Attorney-Approved Deed in Lieu of Foreclosure Template

The Deed in Lieu of Foreclosure form serves as an important legal document in the realm of real estate transactions, particularly for homeowners facing financial difficulties. This form allows a property owner to voluntarily transfer the title of their home to the lender, thereby avoiding the lengthy and often stressful process of foreclosure. By completing this form, homeowners can settle their mortgage obligations and potentially mitigate the negative impact on their credit score. The process typically involves several key elements, including an agreement between the homeowner and the lender, the condition of the property, and any outstanding debts associated with the mortgage. Additionally, the form may include clauses that address the homeowner's rights and responsibilities, ensuring that both parties understand the implications of the transfer. Understanding the Deed in Lieu of Foreclosure form is crucial for those navigating financial hardship, as it provides a possible alternative to foreclosure while allowing homeowners to move forward with their lives.

Dos and Don'ts

When filling out the Deed in Lieu of Foreclosure form, it is essential to approach the process with care. Here’s a list of things to do and avoid to ensure a smoother experience.

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do consult with a legal expert if you have questions.

- Do make sure to sign and date the document where required.

- Do keep copies of all documents for your records.

- Don't rush through the form; take your time.

- Don't leave any sections blank unless instructed.

- Don't use unclear or ambiguous language.

- Don't forget to check for any additional requirements from your lender.

- Don't submit the form without reviewing it for errors.

Deed in Lieu of ForeclosureTemplates for Particular US States

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is an agreement where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Purpose | This form helps borrowers avoid the lengthy and costly foreclosure process while allowing lenders to take possession of the property more quickly. |

| State-Specific Forms | Each state may have its own version of the Deed in Lieu of Foreclosure, reflecting local laws and requirements. |

| Governing Laws | In California, for example, the relevant laws include California Civil Code Section 2943. |

| Impact on Credit | While a Deed in Lieu of Foreclosure is less damaging than a foreclosure, it can still negatively affect a borrower’s credit score. |

| Negotiation | Borrowers can negotiate terms with lenders, including potential forgiveness of remaining debt after the deed transfer. |

| Eligibility | Not all borrowers qualify; lenders often require proof of financial hardship and an inability to continue mortgage payments. |

| Legal Advice | It’s recommended that borrowers seek legal advice before signing a Deed in Lieu of Foreclosure to understand their rights and obligations. |

Key takeaways

When considering a Deed in Lieu of Foreclosure, it’s important to understand the implications and process. Here are some key takeaways:

- Understanding the Process: A Deed in Lieu of Foreclosure allows homeowners to voluntarily transfer their property to the lender to avoid foreclosure. This process can help you avoid a lengthy foreclosure procedure.

- Impact on Credit: While a Deed in Lieu of Foreclosure is less damaging than a foreclosure, it can still negatively affect your credit score. It’s essential to consider how this decision might impact your financial future.

- Negotiation Opportunities: Homeowners may have the chance to negotiate terms with the lender. This could include debt forgiveness or assistance in finding new housing.

- Legal Advice: Consulting with a legal professional is advisable. They can provide guidance specific to your situation and help ensure that your rights are protected throughout the process.

Popular Deed in Lieu of Foreclosure Documents:

Blank Deed of Trust - The trustee has obligations, which include notifying parties in case of default or foreclosure.

The Arizona Residential Lease Agreement is a legal document that outlines the terms and conditions between a landlord and tenant for renting residential property in Arizona. This agreement serves to protect the rights of both parties while ensuring clarity regarding rental obligations. For more details and resources on this form, you can visit arizonapdfs.com/, which provides valuable information for anyone involved in a rental transaction in the state.

Transfer on Death Deed California - Generally, the simplicity and effectiveness of the Transfer-on-Death Deed make it an appealing choice for many Americans.

Quitclaim Deed Form New Jersey - A Quitclaim Deed may be used to clarify ownership between business partners.

Example - Deed in Lieu of Foreclosure Form

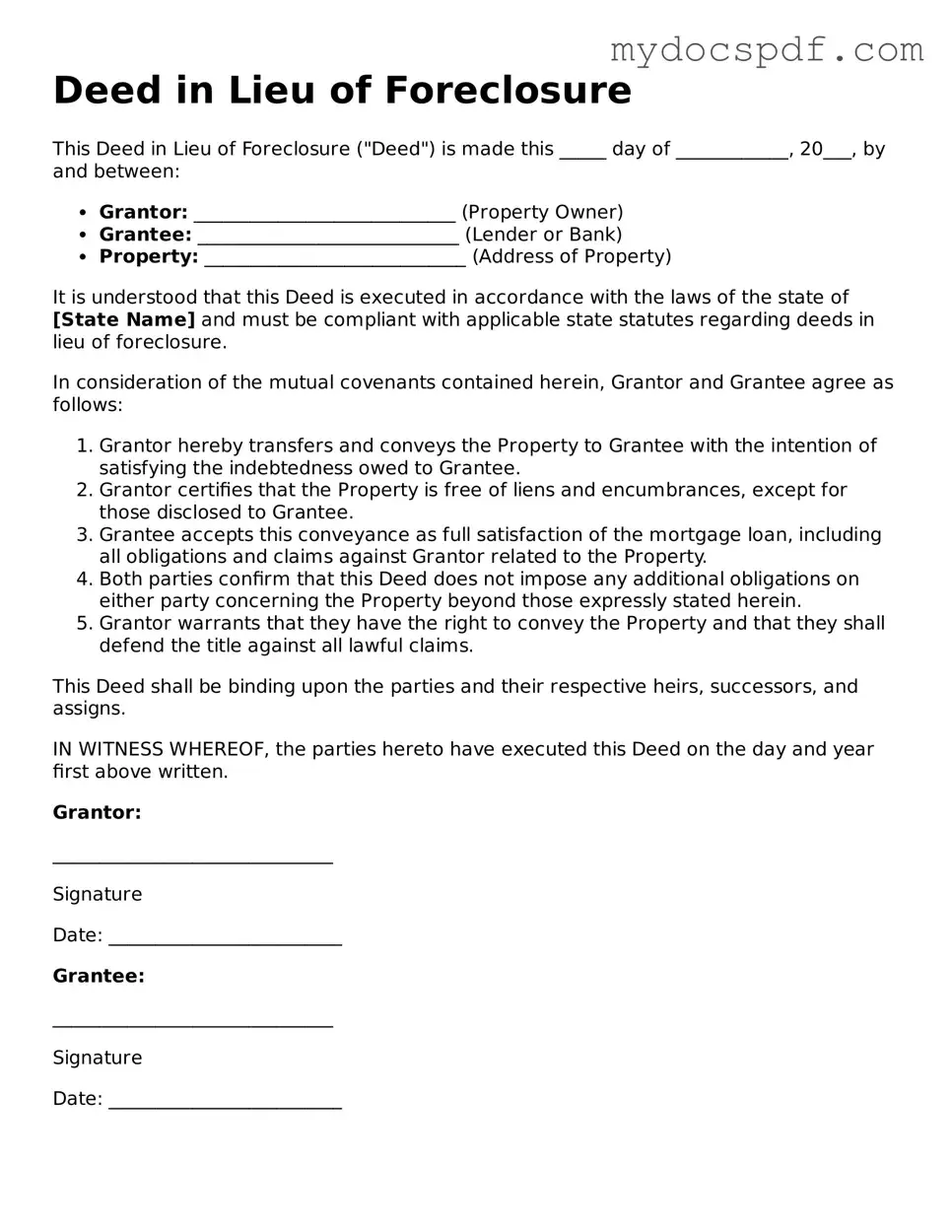

Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure ("Deed") is made this _____ day of ____________, 20___, by and between:

- Grantor: ____________________________ (Property Owner)

- Grantee: ____________________________ (Lender or Bank)

- Property: ____________________________ (Address of Property)

It is understood that this Deed is executed in accordance with the laws of the state of [State Name] and must be compliant with applicable state statutes regarding deeds in lieu of foreclosure.

In consideration of the mutual covenants contained herein, Grantor and Grantee agree as follows:

- Grantor hereby transfers and conveys the Property to Grantee with the intention of satisfying the indebtedness owed to Grantee.

- Grantor certifies that the Property is free of liens and encumbrances, except for those disclosed to Grantee.

- Grantee accepts this conveyance as full satisfaction of the mortgage loan, including all obligations and claims against Grantor related to the Property.

- Both parties confirm that this Deed does not impose any additional obligations on either party concerning the Property beyond those expressly stated herein.

- Grantor warrants that they have the right to convey the Property and that they shall defend the title against all lawful claims.

This Deed shall be binding upon the parties and their respective heirs, successors, and assigns.

IN WITNESS WHEREOF, the parties hereto have executed this Deed on the day and year first above written.

Grantor:

______________________________

Signature

Date: _________________________

Grantee:

______________________________

Signature

Date: _________________________

Detailed Instructions for Writing Deed in Lieu of Foreclosure

After completing the Deed in Lieu of Foreclosure form, the next steps involve submitting the document to your lender for review. This process may lead to discussions regarding any remaining obligations or arrangements for your mortgage. It is essential to keep communication open with your lender during this time.

- Begin by obtaining the Deed in Lieu of Foreclosure form from your lender or an online legal resource.

- Fill in your personal information, including your full name, address, and contact details.

- Provide the property information, including the address and legal description of the property in question.

- Clearly state the lender's name and address as it appears on your mortgage documents.

- Indicate the date on which the deed is being executed.

- Review the section regarding any outstanding obligations or claims against the property, and fill in any necessary details.

- Sign the form in the designated area, ensuring that your signature matches the name provided at the top of the form.

- Have the form notarized by a licensed notary public to validate your signature.

- Make copies of the completed and notarized form for your records.

- Submit the original form to your lender, either in person or via certified mail, ensuring you keep proof of submission.

Documents used along the form

A Deed in Lieu of Foreclosure is a significant document in the process of resolving mortgage default. However, several other forms and documents often accompany it to ensure a smooth transition and clear communication between parties involved. Here are six common documents used alongside the Deed in Lieu of Foreclosure:

- Loan Modification Agreement: This document outlines changes to the original loan terms, such as interest rate adjustments or extended repayment periods, which may be offered as an alternative to foreclosure.

- Notice of Default: This formal notice is sent to the borrower indicating that they have failed to meet the loan obligations, typically preceding the foreclosure process.

- Durable Power of Attorney: This form allows an individual to designate someone to manage their financial affairs if they become incapacitated, ensuring that their personal matters are handled responsibly, often referenced in contexts like https://newyorkform.com/free-durable-power-of-attorney-template/.

- Release of Liability: This document releases the borrower from any further obligations under the mortgage once the Deed in Lieu is executed, providing peace of mind to the borrower.

- Property Condition Disclosure: This form requires the borrower to disclose the current condition of the property, ensuring the lender is aware of any issues before taking ownership.

- Affidavit of Title: This legal document confirms the borrower's ownership of the property and that there are no outstanding liens or claims against it, providing clarity for the lender.

- Settlement Statement: This document details the financial aspects of the transaction, including any costs associated with the Deed in Lieu, ensuring transparency for both parties.

Understanding these documents is crucial for both borrowers and lenders. Each serves a specific purpose in facilitating a smoother process and protecting the interests of everyone involved.