Fillable California Quitclaim Deed Document

When it comes to transferring property ownership in California, the Quitclaim Deed form serves as a straightforward and efficient tool. This legal document allows one party, known as the grantor, to relinquish any interest they may have in a property to another party, referred to as the grantee. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor holds clear title to the property; instead, it simply conveys whatever rights the grantor possesses, if any. This makes it particularly useful in situations such as transferring property between family members, settling estate matters, or clarifying ownership among co-owners. The form requires specific information, including the names of both parties, a legal description of the property, and the date of the transfer. Additionally, it must be signed and notarized to ensure its validity. Understanding the Quitclaim Deed is essential for anyone looking to navigate property transfers in California, as it can simplify the process while also carrying certain risks that should be carefully considered.

Dos and Don'ts

When filling out the California Quitclaim Deed form, it is essential to approach the process with care. Here is a list of things you should and shouldn't do to ensure a smooth experience.

- Do ensure that all names are spelled correctly.

- Do provide the correct legal description of the property.

- Do include the current owner's name as the grantor.

- Do sign the form in the presence of a notary public.

- Do keep a copy of the completed deed for your records.

- Don't leave any required fields blank.

- Don't use nicknames; always use legal names.

- Don't forget to check local recording requirements.

- Don't submit the form without notarization.

- Don't rush through the process; take your time to review everything.

By following these guidelines, you can help ensure that your Quitclaim Deed is completed accurately and effectively. Taking the time to double-check your work can prevent future complications.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another without any warranties. |

| Governing Law | The Quitclaim Deed in California is governed by the California Civil Code, specifically Section 1092. |

| Parties Involved | Typically, there are two parties involved: the grantor (the person transferring the property) and the grantee (the person receiving the property). |

| Use Cases | Commonly used in divorce settlements, transferring property between family members, or clearing up title issues. |

| No Guarantees | The grantor makes no guarantees about the property’s title; the grantee accepts the property as-is. |

| Filing Requirements | To make the Quitclaim Deed effective, it must be signed by the grantor and recorded with the county recorder's office. |

| Consideration | While some Quitclaim Deeds involve payment (consideration), others may be executed for no consideration, especially among family members. |

| Tax Implications | Transfer taxes may apply, depending on the value of the property and local regulations. |

| Notarization | In California, the Quitclaim Deed must be notarized to be valid and enforceable. |

| Revocation | Once executed, a Quitclaim Deed cannot be revoked unilaterally; it requires mutual consent or a court order. |

Key takeaways

Filling out and using the California Quitclaim Deed form can seem daunting, but understanding the key elements can simplify the process. Here are some essential takeaways to keep in mind:

- Purpose of the Quitclaim Deed: This form is primarily used to transfer ownership of real property from one person to another without guaranteeing the title.

- Parties Involved: The form requires the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Property Description: A clear and accurate description of the property is crucial. This includes the address and legal description, which can often be found on previous deeds or property tax documents.

- Signature Requirements: The grantor must sign the document in front of a notary public. This step is essential for the deed to be legally binding.

- Notarization: After signing, the deed must be notarized. This adds an extra layer of authenticity and helps prevent fraud.

- Recording the Deed: To make the transfer official, the completed quitclaim deed should be recorded with the county recorder’s office where the property is located.

- Transfer Taxes: Be aware that transferring property may incur transfer taxes. Check with your local tax authority for specific details.

- Impact on Title Insurance: Using a quitclaim deed may affect the title insurance policy. It’s wise to consult with a title company for guidance.

- Legal Advice: While a quitclaim deed is straightforward, seeking legal advice can be beneficial, especially for complex situations or if you have concerns about the title.

- Revoking a Quitclaim Deed: Once a quitclaim deed is executed and recorded, it cannot be revoked unilaterally. Understanding this permanence is vital before proceeding.

By keeping these points in mind, you can navigate the process of filling out and using a California Quitclaim Deed with greater confidence.

Popular State-specific Quitclaim Deed Forms

Idaho Quit Claim Deed Form - This document embodies the premise of good faith in property transactions among trusted parties.

The importance of having a clear and comprehensive New York Residential Lease Agreement cannot be overstated, as it serves to prevent misunderstandings between landlords and tenants. For those looking to draft their lease documents, resources are available, such as this template at https://newyorkform.com/free-residential-lease-agreement-template, which can provide guidance on the necessary terms and conditions for a successful rental agreement.

Massachusetts Quit Claim Deed Form - The simplicity of this document makes it appealing for personal transactions, where money is not changing hands.

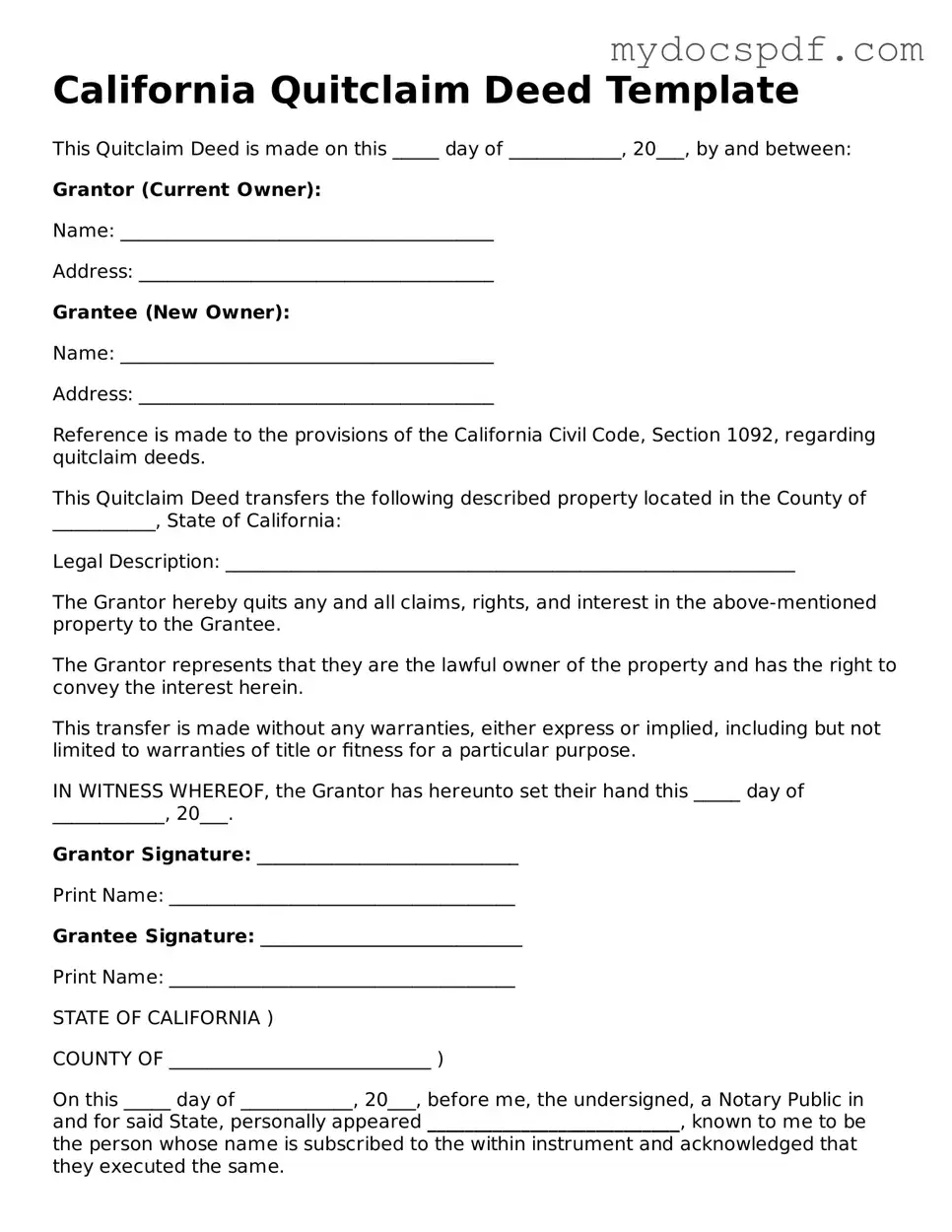

Example - California Quitclaim Deed Form

California Quitclaim Deed Template

This Quitclaim Deed is made on this _____ day of ____________, 20___, by and between:

Grantor (Current Owner):

Name: ________________________________________

Address: ______________________________________

Grantee (New Owner):

Name: ________________________________________

Address: ______________________________________

Reference is made to the provisions of the California Civil Code, Section 1092, regarding quitclaim deeds.

This Quitclaim Deed transfers the following described property located in the County of ___________, State of California:

Legal Description: _____________________________________________________________

The Grantor hereby quits any and all claims, rights, and interest in the above-mentioned property to the Grantee.

The Grantor represents that they are the lawful owner of the property and has the right to convey the interest herein.

This transfer is made without any warranties, either express or implied, including but not limited to warranties of title or fitness for a particular purpose.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand this _____ day of ____________, 20___.

Grantor Signature: ____________________________

Print Name: _____________________________________

Grantee Signature: ____________________________

Print Name: _____________________________________

STATE OF CALIFORNIA )

COUNTY OF ____________________________ )

On this _____ day of ____________, 20___, before me, the undersigned, a Notary Public in and for said State, personally appeared ___________________________, known to me to be the person whose name is subscribed to the within instrument and acknowledged that they executed the same.

WITNESS my hand and official seal.

Notary Public Signature: ______________________

My Commission Expires: ______________________

Detailed Instructions for Writing California Quitclaim Deed

Once you have the California Quitclaim Deed form ready, you will need to fill it out carefully. This process involves providing specific information about the property and the parties involved. Make sure to have all necessary details at hand before starting.

- Obtain the form: Download the California Quitclaim Deed form from a reliable source or visit your local county recorder's office to get a physical copy.

- Fill in the title: At the top of the form, write “Quitclaim Deed.”

- Identify the grantor: Provide the full name and address of the person transferring the property. This is the grantor.

- Identify the grantee: Enter the full name and address of the person receiving the property. This is the grantee.

- Describe the property: Include a legal description of the property. This can often be found on the property’s deed or tax records.

- State the consideration: Mention the amount of money or value exchanged for the property. If it’s a gift, you can write “for love and affection.”

- Sign the form: The grantor must sign the form in the presence of a notary public.

- Notarization: Have the notary public complete their section, confirming the grantor’s identity and signature.

- File the deed: Submit the completed Quitclaim Deed to the county recorder's office where the property is located. Pay any required filing fees.

Documents used along the form

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. When completing this process, several other forms and documents may be necessary to ensure a smooth transaction. Below are some commonly used documents that often accompany a Quitclaim Deed in California.

- Grant Deed: This document is similar to a Quitclaim Deed but provides a guarantee that the grantor has the right to transfer the property and that there are no undisclosed encumbrances. It offers more protection to the grantee.

- Preliminary Change of Ownership Report: This form must be filed with the county assessor when a property changes hands. It provides information about the transaction and helps determine property tax assessments.

- Title Insurance Policy: This document protects the buyer against any potential claims or disputes regarding the property’s title. It ensures that the buyer has clear ownership and can defend against any future claims.

- Motor Vehicle Power of Attorney: A crucial form that allows individuals to delegate authority for specific motor vehicle transactions, making it easier to handle title transfers and registrations. For more information, visit Texas Forms Online.

- Property Transfer Tax Statement: This form is required in many counties to report the transfer of property. It outlines any taxes owed due to the change in ownership and must be filed with the Quitclaim Deed.

Using these documents alongside a Quitclaim Deed can help facilitate the transfer of property and protect the interests of all parties involved. It is advisable to consult with a legal professional to ensure compliance with local regulations and requirements.