Fillable California Transfer-on-Death Deed Document

In California, the Transfer-on-Death Deed (TOD Deed) offers a straightforward way for property owners to transfer real estate to their beneficiaries without the complexities of probate. This legal tool allows individuals to designate who will inherit their property upon their passing, ensuring a smoother transition and potentially saving loved ones time and money. One of the most appealing features of the TOD Deed is that it allows the original owner to retain full control of the property during their lifetime, meaning they can sell, modify, or even revoke the deed if their circumstances change. Additionally, the TOD Deed must be recorded with the county recorder's office to be valid, and it can only be used for residential properties, making it an ideal option for homeowners. Understanding the intricacies of this deed is essential, as it can significantly impact estate planning and the financial well-being of your heirs. Whether you are looking to simplify the transfer process or ensure your loved ones are taken care of, the California Transfer-on-Death Deed provides a practical solution worth considering.

Dos and Don'ts

When filling out the California Transfer-on-Death Deed form, it's essential to take care to ensure everything is completed correctly. Here are some important dos and don’ts to keep in mind:

- Do ensure that you are eligible to use a Transfer-on-Death Deed. Only property owners can create this type of deed.

- Do provide accurate information about the property. Include the correct legal description to avoid any confusion later.

- Do sign the deed in front of a notary public. This step is crucial for the deed to be legally valid.

- Do record the deed with the county recorder’s office. This action makes the deed effective and enforceable.

- Don't forget to name a beneficiary. Without this, the deed may not serve its intended purpose.

- Don't use vague language. Be clear and specific to prevent misunderstandings about the property transfer.

PDF Properties

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in California to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by California Probate Code Sections 5600-5694. |

| Execution Requirements | The deed must be signed by the property owner and recorded with the county recorder's office to be valid. |

| Revocation | Property owners can revoke the Transfer-on-Death Deed at any time before their death by recording a revocation document. |

Key takeaways

Understand that a California Transfer-on-Death Deed allows you to transfer real property to a designated beneficiary upon your death without going through probate.

Ensure that the deed is properly completed, signed, and notarized. This step is crucial for the deed to be valid.

File the deed with the county recorder’s office where the property is located. This filing is necessary for the transfer to take effect.

Be aware that the beneficiary will inherit the property automatically, but they will need to take certain steps to officially claim it.

Consider consulting with a legal professional to discuss the implications of using a Transfer-on-Death Deed, especially regarding tax and estate planning.

Popular State-specific Transfer-on-Death Deed Forms

Transfer on Death Deed Form Florida - Beneficiaries may sell or keep the property after the owner’s death.

A Texas Hold Harmless Agreement is a legal document designed to protect one party from liability for any injuries or damages that may occur during a specific activity or event. This form outlines the responsibilities of each party involved and ensures that the party being held harmless will not be held accountable for certain claims. For those looking for a reliable template, resources like Texas Forms Online can be invaluable. Understanding the importance of this agreement can help individuals and organizations mitigate risks effectively.

Problems With Transfer on Death Deeds Ohio - It reinforces the importance of having a well-structured estate plan that includes real property considerations.

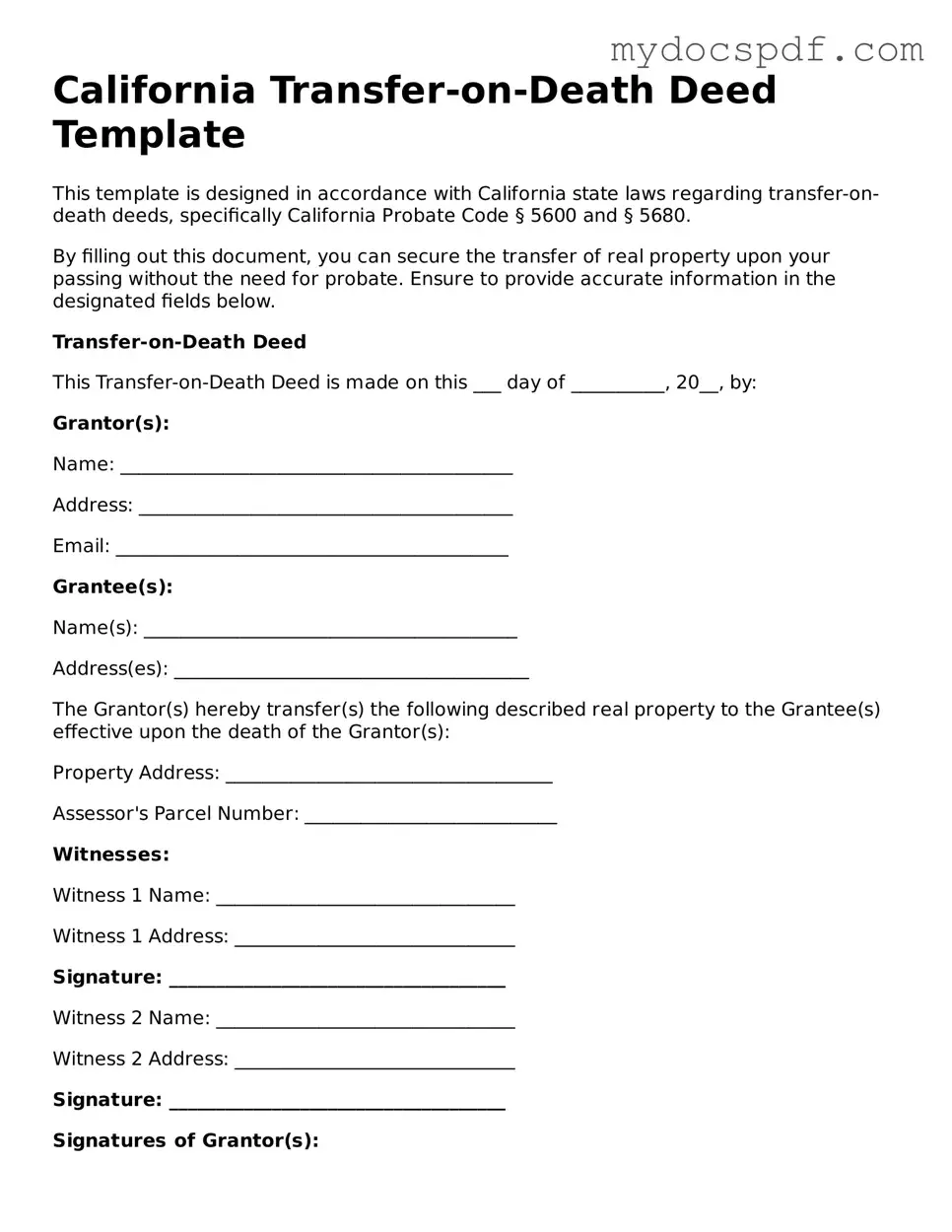

Example - California Transfer-on-Death Deed Form

California Transfer-on-Death Deed Template

This template is designed in accordance with California state laws regarding transfer-on-death deeds, specifically California Probate Code § 5600 and § 5680.

By filling out this document, you can secure the transfer of real property upon your passing without the need for probate. Ensure to provide accurate information in the designated fields below.

Transfer-on-Death Deed

This Transfer-on-Death Deed is made on this ___ day of __________, 20__, by:

Grantor(s):

Name: __________________________________________

Address: ________________________________________

Email: __________________________________________

Grantee(s):

Name(s): ________________________________________

Address(es): ______________________________________

The Grantor(s) hereby transfer(s) the following described real property to the Grantee(s) effective upon the death of the Grantor(s):

Property Address: ___________________________________

Assessor's Parcel Number: ___________________________

Witnesses:

Witness 1 Name: ________________________________

Witness 1 Address: ______________________________

Signature: ____________________________________

Witness 2 Name: ________________________________

Witness 2 Address: ______________________________

Signature: ____________________________________

Signatures of Grantor(s):

Grantor Signature: _________________________________

Co-Grantor Signature (if any): _____________________

This deed must be recorded in the county where the property is located within 60 days after it is executed in order to be effective.

Notice:

- This deed revokes any prior transfer-on-death deed for the same property.

- The Grantee(s) shall take the property subject to any liens or encumbrances.

By executing this deed, the Grantor(s) confirm that they have read and understood the implications of this Transfer-on-Death Deed.

Detailed Instructions for Writing California Transfer-on-Death Deed

After obtaining the California Transfer-on-Death Deed form, it is essential to fill it out accurately to ensure your intentions are clearly documented. Follow the steps below to complete the form properly.

- Begin by entering your name as the transferor in the designated space at the top of the form.

- Provide your address, including the city, state, and ZIP code, below your name.

- Identify the property you wish to transfer by including the full address and a legal description of the property. This may be found in your property deed.

- Next, list the name(s) of the beneficiary or beneficiaries who will receive the property upon your passing. Ensure the names are spelled correctly.

- Include the address of each beneficiary to avoid any confusion in the future.

- Sign and date the form in the designated areas to validate your intentions. Make sure to do this in front of a notary public.

- Finally, submit the completed form to your county recorder’s office for it to be officially recorded.

Documents used along the form

The California Transfer-on-Death Deed (TOD) allows property owners to transfer real estate to a designated beneficiary upon their death, avoiding probate. To ensure a smooth transition of property ownership, several other documents may be utilized in conjunction with the TOD form. Below are some commonly used forms and documents that can complement the Transfer-on-Death Deed.

- Grant Deed: This document is used to transfer ownership of real property from one party to another. It provides evidence of the transfer and includes details about the property and the parties involved.

- Will: A legal document that outlines how a person's assets, including real estate, should be distributed after their death. While a TOD deed bypasses probate, a will can still serve as a comprehensive estate planning tool.

- Revocable Living Trust: This is a legal entity that holds an individual's assets during their lifetime and specifies how those assets should be distributed after death. It can help avoid probate and provide privacy for the estate.

- California Bill of Sale Form: For those involved in transactions requiring formal agreements, refer to the essential California bill of sale form template to ensure safe and documented exchanges.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for various accounts, such as bank accounts or retirement plans. They work similarly to a TOD deed by allowing assets to transfer directly to the designated beneficiaries upon death.

- Affidavit of Death: This document is often required to confirm a person's death and may be needed when transferring property or assets. It provides legal proof of death and can facilitate the transfer process.

Understanding these documents can help individuals navigate property transfers effectively and ensure their wishes are honored. Proper documentation and planning can simplify the process for beneficiaries and reduce potential complications after death.