Get Fl Dr 312 Form in PDF

The FL DR 312 form, formally known as the Affidavit of No Florida Estate Tax Due, serves a crucial role in the estate administration process in Florida. This form is utilized by personal representatives of estates that are not subject to Florida estate tax, as outlined in Chapter 198 of the Florida Statutes. When a decedent passes away, their estate may be required to file certain tax forms, but in cases where no federal estate tax return is necessary—specifically, when the estate does not exceed established thresholds—the FL DR 312 can be filed to affirm that no Florida estate tax is due. This affidavit not only helps in clearing any potential tax liens but also provides legal assurance that the estate can be distributed without the burden of estate tax liabilities. The personal representative, who is responsible for managing the estate, must complete the form accurately, including details such as the decedent’s name, date of death, and their residency status at the time of passing. Filing the FL DR 312 with the appropriate clerk of the court is essential, as this step formally documents the estate's non-liability for Florida estate tax. It is important to note that this form should not be sent to the Florida Department of Revenue, as it is strictly a court filing. Understanding the nuances of this form can significantly ease the process of estate administration, allowing for a smoother transition during a challenging time.

Dos and Don'ts

When filling out the Fl Dr 312 form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here are four things you should and shouldn’t do:

- Do ensure that all information is accurate and complete. Double-check names, dates, and addresses.

- Do file the form directly with the clerk of the circuit court in the appropriate county.

- Do include the case style of the estate probate proceeding in the designated area of the form.

- Do keep a copy of the completed form for your records.

- Don’t mail the form to the Florida Department of Revenue; it must be filed with the court.

- Don’t write or mark in the 3-inch by 3-inch space reserved for the clerk.

- Don’t use this form if a federal estate tax return is required (Form 706 or 706-NA).

- Don’t forget to sign and date the affidavit before submitting it.

Document Attributes

| Fact Name | Fact Description |

|---|---|

| Form Title | The form is officially titled "Affidavit of No Florida Estate Tax Due DR-312." |

| Governing Laws | This form is governed by Rule 12C-3.008 of the Florida Administrative Code and Chapter 198 of the Florida Statutes. |

| Purpose | It serves to declare that no Florida estate tax is due for the estate of a deceased person. |

| Filing Requirement | The form must be filed with the clerk of the circuit court in the county where the decedent owned property. |

| Federal Tax Return | A federal estate tax return (Form 706 or 706-NA) is not required if this form is used. |

| Personal Representative | The person filing the form must be the personal representative of the estate, as defined in Florida law. |

| Liability Acknowledgment | The personal representative acknowledges personal liability for any distributions made from the estate. |

| Nonliability Evidence | This affidavit is admissible as evidence of nonliability for Florida estate tax. |

| Exclusions | This form cannot be used if the estate is required to file a federal Form 706 or 706-NA. |

| Effective Date | The current version of the form became effective in January 2021. |

Key takeaways

Form DR-312, known as the Affidavit of No Florida Estate Tax Due, is essential for personal representatives of estates that do not owe Florida estate tax and do not require a federal estate tax return.

This form must be filed with the clerk of the circuit court in the county where the decedent owned property. It should not be mailed to the Florida Department of Revenue.

The personal representative must provide specific details, including the decedent's name, date of death, and their domicile at the time of death, ensuring accuracy to avoid potential legal complications.

Filing this form removes any existing estate tax lien from the Florida Department of Revenue, serving as evidence of nonliability for estate tax.

It is crucial to note that Form DR-312 cannot be used if a federal estate tax return (Form 706 or 706-NA) is required. Always verify the filing thresholds based on the decedent's date of death.

Other PDF Templates

Ncaa Tournament Bracket Printable Pdf - Consider factors like team momentum when making choices.

How to Get Power of Attorney in Florida - The property in question must be clearly identified to ensure proper handling by the agent.

In times of uncertainty, having a New York Durable Power of Attorney form in place can provide peace of mind, allowing a designated person to make important financial decisions when needed. This legal document remains effective even if the individual becomes incapacitated, ensuring that their affairs are managed by someone they trust. For those seeking a reliable way to create such an important form, they can refer to the resources available at newyorkform.com/free-durable-power-of-attorney-template for a comprehensive template.

Free Doctor Release to Return to Work - The Work Release form allows individuals to leave their confinement for employment purposes.

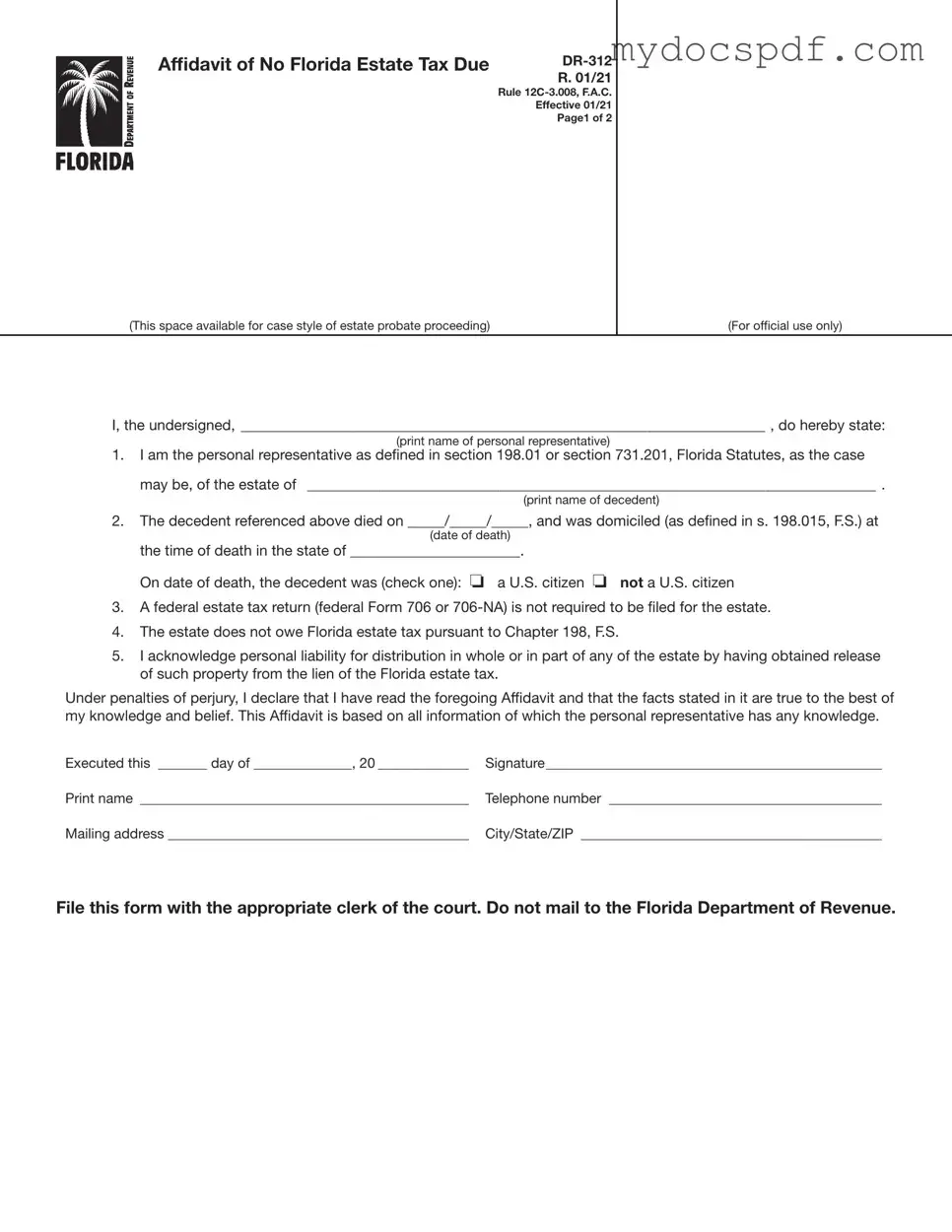

Example - Fl Dr 312 Form

Affidavit of No Florida Estate Tax Due

Rule

Effective 01/21

Page1 of 2

(This space available for case style of estate probate proceeding) |

(For official use only) |

I, the undersigned, _______________________________________________________________________ , do hereby state:

(print name of personal representative)

1.I am the personal representative as defined in section 198.01 or section 731.201, Florida Statutes, as the case may be, of the estate of _____________________________________________________________________________ .

(print name of decedent)

2.The decedent referenced above died on _____/_____/_____, and was domiciled (as defined in s. 198.015, F.S.) at

(date of death)

the time of death in the state of _______________________.

On date of death, the decedent was (check one): o a U.S. citizen o not a U.S. citizen

3.A federal estate tax return (federal Form 706 or

4.The estate does not owe Florida estate tax pursuant to Chapter 198, F.S.

5.I acknowledge personal liability for distribution in whole or in part of any of the estate by having obtained release of such property from the lien of the Florida estate tax.

Under penalties of perjury, I declare that I have read the foregoing Affidavit and that the facts stated in it are true to the best of my knowledge and belief. This Affidavit is based on all information of which the personal representative has any knowledge.

Executed this _______ day of ______________, 20 _____________ |

Signature________________________________________________ |

Print name _______________________________________________ |

Telephone number _______________________________________ |

Mailing address ___________________________________________ |

City/State/ZIP ___________________________________________ |

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.

R. 01/21

Page 2 of 2

Instructions for Completing Form

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.

General Information

If Florida estate tax is not due and a federal estate tax return (federal Form 706 or

Form

The

Where to File Form

Form

When to Use Form

Form

and a federal estate tax return (federal Form 706 or

Federal thresholds for filing federal Form 706 only: (For informational purposes only. Please confirm with Form 706 instructions.)

Date of Death |

Dollar Threshold |

(year) |

for Filing Form 706 |

|

(value of gross estate) |

|

|

2000 and 2001 |

$675,000 |

|

|

2002 and 2003 |

$1,000,000 |

|

|

2004 and 2005 |

$1,500,000 |

|

|

For 2006 and forward |

|

go to the IRS website at |

|

www.irs.gov to obtain |

|

thresholds. |

|

|

|

For thresholds for filing federal Form

If an administration proceeding is pending for an estate, Form

To Contact Us

Information, forms, and tutorials are available on the Department’s website floridarevenue.com

If you have any questions, or need assistance, call Taxpayer Services at

To find a taxpayer service center near you, go to: floridarevenue.com/taxes/servicecenters

For written replies to tax questions, write to: Taxpayer Services - Mail Stop

5050 W Tennessee St Tallahassee FL

Subscribe to Receive Email Alerts from the Department.

Subscribe to receive an email when Tax Information Publications and proposed rules are posted to the Department’s website. Subscribe today at floridarevenue.com/dor/subscribe.

Reference Material

Rule Chapter

Detailed Instructions for Writing Fl Dr 312

Filling out the Fl Dr 312 form is a straightforward process that requires attention to detail. This form serves as an affidavit indicating that no Florida estate tax is due. After completing the form, it must be filed with the appropriate clerk of the court in the county where the decedent owned property. Ensure all information is accurate to avoid any potential issues.

- Begin by entering the name of the personal representative in the designated space at the top of the form.

- In the next section, provide the name of the decedent.

- Fill in the date of death in the format of month/day/year.

- Indicate the state where the decedent was domiciled at the time of death.

- Check the appropriate box to specify whether the decedent was a U.S. citizen or not.

- Confirm that a federal estate tax return (Form 706 or 706-NA) is not required for the estate.

- State that the estate does not owe any Florida estate tax under Chapter 198.

- Acknowledge personal liability for the distribution of the estate by signing and dating the form.

- Print your name below your signature.

- Provide your telephone number and mailing address, including city, state, and ZIP code.

Once the form is completed, file it with the clerk of the circuit court in the appropriate county. Do not send it to the Florida Department of Revenue. Proper filing will ensure that the estate tax lien is removed and that the affidavit serves as evidence of nonliability for Florida estate tax.

Documents used along the form

The Fl Dr 312 form, known as the Affidavit of No Florida Estate Tax Due, is an important document for personal representatives of estates in Florida. It serves to confirm that an estate is not liable for Florida estate tax. Alongside this form, several other documents are often required or recommended to ensure a smooth probate process. Below is a brief overview of these related forms and documents.

- Federal Form 706: This is the United States Estate (and Generation-Skipping Transfer) Tax Return. It is required for estates that exceed certain value thresholds. If the estate's value is above the threshold, filing this form is necessary to report the estate's assets and calculate any federal estate tax owed.

- Federal Form 706-NA: This form is specifically for nonresident aliens. It serves a similar purpose to Form 706, reporting the estate of a non-U.S. citizen decedent. This form helps determine if any federal estate tax is due based on the decedent's U.S. assets.

- Certificate of Title: If the decedent owned real property, a Certificate of Title may be required to transfer ownership to the heirs or beneficiaries. This document provides proof of ownership and is essential for updating property records following the decedent's passing.

- Durable Power of Attorney: This essential document allows individuals to appoint an agent to handle their financial and legal matters, ensuring seamless management if they become incapacitated. For more information, you can visit Texas Forms Online.

- Letters of Administration: This document is issued by the court to appoint a personal representative for the estate. It grants the personal representative the authority to manage the estate, including settling debts and distributing assets according to the will or state law.

Understanding these documents and their purposes can help streamline the probate process, ensuring that all legal obligations are met efficiently. Each form plays a crucial role in managing an estate and protecting the interests of both the decedent's heirs and the state.