Get Citibank Direct Deposit Form in PDF

When it comes to managing finances efficiently, setting up direct deposit can be a game-changer for many individuals. The Citibank Direct Deposit form serves as a crucial tool in this process, allowing customers to streamline the way they receive their income. This form not only facilitates the automatic transfer of funds from employers or government agencies directly into a Citibank account but also offers a secure and reliable means of managing personal finances. Key components of the form include the account holder's personal information, such as their name and Social Security number, as well as the specific bank account details where the funds will be deposited. Additionally, the form often requires the signature of the account holder, thereby authorizing the transfer of funds. Understanding how to properly fill out and submit this form can significantly enhance one’s financial management experience, ensuring timely access to funds without the hassle of manual deposits. Whether you are a new employee eager to set up your payment method or a long-time customer looking to switch accounts, mastering the Citibank Direct Deposit form is an essential step toward financial convenience.

Dos and Don'ts

When filling out the Citibank Direct Deposit form, it's important to ensure that all information is accurate and complete. Here are some essential dos and don'ts to keep in mind:

- Do double-check your account number and routing number for accuracy.

- Do provide your employer with a clear and legible copy of the form.

- Do confirm the deposit schedule with your employer to ensure timely payments.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank; incomplete forms may delay your deposits.

- Don't use a personal account for business deposits unless specified.

- Don't forget to sign and date the form before submission.

- Don't share your account information with anyone you do not trust.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Citibank Direct Deposit form allows customers to authorize automatic deposits into their bank accounts. |

| Eligibility | Individuals with a Citibank account can use this form to set up direct deposits. |

| Information Required | The form typically requires personal details, including account number and routing number. |

| Submission Method | Customers can submit the completed form to their employer or the entity making the deposits. |

| Processing Time | Once submitted, it may take one or two pay cycles for the direct deposit to begin. |

| State-Specific Forms | Some states may have specific requirements for direct deposit forms governed by local laws. |

| Revocation | Customers can revoke the authorization by submitting a new form or a written request. |

| Security | All sensitive information should be handled carefully to protect against identity theft. |

| Benefits | Direct deposit offers convenience, quicker access to funds, and reduces the risk of lost checks. |

| Contact Information | For questions, customers can reach out to Citibank customer service for assistance. |

Key takeaways

When filling out the Citibank Direct Deposit form, it is essential to pay attention to the details. Here are some key takeaways to consider:

- Provide Accurate Information: Ensure that all personal details, such as your name, address, and Social Security number, are correct. Any discrepancies can delay your deposits.

- Bank Account Details: Double-check your bank account number and routing number. Errors in these numbers can result in funds being deposited into the wrong account.

- Signature Requirement: Don’t forget to sign the form. Your signature authorizes the direct deposit and confirms that you agree to the terms.

- Keep a Copy: Always keep a copy of the completed form for your records. This can be helpful if there are any issues or if you need to make changes in the future.

By following these guidelines, you can help ensure a smooth and efficient direct deposit process with Citibank.

Other PDF Templates

Vs-4 Form Pdf - Information regarding the marriage, including date and place, must be provided.

A Texas Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another without any warranties or guarantees. This form is often utilized in situations such as transferring property between family members or clearing up title issues. For those looking to easily create this important document, resources like Texas Forms Online can be quite helpful. Understanding its implications is essential for anyone considering property transactions in Texas.

Custody Affidavit - The affidavit must be acknowledged before a notary public, adding an extra layer of validation.

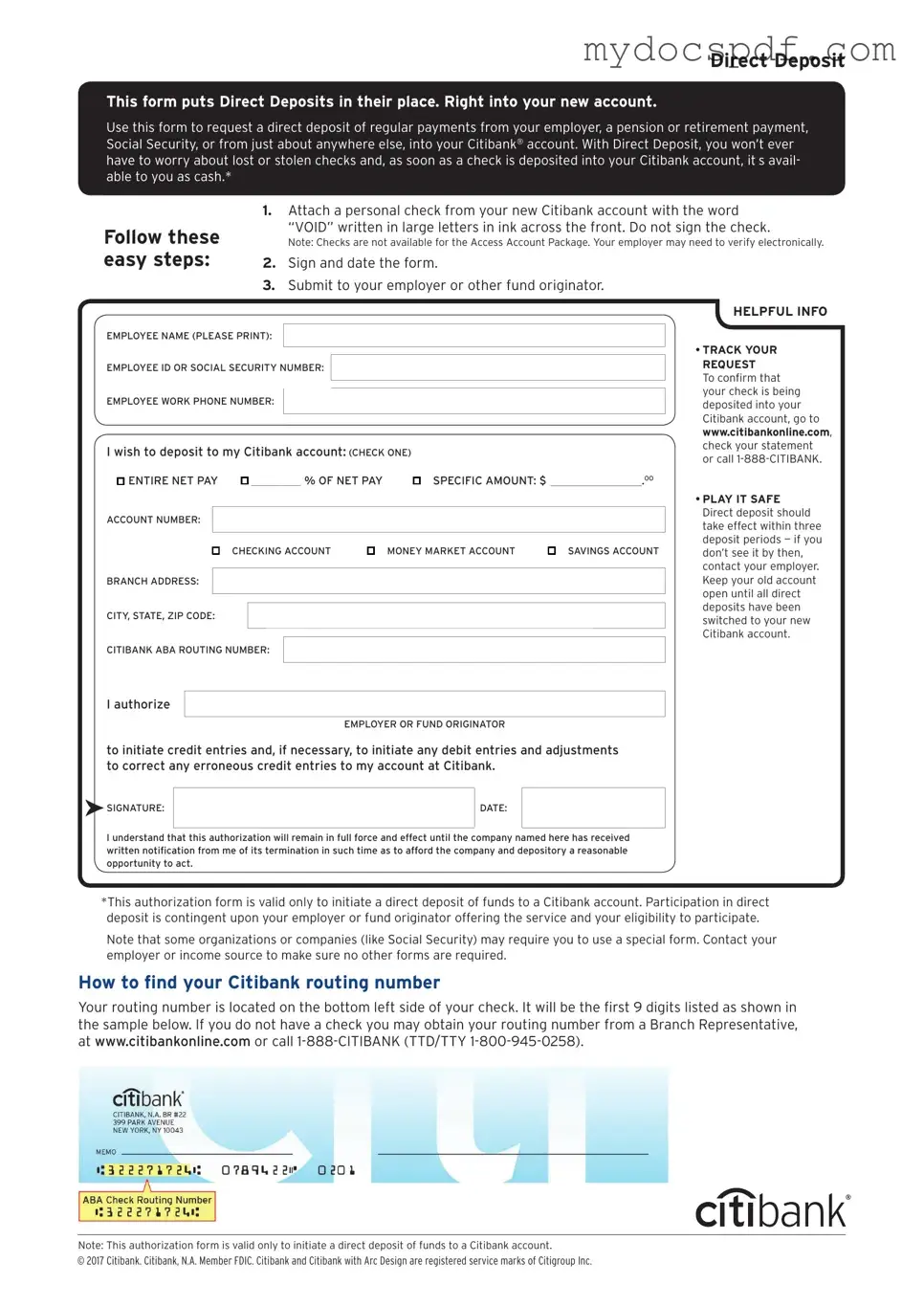

Example - Citibank Direct Deposit Form

Direct Deposit

This form puts Direct Deposits in their place. Right into your new account.

Use this form to request a direct deposit of regular payments from your employer, a pension or retirement payment, Social Security, or from just about anywhere else, into your Citibank® account. With Direct Deposit, you won’t ever have to worry about lost or stolen checks and, as soon as a check is deposited into your Citibank account, it’s avail- able to you as cash.*

Follow these easy steps:

1.Attach a personal check from your new Citibank account with the word

“VOID” written in large letters in ink across the front. Do not sign the check.

Note: Checks are not available for the Access Account Package. Your employer may need to verify electronically.

2.Sign and date the form.

3.Submit to your employer or other fund originator.

HELPFUL INFO

EMPLOYEE NAME (PLEASE PRINT):

• TRACK YOUR

EMPLOYEE ID OR SOCIAL SECURITY NUMBER:

EMPLOYEE WORK PHONE NUMBER:

I wish to deposit to my Citibank account: (CHECK ONE)

ENTIRE NET PAY ı__________ % OF NET PAY |

ı SPECIFIC AMOUNT: $ ________________.OO |

ACCOUNT NUMBER:

ı CHECKING ACCOUNT |

ı MONEY MARKET ACCOUNT |

ı SAVINGS ACCOUNT |

BRANCH ADDRESS:

CITY, STATE, ZIP CODE:

CITIBANK ABA ROUTING NUMBER:

REQUEST

To confirm that your check is being deposited into your Citibank account, go to www.citibankonline.com, check your statement or call

•PLAY IT SAFE Direct deposit should take effect within three deposit periods — if you don’t see it by then, contact your employer. Keep your old account open until all direct deposits have been switched to your new Citibank account.

I authorize

EMPLOYER OR FUND ORIGINATOR

to initiate credit entries and, if necessary, to initiate any debit entries and adjustments to correct any erroneous credit entries to my account at Citibank.

SIGNATURE:

SIGNATURE:

DATE:

I understand that this authorization will remain in full force and effect until the company named here has received written notification from me of its termination in such time as to afford the company and depository a reasonable opportunity to act.

*This authorization form is valid only to initiate a direct deposit of funds to a Citibank account. Participation in direct deposit is contingent upon your employer or fund originator offering the service and your eligibility to participate.

Note that some organizations or companies (like Social Security) may require you to use a special form. Contact your employer or income source to make sure no other forms are required.

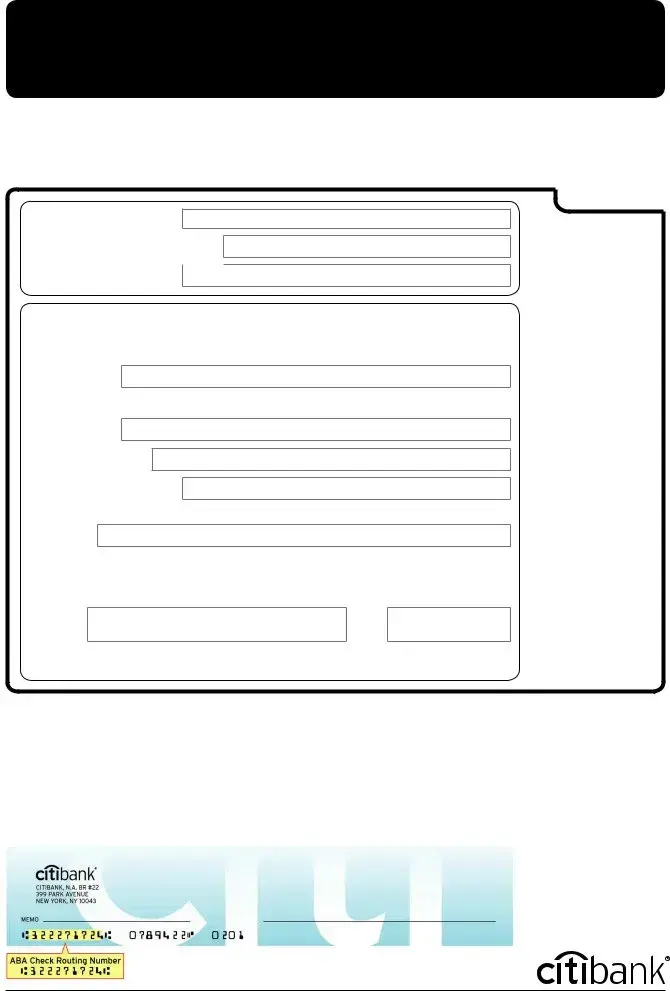

How to find your Citibank routing number

Your routing number is located on the bottom left side of your check. It will be the first 9 digits listed as shown in the sample below. If you do not have a check you may obtain your routing number from a Branch Representative, at www.citibankonline.com or call

Note: This authorization form is valid only to initiate a direct deposit of funds to a Citibank account.

© 2017 Citibank. Citibank, N.A. Member FDIC. Citibank and Citibank with Arc Design are registered service marks of Citigroup Inc.

Detailed Instructions for Writing Citibank Direct Deposit

Once you have the Citibank Direct Deposit form in front of you, it's time to fill it out carefully. This form is essential for setting up direct deposit, which means your paycheck will go directly into your bank account. Make sure to have your bank account details handy as you complete the form.

- Begin by entering your personal information. This includes your full name, address, and contact number.

- Next, locate the section for your bank account details. Here, you will need to provide your bank's name and your account number.

- Fill in the routing number for your bank. This number is usually found on your checks or can be obtained from your bank's website.

- Indicate the type of account you have. Choose either "Checking" or "Savings" based on your preference.

- Review the information you have entered to ensure accuracy. Mistakes can delay the setup of your direct deposit.

- Sign and date the form at the bottom. Your signature is important as it authorizes the direct deposit.

- Finally, submit the completed form to your employer or the designated department responsible for payroll.

Documents used along the form

When setting up direct deposit with Citibank, several other forms and documents may be required to ensure a smooth process. Each of these documents serves a specific purpose and helps facilitate the direct deposit arrangement.

- W-4 Form: This form is used to determine the amount of federal income tax to withhold from your paycheck. It provides your employer with information about your filing status and the number of allowances you claim.

- Void Check: A voided check is often required to confirm your bank account details. By writing "VOID" across the front, you ensure that the check cannot be used for payment, while still providing your account number and routing number.

- California ATV Bill of Sale: This form records the transfer of ownership and is crucial for avoiding disputes. For more information, check the Four Wheeler Bill of Sale.

- Employee Information Form: This document collects essential details about you as an employee, such as your name, address, Social Security number, and contact information. It helps your employer maintain accurate records.

- Bank Account Authorization Form: This form grants your employer permission to deposit your paycheck directly into your bank account. It typically includes your bank's name, account number, and routing number.

- State Tax Withholding Form: Similar to the W-4, this form specifies how much state tax should be withheld from your paycheck. Requirements vary by state, so it's important to complete this accurately.

Having these documents ready can streamline the direct deposit setup process. Each form plays a crucial role in ensuring that your payroll is handled efficiently and correctly.