Get Cash Receipt Form in PDF

The Cash Receipt form serves as a vital document in the world of financial transactions, capturing essential information regarding the receipt of cash payments. This form typically includes details such as the date of the transaction, the name of the payer, and the amount received. It often features a unique receipt number for tracking purposes, ensuring that each transaction can be easily referenced in the future. Additionally, the form may outline the purpose of the payment, whether it be for goods, services, or other financial obligations. By documenting these transactions, the Cash Receipt form not only aids in maintaining accurate financial records but also provides a layer of accountability for both the payer and the recipient. In many organizations, this form is integral to the bookkeeping process, facilitating transparency and helping to prevent discrepancies in financial reporting.

Dos and Don'ts

When filling out a Cash Receipt form, attention to detail is crucial. The following list outlines essential dos and don'ts to ensure accuracy and compliance.

- Do double-check all amounts entered to avoid errors.

- Do use clear and legible handwriting if filling out the form by hand.

- Do include the date of the transaction for proper record-keeping.

- Do specify the purpose of the payment to provide context.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank; fill in all required information.

- Don't use correction fluid; it can create confusion.

- Don't forget to sign the form if required.

- Don't alter any figures after the form has been submitted.

- Don't submit the form without verifying that all information is accurate.

Document Attributes

| Fact Name | Description |

|---|---|

| Definition | A Cash Receipt form is a document used to record the receipt of cash payments. |

| Purpose | This form provides a clear record for both the payer and the payee regarding the transaction. |

| Components | Typically includes date, amount received, payer's information, and purpose of the payment. |

| Legal Requirement | In many states, businesses are required to provide a receipt for cash transactions to ensure transparency. |

| Record Keeping | It serves as an important document for accounting and tax purposes. |

| State-Specific Forms | Some states have specific requirements for cash receipt forms under their sales tax laws. |

| Governing Laws | For example, California's Revenue and Taxation Code outlines receipt requirements for cash transactions. |

| Format | Can be printed or electronic, but must be easily accessible for auditing purposes. |

| Signatures | Often requires signatures from both the payer and the payee to validate the transaction. |

| Retention Period | Businesses should retain cash receipt forms for a minimum of three to seven years, depending on state laws. |

Key takeaways

When filling out and using the Cash Receipt form, several key points can enhance accuracy and efficiency. Here are nine important takeaways:

- Complete All Required Fields: Ensure that every mandatory field on the form is filled out. Missing information can lead to delays in processing.

- Use Clear and Legible Writing: Whether filling out the form by hand or digitally, clarity is crucial. This helps prevent misunderstandings.

- Record the Date of Receipt: Always include the date when the cash was received. This provides a clear timeline for financial records.

- Specify the Amount: Clearly state the total amount received. Double-check this figure to avoid discrepancies.

- Identify the Source: Include details about who made the payment. This could be an individual or an organization, and it is essential for tracking purposes.

- Provide a Description: Offer a brief description of the transaction. This helps contextualize the payment in future audits or reviews.

- Keep a Copy: Always retain a copy of the completed Cash Receipt form for your records. This is important for both accountability and reference.

- Submit Timely: After completing the form, submit it promptly to the appropriate department or individual. Timeliness can impact cash flow management.

- Review Policies: Familiarize yourself with your organization’s policies regarding cash handling and receipt documentation. Adhering to these guidelines is essential for compliance.

By following these takeaways, individuals can ensure that the Cash Receipt form is filled out correctly and used effectively, contributing to better financial management.

Other PDF Templates

Edison Account Number - Explains rotating outages and how they affect customers.

Form Fillable Character Sheet 5e - A tech-savvy mage blending magic with technology.

The Texas Motorcycle Bill of Sale form is essential for ensuring a clear and legal transaction when purchasing a motorcycle, and you can find a great resource for this document at Texas Forms Online. This form not only records the sale and transfer of ownership but also serves as proof of the transaction, detailing key information about the buyer, seller, and the motorcycle itself. Proper completion and filing can provide important protections for both parties involved in the sale.

Employment Application Template - Provide a clear explanation for any gaps in your employment history.

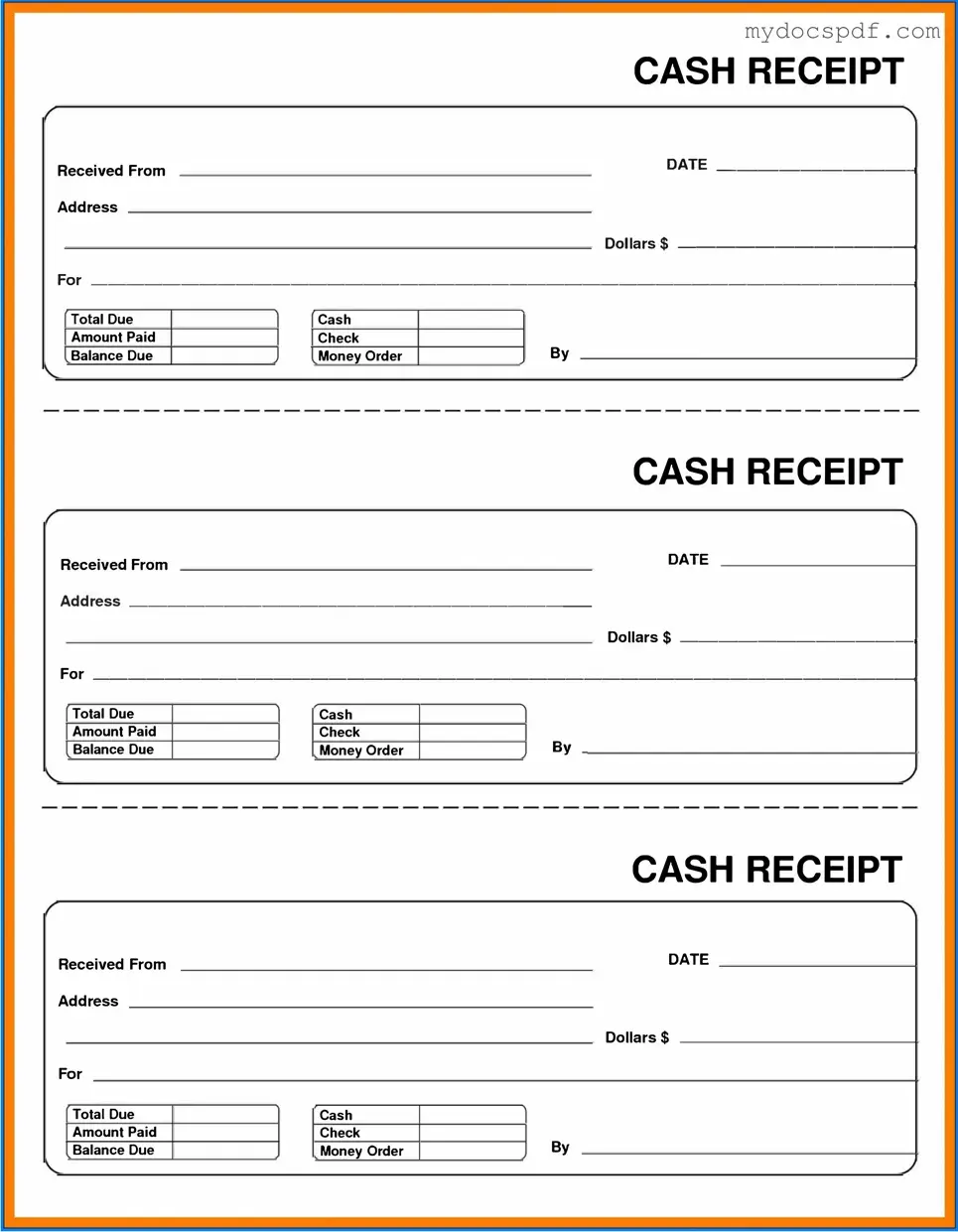

Example - Cash Receipt Form

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

Detailed Instructions for Writing Cash Receipt

After gathering the necessary information, you'll be ready to fill out the Cash Receipt form. This form is essential for documenting cash transactions, ensuring proper record-keeping for both the payer and the recipient. Follow these steps to complete the form accurately.

- Begin by entering the date of the transaction in the designated field.

- Next, fill in the payer's name as it appears on their identification or account.

- Provide the amount received in the appropriate box, ensuring you include cents if applicable.

- Specify the payment method, such as cash, check, or credit card, by marking the corresponding option.

- If necessary, include any reference number associated with the transaction for tracking purposes.

- In the description section, briefly explain the purpose of the payment.

- Finally, sign and date the form to validate the transaction.

Documents used along the form

When managing financial transactions, several forms and documents complement the Cash Receipt form. Each document plays a role in ensuring accurate record-keeping and transparency. Here’s a list of commonly used forms that often accompany the Cash Receipt form.

- Invoice: An invoice details the goods or services provided, along with the amount due. It serves as a request for payment and helps both parties keep track of what has been sold.

- Payment Voucher: A payment voucher acts as a formal request for payment. It includes information about the transaction and is often used to authorize the payment process.

- Durable Power of Attorney Form: To ensure legal representation even when incapacitated, refer to our comprehensive Durable Power of Attorney form options for empowered decision-making.

- Bank Deposit Slip: This slip is used when depositing cash or checks into a bank account. It provides a record of the amount being deposited and helps reconcile bank statements.

- Receipt Acknowledgment: This document confirms that a payment has been received. It serves as proof for the payer and is often signed by both parties to acknowledge the transaction.

- Transaction Log: A transaction log keeps a detailed record of all financial transactions. It helps track income and expenses and is useful for audits or financial reviews.

Using these documents alongside the Cash Receipt form can enhance financial management and accountability. Keeping everything organized ensures clarity for all parties involved.