Fillable Florida Affidavit of Gift Document

The Florida Affidavit of Gift form serves as a crucial document for individuals looking to transfer ownership of property or assets without monetary exchange. This form is often utilized in scenarios involving gifts between family members or friends, ensuring that the transfer is legally recognized and documented. By completing this affidavit, the donor affirms their intention to give the property as a gift, while the recipient acknowledges acceptance. It is essential to include accurate details such as the description of the property, the names of both the donor and recipient, and the date of the transfer. Additionally, the form may require notarization, adding an extra layer of authenticity to the transaction. Understanding the implications of this affidavit is vital, as it can have significant tax and legal consequences for both parties involved.

Dos and Don'ts

When filling out the Florida Affidavit of Gift form, consider the following guidelines:

- Do ensure all personal information is accurate and up-to-date.

- Do clearly describe the gift being given, including its value.

- Do sign and date the affidavit in the appropriate sections.

- Do keep a copy of the completed form for your records.

- Do consult with a legal professional if you have questions about the process.

- Don't leave any sections blank; fill out all required fields.

- Don't provide false information, as this can lead to legal issues.

- Don't forget to check for any specific instructions related to your situation.

- Don't submit the form without reviewing it for errors.

- Don't assume that verbal agreements are sufficient; written documentation is essential.

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose | The Florida Affidavit of Gift form is used to document the transfer of property as a gift, ensuring that the transaction is legally recognized. |

| Governing Law | This form is governed by Florida Statutes, specifically under Chapter 709, which outlines the laws related to gifts and property transfers. |

| Requirements | The form must be signed by the donor and may need to be notarized to validate the gift, depending on the value of the property being transferred. |

| Usage | It is commonly used in situations where individuals wish to give property, such as real estate or personal items, without any expectation of payment. |

Key takeaways

Filling out the Florida Affidavit of Gift form is a straightforward process, but it is essential to understand the key points to ensure proper use and compliance. Here are four important takeaways:

- Understand the Purpose: The Affidavit of Gift form is used to document the transfer of property or assets as a gift. This form helps clarify the intent of the giver and provides proof of the gift for tax purposes.

- Complete All Required Sections: Ensure that every section of the form is filled out completely. Missing information can lead to delays or complications in the gift transfer process.

- Signatures Matter: Both the giver and the recipient must sign the form. This step is crucial as it confirms that both parties agree to the terms of the gift.

- Keep Copies: After completing the form, make copies for your records. Having a copy can be beneficial for future reference or if any disputes arise regarding the gift.

By following these takeaways, you can navigate the process of using the Florida Affidavit of Gift form more effectively.

Example - Florida Affidavit of Gift Form

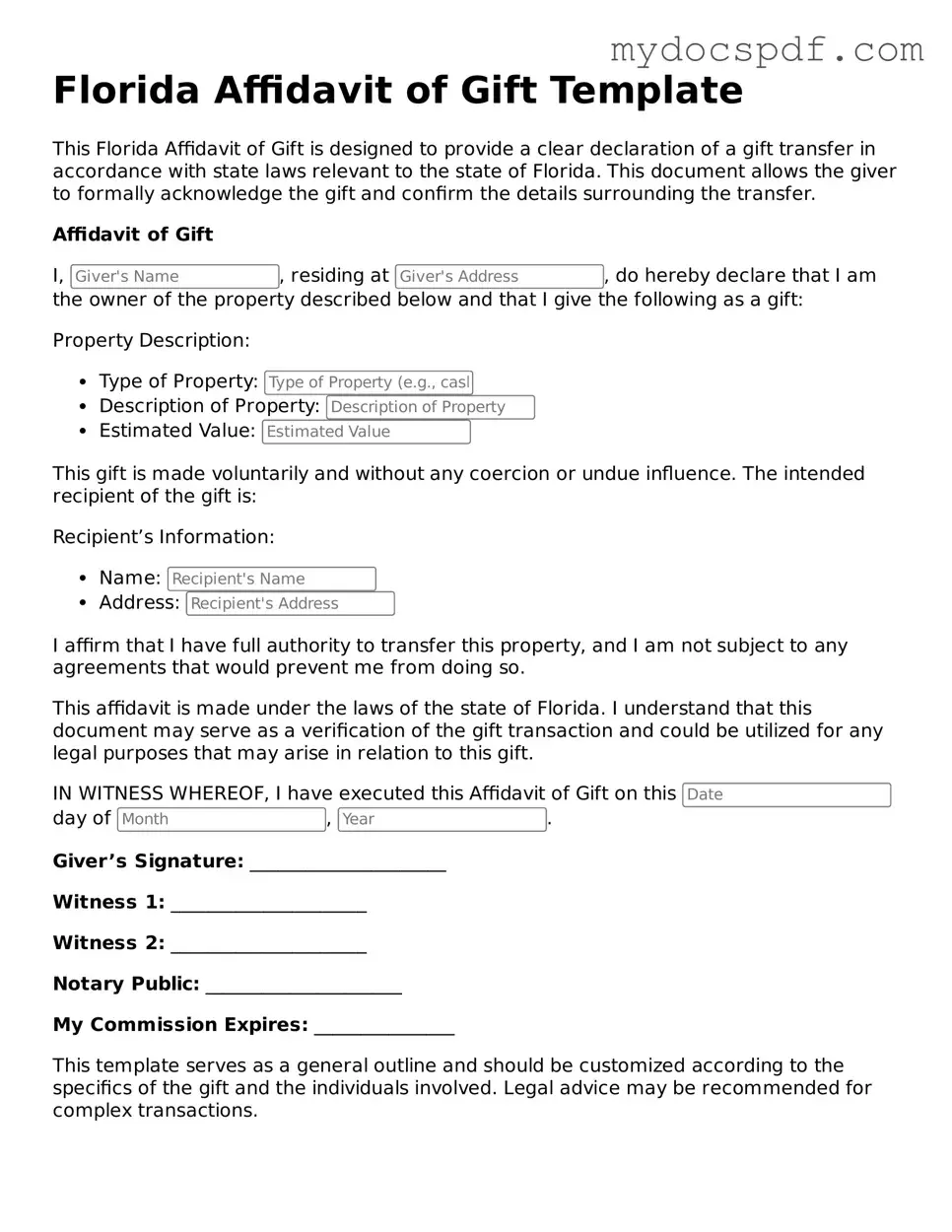

Florida Affidavit of Gift Template

This Florida Affidavit of Gift is designed to provide a clear declaration of a gift transfer in accordance with state laws relevant to the state of Florida. This document allows the giver to formally acknowledge the gift and confirm the details surrounding the transfer.

Affidavit of Gift

I, , residing at , do hereby declare that I am the owner of the property described below and that I give the following as a gift:

Property Description:

- Type of Property:

- Description of Property:

- Estimated Value:

This gift is made voluntarily and without any coercion or undue influence. The intended recipient of the gift is:

Recipient’s Information:

- Name:

- Address:

I affirm that I have full authority to transfer this property, and I am not subject to any agreements that would prevent me from doing so.

This affidavit is made under the laws of the state of Florida. I understand that this document may serve as a verification of the gift transaction and could be utilized for any legal purposes that may arise in relation to this gift.

IN WITNESS WHEREOF, I have executed this Affidavit of Gift on this day of , .

Giver’s Signature: _____________________

Witness 1: _____________________

Witness 2: _____________________

Notary Public: _____________________

My Commission Expires: _______________

This template serves as a general outline and should be customized according to the specifics of the gift and the individuals involved. Legal advice may be recommended for complex transactions.

Detailed Instructions for Writing Florida Affidavit of Gift

Completing the Florida Affidavit of Gift form is an important step in documenting a transfer of property or assets as a gift. After filling out the form, ensure it is signed in the presence of a notary public to validate the document. Below are the steps to guide you through the process of filling out the form.

- Obtain the Florida Affidavit of Gift form from a reliable source, such as a legal website or local government office.

- Begin by entering the date at the top of the form.

- Provide the full name and address of the donor (the person giving the gift).

- Next, enter the full name and address of the recipient (the person receiving the gift).

- Clearly describe the gift being transferred. Include details such as the type of property or asset and any relevant identification numbers.

- Indicate the fair market value of the gift at the time of transfer.

- Sign the form where indicated to affirm that the information provided is accurate and truthful.

- Have the signature notarized by a licensed notary public to ensure the document is legally binding.

- Keep a copy of the completed and notarized form for your records.

Documents used along the form

When preparing to execute a Florida Affidavit of Gift, several other forms and documents may be necessary to ensure a smooth and legally compliant process. Each of these documents serves a specific purpose, contributing to the overall clarity and legality of the gift transaction. Below is a list of commonly used forms that can accompany the Affidavit of Gift.

- Gift Tax Return (Form 709): This form is used to report gifts that exceed the annual exclusion amount set by the IRS. It helps to ensure compliance with federal tax laws regarding gift taxation.

- Operating Agreement: For those establishing an LLC in New York, having a thorough NY Templates is essential to delineate the management structure and operational procedures, safeguarding member interests.

- Bill of Sale: A bill of sale serves as a written record of the transfer of ownership of an item from one party to another. This document can provide additional proof that a gift was made and received.

- Warranty Deed: If the gift involves real property, a warranty deed is necessary. This document transfers ownership of real estate and guarantees that the title is clear of any liens or claims.

- Letter of Intent: This informal document outlines the donor's intentions regarding the gift. While not legally binding, it can clarify the donor's wishes and the context of the gift.

- Power of Attorney: In some cases, a power of attorney may be required if the donor is unable to execute the Affidavit of Gift themselves. This document allows another individual to act on the donor's behalf.

- IRS Form 8283: This form is used for non-cash charitable contributions. If the gift involves items such as art or collectibles, this form helps to document the value of the donation for tax purposes.

Each of these documents plays a vital role in the process of gifting, ensuring that all parties understand their rights and responsibilities. By preparing the necessary forms, individuals can navigate the complexities of gifting with greater ease and confidence.