Fillable California Tractor Bill of Sale Document

In California, when buying or selling a tractor, a Bill of Sale serves as an essential document to finalize the transaction. This form provides a written record of the sale, detailing important information about the parties involved, the tractor being sold, and the terms of the sale. Typically, it includes the names and addresses of both the seller and the buyer, a description of the tractor, including its make, model, year, and vehicle identification number (VIN). Additionally, the form often outlines the sale price, payment method, and any warranties or conditions related to the sale. Having a properly completed Bill of Sale not only protects both parties by providing proof of ownership transfer but also helps in the registration process with the California Department of Motor Vehicles (DMV). It is crucial for both buyers and sellers to understand the significance of this document, as it ensures a smooth transaction and provides clarity in case of future disputes.

Dos and Don'ts

When filling out the California Tractor Bill of Sale form, it is important to ensure that the process goes smoothly. Below are some guidelines to follow, including things you should do and things you should avoid.

Things You Should Do:

- Provide accurate information about the tractor, including the make, model, year, and Vehicle Identification Number (VIN).

- Clearly state the sale price and the date of the transaction.

- Sign and date the form to validate the sale.

- Keep a copy of the completed Bill of Sale for your records.

Things You Shouldn't Do:

- Do not leave any sections of the form blank; incomplete information can lead to issues later.

- Avoid using incorrect or misleading information about the tractor's condition.

- Do not forget to have both the buyer and seller sign the document; both signatures are essential.

- Refrain from making alterations or corrections on the form without proper documentation.

By following these guidelines, you can help ensure that the sale process is clear and legally sound. Always take your time to review the form before submitting it.

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose | The California Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor in California. |

| Governing Law | This form is governed by California Vehicle Code Sections 5901-5903, which outline the requirements for vehicle sales and transfers. |

| Parties Involved | The form requires information from both the seller and the buyer, ensuring that both parties are clearly identified in the transaction. |

| Required Information | Essential details such as the tractor's make, model, year, and Vehicle Identification Number (VIN) must be included to validate the sale. |

| Signatures | Both the seller and buyer must sign the form to finalize the transaction, making it legally binding. |

Key takeaways

When dealing with the California Tractor Bill of Sale form, understanding its components and implications is crucial. Here are some key takeaways to keep in mind:

- Purpose of the Form: The Tractor Bill of Sale serves as a legal document that records the transfer of ownership of a tractor from the seller to the buyer.

- Information Required: Essential details such as the tractor's make, model, year, Vehicle Identification Number (VIN), and the sale price must be included.

- Signatures: Both the seller and buyer must sign the form to validate the transaction. This step is critical for legal acknowledgment.

- Record Keeping: It is advisable for both parties to retain a copy of the completed bill of sale for their records. This can be important for future reference or disputes.

- Sales Tax Implications: Be aware that sales tax may apply to the purchase. Buyers should check with local authorities to understand their tax obligations.

- Notarization: While notarization is not always required, having the document notarized can provide an extra layer of security and authenticity.

Completing the California Tractor Bill of Sale accurately and thoroughly can prevent potential issues in the future. Be diligent in gathering all necessary information and ensure that both parties understand their rights and responsibilities.

Popular State-specific Tractor Bill of Sale Forms

Can You Get a Title With a Bill of Sale - A practical document that complements verbal agreements.

When completing the transfer of a trailer, it is important to use the correct legal documentation, such as the New York Trailer Bill of Sale. This form not only outlines critical details about the trailer and the parties involved but also serves to safeguard their respective rights throughout the transaction. For those interested in a reliable and easy-to-use format, you can find a suitable template at NY Templates.

Example - California Tractor Bill of Sale Form

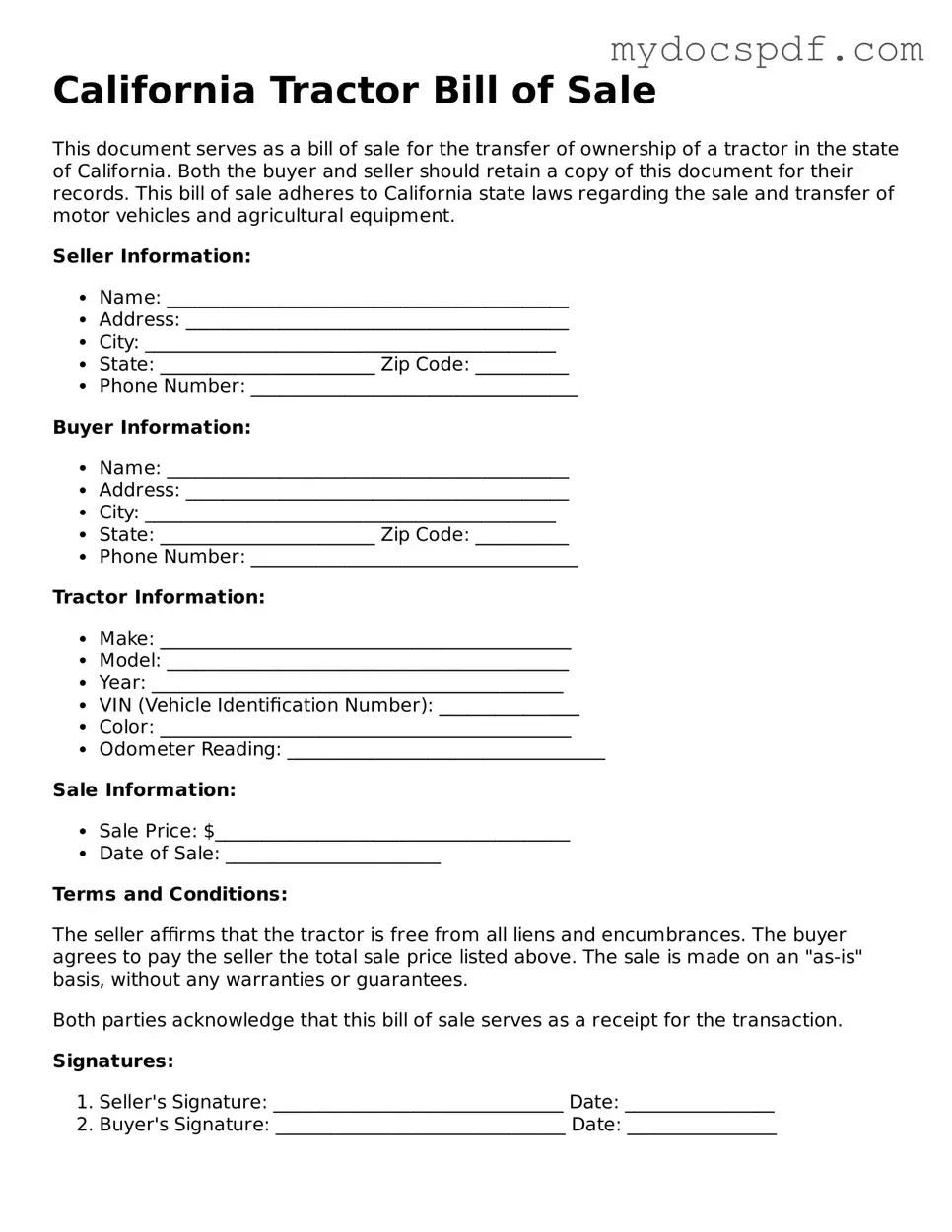

California Tractor Bill of Sale

This document serves as a bill of sale for the transfer of ownership of a tractor in the state of California. Both the buyer and seller should retain a copy of this document for their records. This bill of sale adheres to California state laws regarding the sale and transfer of motor vehicles and agricultural equipment.

Seller Information:

- Name: ___________________________________________

- Address: _________________________________________

- City: ____________________________________________

- State: _______________________ Zip Code: __________

- Phone Number: ___________________________________

Buyer Information:

- Name: ___________________________________________

- Address: _________________________________________

- City: ____________________________________________

- State: _______________________ Zip Code: __________

- Phone Number: ___________________________________

Tractor Information:

- Make: ____________________________________________

- Model: ___________________________________________

- Year: ____________________________________________

- VIN (Vehicle Identification Number): _______________

- Color: ____________________________________________

- Odometer Reading: __________________________________

Sale Information:

- Sale Price: $______________________________________

- Date of Sale: _______________________

Terms and Conditions:

The seller affirms that the tractor is free from all liens and encumbrances. The buyer agrees to pay the seller the total sale price listed above. The sale is made on an "as-is" basis, without any warranties or guarantees.

Both parties acknowledge that this bill of sale serves as a receipt for the transaction.

Signatures:

- Seller's Signature: _______________________________ Date: ________________

- Buyer's Signature: _______________________________ Date: ________________

This document may be used to register the tractor with the California Department of Motor Vehicles.

Detailed Instructions for Writing California Tractor Bill of Sale

Filling out the California Tractor Bill of Sale form is an important step in the process of transferring ownership of a tractor. This form provides essential information about the transaction and ensures that both the buyer and seller are protected. Once completed, you can proceed with the necessary steps to finalize the sale and register the tractor under the new owner's name.

- Begin by obtaining the California Tractor Bill of Sale form. You can find it online or at a local Department of Motor Vehicles (DMV) office.

- Fill in the date of the sale at the top of the form. This date marks when the transaction takes place.

- Provide the seller's information. This includes the full name and address of the individual or business selling the tractor.

- Next, enter the buyer's information. Include the full name and address of the person or business purchasing the tractor.

- Describe the tractor in detail. Include the make, model, year, and Vehicle Identification Number (VIN). This information helps to clearly identify the tractor being sold.

- Indicate the sale price. Write down the agreed-upon amount for the tractor. This is important for both parties and for any potential tax implications.

- Both the buyer and seller should sign and date the form. This step is crucial as it signifies that both parties agree to the terms of the sale.

- Make copies of the completed form for both the buyer and seller. Keeping a record of the transaction is beneficial for future reference.

Documents used along the form

The California Tractor Bill of Sale form is an important document used in the sale and transfer of ownership for tractors. However, several other forms and documents may accompany it to ensure a smooth transaction and proper record-keeping. Below is a list of commonly used forms that complement the Tractor Bill of Sale.

- Title Transfer Document: This document officially transfers the ownership of the tractor from the seller to the buyer. It typically includes details such as the vehicle identification number (VIN) and the names of both parties.

- Vehicle Registration Application: After purchasing a tractor, the new owner must complete this application to register the vehicle with the California Department of Motor Vehicles (DMV).

- Odometer Disclosure Statement: Required for vehicles under 10 years old, this statement discloses the current odometer reading to ensure transparency regarding the tractor's mileage.

- Proof of Insurance: Buyers often need to provide evidence of insurance coverage for the tractor before they can complete the registration process.

- Sales Tax Payment Receipt: This receipt confirms that the buyer has paid any applicable sales tax on the purchase of the tractor, which is necessary for the registration process.

- Transfer-on-Death Deed: To simplify property transfer, consider the easy-to-use Transfer-on-Death Deed options available in Arizona, which allow for direct transfer of real estate to beneficiaries upon death.

- Release of Liability Form: This form protects the seller by notifying the DMV that they are no longer responsible for the tractor once it has been sold.

- Bill of Sale for Equipment: If the tractor comes with additional equipment or attachments, a separate bill of sale for those items may be required.

- Inspection Certificate: Some buyers may request a certificate that verifies the tractor has passed any necessary inspections, ensuring it meets safety and operational standards.

- Financing Agreement: If the buyer is financing the tractor, this document outlines the terms of the loan, including payment amounts and interest rates.

Having these documents prepared and organized can facilitate a smoother transaction when buying or selling a tractor in California. Each form plays a vital role in ensuring compliance with state regulations and protecting the interests of both parties involved in the sale.