Attorney-Approved Deed of Trust Template

When navigating the intricate world of real estate transactions, understanding the Deed of Trust form becomes essential for both borrowers and lenders. This legal document serves as a cornerstone in the financing of property, establishing a secure framework for the loan process. At its core, the Deed of Trust creates a three-party agreement among the borrower, the lender, and a neutral third party known as the trustee. This arrangement ensures that the lender's interests are protected while also outlining the rights and responsibilities of each party involved. Key aspects of the form include the details of the loan amount, the terms of repayment, and the stipulations surrounding default and foreclosure. Additionally, the Deed of Trust may specify the property being financed, thereby providing a clear legal description that ties the loan to a specific piece of real estate. Understanding these components is crucial, as they not only dictate the terms of the financial agreement but also influence the legal recourse available should disputes arise. By delving into the nuances of the Deed of Trust, parties can better safeguard their interests and navigate the complexities of property financing with confidence.

Dos and Don'ts

Filling out a Deed of Trust form is a crucial step in securing a loan against real property. Here are some important dos and don'ts to keep in mind:

- Do ensure that all names are spelled correctly. This includes the borrower and the lender.

- Do provide accurate property details. Include the full address and legal description.

- Do read the entire document carefully before signing. Understanding the terms is essential.

- Do have a witness present when signing the form, if required by your state.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank. Fill out every section as required.

- Don't use white-out or erase any mistakes. Cross out errors and initial them instead.

- Don't rush through the process. Take your time to ensure everything is correct.

- Don't forget to check local laws. Requirements can vary by state.

By following these guidelines, you can help ensure that your Deed of Trust form is filled out correctly and is legally binding.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Deed of Trust is a legal document that secures a loan by transferring the title of a property to a third party, known as a trustee, until the loan is repaid. |

| Parties Involved | Typically, there are three parties involved: the borrower (trustor), the lender (beneficiary), and the trustee. |

| Purpose | The primary purpose is to protect the lender's interest in the property by ensuring the loan is secured against it. |

| Governing Law | The laws governing Deeds of Trust vary by state. For example, in California, it is governed by the California Civil Code. |

| Foreclosure Process | In the event of default, the trustee has the authority to initiate a non-judicial foreclosure, which can be quicker than judicial foreclosure. |

| Recording | A Deed of Trust must be recorded with the county recorder’s office to be enforceable against third parties. |

| Beneficiary Rights | The lender (beneficiary) has the right to receive payments and can initiate foreclosure if the borrower defaults. |

| Trustee Responsibilities | The trustee acts as a neutral party, holding the legal title to the property until the loan is repaid. |

| Variations by State | Some states may have specific requirements or forms for Deeds of Trust, such as Texas or Virginia, which have their own statutes. |

| Importance of Clarity | It is crucial for all parties to understand the terms outlined in the Deed of Trust to avoid disputes and ensure a smooth transaction. |

Key takeaways

When filling out and using a Deed of Trust form, it’s essential to keep several important points in mind. Here are some key takeaways to help you navigate the process effectively:

- Understand the Purpose: A Deed of Trust is a legal document that secures a loan by transferring the title of the property to a trustee until the loan is paid off.

- Identify the Parties: Clearly list all parties involved, including the borrower, lender, and trustee. Accurate identification is crucial for the document’s validity.

- Property Description: Provide a detailed description of the property being secured. This includes the address and any legal descriptions necessary for identification.

- Loan Amount: Specify the amount of the loan being secured by the Deed of Trust. This amount should match the loan documents.

- Signatures Required: Ensure that all parties sign the document. Notarization may also be required to authenticate the signatures.

- Recording the Document: After completion, the Deed of Trust should be recorded with the appropriate county office. This step protects the lender's interest in the property.

- Understand the Terms: Familiarize yourself with the terms and conditions outlined in the Deed of Trust, including any default provisions and rights of the parties involved.

By keeping these takeaways in mind, you can fill out and utilize the Deed of Trust form more confidently and effectively.

Popular Deed of Trust Documents:

Transfer on Death Deed California - Using a Transfer-on-Death Deed can significantly reduce the legal complexities involved in estate management.

For those looking to understand property transfers, the effective Georgia Quitclaim Deed process simplifies the transfer of ownership rights without the complexities of title guarantees. It is particularly useful in familial situations or when no monetary exchange is involved.

Example - Deed of Trust Form

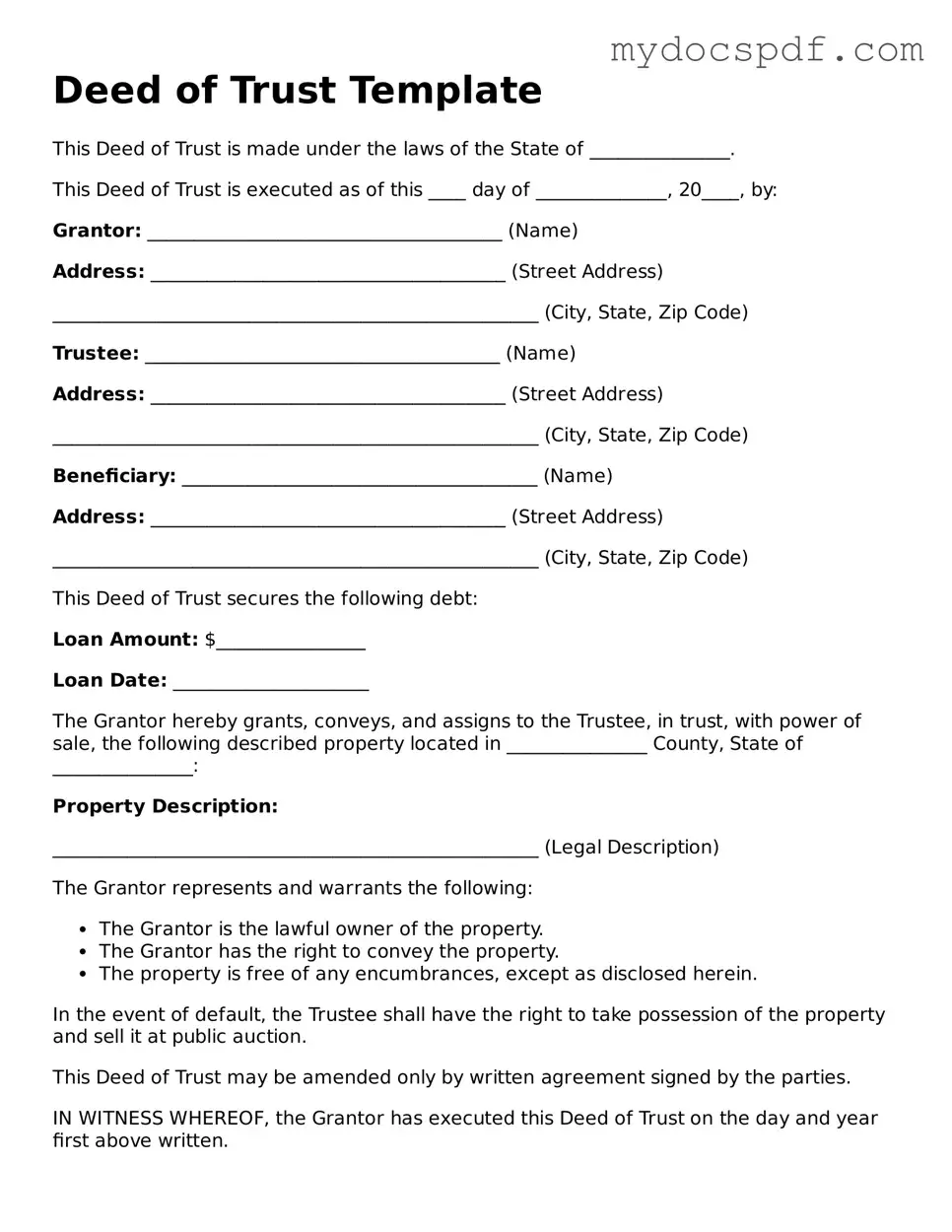

Deed of Trust Template

This Deed of Trust is made under the laws of the State of _______________.

This Deed of Trust is executed as of this ____ day of ______________, 20____, by:

Grantor: ______________________________________ (Name)

Address: ______________________________________ (Street Address)

____________________________________________________ (City, State, Zip Code)

Trustee: ______________________________________ (Name)

Address: ______________________________________ (Street Address)

____________________________________________________ (City, State, Zip Code)

Beneficiary: ______________________________________ (Name)

Address: ______________________________________ (Street Address)

____________________________________________________ (City, State, Zip Code)

This Deed of Trust secures the following debt:

Loan Amount: $________________

Loan Date: _____________________

The Grantor hereby grants, conveys, and assigns to the Trustee, in trust, with power of sale, the following described property located in _______________ County, State of _______________:

Property Description:

____________________________________________________ (Legal Description)

The Grantor represents and warrants the following:

- The Grantor is the lawful owner of the property.

- The Grantor has the right to convey the property.

- The property is free of any encumbrances, except as disclosed herein.

In the event of default, the Trustee shall have the right to take possession of the property and sell it at public auction.

This Deed of Trust may be amended only by written agreement signed by the parties.

IN WITNESS WHEREOF, the Grantor has executed this Deed of Trust on the day and year first above written.

Grantor's Signature: ___________________________

Date: ___________________________

Trustee's Signature: ___________________________

Date: ___________________________

Beneficiary's Signature: ___________________________

Date: ___________________________

Notary Public:

State of ______________, County of ______________

Subscribed and sworn to before me on this ____ day of ______________, 20____.

Notary Signature: ___________________________

My Commission Expires: ___________________________

Detailed Instructions for Writing Deed of Trust

Once you have the Deed of Trust form ready, it is important to fill it out accurately to ensure that all necessary information is included. After completing the form, you will typically need to have it signed and notarized before filing it with the appropriate county office.

- Begin by entering the date at the top of the form.

- Provide the names and addresses of the borrower(s) in the designated section.

- Next, list the name and address of the lender.

- Fill in the legal description of the property being secured by the Deed of Trust. This information can usually be found on the property’s title or deed.

- Indicate the loan amount in the specified area.

- Include any terms related to the loan repayment schedule, such as interest rates and payment intervals.

- Sign the form in the appropriate places as the borrower(s).

- Have the form notarized by a licensed notary public.

- Submit the completed and notarized form to the county recorder's office for filing.

Documents used along the form

A Deed of Trust is often used in real estate transactions to secure a loan. Several other documents may accompany it to ensure the transaction is clear and legally binding. Here is a list of related forms and documents commonly used alongside a Deed of Trust.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It specifies the loan amount, interest rate, repayment schedule, and consequences of default.

- Loan Agreement: This agreement details the terms and conditions of the loan. It may include provisions about fees, prepayment options, and the obligations of both the lender and borrower.

- Title Insurance Policy: This policy protects the lender and borrower against potential defects in the title. It ensures that the property is free from liens or claims that could affect ownership.

- Property Appraisal: An appraisal provides an estimate of the property's value. Lenders often require this to determine the loan amount based on the property's worth.

- Property Survey: A survey outlines the property boundaries and any easements. It helps identify potential issues related to property lines and encroachments.

- Closing Disclosure: This document summarizes the final terms of the loan and all closing costs. It ensures that borrowers understand their financial obligations before finalizing the transaction.

- Borrower's Affidavit: This sworn statement confirms the borrower's identity and financial status. It may include information about other debts and assets.

- : This legal document is essential for transferring ownership of real property in Georgia. For more information and to access the form, visit https://georgiapdf.com/deed.

- Notice of Default: If the borrower fails to meet payment obligations, this document formally notifies them of the default. It outlines the steps the lender may take to recover the loan.

Each of these documents plays a crucial role in the real estate transaction process. They help protect the interests of both parties and ensure that all legal requirements are met.