Fillable California Loan Agreement Document

When entering into a loan agreement in California, understanding the essential components of the Loan Agreement form is crucial for both lenders and borrowers. This form serves as a legally binding document that outlines the terms and conditions of the loan, ensuring clarity and protection for all parties involved. Key aspects typically include the loan amount, interest rate, repayment schedule, and any collateral required. Additionally, the form may specify late payment penalties, default terms, and the governing law, which is particularly important in California due to its unique legal landscape. By clearly detailing these elements, the Loan Agreement form helps to prevent misunderstandings and disputes down the line, allowing both lenders and borrowers to move forward with confidence in their financial arrangements.

Dos and Don'ts

When filling out the California Loan Agreement form, attention to detail is crucial. Here’s a list of things you should and shouldn't do to ensure a smooth process.

- Do double-check all information: Ensure that all personal and financial details are accurate. Mistakes can lead to delays or complications.

- Do read the entire document: Familiarize yourself with all terms and conditions. Understanding your obligations is essential.

- Do sign and date the form: Ensure that you provide your signature and the date in the appropriate sections. This validates your agreement.

- Do keep a copy for your records: After submitting, retain a copy of the signed agreement for your personal files. This can be helpful in the future.

- Don’t rush through the form: Take your time to avoid errors. Hasty submissions can lead to significant issues.

- Don’t leave any fields blank: Fill out every section completely. Missing information can result in processing delays.

- Don’t ignore the fine print: Pay attention to any additional clauses or stipulations. They may affect your rights and responsibilities.

- Don’t hesitate to ask for help: If you’re unsure about any part of the form, seek assistance. It’s better to clarify than to guess.

PDF Properties

| Fact Name | Details |

|---|---|

| Governing Law | The California Loan Agreement is governed by California state law, specifically the California Civil Code. |

| Purpose | This form is used to outline the terms and conditions of a loan between a lender and a borrower in California. |

| Required Information | The agreement typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. |

| Enforceability | For the agreement to be enforceable, it must be signed by both parties and include clear terms. |

Key takeaways

When filling out and using the California Loan Agreement form, consider the following key takeaways:

- Identify the Parties: Clearly state the names and addresses of both the lender and the borrower. This information is crucial for establishing who is involved in the agreement.

- Specify Loan Amount: Clearly indicate the total amount of the loan. This should be written in both numbers and words to avoid any confusion.

- Detail Interest Rate: Include the interest rate applicable to the loan. This should be expressed as an annual percentage rate (APR) to provide clarity on the cost of borrowing.

- Outline Repayment Terms: Define the repayment schedule, including the frequency of payments (monthly, bi-weekly, etc.) and the total duration of the loan.

- Include Default Terms: Specify what constitutes a default on the loan and the potential consequences. This can help protect the lender's interests.

- Signatures Required: Ensure that both parties sign and date the agreement. This step is essential for the document to be legally binding.

Review the completed form carefully before finalizing it. This helps prevent misunderstandings and ensures that all terms are clear to both parties.

Popular State-specific Loan Agreement Forms

Promissory Note Georgia - It illustrates the commitment of the borrower to repay the money borrowed.

For those looking to facilitate the transfer of ownership, the comprehensive guide on the Boat Bill of Sale form is indispensable. This document ensures that all necessary information is accurately recorded, thus providing legal protection for both the buyer and the seller. For more information, you can refer to the comprehensive Boat Bill of Sale.

Example - California Loan Agreement Form

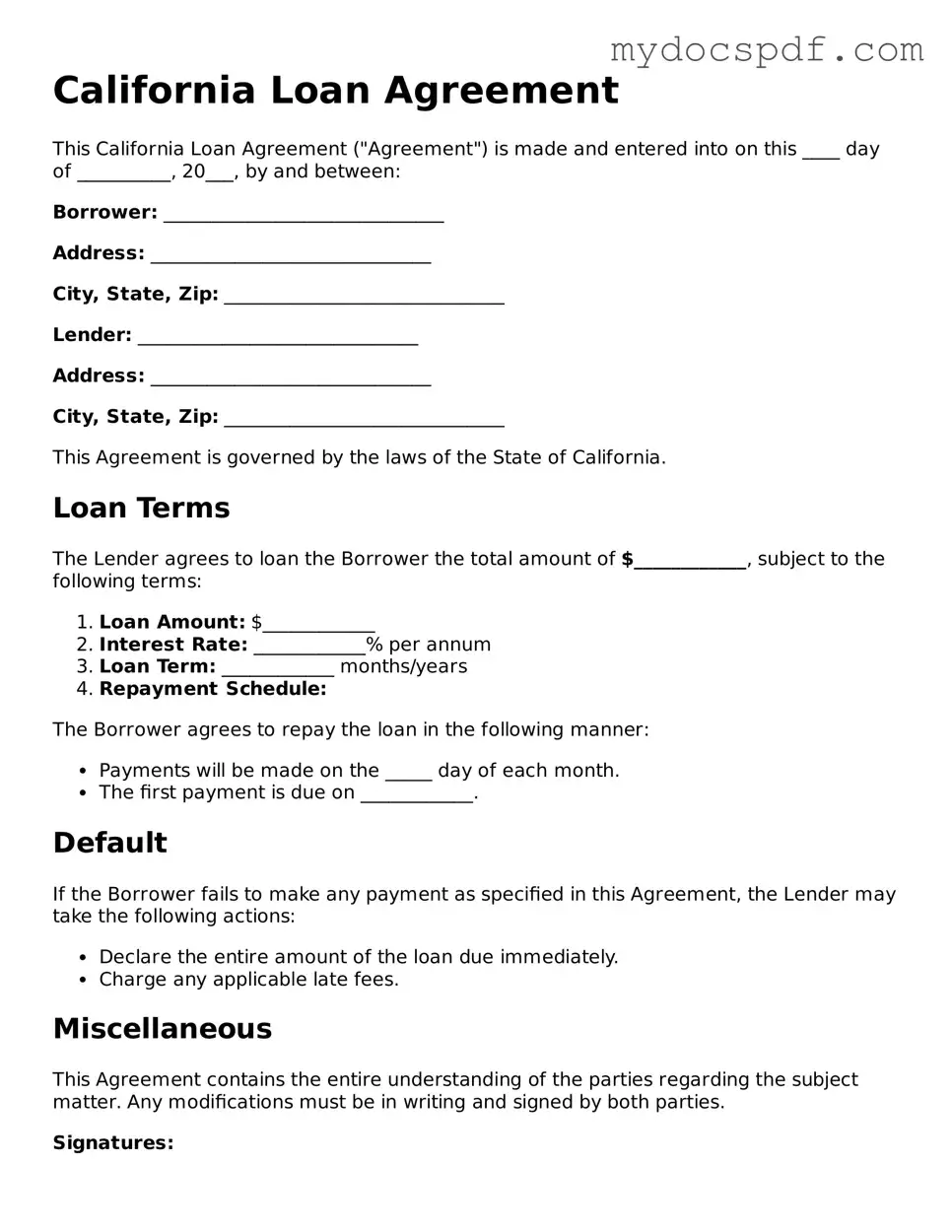

California Loan Agreement

This California Loan Agreement ("Agreement") is made and entered into on this ____ day of __________, 20___, by and between:

Borrower: ______________________________

Address: ______________________________

City, State, Zip: ______________________________

Lender: ______________________________

Address: ______________________________

City, State, Zip: ______________________________

This Agreement is governed by the laws of the State of California.

Loan Terms

The Lender agrees to loan the Borrower the total amount of $____________, subject to the following terms:

- Loan Amount: $____________

- Interest Rate: ____________% per annum

- Loan Term: ____________ months/years

- Repayment Schedule:

The Borrower agrees to repay the loan in the following manner:

- Payments will be made on the _____ day of each month.

- The first payment is due on ____________.

Default

If the Borrower fails to make any payment as specified in this Agreement, the Lender may take the following actions:

- Declare the entire amount of the loan due immediately.

- Charge any applicable late fees.

Miscellaneous

This Agreement contains the entire understanding of the parties regarding the subject matter. Any modifications must be in writing and signed by both parties.

Signatures:

Borrower: ______________________ Date: ____________

Lender: ______________________ Date: ____________

Detailed Instructions for Writing California Loan Agreement

Completing the California Loan Agreement form is an important step in formalizing a loan between parties. Once you have the form ready, you can ensure that all necessary information is accurately filled out. This process helps protect the interests of both the lender and the borrower.

- Begin by entering the date at the top of the form. This should reflect the date when the agreement is being signed.

- Next, fill in the names and addresses of both the lender and the borrower. Make sure to include full legal names to avoid any confusion later.

- Specify the loan amount. This is the total sum of money being borrowed.

- Indicate the interest rate. Clearly state the percentage that will be applied to the loan amount.

- Outline the repayment terms. This includes the duration of the loan and the schedule for payments (monthly, quarterly, etc.).

- Include any additional fees or charges associated with the loan. Be transparent about any extra costs that may arise.

- Both parties should sign and date the form at the bottom. Ensure that each signature is accompanied by the printed name of the signer.

After filling out the form, review it carefully to ensure all information is correct and complete. This agreement will serve as a formal record of the loan, so accuracy is key.

Documents used along the form

When entering into a loan agreement in California, several other forms and documents may be necessary to ensure clarity and legal compliance. Each of these documents serves a specific purpose in the loan process, providing additional information or outlining the terms of the agreement. Here’s a brief overview of some commonly used forms alongside the California Loan Agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details such as the loan amount, interest rate, repayment schedule, and consequences for defaulting on the loan.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the collateral and the rights of both parties regarding the collateral in case of default.

- Last Will and Testament: This legal document outlines how an individual's assets will be managed after their passing. It's crucial for ensuring that one's final wishes are honored and can be obtained through resources like Texas Forms Online.

- Truth in Lending Disclosure: This form provides borrowers with essential information about the loan, including the annual percentage rate (APR), total finance charges, and payment schedule. It ensures transparency in lending practices.

- Loan Application: This document collects information from the borrower, such as personal details, financial status, and the purpose of the loan. It helps lenders assess the borrower's creditworthiness.

- Guaranty Agreement: If a third party guarantees the loan, this document outlines their responsibility to repay the loan if the borrower defaults. It adds an extra layer of security for the lender.

- Amortization Schedule: This schedule breaks down the repayment of the loan into regular payments over time. It shows how much of each payment goes toward principal and interest, providing clarity on the repayment process.

Understanding these documents can help both borrowers and lenders navigate the loan process more effectively. Each form plays a crucial role in protecting the interests of all parties involved, ensuring that the terms of the loan are clear and legally binding.