Attorney-Approved Corrective Deed Template

The Corrective Deed form serves as a crucial tool in real estate transactions, addressing and rectifying errors or omissions in previously executed deeds. This form ensures that the intended property ownership is accurately reflected in public records, providing clarity and legal certainty for all parties involved. Common issues that may necessitate a corrective deed include misspellings of names, incorrect property descriptions, or changes in ownership interests. By utilizing this form, property owners can effectively correct these discrepancies, thereby safeguarding their rights and interests. The process typically involves the original parties to the deed, who must agree on the corrections being made. Once completed and properly recorded, the Corrective Deed form restores the integrity of the property title, helping to prevent future disputes and ensuring a smooth transfer of ownership.

Dos and Don'ts

When filling out the Corrective Deed form, it’s important to approach the task with care. Here are some guidelines to help you navigate the process effectively.

- Do read the instructions carefully before starting.

- Do ensure all names and addresses are accurate.

- Do double-check the property description for accuracy.

- Do sign the form in the presence of a notary.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any required fields blank.

- Don't use correction fluid or tape on the form.

- Don't forget to check local filing requirements.

By following these tips, you can help ensure that your Corrective Deed form is filled out correctly and processed without unnecessary delays.

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose | A Corrective Deed is used to correct errors in a previously recorded deed, ensuring the accuracy of property ownership records. |

| Common Errors | Errors that may be corrected include misspellings of names, incorrect legal descriptions, or mistakes in property boundaries. |

| Governing Law | In the United States, the laws governing Corrective Deeds vary by state. For example, in California, it is governed by the California Civil Code. |

| Parties Involved | The parties typically involved in a Corrective Deed include the original grantor, the grantee, and sometimes witnesses or notaries. |

| Filing Requirements | After completion, the Corrective Deed must be filed with the county recorder’s office where the property is located. |

| Impact on Title | A Corrective Deed does not change ownership; it simply clarifies or corrects the existing title information. |

| Legal Advice | It is advisable to seek legal counsel when preparing a Corrective Deed to ensure compliance with state laws and regulations. |

| Cost | The cost of filing a Corrective Deed varies by county and may include recording fees and potential attorney fees. |

Key takeaways

When filling out and utilizing the Corrective Deed form, it is essential to keep several important points in mind. Below are key takeaways that can guide you through the process.

- Ensure that the correct information is provided in all sections of the form to avoid any future discrepancies.

- Verify that the property description is accurate and matches the original deed to prevent confusion.

- Include all necessary parties' signatures to validate the document. Without proper signatures, the deed may not be enforceable.

- Consider having the document witnessed and notarized to enhance its legitimacy and acceptance.

- Check local regulations, as some jurisdictions may have specific requirements for filing a Corrective Deed.

- File the Corrective Deed with the appropriate county recorder's office to ensure it is officially recorded.

- Keep copies of the completed form for your records. This can be important for future reference or disputes.

- Understand that a Corrective Deed is not meant to change the ownership but rather to correct errors in the original deed.

- Consult with a real estate professional or attorney if you have any questions about the process or need assistance.

Being thorough and attentive when completing the Corrective Deed form can help ensure a smooth process and protect your property rights.

Popular Corrective Deed Documents:

What Is a Deed in Lieu of Foreclosure? - A Deed in Lieu may help homeowners avoid costly legal fees associated with foreclosure proceedings.

To learn more about the legalities and specifics of a quitclaim transfer, you can visit this guide on a practical Georgia Quitclaim Deed format which outlines essential considerations that must be understood before execution.

Quitclaim Deed Form New Jersey - It offers a convenient way to add or remove someone from the title.

Example - Corrective Deed Form

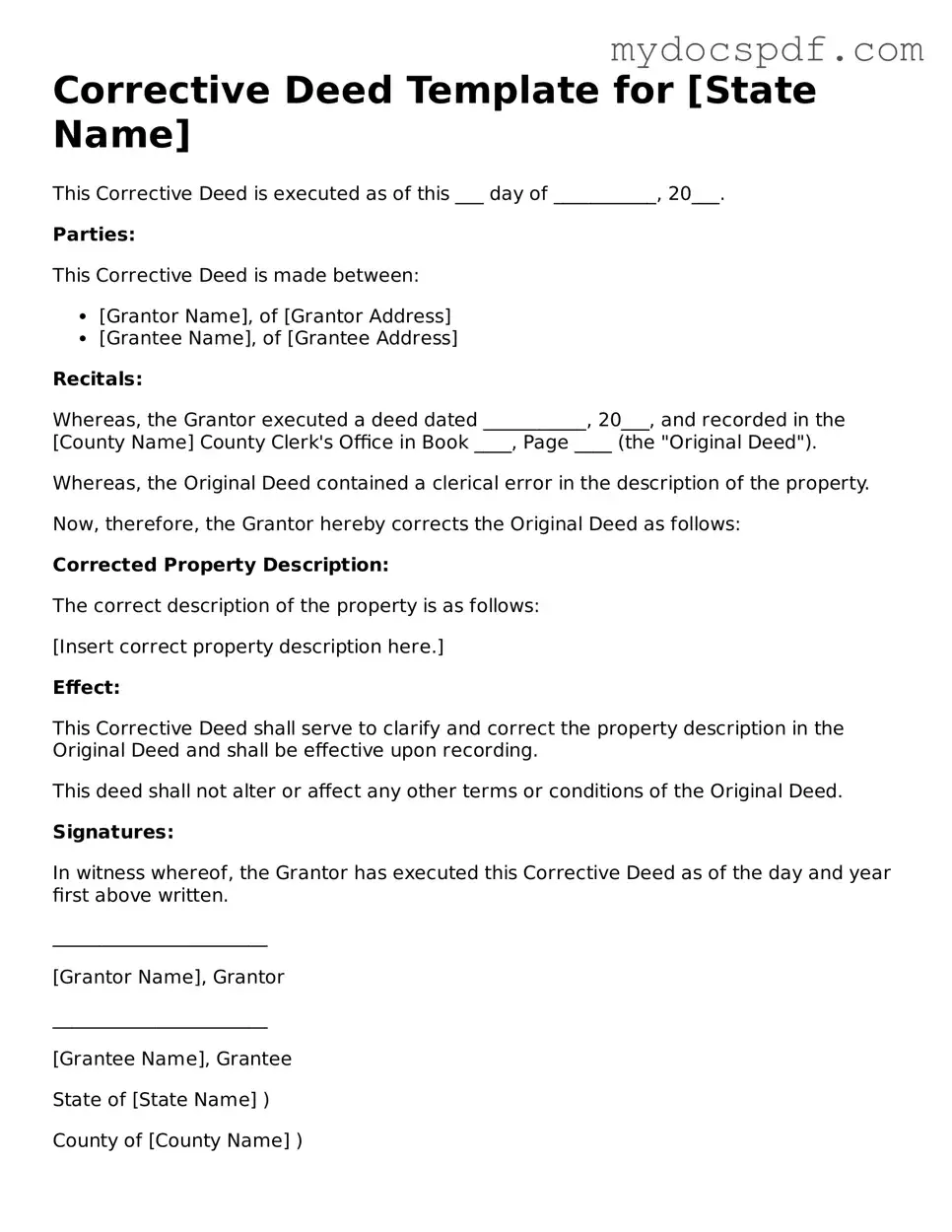

Corrective Deed Template for [State Name]

This Corrective Deed is executed as of this ___ day of ___________, 20___.

Parties:

This Corrective Deed is made between:

- [Grantor Name], of [Grantor Address]

- [Grantee Name], of [Grantee Address]

Recitals:

Whereas, the Grantor executed a deed dated ___________, 20___, and recorded in the [County Name] County Clerk's Office in Book ____, Page ____ (the "Original Deed").

Whereas, the Original Deed contained a clerical error in the description of the property.

Now, therefore, the Grantor hereby corrects the Original Deed as follows:

Corrected Property Description:

The correct description of the property is as follows:

[Insert correct property description here.]

Effect:

This Corrective Deed shall serve to clarify and correct the property description in the Original Deed and shall be effective upon recording.

This deed shall not alter or affect any other terms or conditions of the Original Deed.

Signatures:

In witness whereof, the Grantor has executed this Corrective Deed as of the day and year first above written.

_______________________

[Grantor Name], Grantor

_______________________

[Grantee Name], Grantee

State of [State Name] )

County of [County Name] )

On this ___ day of ___________, 20___, before me, a notary public, personally appeared [Grantor Name], who is known to me to be the person described in this Corrective Deed, and acknowledged to me that he/she executed the same.

_______________________

Notary Public

My commission expires: _____________

Detailed Instructions for Writing Corrective Deed

After gathering the necessary information, you are ready to proceed with filling out the Corrective Deed form. This process involves ensuring that all relevant details are accurately captured to rectify any errors in the original deed. Follow these steps to complete the form correctly.

- Begin by entering the date at the top of the form. This should be the date you are filling out the Corrective Deed.

- In the first section, provide the names of the parties involved in the deed. Include the full legal names of all individuals or entities.

- Next, fill in the address of the property. This should include the street address, city, state, and zip code.

- Identify the original deed by providing the date it was executed and the book and page number where it is recorded.

- Clearly state the specific corrections that need to be made. Be concise and precise to avoid any confusion.

- Sign the form in the designated area. Ensure that all parties involved sign if required.

- Have the form notarized. A notary public must witness the signatures and provide their seal.

- Finally, submit the completed Corrective Deed to the appropriate county recorder's office for official recording.

Documents used along the form

The Corrective Deed form is often used to amend errors in a previously executed deed. It is essential to ensure that property records accurately reflect ownership and any changes made. In addition to the Corrective Deed, several other forms and documents may be necessary to support the process. Below are five commonly used documents that complement the Corrective Deed.

- Original Deed: This document serves as the foundation for the property transfer. It contains the initial terms and conditions of the property ownership.

- Affidavit of Correction: This sworn statement is used to clarify the intent behind the corrections made in the Corrective Deed. It may provide additional context or details about the changes.

- Title Search Report: A title search report verifies the current ownership and any liens or encumbrances on the property. This document ensures that all parties are aware of the property’s legal standing.

- Georgia Deed Form: This form is essential for transferring property ownership in Georgia, and to ensure proper completion and compliance, you can visit georgiapdf.com for more information.

- Property Survey: A property survey outlines the exact boundaries and dimensions of the property. It can help resolve disputes or clarify any discrepancies that led to the need for a corrective deed.

- Transfer Tax Declaration: This document is often required by local governments when a property changes hands. It provides information about the sale price and any applicable taxes that need to be paid.

Understanding these documents is crucial for anyone involved in real estate transactions. Each plays a vital role in ensuring clarity and legality in property ownership and transfers.