Attorney-Approved Employee Loan Agreement Template

An Employee Loan Agreement form is a crucial document that outlines the terms and conditions under which an employer provides a loan to an employee. This agreement serves to protect both parties by clearly defining the loan amount, interest rate, repayment schedule, and any applicable fees. It also specifies the consequences of default, ensuring that employees understand their obligations. Additionally, the form may include provisions for early repayment and the process for handling disputes. By detailing these aspects, the Employee Loan Agreement fosters transparency and accountability, creating a structured framework for financial assistance within the workplace. Such agreements can enhance employee satisfaction while safeguarding the employer's interests.

Dos and Don'ts

When filling out the Employee Loan Agreement form, it is crucial to follow specific guidelines to ensure accuracy and compliance. Below is a list of nine things to do and avoid during this process.

- Do: Read the entire agreement thoroughly before filling it out.

- Do: Provide accurate personal information, including your full name and employee ID.

- Do: Specify the loan amount clearly to avoid any misunderstandings.

- Do: Review the repayment terms and conditions carefully.

- Do: Sign and date the form in the designated areas.

- Don't: Leave any sections blank unless instructed to do so.

- Don't: Use abbreviations or nicknames in your personal information.

- Don't: Forget to keep a copy of the completed agreement for your records.

- Don't: Rush through the form; take your time to ensure everything is correct.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | An Employee Loan Agreement is a legal document outlining the terms of a loan given by an employer to an employee. |

| Purpose | This agreement serves to protect both the employer and employee by clearly defining the loan amount, repayment terms, and interest rates. |

| Repayment Terms | The agreement specifies how and when the employee must repay the loan, including any applicable interest rates. |

| Governing Law | The agreement is typically governed by state laws, which may vary by jurisdiction. For example, in California, it adheres to the California Civil Code. |

| Tax Implications | Loans provided to employees may have tax implications, and both parties should be aware of potential tax liabilities. |

| Default Consequences | The agreement outlines the consequences of defaulting on the loan, which may include deductions from the employee's wages. |

| Confidentiality | Typically, the agreement includes a confidentiality clause to protect sensitive financial information of both parties. |

Key takeaways

When filling out and using the Employee Loan Agreement form, it's essential to keep several key points in mind. Understanding these takeaways can help ensure a smooth process for both the employer and the employee.

- Clarity is Crucial: Clearly outline the terms of the loan, including the amount, interest rate, and repayment schedule.

- Document Everything: Ensure that all details are documented in the agreement to avoid misunderstandings later.

- Legal Compliance: Verify that the agreement complies with federal and state laws regarding employee loans.

- Repayment Terms: Specify how and when repayments will be made, including any grace periods or penalties for late payments.

- Employee Acknowledgment: Have the employee sign the agreement to acknowledge their understanding and acceptance of the terms.

- Confidentiality: Keep the agreement confidential to protect the privacy of the employee’s financial information.

- Review Regularly: Periodically review the agreement to ensure it remains relevant and compliant with any changes in laws or company policy.

- Communication is Key: Maintain open lines of communication with the employee regarding their loan status and any changes that may arise.

- Record Keeping: Keep a copy of the signed agreement and any related correspondence for your records.

Following these takeaways can help both parties navigate the employee loan process effectively and minimize potential issues.

Example - Employee Loan Agreement Form

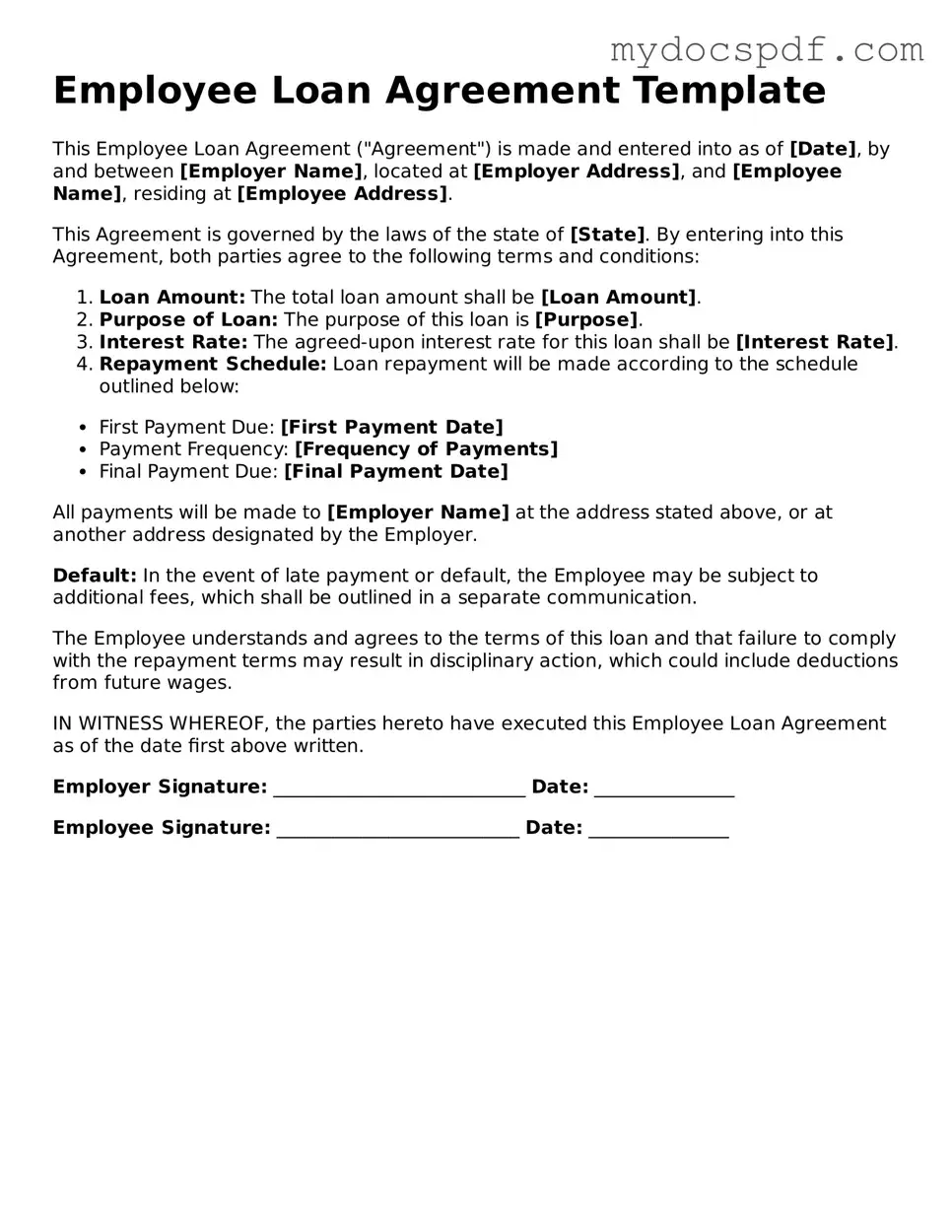

Employee Loan Agreement Template

This Employee Loan Agreement ("Agreement") is made and entered into as of [Date], by and between [Employer Name], located at [Employer Address], and [Employee Name], residing at [Employee Address].

This Agreement is governed by the laws of the state of [State]. By entering into this Agreement, both parties agree to the following terms and conditions:

- Loan Amount: The total loan amount shall be [Loan Amount].

- Purpose of Loan: The purpose of this loan is [Purpose].

- Interest Rate: The agreed-upon interest rate for this loan shall be [Interest Rate].

- Repayment Schedule: Loan repayment will be made according to the schedule outlined below:

- First Payment Due: [First Payment Date]

- Payment Frequency: [Frequency of Payments]

- Final Payment Due: [Final Payment Date]

All payments will be made to [Employer Name] at the address stated above, or at another address designated by the Employer.

Default: In the event of late payment or default, the Employee may be subject to additional fees, which shall be outlined in a separate communication.

The Employee understands and agrees to the terms of this loan and that failure to comply with the repayment terms may result in disciplinary action, which could include deductions from future wages.

IN WITNESS WHEREOF, the parties hereto have executed this Employee Loan Agreement as of the date first above written.

Employer Signature: ___________________________ Date: _______________

Employee Signature: __________________________ Date: _______________

Detailed Instructions for Writing Employee Loan Agreement

Filling out the Employee Loan Agreement form is a straightforward process. This document outlines the terms of the loan between the employee and the employer, ensuring clarity and mutual understanding. Follow these steps carefully to complete the form accurately.

- Read the form thoroughly. Familiarize yourself with all sections before starting to fill it out.

- Enter your personal information. Fill in your full name, address, and contact details in the designated fields.

- Provide loan details. Specify the loan amount you are requesting and the purpose of the loan.

- Set repayment terms. Indicate the repayment schedule, including the start date and duration of the loan.

- Review interest rates. If applicable, check the interest rate and ensure it is clearly stated.

- Sign the form. Add your signature and date it to confirm your agreement to the terms.

- Submit the form. Hand in the completed form to your HR department or the designated loan officer.

Documents used along the form

When entering into an Employee Loan Agreement, it is essential to consider additional forms and documents that often accompany this agreement. These documents help clarify the terms of the loan, outline responsibilities, and protect both the employer and employee. Below is a list of commonly used forms that complement the Employee Loan Agreement.

- Promissory Note: This document serves as a written promise from the employee to repay the loan under specified terms. It details the loan amount, interest rate, repayment schedule, and consequences of default. The promissory note provides legal evidence of the debt and the employee's commitment to repay it.

- Loan Agreement Form: This form serves as a legally binding contract and should be carefully completed, which can be done at LegalDocumentsTemplates.com, ensuring all terms and conditions are understood.

- Loan Repayment Schedule: A detailed schedule that outlines the specific dates and amounts due for each repayment. This document helps both parties keep track of the loan's repayment timeline, ensuring clarity and accountability throughout the loan period.

- Authorization for Payroll Deduction: This form allows the employer to deduct loan repayments directly from the employee's paycheck. It streamlines the repayment process and ensures that payments are made on time, reducing the likelihood of missed payments.

- Loan Agreement Amendment: If any changes to the original loan terms are necessary, this document formalizes those amendments. It may address adjustments in repayment terms, interest rates, or any other modifications agreed upon by both parties, ensuring that all changes are documented and legally binding.

Incorporating these documents alongside the Employee Loan Agreement enhances clarity and protects the interests of both the employer and the employee. Each form plays a vital role in establishing a transparent and mutually beneficial lending relationship.