Get Cash Drawer Count Sheet Form in PDF

The Cash Drawer Count Sheet form plays a crucial role in maintaining accurate financial records within a retail environment. This form is designed to help businesses track cash flow, ensuring that the amount of cash in the drawer aligns with sales and transactions throughout the day. Key components of the form include sections for recording the starting cash balance, daily sales, and any cash received from returns or exchanges. Additionally, it provides a space for documenting discrepancies, should they arise, which can help identify potential issues or theft. By systematically using this form, businesses can enhance their accountability and streamline the cash management process, ultimately leading to better financial oversight and operational efficiency.

Dos and Don'ts

When filling out the Cash Drawer Count Sheet form, it is important to follow certain guidelines to ensure accuracy and efficiency. Below are five things you should do and five things you should avoid.

Things You Should Do:

- Double-check all cash amounts for accuracy before entering them on the form.

- Use clear and legible handwriting to avoid any confusion later.

- Ensure that all sections of the form are filled out completely.

- Keep the form in a secure location until it is submitted.

- Review the completed form for any errors before finalizing it.

Things You Shouldn't Do:

- Do not leave any sections of the form blank.

- Avoid using abbreviations that may not be understood by others.

- Do not rush through the process; take your time to ensure accuracy.

- Never submit the form without a supervisor's review if required.

- Do not discard any previous versions of the form without proper documentation.

Document Attributes

| Fact Name | Details |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to track cash transactions and ensure accurate cash handling in retail or service environments. |

| Components | This form typically includes fields for recording the opening balance, cash sales, cash received, and cash paid out. |

| Frequency of Use | Businesses often use this form daily, especially at the end of shifts, to reconcile cash on hand. |

| Importance of Accuracy | Accurate completion of the Cash Drawer Count Sheet helps prevent discrepancies and potential theft. |

| Record Keeping | Maintaining these records is crucial for financial audits and can assist in identifying trends in cash flow. |

| State Regulations | Some states may have specific regulations regarding cash handling and record-keeping, which can influence the use of this form. |

| Digital vs. Paper | While traditionally paper-based, many businesses now opt for digital versions of the Cash Drawer Count Sheet for ease of use and storage. |

Key takeaways

When it comes to managing cash flow in a retail environment, the Cash Drawer Count Sheet is an essential tool. Here are some key takeaways to consider when filling out and using this form:

- Accuracy is Crucial: Ensure all amounts are counted correctly to maintain financial integrity.

- Document Every Transaction: Record every sale and return to provide a clear financial picture.

- Use Clear Categories: Separate different types of cash and payment methods for easier tracking.

- Double-Check Your Totals: Always verify your calculations to avoid discrepancies.

- Time Stamping: Include the date and time of the count to maintain an accurate record of cash flow.

- Signature Verification: Have a second person sign off on the count to ensure accountability.

- Regular Counts: Conduct counts at regular intervals to spot issues early.

- Training Staff: Ensure all employees understand how to fill out the form correctly.

- Use for Reconciliation: This form can help reconcile cash at the end of the day or shift.

- Store Securely: Keep completed sheets in a safe place to protect sensitive financial information.

By following these takeaways, you can effectively manage your cash drawer and maintain accurate financial records. This form not only aids in tracking cash flow but also enhances accountability within your team.

Other PDF Templates

Free Doctor Release to Return to Work - The Work Release form is a proactive step toward building a successful future.

Death of Joint Tenant California - It may also lead to the re-evaluation of trust asset distribution among the beneficiaries.

To facilitate the address updating process, businesses can utilize the resources available online, including the newyorkform.com/free-new-york-dtf-84-template, which provides a user-friendly template for the New York Dtf 84 form, ensuring compliance with state regulations.

USCIS Form I-864 - Legal advice can be beneficial when completing the I-864 or understanding sponsorship obligations.

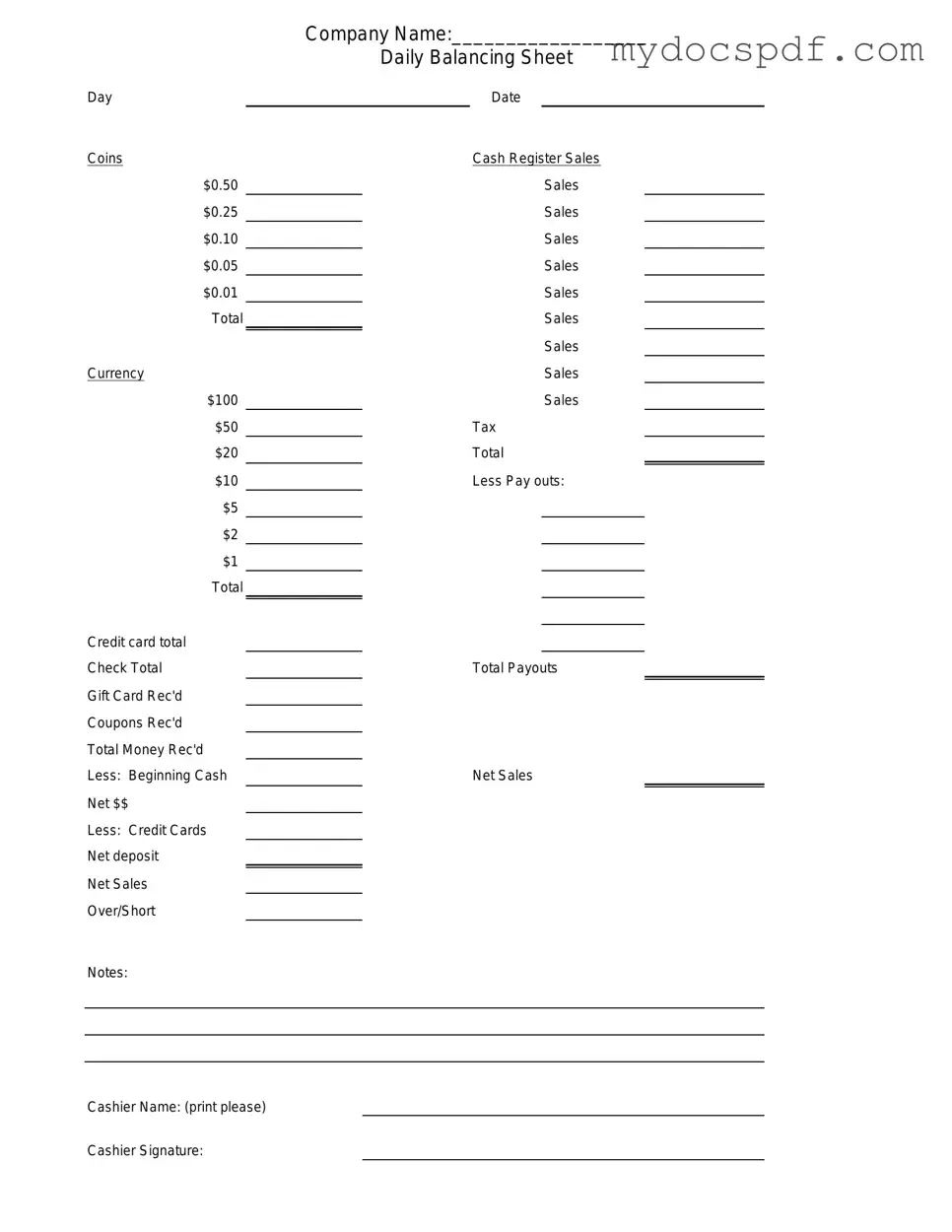

Example - Cash Drawer Count Sheet Form

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature:

Detailed Instructions for Writing Cash Drawer Count Sheet

Completing the Cash Drawer Count Sheet form is an essential task that helps maintain accurate financial records. Once you have filled out the form, it will be used to verify the cash balance in your drawer against the expected amounts. This ensures accountability and aids in identifying any discrepancies that may arise during daily operations.

- Begin by entering the date at the top of the form. This will help you keep track of when the count was conducted.

- Next, write your name or the name of the person responsible for the cash drawer count. This adds a layer of accountability.

- In the designated section, list all denominations of cash present in the drawer. This includes bills and coins.

- For each denomination, enter the quantity you have counted. Be sure to double-check your counts to avoid errors.

- Calculate the total amount for each denomination by multiplying the quantity by the value of the bills or coins.

- Sum up all the totals from each denomination to get the overall cash total in the drawer.

- Finally, sign and date the form to confirm that the count is accurate and complete.

Documents used along the form

The Cash Drawer Count Sheet is an essential tool for businesses that handle cash transactions. However, it is often accompanied by several other forms and documents that help streamline financial operations, ensure accuracy, and maintain accountability. Below is a list of common documents that may be used alongside the Cash Drawer Count Sheet.

- Daily Sales Report: This document summarizes the total sales made during a specific day. It includes information about cash, credit, and other forms of payment, providing a comprehensive view of daily revenue.

- Deposit Slip: A deposit slip is used when cash is taken to the bank. It details the amount being deposited and serves as a record for both the business and the bank.

- Cash Register Tape: This tape provides a printout of transactions processed by the cash register. It can help verify sales figures and is crucial for reconciling the cash drawer.

- Expense Report: An expense report tracks all business-related expenses. This document is essential for maintaining financial records and can aid in budgeting and expense management.

- Petty Cash Log: This log records all petty cash transactions. It helps monitor small cash expenditures and ensures that petty cash is accounted for properly.

- End-of-Day Reconciliation Sheet: This sheet is used to compare the cash counted in the drawer against the expected amount based on sales. It helps identify discrepancies and ensures financial accuracy.

- Motorcycle Bill of Sale: This form, similar to the others, provides essential details regarding the sale and transfer of ownership for motorcycles, and you can find a template for it at Texas Forms Online.

- Bank Reconciliation Statement: This statement compares the business's cash records with bank statements. It helps identify any differences and ensures that all transactions are accounted for.

- Inventory Count Sheet: While not directly related to cash handling, this sheet helps track inventory levels. Accurate inventory management can influence cash flow and overall business health.

Each of these documents plays a vital role in maintaining financial integrity and operational efficiency. By utilizing them alongside the Cash Drawer Count Sheet, businesses can ensure they have a clear and accurate understanding of their financial standing.