Fillable California Promissory Note Document

The California Promissory Note form serves as a crucial tool for individuals and businesses engaging in lending and borrowing transactions. This legally binding document outlines the terms of a loan, including the principal amount, interest rate, repayment schedule, and any applicable fees. By clearly defining the obligations of both the borrower and the lender, the form helps to prevent misunderstandings and disputes. It can be customized to fit various lending scenarios, whether it involves a personal loan between friends or a formal agreement between a business and a financial institution. Additionally, the California Promissory Note includes essential details such as the maturity date and provisions for late payments, which are critical for ensuring compliance and protecting the interests of the lender. Understanding the key components of this form is vital for anyone considering a loan agreement in California, as it lays the foundation for a transparent and enforceable financial relationship.

Dos and Don'ts

When filling out the California Promissory Note form, it's important to be thorough and careful. Here are some key dos and don'ts to keep in mind:

- Do read the entire form carefully before you start filling it out.

- Do provide accurate information regarding the borrower and lender.

- Do clearly state the loan amount and the interest rate.

- Do include the repayment terms, including the due date.

- Don't leave any blank spaces; fill in all required fields.

- Don't use ambiguous language; be clear and specific.

- Don't forget to sign and date the document at the end.

By following these guidelines, you can ensure that your Promissory Note is completed correctly and is legally binding. Taking your time and paying attention to detail will help prevent any misunderstandings in the future.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A California Promissory Note is a written promise to pay a specific amount of money to a designated party at a specified time. |

| Governing Law | The California Civil Code governs promissory notes in the state. |

| Parties Involved | The note involves at least two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate must be clearly stated and should comply with California usury laws. |

| Payment Terms | Payment terms, including the due date and installment schedule, should be explicitly outlined. |

| Signature Requirement | The promissory note must be signed by the borrower to be enforceable. |

| Default Provisions | Provisions regarding default and remedies should be included to protect the lender's rights. |

| Transferability | A promissory note can be transferred to another party unless it states otherwise. |

Key takeaways

When filling out and using the California Promissory Note form, it is essential to understand several key aspects to ensure that the document serves its intended purpose effectively.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This information is crucial for establishing who is involved in the agreement.

- Specify the Loan Amount: Clearly indicate the total amount of money being borrowed. This should be a precise figure to avoid any confusion later on.

- Detail the Repayment Terms: Outline how and when the borrower will repay the loan. This includes specifying the payment schedule, interest rate, and any penalties for late payments.

- Include Signatures: Both parties must sign the document for it to be legally binding. Ensure that the date of signing is also included.

- Consider Notarization: While not always required, having the document notarized can add an extra layer of security and authenticity to the agreement.

By paying attention to these key elements, you can create a clear and enforceable promissory note that protects the interests of both the borrower and the lender.

Popular State-specific Promissory Note Forms

Georgia Promissory Note - Parties should consider discussing the terms with legal counsel for additional assurance.

Idaho Promissory Note Descargar - This document can be used for various types of loans, big or small, including personal loans or business financing.

When selling or purchasing a vehicle in Texas, it's important to have all necessary documentation in order, including the Texas Motor Vehicle Bill of Sale form, which ensures legal protection for both the buyer and seller. For those looking for an efficient way to manage this process, resources such as Texas Forms Online provide templates and guidance to facilitate a smooth transaction.

Promissory Note Template Florida Pdf - The promise indicates the borrower's commitment to repay the debt.

Notarized Promissory Note - A well-drafted note can help prevent misunderstandings between the parties involved.

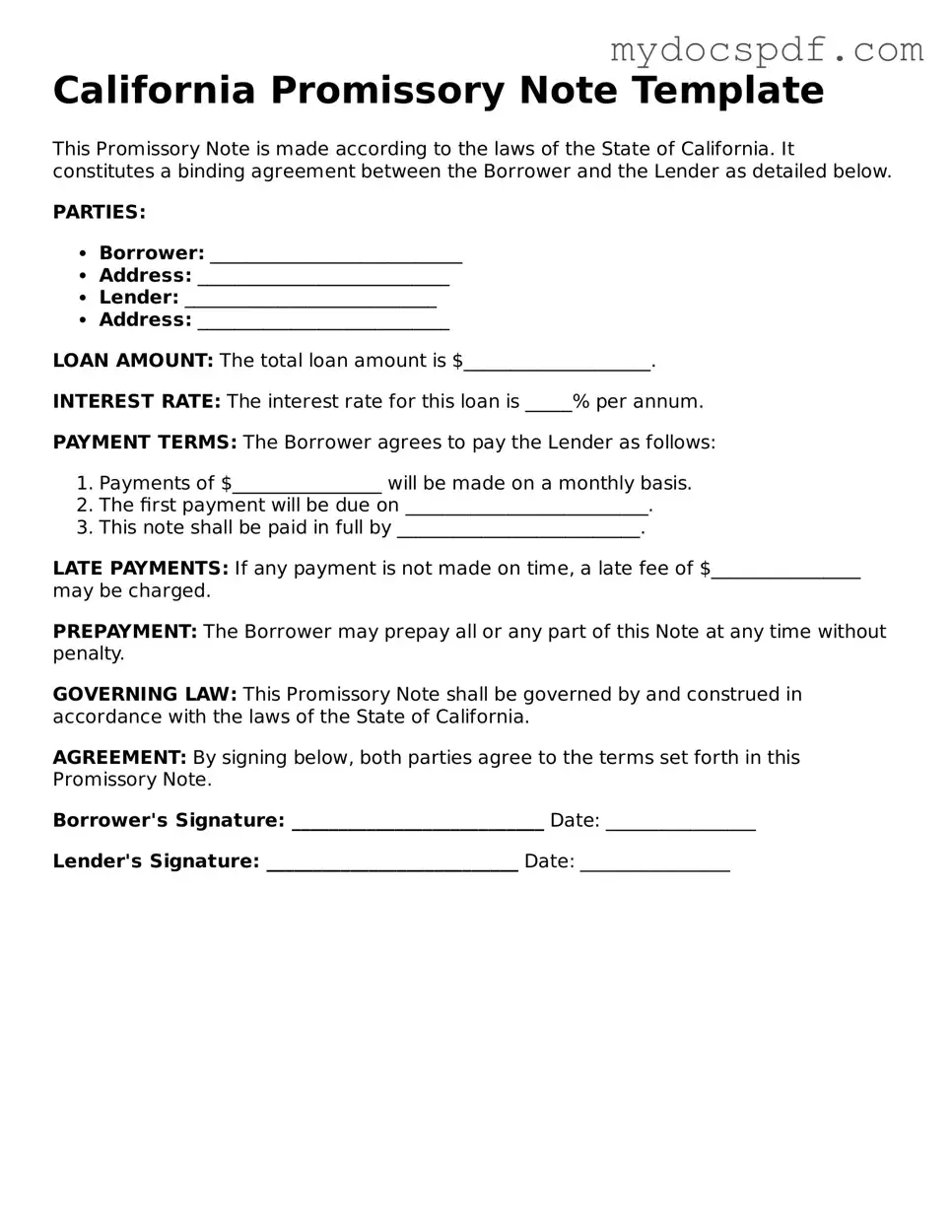

Example - California Promissory Note Form

California Promissory Note Template

This Promissory Note is made according to the laws of the State of California. It constitutes a binding agreement between the Borrower and the Lender as detailed below.

PARTIES:

- Borrower: ___________________________

- Address: ___________________________

- Lender: ___________________________

- Address: ___________________________

LOAN AMOUNT: The total loan amount is $____________________.

INTEREST RATE: The interest rate for this loan is _____% per annum.

PAYMENT TERMS: The Borrower agrees to pay the Lender as follows:

- Payments of $________________ will be made on a monthly basis.

- The first payment will be due on __________________________.

- This note shall be paid in full by __________________________.

LATE PAYMENTS: If any payment is not made on time, a late fee of $________________ may be charged.

PREPAYMENT: The Borrower may prepay all or any part of this Note at any time without penalty.

GOVERNING LAW: This Promissory Note shall be governed by and construed in accordance with the laws of the State of California.

AGREEMENT: By signing below, both parties agree to the terms set forth in this Promissory Note.

Borrower's Signature: ___________________________ Date: ________________

Lender's Signature: ___________________________ Date: ________________

Detailed Instructions for Writing California Promissory Note

After obtaining the California Promissory Note form, you will need to fill it out carefully. Ensure that all information is accurate and complete to avoid any potential issues in the future. Follow the steps below to complete the form properly.

- Begin by entering the date at the top of the form.

- Write the name and address of the borrower in the designated section.

- Next, provide the lender's name and address.

- Indicate the principal amount being borrowed in words and numbers.

- Specify the interest rate, if applicable, in the appropriate section.

- Detail the repayment schedule, including the due date and frequency of payments.

- Include any late fees or penalties for missed payments, if applicable.

- Sign and date the form at the bottom as the borrower.

- If required, have a witness or notary public sign the form to validate it.

Once the form is filled out, make copies for both the borrower and lender. Keep these copies in a safe place for future reference.

Documents used along the form

When entering into a loan agreement in California, a Promissory Note is often accompanied by several other important documents. These documents help clarify the terms of the loan and protect the interests of both the borrower and the lender. Below is a list of commonly used forms and documents that may accompany a California Promissory Note.

- Loan Agreement: This document outlines the specific terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral securing the loan. It serves as a comprehensive guide for both parties.

- Security Agreement: If the loan is secured by collateral, this agreement details the assets pledged by the borrower. It establishes the lender's rights to the collateral in case of default.

- Disclosure Statement: This document provides essential information about the loan, including the total cost, any fees, and the annual percentage rate (APR). It ensures transparency and helps borrowers understand their financial obligations.

- Dog Bill of Sale Form: When finalizing the transfer of dog ownership, consult the essential Dog Bill of Sale documentation to ensure compliance with legal standards.

- Personal Guarantee: In some cases, a lender may require a personal guarantee from a third party, ensuring that they will be responsible for the loan if the borrower defaults. This document adds an extra layer of security for the lender.

- Amortization Schedule: This schedule breaks down the repayment of the loan into regular payments, showing how much of each payment goes toward interest and how much goes toward the principal balance. It helps borrowers plan their finances.

- Loan Modification Agreement: If the terms of the original loan need to be changed, this document outlines the new terms and conditions. It is essential for both parties to agree to any modifications formally.

Each of these documents plays a crucial role in the lending process, ensuring that both parties are aware of their rights and responsibilities. Properly executed, they can prevent misunderstandings and disputes down the line.