Fillable California Operating Agreement Document

The California Operating Agreement form is a vital document for any Limited Liability Company (LLC) operating within the state. This form outlines the internal management structure and operational procedures of the LLC, ensuring that all members are on the same page regarding their roles and responsibilities. It addresses key elements such as the distribution of profits and losses, voting rights, and the process for adding or removing members. Additionally, the agreement can specify the duration of the LLC and the procedures for dissolution, providing clarity and protection for all involved. By establishing clear guidelines, the Operating Agreement helps to prevent disputes among members and provides a framework for effective decision-making. It is essential for LLCs to customize this document to reflect their unique needs and circumstances, making it a cornerstone of successful business operations in California.

Dos and Don'ts

When filling out the California Operating Agreement form, it’s important to keep a few key points in mind. Here are some dos and don’ts to help you through the process.

- Do ensure that all members' names and addresses are accurate and complete.

- Do clearly outline the roles and responsibilities of each member.

- Do review the document for any typos or errors before submitting.

- Do keep a copy of the signed agreement for your records.

- Don’t leave any sections blank; fill in all required information.

- Don’t use vague language; be specific about terms and conditions.

- Don’t forget to include the date the agreement is signed.

- Don’t ignore state laws; ensure compliance with California regulations.

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose | The California Operating Agreement outlines the management structure and operational procedures for a limited liability company (LLC). |

| Governing Law | This agreement is governed by the California Corporations Code, specifically Section 17300 and related provisions. |

| Member Rights | The agreement defines the rights and responsibilities of members, including profit distribution and decision-making processes. |

| Flexibility | California allows LLCs to customize their Operating Agreements, providing flexibility to meet specific business needs. |

| Not Mandatory | While not required by law, having an Operating Agreement is highly recommended to prevent disputes among members. |

Key takeaways

When filling out and using the California Operating Agreement form, it is important to keep several key points in mind. Here are some essential takeaways:

- Understand the Purpose: The Operating Agreement outlines the management structure and operational procedures of your LLC. It serves as a foundational document for your business.

- Identify Members: Clearly list all members of the LLC. This includes their names and addresses, which helps establish ownership and responsibilities.

- Define Roles: Specify the roles and responsibilities of each member. This clarity can prevent disputes and misunderstandings in the future.

- Outline Profit Distribution: Detail how profits and losses will be distributed among members. This section should reflect the agreement among members and can be based on ownership percentages or other criteria.

- Include Voting Procedures: Establish how decisions will be made within the LLC. This may include voting rights, quorum requirements, and procedures for resolving disputes.

- Address Changes: Include provisions for adding or removing members. This flexibility can be crucial as the business evolves.

- Consult Legal Resources: While templates are available, it is advisable to consult legal professionals to ensure compliance with California laws and to address specific business needs.

By keeping these points in mind, individuals can create a comprehensive Operating Agreement that meets their business requirements and protects their interests.

Popular State-specific Operating Agreement Forms

An Agreement to Operate a Business in the Name of an Established Company - The document can specify the duration of the LLC's existence.

The Texas Notice to Quit form serves as a crucial legal tool for landlords, providing a clear communication of the intent to terminate a rental agreement. It is imperative for tenants to understand this document, as it outlines a specified timeframe for vacating the premises. For additional resources and templates related to this process, landlords and tenants can visit Texas Forms Online, which offers helpful guidance to ensure compliance with Texas rental laws.

Florida Operating Agreement Template - An Operating Agreement sets the tone for the culture and values of the LLC.

Georgia Llc Operating Agreement - It can articulate the vision and purpose behind the LLC's formation.

Idaho Llc Operating Agreement Form - This document helps in documenting agreements reached among members.

Example - California Operating Agreement Form

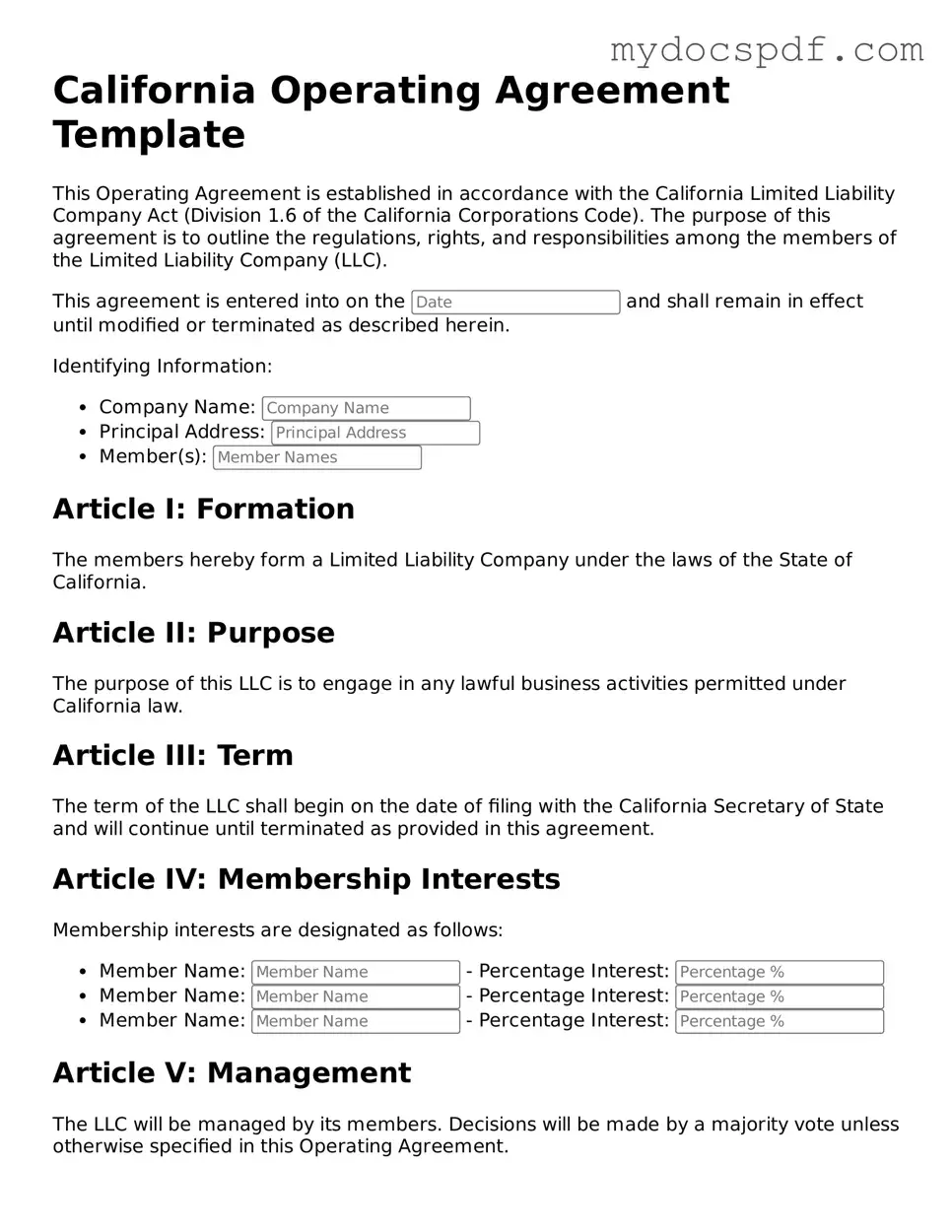

California Operating Agreement Template

This Operating Agreement is established in accordance with the California Limited Liability Company Act (Division 1.6 of the California Corporations Code). The purpose of this agreement is to outline the regulations, rights, and responsibilities among the members of the Limited Liability Company (LLC).

This agreement is entered into on the and shall remain in effect until modified or terminated as described herein.

Identifying Information:

- Company Name:

- Principal Address:

- Member(s):

Article I: Formation

The members hereby form a Limited Liability Company under the laws of the State of California.

Article II: Purpose

The purpose of this LLC is to engage in any lawful business activities permitted under California law.

Article III: Term

The term of the LLC shall begin on the date of filing with the California Secretary of State and will continue until terminated as provided in this agreement.

Article IV: Membership Interests

Membership interests are designated as follows:

- Member Name: - Percentage Interest:

- Member Name: - Percentage Interest:

- Member Name: - Percentage Interest:

Article V: Management

The LLC will be managed by its members. Decisions will be made by a majority vote unless otherwise specified in this Operating Agreement.

Article VI: Capital Contributions

Each member will contribute the following initial capital:

- Member Name: - Contribution Amount:

- Member Name: - Contribution Amount:

- Member Name: - Contribution Amount:

Article VII: Distributions

Distributions of profits and losses will be allocated to members in proportion to their respective membership interests.

Article VIII: Indemnification

The LLC will indemnify members against any debts and obligations incurred in the course of the LLC's business operations, except in cases of gross negligence or willful misconduct.

Article IX: Amendments

This Operating Agreement may be amended only by a written agreement signed by all members of the LLC.

Article X: Governing Law

This agreement will be governed by the laws of the State of California.

IN WITNESS WHEREOF, the members have executed this Operating Agreement as of the date first written above:

- Member Signature: ___________________________

- Member Signature: ___________________________

- Member Signature: ___________________________

Detailed Instructions for Writing California Operating Agreement

Filling out the California Operating Agreement form is an important step for your business. This document outlines the rules and regulations for your company and ensures everyone is on the same page. Follow these steps to complete the form accurately.

- Gather Information: Collect all necessary details about your business, including the name, address, and purpose.

- List Members: Write down the names and addresses of all members involved in the business.

- Define Roles: Clearly state the roles and responsibilities of each member. This helps avoid confusion later.

- Decide on Profit Distribution: Determine how profits and losses will be shared among members. Specify percentages or amounts.

- Include Management Structure: Outline how the business will be managed. Will it be member-managed or manager-managed?

- Set Voting Rights: Decide how voting will work. Specify if all members have equal votes or if it varies by role.

- Address Changes: Include provisions for what happens if a member wants to leave or if new members join.

- Sign the Agreement: Once everything is filled out, all members should sign the document to make it official.

After completing the form, keep a copy for your records. You may also want to share it with all members to ensure everyone understands the agreement. This document serves as a guide for your business operations moving forward.

Documents used along the form

When forming a limited liability company (LLC) in California, an Operating Agreement is a crucial document that outlines the management structure and operational procedures of the business. However, several other forms and documents are often used in conjunction with the Operating Agreement to ensure compliance with state laws and to protect the interests of the members. Here’s a list of key documents you should consider:

- Articles of Organization: This is the foundational document filed with the California Secretary of State to officially create your LLC. It includes basic information such as the LLC's name, address, and the name of the registered agent.

- Statement of Information: Required to be filed within 90 days of forming your LLC, this document provides updated information about the company’s management and addresses. It must be filed every two years thereafter.

- Employer Identification Number (EIN): Obtained from the IRS, this number is essential for tax purposes. It allows your LLC to open a bank account, hire employees, and file federal taxes.

- Membership Certificates: While not legally required, these certificates serve as proof of ownership for each member of the LLC. They can help clarify ownership stakes and rights within the company.

- Bylaws or Operating Procedures: These documents outline the internal rules and procedures for the LLC. They can complement the Operating Agreement by detailing specific operational protocols.

- Bank Resolution: This document authorizes specific individuals to open and manage the LLC’s bank accounts. It’s crucial for establishing who has the authority to handle the company’s finances.

- New York Dtf 84 Form: This form is essential for businesses in New York to update their address with the state's tax department, ensuring accurate records and communication. For more details, visit newyorkform.com/free-new-york-dtf-84-template.

- Tax Forms: Depending on the nature of your business and its structure, various tax forms may need to be filed. These can include state and federal tax forms that ensure compliance with tax regulations.

Each of these documents plays a vital role in establishing and maintaining your LLC in California. Properly preparing and filing them can help you avoid legal complications down the road and ensure your business operates smoothly from the start. Don't overlook the importance of these forms; they are integral to your LLC’s success.