Attorney-Approved Durable Power of Attorney Template

The Durable Power of Attorney form is an essential legal document that allows individuals to appoint someone they trust to make decisions on their behalf, particularly in times when they may be unable to do so themselves. This powerful tool ensures that your financial and medical affairs are managed according to your wishes, even if you become incapacitated. The form can cover a wide range of responsibilities, from handling bank transactions and paying bills to making critical healthcare decisions. It is crucial to select an agent who understands your values and preferences, as this person will have the authority to act in your best interest. Importantly, the Durable Power of Attorney remains effective even if you lose the capacity to make decisions, providing peace of mind that your affairs will be in capable hands. Understanding the nuances of this form, including the difference between durable and non-durable powers of attorney, is vital for anyone considering this option. By preparing this document, you take a proactive step in safeguarding your future and ensuring that your voice is heard, regardless of the circumstances.

Dos and Don'ts

When filling out a Durable Power of Attorney form, it is important to follow certain guidelines to ensure that the document is valid and meets your needs. Here’s a list of things you should and shouldn’t do:

- Do choose a trusted person as your agent.

- Do clearly define the powers you are granting.

- Do sign the form in the presence of a notary public, if required by your state.

- Do keep a copy of the completed form for your records.

- Do discuss your wishes with your agent beforehand.

- Don't leave any sections of the form blank.

- Don't choose an agent who may have conflicts of interest.

- Don't assume all states have the same requirements for the form.

- Don't forget to update the form if your circumstances change.

Durable Power of AttorneyTemplates for Particular US States

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney (DPOA) is a legal document that allows an individual (the principal) to designate another person (the agent) to make decisions on their behalf, even if the principal becomes incapacitated. |

| State-Specific Forms | Each state has its own specific Durable Power of Attorney form. For example, in California, the governing law is found in the California Probate Code Section 4400. |

| Durability | The term "durable" means that the power of attorney remains effective even if the principal becomes mentally or physically incapacitated. This feature is crucial for long-term planning. |

| Revocation | A Durable Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent. This provides flexibility and control over the agent's authority. |

Key takeaways

Filling out and using a Durable Power of Attorney (DPOA) form is an important step in planning for your future. Here are some key takeaways to keep in mind:

- Understand the Purpose: A Durable Power of Attorney allows you to designate someone to make decisions on your behalf if you become unable to do so. This can include financial and medical decisions.

- Choose Your Agent Wisely: Select a trusted individual who understands your wishes and values. This person will have significant authority over your affairs, so it’s crucial to choose someone responsible.

- Be Specific: Clearly outline the powers you are granting to your agent. You can specify what decisions they can make, ensuring your wishes are respected.

- Review and Update: Regularly review your DPOA to ensure it reflects your current wishes and circumstances. Life changes, such as marriage or divorce, may require updates to the document.

Popular Durable Power of Attorney Documents:

Power of Attorney Example - Such authority helps avoid complications that arise from remote transactions.

When engaging in any sale, utilizing a formal document is essential for clarity and protection. A Bill of Sale form is a legal document that serves as proof of the transfer of ownership of goods or property from one party to another. It outlines essential details such as the description of the item, the sale price, and the parties involved. For those looking for resources to assist in this process, Free Business Forms can provide templates and guidance that help ensure a smooth transaction.

Example - Durable Power of Attorney Form

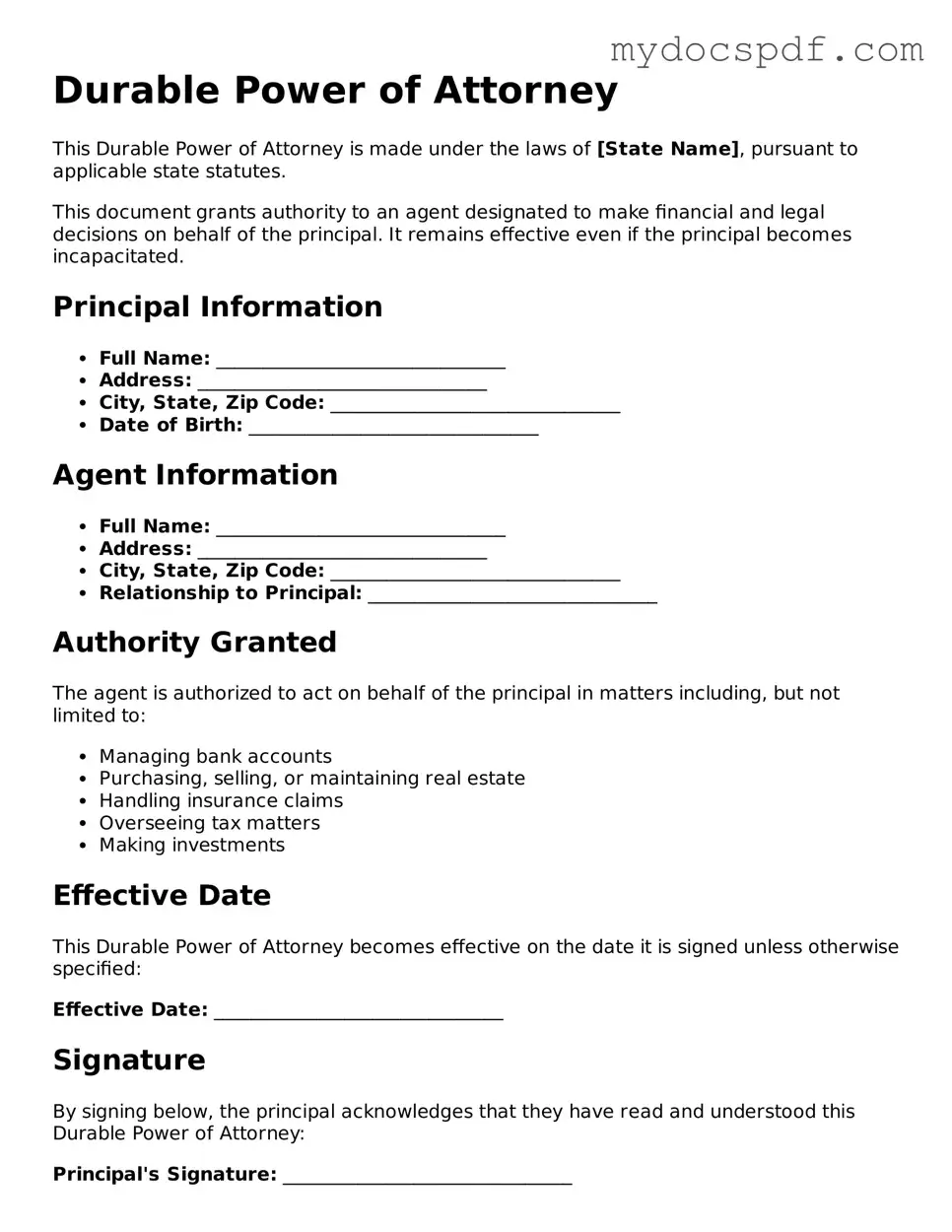

Durable Power of Attorney

This Durable Power of Attorney is made under the laws of [State Name], pursuant to applicable state statutes.

This document grants authority to an agent designated to make financial and legal decisions on behalf of the principal. It remains effective even if the principal becomes incapacitated.

Principal Information

- Full Name: _______________________________

- Address: _______________________________

- City, State, Zip Code: _______________________________

- Date of Birth: _______________________________

Agent Information

- Full Name: _______________________________

- Address: _______________________________

- City, State, Zip Code: _______________________________

- Relationship to Principal: _______________________________

Authority Granted

The agent is authorized to act on behalf of the principal in matters including, but not limited to:

- Managing bank accounts

- Purchasing, selling, or maintaining real estate

- Handling insurance claims

- Overseeing tax matters

- Making investments

Effective Date

This Durable Power of Attorney becomes effective on the date it is signed unless otherwise specified:

Effective Date: _______________________________

Signature

By signing below, the principal acknowledges that they have read and understood this Durable Power of Attorney:

Principal's Signature: _______________________________

Date: _______________________________

Witnesses

This document must be witnessed by two individuals who are not related to the principal or agent:

- Witness 1 Name: _______________________________

- Witness 1 Signature: _______________________________

- Witness 2 Name: _______________________________

- Witness 2 Signature: _______________________________

It is recommended that this document be notarized to ensure its validity under state law.

Detailed Instructions for Writing Durable Power of Attorney

Filling out a Durable Power of Attorney form is a straightforward process. It allows you to designate someone to make decisions on your behalf when you cannot. Once you have completed the form, you will need to sign it in front of a notary public or witnesses, depending on your state's requirements.

- Obtain the Durable Power of Attorney form. You can find this online or through legal offices.

- Read through the form carefully to understand its sections and requirements.

- Fill in your name and address at the top of the form.

- Identify the person you are appointing as your agent. Include their full name and contact information.

- Specify the powers you wish to grant your agent. Be clear about what decisions they can make on your behalf.

- Indicate the duration of the power of attorney. Decide if it will be effective immediately or only under certain conditions.

- Review the form to ensure all information is accurate and complete.

- Sign the form in the presence of a notary public or witnesses, as required by your state.

- Provide a copy of the signed form to your agent and keep one for your records.

Documents used along the form

A Durable Power of Attorney (DPOA) is a crucial document that allows an individual to designate someone else to make decisions on their behalf, especially during times of incapacity. However, it often works best in conjunction with other legal documents that can help clarify intentions and provide comprehensive support for decision-making. Below is a list of additional forms and documents commonly used alongside a Durable Power of Attorney.

- Health Care Proxy: This document allows you to appoint someone to make medical decisions for you if you become unable to communicate your wishes. It ensures that your health care preferences are honored.

- Living Will: A living will outlines your preferences regarding medical treatment and life-sustaining measures in situations where you cannot express your wishes. This document complements a health care proxy by providing specific instructions.

- Financial Power of Attorney: Similar to a DPOA, this document specifically grants someone authority to manage your financial affairs. It can be tailored to be effective immediately or only when you are incapacitated.

- Will: A will is a legal document that outlines how your assets will be distributed after your death. It can also appoint guardians for minor children, ensuring that your wishes are followed even after you are gone.

- Trust Agreement: A trust allows you to transfer assets into a trust for the benefit of others, often helping to avoid probate. It can provide greater control over how and when your assets are distributed.

- Beneficiary Designations: These are forms used to designate who will receive your assets upon your death, such as life insurance policies or retirement accounts. Keeping these updated is essential for ensuring your wishes are carried out.

- California Motorcycle Bill of Sale: This document is essential for recording the sale or transfer of ownership of a motorcycle, capturing key details of the transaction to protect both parties involved. For more information, you can refer to the Bill of Sale for Motorcycles.

- Authorization for Release of Medical Records: This document allows designated individuals access to your medical records. It is vital for ensuring that your health care proxy or family members can make informed decisions about your care.

- HIPAA Release Form: This form allows you to authorize specific individuals to access your health information under the Health Insurance Portability and Accountability Act (HIPAA). It ensures that your privacy is maintained while allowing trusted individuals to assist with your care.

- Asset Inventory List: This is a comprehensive list of your assets, including properties, bank accounts, and investments. It can help your agent manage your affairs more effectively and ensure nothing is overlooked.

- Letter of Intent: While not a legally binding document, a letter of intent can provide guidance to your loved ones and your agents about your wishes, values, and specific instructions for your care and estate.

Each of these documents plays a unique role in creating a robust plan for your future. By considering them alongside a Durable Power of Attorney, you can ensure that your preferences are clearly communicated and respected, providing peace of mind for both you and your loved ones.