Fillable California Last Will and Testament Document

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. In California, this legal document serves as a blueprint for how your assets will be distributed, who will care for your dependents, and who will execute your estate. The California Last Will and Testament form outlines key components such as the appointment of an executor, the designation of guardians for minor children, and specific bequests to individuals or organizations. It also includes provisions for the revocation of any prior wills, ensuring clarity and preventing confusion. Furthermore, the form requires signatures from witnesses to validate its authenticity, reflecting the state's commitment to upholding the intentions of the deceased. Understanding these aspects is crucial for anyone looking to create a comprehensive and legally sound will in California.

Dos and Don'ts

When filling out the California Last Will and Testament form, it is essential to follow certain guidelines to ensure that your will is valid and reflects your wishes. Below are ten important dos and don’ts to consider.

- Do ensure you are of sound mind when completing the form.

- Do clearly identify yourself, including your full name and address.

- Do specify your beneficiaries in clear terms, detailing who receives what.

- Do appoint an executor to manage the distribution of your estate.

- Do sign the document in the presence of at least two witnesses.

- Don't use vague language that may lead to confusion about your intentions.

- Don't forget to date the will, as this establishes the order of precedence.

- Don't include any illegal provisions that cannot be enforced.

- Don't neglect to review the will periodically to ensure it still reflects your wishes.

- Don't assume that verbal agreements will suffice; written documentation is necessary.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets will be distributed after their death. |

| Governing Law | The California Probate Code governs the creation and execution of wills in California. |

| Age Requirement | To create a valid will in California, the person must be at least 18 years old. |

| Witness Requirement | California law requires that a will be signed by at least two witnesses who are present at the same time. |

| Revocation | A will can be revoked by creating a new will or by destroying the original document with the intent to revoke it. |

| Holographic Wills | California recognizes holographic wills, which are handwritten and do not require witnesses if they are signed by the testator. |

| Probate Process | After death, the will must go through the probate process, which is a legal procedure to validate the will and distribute the estate. |

Key takeaways

When filling out and using the California Last Will and Testament form, keep these key takeaways in mind:

- Understand the Purpose: A will outlines how your assets will be distributed after your death. It also allows you to name guardians for minor children.

- Eligibility Requirements: To create a valid will in California, you must be at least 18 years old and of sound mind.

- Signature Requirements: Your will must be signed by you and witnessed by at least two people who are not beneficiaries of the will.

- Revocation of Previous Wills: If you create a new will, it automatically revokes any previous wills unless stated otherwise.

- Storage and Accessibility: Keep your will in a safe place, and inform your executor or family members where it can be found.

- Consider Legal Assistance: While you can fill out the form yourself, consulting with an attorney can help ensure your wishes are clearly expressed and legally binding.

Popular State-specific Last Will and Testament Forms

Free Will Template Massachusetts - Can specify who will manage digital assets after death.

Wills in Georgia - Provides peace of mind knowing wishes are legally documented.

Will and Testament Florida - Can include provisions for charitable donations to organizations or causes the individual supports.

In order to facilitate a hassle-free trailer transaction, it is important to utilize the appropriate documentation. The Arizona Trailer Bill of Sale form is essential for accurately recording the details of the sale, and you can find a useful template at https://arizonapdfs.com, which offers guidance on how to complete this process effectively.

Last Will and Testament Form Idaho - The document can clarify how personal property, like family heirlooms, should be divided among loved ones.

Example - California Last Will and Testament Form

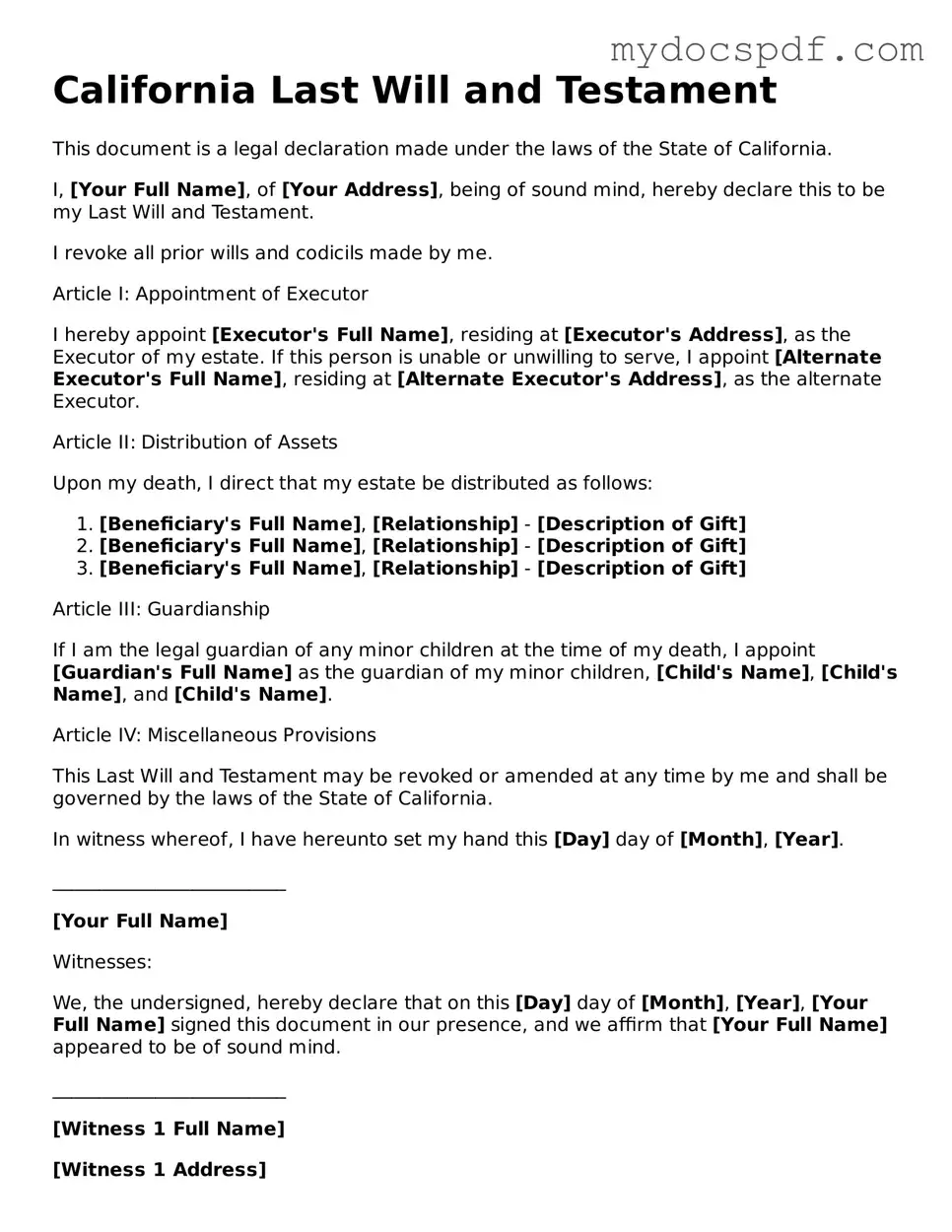

California Last Will and Testament

This document is a legal declaration made under the laws of the State of California.

I, [Your Full Name], of [Your Address], being of sound mind, hereby declare this to be my Last Will and Testament.

I revoke all prior wills and codicils made by me.

Article I: Appointment of Executor

I hereby appoint [Executor's Full Name], residing at [Executor's Address], as the Executor of my estate. If this person is unable or unwilling to serve, I appoint [Alternate Executor's Full Name], residing at [Alternate Executor's Address], as the alternate Executor.

Article II: Distribution of Assets

Upon my death, I direct that my estate be distributed as follows:

- [Beneficiary's Full Name], [Relationship] - [Description of Gift]

- [Beneficiary's Full Name], [Relationship] - [Description of Gift]

- [Beneficiary's Full Name], [Relationship] - [Description of Gift]

Article III: Guardianship

If I am the legal guardian of any minor children at the time of my death, I appoint [Guardian's Full Name] as the guardian of my minor children, [Child's Name], [Child's Name], and [Child's Name].

Article IV: Miscellaneous Provisions

This Last Will and Testament may be revoked or amended at any time by me and shall be governed by the laws of the State of California.

In witness whereof, I have hereunto set my hand this [Day] day of [Month], [Year].

_________________________

[Your Full Name]

Witnesses:

We, the undersigned, hereby declare that on this [Day] day of [Month], [Year], [Your Full Name] signed this document in our presence, and we affirm that [Your Full Name] appeared to be of sound mind.

_________________________

[Witness 1 Full Name]

[Witness 1 Address]

_________________________

[Witness 2 Full Name]

[Witness 2 Address]

Detailed Instructions for Writing California Last Will and Testament

After obtaining the California Last Will and Testament form, it is essential to complete it accurately to ensure that your wishes regarding asset distribution and other matters are clearly expressed. The following steps outline the process for filling out the form correctly.

- Begin by entering your full legal name at the top of the form.

- Provide your address, including city, state, and zip code.

- Specify the date on which you are filling out the will.

- Clearly state that this document is your Last Will and Testament.

- Designate an executor by naming the person you wish to manage your estate after your passing. Include their full name and address.

- List your beneficiaries, indicating their names and relationships to you. Specify what each beneficiary will receive from your estate.

- If you have minor children, appoint a guardian for them. Include the guardian's name and address.

- Include any specific bequests, detailing any personal property or assets you wish to leave to specific individuals.

- Sign the document in the presence of at least two witnesses, who must also sign the form. Ensure that the witnesses are not beneficiaries of the will.

- Date the signatures of the witnesses to confirm when they observed your signing of the will.

Once the form is completed and signed, it is advisable to keep it in a safe place and inform your executor and family members of its location. Regularly review and update the will as necessary to reflect any changes in your circumstances or wishes.

Documents used along the form

When preparing a Last Will and Testament in California, it is important to consider several other legal documents that may complement or enhance the estate planning process. These documents serve various purposes, from designating guardianship to managing health care decisions. Below is a list of commonly used forms and documents that individuals may find beneficial.

- Living Trust: A legal arrangement that allows a person to place assets into a trust during their lifetime, with the intention of distributing those assets to beneficiaries upon their death, often avoiding probate.

- Durable Power of Attorney: This document appoints someone to manage your financial affairs if you become incapacitated. It ensures that your financial matters are handled according to your wishes.

- Advance Health Care Directive: A legal document that outlines your preferences for medical treatment and appoints someone to make health care decisions on your behalf if you are unable to do so.

- Beneficiary Designations: Forms used to specify who will receive certain assets, such as life insurance policies or retirement accounts, directly upon your death, bypassing probate.

- Guardianship Designation: A document that allows you to name a guardian for your minor children, ensuring that they are cared for by someone you trust in the event of your passing.

- Trader Joe's Application Form: This essential document serves as the first step for those seeking employment at Trader Joe's, collecting personal information, availability, and past work experience. You can find more information for the form.

- Transfer on Death Deed: A deed that allows you to transfer real estate to a beneficiary upon your death without the need for probate, simplifying the transfer process.

- Letter of Intent: Although not a legally binding document, this letter provides guidance to your executor and loved ones regarding your wishes, funeral arrangements, and other important details.

- Special Needs Trust: A specific type of trust designed to provide for a beneficiary with disabilities without jeopardizing their eligibility for government assistance programs.

- Pet Trust: A legal arrangement that ensures your pets are cared for after your death, specifying funds and care instructions for their well-being.

Incorporating these documents into your estate planning can provide clarity and peace of mind, ensuring that your wishes are honored and your loved ones are taken care of. Each document serves a unique purpose, and together, they create a comprehensive plan that addresses various aspects of your life and legacy.