Attorney-Approved Closing Date Extension Addendum Form Template

The Closing Date Extension Addendum Form plays a crucial role in real estate transactions, particularly when unforeseen circumstances arise that necessitate a delay in closing. This form allows parties to extend the original closing date, providing flexibility and accommodating the needs of both buyers and sellers. It outlines the new closing date, ensuring that all parties are on the same page and minimizing the risk of disputes. Additionally, the form may address any conditions that must be met prior to the new closing date, such as inspections or financing requirements. By formalizing this extension, the addendum protects the interests of all involved, ensuring that the transaction can proceed smoothly despite potential setbacks. Understanding the importance of this form is essential for anyone navigating the complexities of real estate deals.

Dos and Don'ts

When filling out the Closing Date Extension Addendum Form, it is crucial to follow certain guidelines to ensure accuracy and compliance. Here are seven important dos and don'ts to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Do ensure that all parties involved in the transaction sign the form.

- Do provide the correct closing date extension that all parties agree upon.

- Do double-check for any errors or omissions before submitting the form.

- Don't leave any sections blank unless instructed to do so.

- Don't use white-out or erase any information on the form.

- Don't submit the form without confirming that all parties have received a copy.

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose | The Closing Date Extension Addendum Form is used to extend the closing date of a real estate transaction, allowing parties more time to complete necessary steps before finalizing the sale. |

| Parties Involved | This form typically involves the buyer and seller of a property, both of whom must agree to the extension for it to be valid. |

| State-Specific Regulations | In states like California, the form is governed by the California Civil Code, which outlines the requirements for real estate contracts and extensions. |

| Execution Requirements | All parties must sign the addendum for it to take effect. It is advisable to date the signatures to ensure clarity regarding the agreement. |

Key takeaways

When filling out and using the Closing Date Extension Addendum Form, keep these key points in mind:

- Understand the purpose of the form. It allows parties to extend the closing date of a real estate transaction.

- Ensure all parties involved in the transaction sign the addendum. This includes both the buyer and the seller.

- Clearly state the new closing date. Be specific to avoid any confusion or disputes later on.

- Include the reason for the extension. This helps provide context and can be important for record-keeping.

- Review any deadlines that may be affected by the extension. This includes inspection periods and financing deadlines.

- Keep a copy of the signed addendum for your records. This is important for future reference.

- Communicate with all parties after the addendum is signed. Confirm that everyone is aware of the new closing date.

- Check local laws or regulations regarding closing date extensions. Requirements may vary by state.

Other Documents

Waiver Forms - Emphasizes the importance of following safety guidelines.

Asurion Revenue - It serves as a record for all claims made through Asurion.

For those looking to secure a clear transfer of property interest, utilizing resources such as the NY Templates can provide valuable assistance, ensuring that all necessary legal requirements are met and minimizing the likelihood of disputes arising from the use of a Quitclaim Deed.

Form Fillable Character Sheet 5e - A mischievous gnome wizard with a knack for illusions.

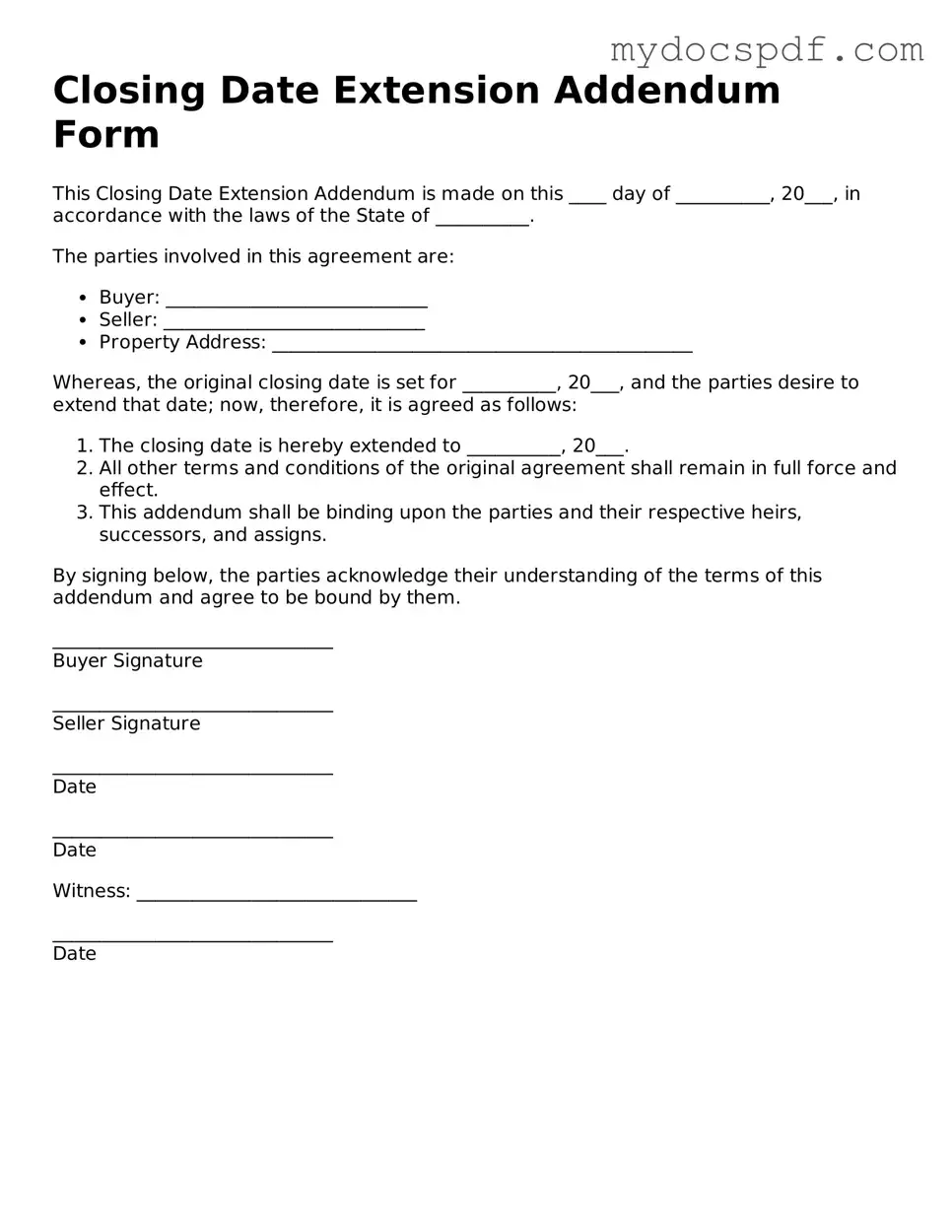

Example - Closing Date Extension Addendum Form Form

Closing Date Extension Addendum Form

This Closing Date Extension Addendum is made on this ____ day of __________, 20___, in accordance with the laws of the State of __________.

The parties involved in this agreement are:

- Buyer: ____________________________

- Seller: ____________________________

- Property Address: _____________________________________________

Whereas, the original closing date is set for __________, 20___, and the parties desire to extend that date; now, therefore, it is agreed as follows:

- The closing date is hereby extended to __________, 20___.

- All other terms and conditions of the original agreement shall remain in full force and effect.

- This addendum shall be binding upon the parties and their respective heirs, successors, and assigns.

By signing below, the parties acknowledge their understanding of the terms of this addendum and agree to be bound by them.

______________________________

Buyer Signature

______________________________

Seller Signature

______________________________

Date

______________________________

Date

Witness: ______________________________

______________________________

Date

Detailed Instructions for Writing Closing Date Extension Addendum Form

Once you have gathered all necessary information, you are ready to fill out the Closing Date Extension Addendum Form. This form is essential for extending the closing date of a real estate transaction. Follow the steps below to ensure that you complete it accurately.

- Begin by entering the date of the original agreement at the top of the form.

- Next, provide the names of all parties involved in the transaction. This includes buyers and sellers.

- In the designated section, write the original closing date. Make sure this is the date agreed upon in the initial contract.

- Now, specify the new closing date you are proposing. Ensure that this date is realistic and agreed upon by all parties.

- Include any additional terms or conditions that may apply to the extension. This could involve considerations like financing or inspection contingencies.

- Have all parties sign and date the form. Each signature should be clear and legible to avoid any confusion later.

- Finally, make copies of the completed form for all parties involved. Keeping a record is crucial for future reference.

Documents used along the form

The Closing Date Extension Addendum Form is an important document in real estate transactions. It allows parties to extend the closing date under specific circumstances. Along with this form, several other documents are commonly used to facilitate the closing process. Below is a list of these documents, each with a brief description.

- Purchase Agreement: This is the primary contract between the buyer and seller outlining the terms of the sale, including the purchase price and closing date.

- Loan Commitment Letter: This document is issued by a lender confirming that they are willing to provide financing to the buyer, subject to specific conditions.

- Title Report: A report that details the legal status of the property title, including any liens or encumbrances that may affect ownership.

- Disclosure Statements: These statements provide important information about the property, including any known defects or issues that may affect its value.

- Closing Disclosure: This document outlines the final terms of the loan, including the costs and fees associated with the closing process, and must be provided to the buyer at least three days before closing.

- Settlement Statement: A detailed account of all financial transactions involved in the closing, including credits and debits for both the buyer and seller.

- Power of Attorney: This document allows one party to act on behalf of another in legal matters, which may be necessary if one party cannot attend the closing.

- Homeowners Association (HOA) Documents: If applicable, these documents provide information about the rules, regulations, and fees associated with the property’s HOA.

- Vehicle Release of Liability: This form is essential in vehicle transactions as it officially marks the transfer of liability from seller to buyer, ensuring both parties are protected. For more information, visit smarttemplates.net/fillable-vehicle-release-of-liability/.

- Inspection Reports: Reports generated from property inspections that highlight any issues needing attention before the sale is finalized.

Understanding these documents is crucial for all parties involved in the real estate transaction. Each one plays a significant role in ensuring a smooth and legally compliant closing process.