Get Employee Advance Form in PDF

When navigating the complexities of workplace finances, the Employee Advance form emerges as a vital tool for both employees and employers. This form facilitates the process of requesting and documenting advances on wages or expenses, ensuring that employees have the necessary funds to cover immediate needs before their regular paychecks arrive. Typically, the form requires essential details such as the employee's name, the amount requested, and the purpose of the advance. It also outlines the repayment terms, which can vary depending on the company's policies. By utilizing this form, organizations can maintain clear records of advances, fostering transparency and accountability within the workplace. Additionally, it serves as a safeguard for employers, helping them manage cash flow while supporting their employees during times of financial strain. Understanding how to properly fill out and process this form can streamline communication and promote a positive work environment.

Dos and Don'ts

When filling out the Employee Advance form, it's important to follow certain guidelines to ensure a smooth process. Here’s a list of things to do and avoid:

- Do read the instructions carefully before starting.

- Do provide accurate and complete information.

- Do double-check your calculations for any requested amounts.

- Do keep a copy of the form for your records.

- Do submit the form within the designated timeframe.

- Don't leave any required fields blank.

- Don't submit the form without your supervisor's approval.

- Don't provide false information or inflate expenses.

- Don't forget to sign and date the form before submission.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Employee Advance form is used to request funds from an employer before the employee's regular payday. |

| Eligibility | Typically, only employees in good standing may request an advance, subject to company policy. |

| Repayment Terms | Repayment usually occurs through deductions from future paychecks, often over a specified period. |

| Tax Implications | Advances may be considered taxable income, affecting the employee's tax withholdings. |

| State Regulations | State laws may govern the terms of employee advances, including repayment and interest rates. |

| Documentation | Employees often need to provide documentation of the purpose for the advance, such as medical bills or emergencies. |

| Approval Process | Most companies require managerial approval before granting an advance to an employee. |

| Limitations | Employers may set limits on the amount of money that can be advanced, often based on salary or tenure. |

| Dispute Resolution | Any disputes regarding advances should be addressed according to the company’s grievance policy. |

| Confidentiality | Requests for advances should be treated confidentially to protect employee privacy. |

Key takeaways

When filling out and using the Employee Advance form, keep these key points in mind:

- Understand the Purpose: This form is designed to request funds for work-related expenses that you will incur before receiving your paycheck.

- Provide Accurate Information: Fill in all required fields with correct details to avoid delays in processing your request.

- Attach Supporting Documents: Include any receipts or documentation that justify the advance request to ensure transparency.

- Know the Limits: Be aware of your company's policy regarding the maximum amount you can request for an advance.

- Submit on Time: Ensure that you submit the form well in advance of when you need the funds to allow for processing time.

- Keep a Copy: Retain a copy of the completed form for your records. This can be useful for tracking your expenses.

- Follow Up: If you don’t receive a response within a reasonable timeframe, follow up with your supervisor or HR department.

Other PDF Templates

How to Fill Out Passport Application - Submitting the DS-11 does not guarantee passport issuance; additional processing may be required.

What Does Order to Show Cause Mean - The form includes space for documenting different vaccine doses received.

The Texas Affidavit of Gift form is a legal document used to transfer ownership of property or assets without the exchange of money. This form serves to establish the intent of the donor to gift the specified items to the recipient. For those seeking to create this document, resources like Texas Forms Online can provide valuable templates and guidance. Understanding its components is essential for both parties involved in the transaction.

Official Cuddle Buddy Application - Explore new friendships while enjoying the comfort of cuddling.

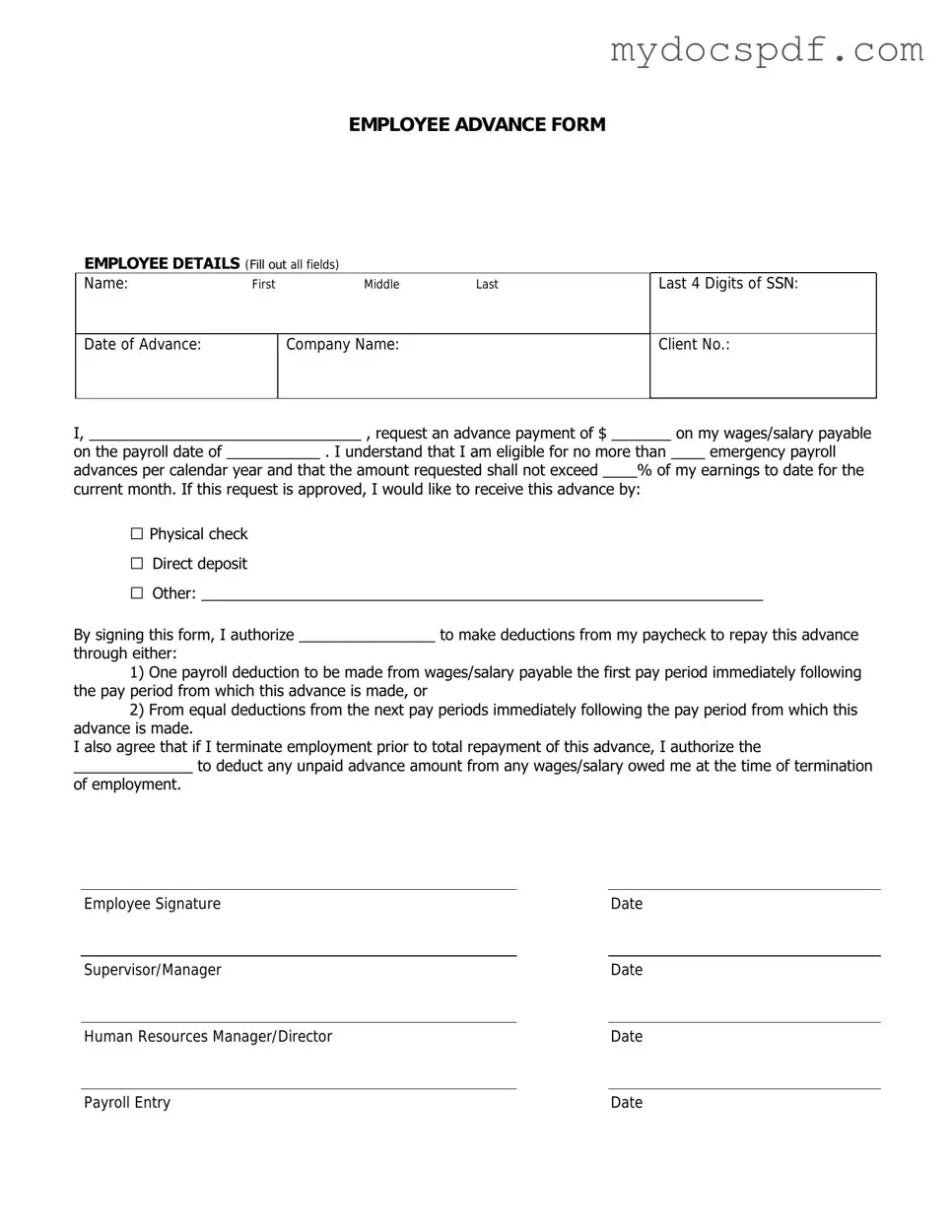

Example - Employee Advance Form

EMPLOYEE ADVANCE FORM

EMPLOYEE DETAILS (Fill out all fields)

Name: |

First |

Middle |

Last |

|

|

|

|

Date of Advance: |

|

Company Name: |

|

|

|

|

|

Last 4 Digits of SSN:

Client No.:

I, ________________________________ , request an advance payment of $ _______ on my wages/salary payable

on the payroll date of ___________ . I understand that I am eligible for no more than ____ emergency payroll

advances per calendar year and that the amount requested shall not exceed ____% of my earnings to date for the

current month. If this request is approved, I would like to receive this advance by:

□Physical check

□Direct deposit

□Other: __________________________________________________________________

By signing this form, I authorize ________________ to make deductions from my paycheck to repay this advance

through either:

1)One payroll deduction to be made from wages/salary payable the first pay period immediately following the pay period from which this advance is made, or

2)From equal deductions from the next pay periods immediately following the pay period from which this advance is made.

I also agree that if I terminate employment prior to total repayment of this advance, I authorize the

______________ to deduct any unpaid advance amount from any wages/salary owed me at the time of termination of employment.

Employee Signature |

|

Date |

|

|

|

Supervisor/Manager |

|

Date |

|

|

|

Human Resources Manager/Director |

|

Date |

Payroll Entry |

Date |

Detailed Instructions for Writing Employee Advance

Once you have the Employee Advance form in hand, you are ready to begin the process of filling it out. This form is essential for requesting an advance on your salary or expenses. Follow the steps below carefully to ensure accurate completion.

- Start by entering your full name in the designated field at the top of the form.

- Provide your employee identification number, which is usually found on your pay stub.

- Fill in your department name to indicate where you work within the organization.

- Specify the date of the request in the appropriate section.

- Clearly state the amount you are requesting as an advance.

- In the next section, describe the purpose of the advance in a few concise sentences.

- Sign the form to confirm that all information provided is accurate and truthful.

- Submit the completed form to your supervisor or the HR department as instructed.

Documents used along the form

When managing employee finances and reimbursements, several forms work hand-in-hand with the Employee Advance form. Each document serves a unique purpose, ensuring clarity and compliance in financial transactions. Below are four commonly used forms that complement the Employee Advance form.

- Expense Reimbursement Form: This document allows employees to request reimbursement for business-related expenses they have already incurred. It typically requires itemized receipts and may have specific guidelines on eligible expenses.

- Room Rental Agreement: Essential for defining the relationship between landlord and tenant, this legal document ensures clarity in the rental process, as found in the comprehensive https://newyorkform.com/free-room-rental-agreement-template/.

- Payroll Deduction Authorization Form: Employees use this form to authorize deductions from their paychecks. This is particularly relevant when an advance needs to be repaid through payroll deductions over a specified period.

- Travel Authorization Form: Before an employee embarks on business travel, this form is often required. It outlines the purpose of the trip, estimated costs, and the approval process, ensuring that all travel-related expenses are pre-approved.

- Employee Agreement Form: This document outlines the terms and conditions associated with the advance. It may include repayment terms, interest rates (if applicable), and the responsibilities of both the employee and employer regarding the advance.

Utilizing these forms alongside the Employee Advance form helps create a structured approach to managing financial transactions within a company. Each document plays a vital role in maintaining transparency and accountability in employee finances.