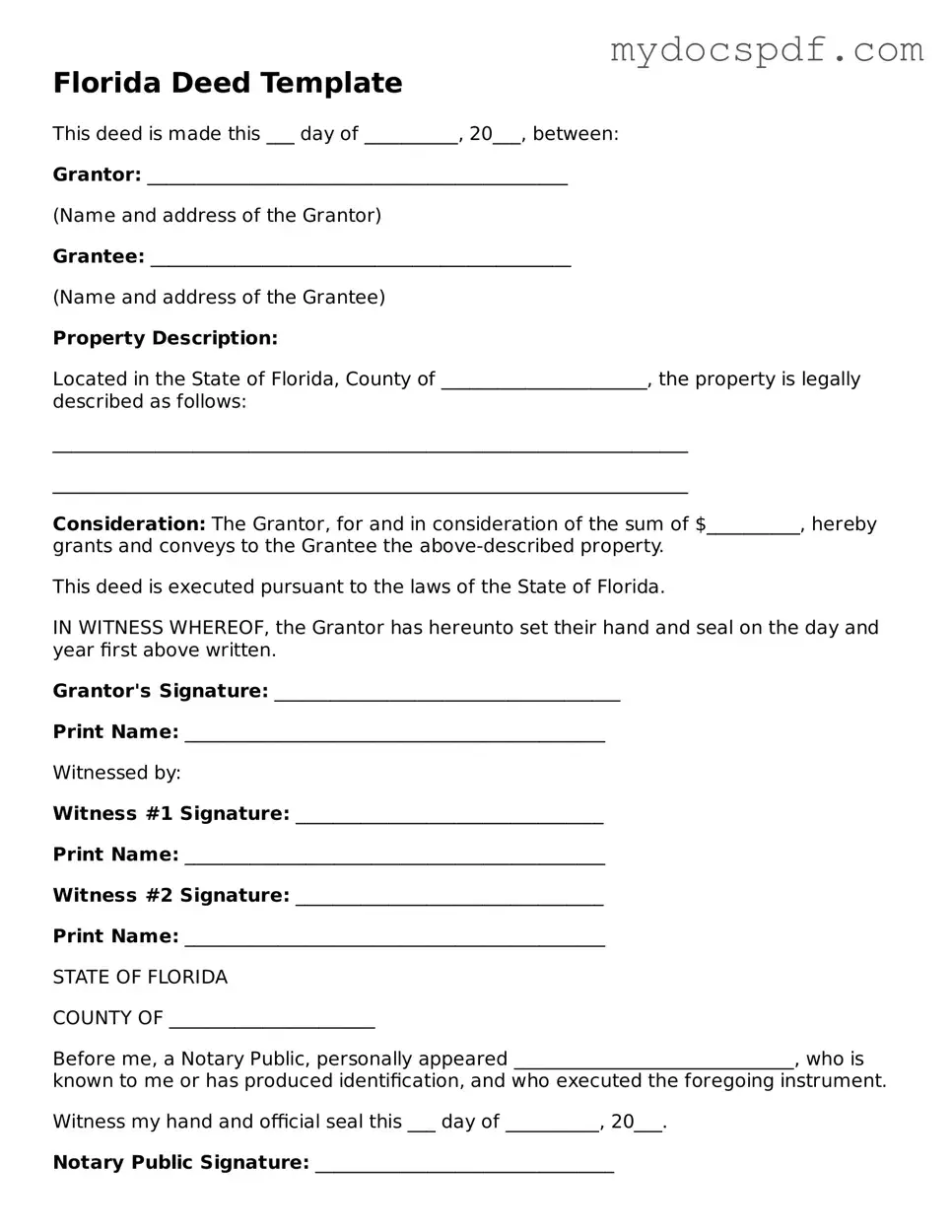

Example - Florida Deed Form

Florida Deed Template

This deed is made this ___ day of __________, 20___, between:

Grantor: _____________________________________________

(Name and address of the Grantor)

Grantee: _____________________________________________

(Name and address of the Grantee)

Property Description:

Located in the State of Florida, County of ______________________, the property is legally described as follows:

____________________________________________________________________

____________________________________________________________________

Consideration: The Grantor, for and in consideration of the sum of $__________, hereby grants and conveys to the Grantee the above-described property.

This deed is executed pursuant to the laws of the State of Florida.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand and seal on the day and year first above written.

Grantor's Signature: _____________________________________

Print Name: _____________________________________________

Witnessed by:

Witness #1 Signature: _________________________________

Print Name: _____________________________________________

Witness #2 Signature: _________________________________

Print Name: _____________________________________________

STATE OF FLORIDA

COUNTY OF ______________________

Before me, a Notary Public, personally appeared ______________________________, who is known to me or has produced identification, and who executed the foregoing instrument.

Witness my hand and official seal this ___ day of __________, 20___.

Notary Public Signature: ________________________________

Print Name: _____________________________________________

My Commission Expires: _________________________________

Detailed Instructions for Writing Florida Deed

After gathering the necessary information, you are ready to fill out the Florida Deed form. Completing this form accurately is essential for ensuring that the transfer of property is legally recognized. Follow the steps below to fill out the form correctly.

- Begin by entering the name of the grantor (the person transferring the property). Make sure to include their full legal name.

- Next, provide the name of the grantee (the person receiving the property). Again, use the full legal name.

- In the designated section, include the property description. This should be a detailed description, including the address and any relevant parcel number.

- Fill in the date of the transaction. This is the date when the deed is being executed.

- Sign the form in the presence of a notary public. The notary will need to witness your signature and provide their seal.

- Finally, submit the completed form to the appropriate county clerk's office for recording. Ensure you keep a copy for your records.

Documents used along the form

When transferring property in Florida, several forms and documents accompany the Florida Deed form. Each of these documents serves a specific purpose in ensuring a smooth transaction and proper record-keeping. Below is a list of commonly used forms that may be needed in conjunction with the Florida Deed.

- Title Search Report: This document provides a history of the property’s ownership and any existing liens or claims. It helps ensure that the seller has the right to sell the property and that the buyer receives clear title.

- Property Disclosure Statement: Sellers often provide this statement to inform buyers of any known issues with the property. It may include information about repairs, environmental hazards, or other significant factors affecting the property’s condition.

- Trailer Bill of Sale: This form is essential when transferring ownership of a trailer, as it includes important information about the trailer and the parties involved in the transaction. For more information, you can visit NY Templates.

- Purchase Agreement: This contract outlines the terms of the sale between the buyer and seller. It typically includes the sale price, closing date, and any contingencies that must be met before the sale can proceed.

- Closing Statement: Also known as a HUD-1 or ALTA statement, this document details all financial transactions related to the sale. It includes the purchase price, closing costs, and any adjustments made at closing.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and asserts that there are no undisclosed liens or claims. It provides additional assurance to the buyer regarding the title’s status.

- IRS Form 1099-S: This tax form is used to report the sale of real estate. It is essential for sellers to complete this form for tax purposes, especially if there is a capital gain from the sale.

- Certificate of Occupancy: This document certifies that a building meets local building codes and is safe for occupancy. It is particularly important for buyers considering properties that have undergone significant renovations or new constructions.

Each of these documents plays a vital role in the property transfer process in Florida. Ensuring that all necessary forms are completed and submitted correctly can help prevent disputes and facilitate a successful transaction.