Get Childcare Receipt Form in PDF

The Childcare Receipt form serves as an essential document for both parents and childcare providers, facilitating clear communication and record-keeping regarding the services rendered. This form includes critical details such as the date of service, the total amount paid, and the name of the child or children receiving care. Parents will find it particularly useful as it provides a formal acknowledgment of payment, which can be important for personal records or tax purposes. Additionally, the form requires the provider's signature, which adds an extra layer of authenticity and accountability. Each receipt is designed to capture the timeframe during which childcare services were provided, ensuring that all parties are aware of the specific dates involved. By utilizing this form, both parents and providers can maintain accurate documentation, thus fostering a professional relationship built on transparency and trust.

Dos and Don'ts

When filling out the Childcare Receipt form, it's important to follow certain guidelines to ensure accuracy and clarity. Here are some dos and don'ts:

- Do fill in the date clearly.

- Do write the amount in numbers and words for clarity.

- Do provide the full name of the person making the payment.

- Do list all children receiving care.

- Don't leave any sections blank; fill out every required field.

- Don't use abbreviations that may confuse the reader.

- Don't forget to sign the form where indicated.

- Don't submit the form without reviewing it for errors.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Childcare Receipt form serves as proof of payment for childcare services, ensuring transparency between parents and providers. |

| Essential Information | Key details required on the form include the date of service, amount paid, names of the children, and the signature of the provider. |

| State-Specific Requirements | In many states, such as California, the form must comply with the California Family Code, which outlines the rights and responsibilities of childcare providers. |

| Tax Implications | Parents may use the receipts for tax purposes, as they can claim childcare expenses when filing their federal tax returns, subject to IRS guidelines. |

| Record Keeping | Both parents and providers should keep copies of the receipts for their records, as they may be needed for disputes or verification of services. |

Key takeaways

Filling out and using the Childcare Receipt form correctly is essential for both parents and childcare providers. Here are some key takeaways to keep in mind:

- Complete all sections: Ensure that every part of the form is filled out accurately. This includes the date, amount, and names of the children.

- Keep copies: After filling out the receipt, make sure to keep a copy for your records. This can be useful for tax purposes or future reference.

- Provider’s signature: The receipt must include the signature of the childcare provider. This verifies that the services were rendered and payment was received.

- Specify service dates: Clearly indicate the start and end dates for the childcare services. This helps in tracking the duration of care provided.

- Use clear handwriting: If filling out the form by hand, use legible handwriting to avoid any misunderstandings regarding the details.

- Amount accuracy: Double-check the amount being charged. Ensure it matches what was agreed upon to prevent disputes.

- Provide detailed information: Include specific details about the childcare services provided. This can help clarify any questions that may arise later.

- Retain for tax deductions: Parents may be eligible for tax deductions related to childcare expenses. Keep these receipts organized for tax filing.

Other PDF Templates

Load Calculation Formula - The outcomes from this form can benefit future maintenance planning.

To facilitate the address update process, businesses may find it helpful to refer to the resources available at newyorkform.com/free-new-york-dtf-84-template, which provide templates and guidance for the completion of the New York Dtf 84 form.

Edison Account Number - Provides educational insights into California’s energy regulations and charges.

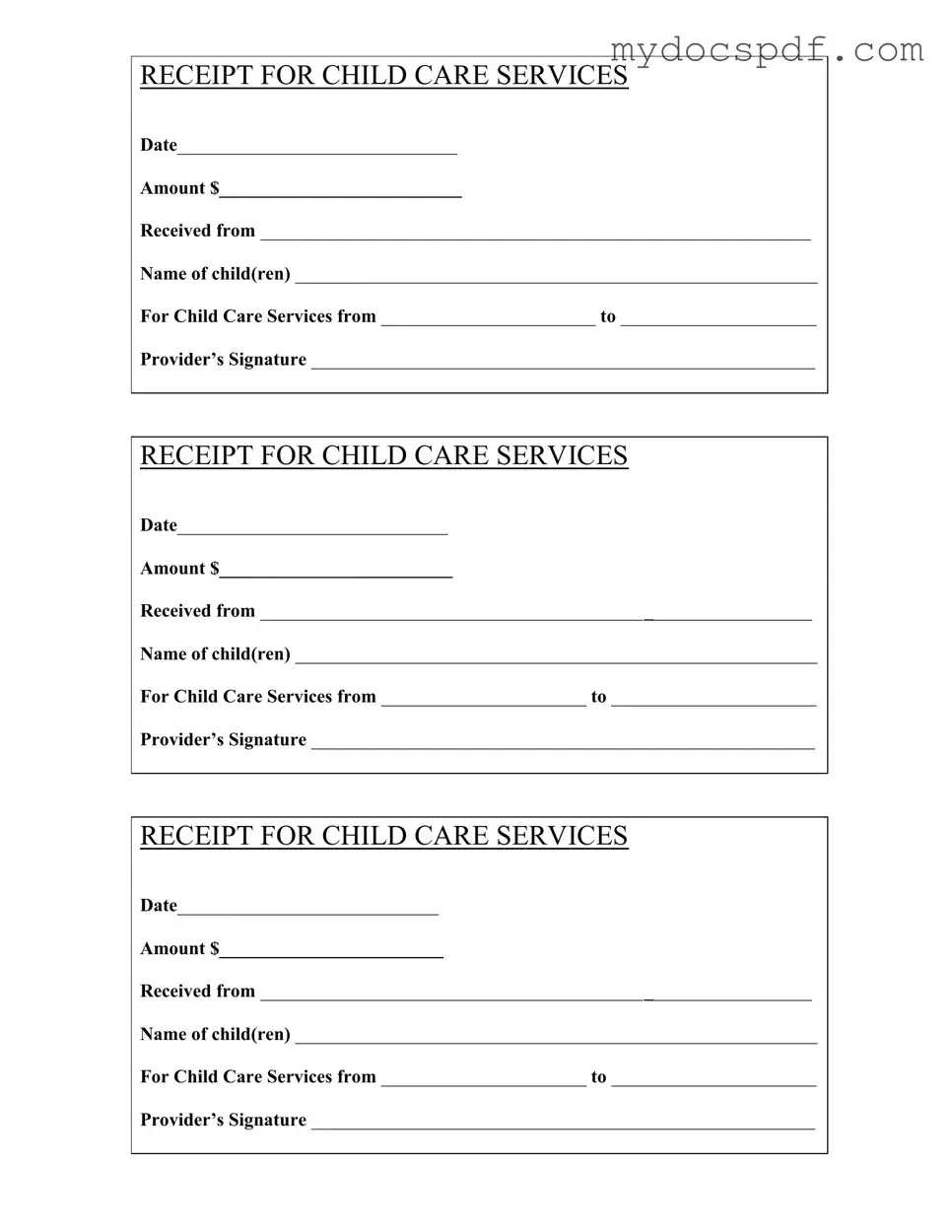

Example - Childcare Receipt Form

RECEIPT FOR CHILD CARE SERVICES

Date______________________________

Amount $__________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from _______________________ to _____________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date_____________________________

Amount $_________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date____________________________

Amount $________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

Detailed Instructions for Writing Childcare Receipt

Completing the Childcare Receipt form is an important step in documenting childcare services provided. This receipt serves as proof of payment and details the services rendered for your child or children. Follow the steps below to ensure that you fill out the form accurately and completely.

- Begin by writing the Date at the top of the form. This should be the date you are filling out the receipt.

- In the next space, fill in the Amount you are paying for the childcare services.

- Write your name in the section labeled Received from. This identifies who made the payment.

- List the Name of child(ren) receiving care. Be sure to include all names if there are multiple children.

- Indicate the period of childcare services by filling in the For Child Care Services from and to sections. This shows the start and end dates of the services provided.

- Finally, the childcare provider should sign in the Provider’s Signature area to validate the receipt.

Documents used along the form

When managing childcare services, several documents complement the Childcare Receipt form. These documents help ensure proper record-keeping and provide clarity for both parents and childcare providers. Below are five important forms often used alongside the Childcare Receipt form.

- Childcare Agreement: This document outlines the terms and conditions of the childcare services provided. It typically includes details such as hours of operation, fees, and responsibilities of both the provider and the parent.

- Enrollment Form: The enrollment form collects essential information about the child, including their name, age, and any special needs. This helps the provider understand the child's requirements and ensures their safety and well-being.

- Payment Agreement: This form specifies the payment schedule and methods accepted by the childcare provider. It clarifies when payments are due and any penalties for late payments, ensuring transparency in financial transactions.

- Motor Vehicle Bill of Sale: This document is essential for the sale and transfer of ownership of a motor vehicle in Texas. It includes details like buyer and seller information, vehicle identification, and the sale price, making it crucial for a smooth transaction. For more details, you can refer to Texas Forms Online.

- Emergency Contact Form: This document contains vital information about whom to contact in case of an emergency. It typically includes names and phone numbers of parents or guardians, as well as alternative contacts.

- Health and Immunization Records: Keeping track of a child's health history is crucial. This document provides information about vaccinations and any medical conditions, ensuring that the childcare provider can respond appropriately in case of health issues.

These documents work together with the Childcare Receipt form to create a comprehensive record of the childcare arrangement. By maintaining these records, parents and providers can foster a clear and organized relationship, enhancing the overall childcare experience.