Attorney-Approved Deed Template

The Deed form is a crucial document in real estate transactions, serving as a legal instrument that conveys ownership of property from one party to another. It typically includes essential information such as the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), a detailed description of the property being transferred, and the terms of the conveyance. Additionally, the Deed form often requires the signatures of both parties, along with witnesses, to ensure its validity. Depending on the type of deed—whether it’s a warranty deed, quitclaim deed, or another variation—different levels of protection and rights may be granted to the grantee. Understanding the nuances of each type can significantly impact property ownership and the rights associated with it. Furthermore, recording the deed with the appropriate local government office is essential for public notice and to establish a clear chain of title. By grasping the major aspects of the Deed form, individuals can navigate the complexities of property transactions more effectively.

Dos and Don'ts

When filling out a Deed form, it is important to approach the process with care. Here are five things you should do and five things you should avoid.

Things You Should Do:

- Read the instructions carefully before starting.

- Ensure all required fields are completed accurately.

- Use clear and legible handwriting or type the information.

- Double-check all names and addresses for accuracy.

- Sign and date the form where indicated.

Things You Shouldn't Do:

- Do not leave any required fields blank.

- Avoid using abbreviations that may cause confusion.

- Do not alter the form in any way, such as crossing out or erasing.

- Refrain from submitting the form without reviewing it for errors.

- Do not forget to include any necessary supporting documents.

DeedTemplates for Particular US States

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A deed is a legal document that signifies the transfer of property ownership from one party to another. |

| Types of Deeds | Common types include warranty deeds, quitclaim deeds, and special purpose deeds, each serving different purposes in property transactions. |

| Governing Law | Deeds are governed by state law, which varies. For example, in California, the California Civil Code outlines the requirements for deeds. |

| Execution Requirements | Most states require that a deed be signed by the grantor and, in some cases, notarized to be legally valid. |

| Recording | After execution, deeds should be recorded with the local county recorder's office to provide public notice of the property transfer. |

| Importance of Title | Having a clear title is essential. It ensures that the property is free from liens or claims, protecting the new owner’s rights. |

Key takeaways

When filling out and using a Deed form, it is essential to follow specific guidelines to ensure accuracy and legality. Here are key takeaways to keep in mind:

- Understand the Purpose: A Deed serves as a formal document to convey ownership of property or assets. Knowing its purpose is crucial.

- Identify the Parties: Clearly list all parties involved. This includes the grantor (the person transferring the property) and the grantee (the person receiving it).

- Provide Accurate Descriptions: Use precise language to describe the property being transferred. This includes the legal description and any relevant details.

- Signatures Matter: Ensure that all required parties sign the Deed. Without proper signatures, the document may not be valid.

- Witnesses and Notarization: Some states require witnesses or notarization. Check local laws to ensure compliance.

- Consider the Type of Deed: Different types of Deeds exist, such as warranty deeds and quitclaim deeds. Choose the appropriate one based on your needs.

- Record the Deed: After completion, the Deed should be recorded with the appropriate local government office. This protects the interests of all parties.

- Review for Errors: Before submission, double-check the document for any mistakes. Errors can lead to significant legal issues later on.

- Consult Legal Expertise: If uncertain about any aspect of the Deed, seeking legal advice is prudent. This can prevent costly mistakes.

Filling out a Deed form correctly is not just a formality; it is a critical step in ensuring that property rights are properly established and protected. Take the time to understand each element involved.

Other Documents

Free Printable Bill of Sale for Mobile Home - This document creates a transparent record of the sale for future reference.

Eviction Forms California - The document outlines violations that may lead to eviction.

For those looking to ensure a smooth transaction, the comprehensive ATV Bill of Sale document is indispensable. This form serves to validate the sale and protect the interests of both parties involved, making it a vital part of the ownership transfer process. For more information, visit the important ATV Bill of Sale guidelines.

Free Printable Affidavit Form - Affidavits can assist in obtaining subpoenas or warrants.

Example - Deed Form

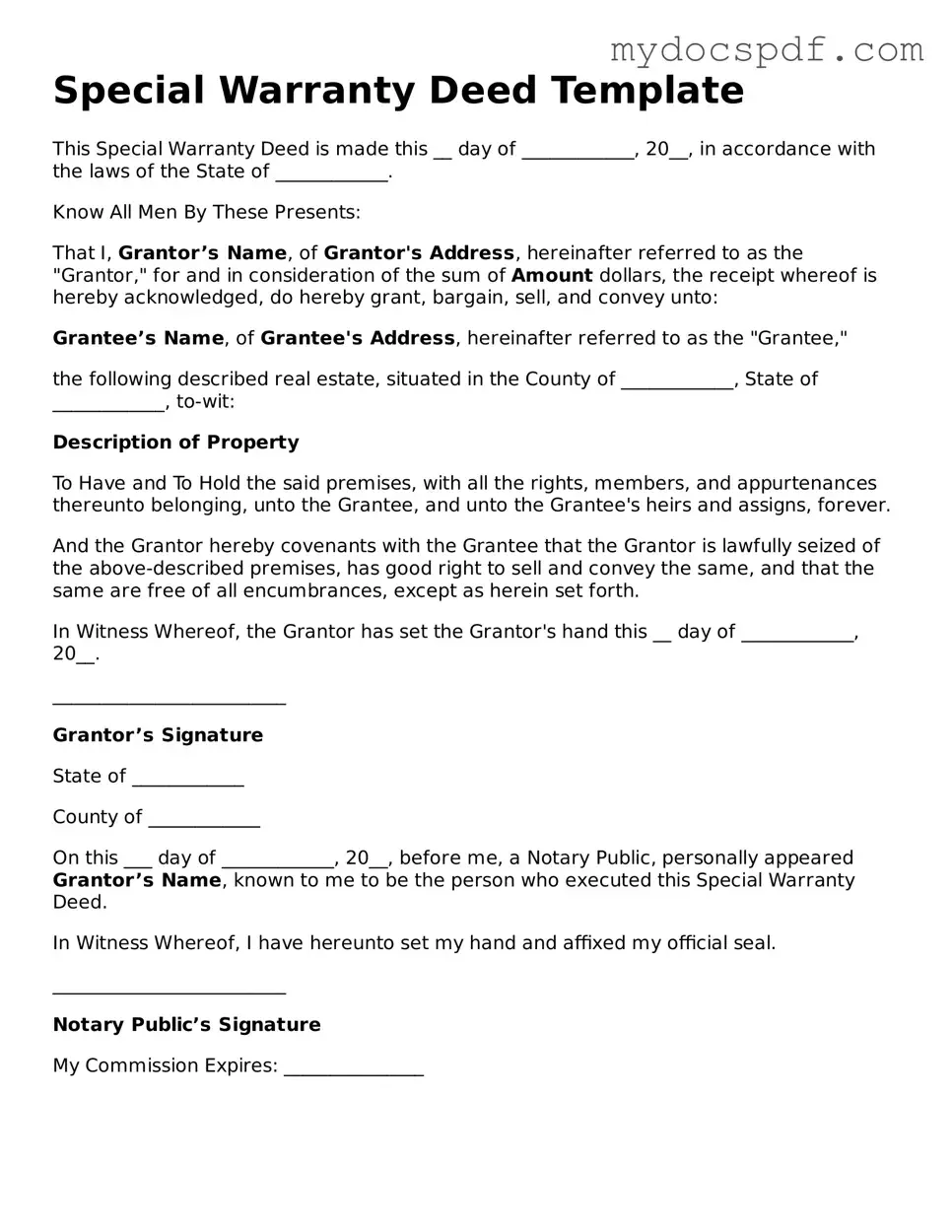

Special Warranty Deed Template

This Special Warranty Deed is made this __ day of ____________, 20__, in accordance with the laws of the State of ____________.

Know All Men By These Presents:

That I, Grantor’s Name, of Grantor's Address, hereinafter referred to as the "Grantor," for and in consideration of the sum of Amount dollars, the receipt whereof is hereby acknowledged, do hereby grant, bargain, sell, and convey unto:

Grantee’s Name, of Grantee's Address, hereinafter referred to as the "Grantee,"

the following described real estate, situated in the County of ____________, State of ____________, to-wit:

Description of Property

To Have and To Hold the said premises, with all the rights, members, and appurtenances thereunto belonging, unto the Grantee, and unto the Grantee's heirs and assigns, forever.

And the Grantor hereby covenants with the Grantee that the Grantor is lawfully seized of the above-described premises, has good right to sell and convey the same, and that the same are free of all encumbrances, except as herein set forth.

In Witness Whereof, the Grantor has set the Grantor's hand this __ day of ____________, 20__.

_________________________

Grantor’s Signature

State of ____________

County of ____________

On this ___ day of ____________, 20__, before me, a Notary Public, personally appeared Grantor’s Name, known to me to be the person who executed this Special Warranty Deed.

In Witness Whereof, I have hereunto set my hand and affixed my official seal.

_________________________

Notary Public’s Signature

My Commission Expires: _______________

Detailed Instructions for Writing Deed

Filling out a Deed form requires careful attention to detail. After completing the form, it will need to be submitted according to local regulations. Ensure that all necessary information is accurate to avoid delays in processing.

- Begin by obtaining the Deed form from a reliable source, such as a legal office or online resource.

- Clearly write the names of the parties involved in the transaction at the top of the form.

- Provide the complete address of the property being transferred. This includes street number, street name, city, state, and zip code.

- Indicate the type of ownership being transferred, such as joint tenancy or tenancy in common.

- Fill in the date of the transaction. Use the format MM/DD/YYYY for clarity.

- Include a legal description of the property. This may require referencing a previous deed or property records.

- Sign the form in the designated area. If multiple parties are involved, ensure all necessary signatures are included.

- Have the form notarized, if required by your state. A notary public will verify the identities of the signers.

- Make copies of the completed form for your records before submitting it.

- Submit the Deed form to the appropriate local government office, such as the county recorder or clerk's office.

Documents used along the form

When dealing with real estate transactions, the Deed form is a crucial document that transfers ownership of property. However, it is often accompanied by several other forms and documents that help clarify the transaction, protect the parties involved, and ensure compliance with local laws. Below is a list of commonly used documents that often accompany a Deed form.

- Title Search Report: This document provides a history of the property’s ownership, revealing any liens or claims against it. It helps buyers ensure they are purchasing a clear title.

- Purchase Agreement: This is a contract between the buyer and seller outlining the terms of the sale, including the purchase price and any contingencies. It serves as the foundation for the transaction.

- Disclosure Statements: Sellers are often required to disclose known issues with the property, such as structural problems or environmental hazards. These statements protect buyers from unexpected surprises.

- Durable Power of Attorney: This legal document allows an individual to appoint an agent to manage their financial and legal decisions, ensuring that matters are handled effectively, even during incapacitation. For more information, you can visit Texas Forms Online.

- Settlement Statement: Also known as a HUD-1 form, this document details all the financial aspects of the transaction, including closing costs, taxes, and any credits or debits between the parties.

- Mortgage Documents: If the buyer is financing the purchase, various mortgage documents will be necessary. These include the loan agreement and any related disclosures that outline the terms of the mortgage.

- Affidavit of Title: This sworn statement by the seller confirms that they are the rightful owner of the property and that there are no undisclosed liens or claims against it.

- Power of Attorney: In some cases, a party may authorize another individual to act on their behalf in the transaction. This document grants that authority and is especially useful if one party cannot be present at closing.

Understanding these documents is essential for anyone involved in a real estate transaction. They not only facilitate the transfer of property but also protect the interests of all parties involved. Being informed can lead to smoother transactions and greater peace of mind.