Fillable California Gift Deed Document

In California, the Gift Deed form serves as a crucial legal instrument for individuals wishing to transfer property without the exchange of money. This document allows a property owner, known as the donor, to convey their interest in real estate to another person, the recipient or donee, as a gift. Unlike traditional sales, a Gift Deed does not require any financial consideration, making it a popular choice for family members or friends looking to assist one another. The form must include specific details such as the names of both parties, a clear description of the property, and the donor's intent to make a gift. Additionally, it must be signed by the donor and typically requires notarization to ensure its validity. Understanding the nuances of this form can help avoid potential disputes or misunderstandings in the future, as it outlines the transfer of ownership and the donor's wishes clearly. Properly executing a Gift Deed is essential for ensuring that the transfer is legally recognized and protects both parties involved.

Dos and Don'ts

When filling out the California Gift Deed form, it is essential to follow certain guidelines to ensure the process goes smoothly. Here are some important dos and don'ts:

- Do provide accurate information about the property being gifted.

- Do include the full names of both the donor and the recipient.

- Do sign the form in front of a notary public.

- Do check for any local requirements that may apply to your specific situation.

- Don't leave any sections of the form blank; fill in all required fields.

- Don't use vague language; be clear about the terms of the gift.

- Don't forget to keep a copy of the completed form for your records.

PDF Properties

| Fact Name | Details |

|---|---|

| Definition | A California Gift Deed is a legal document used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The California Gift Deed is governed by California Civil Code Section 11911. |

| Requirements | The deed must be in writing, signed by the donor, and notarized to be valid. |

| Consideration | No monetary consideration is required for a Gift Deed, distinguishing it from a standard sale. |

| Tax Implications | Gift taxes may apply, and it's important to consult a tax professional when transferring property as a gift. |

| Revocation | A Gift Deed cannot be revoked once it is executed and recorded unless specific conditions are met. |

| Recording | The deed should be recorded with the county recorder's office to ensure public notice of the transfer. |

| Beneficiary Rights | Once the Gift Deed is executed, the recipient (donee) holds full rights to the property, subject to any existing liens. |

Key takeaways

- Understand the Purpose: A Gift Deed is used to transfer property ownership without any exchange of money. It’s essential to grasp that this is a legal document that formalizes the gift.

- Complete All Required Information: Fill out the form accurately. Include details such as the names of the giver and receiver, property description, and the date of the gift.

- Signatures Matter: Both the giver and the recipient must sign the Gift Deed. Ensure that the signatures are notarized to validate the document.

- Consider Tax Implications: Gifts may have tax consequences. Consult a tax professional to understand potential gift tax liabilities and reporting requirements.

- Record the Deed: After completing the form, file it with the county recorder's office. This step is crucial for making the transfer official and protecting the recipient's ownership rights.

- Seek Legal Advice: If you have questions or concerns about the process, consult a lawyer. Professional guidance can help avoid potential pitfalls and ensure compliance with state laws.

Popular State-specific Gift Deed Forms

Transfer Deed - In addition to identifying the donor and donee, the Gift Deed must describe the property being transferred.

When entering into a rental arrangement, it's crucial to be familiar with the specifics of the rental agreements. For a comprehensive understanding, you may want to use resources like the NY Templates, which provide essential forms and templates that can aid in creating a secure and clear rental contract.

Example - California Gift Deed Form

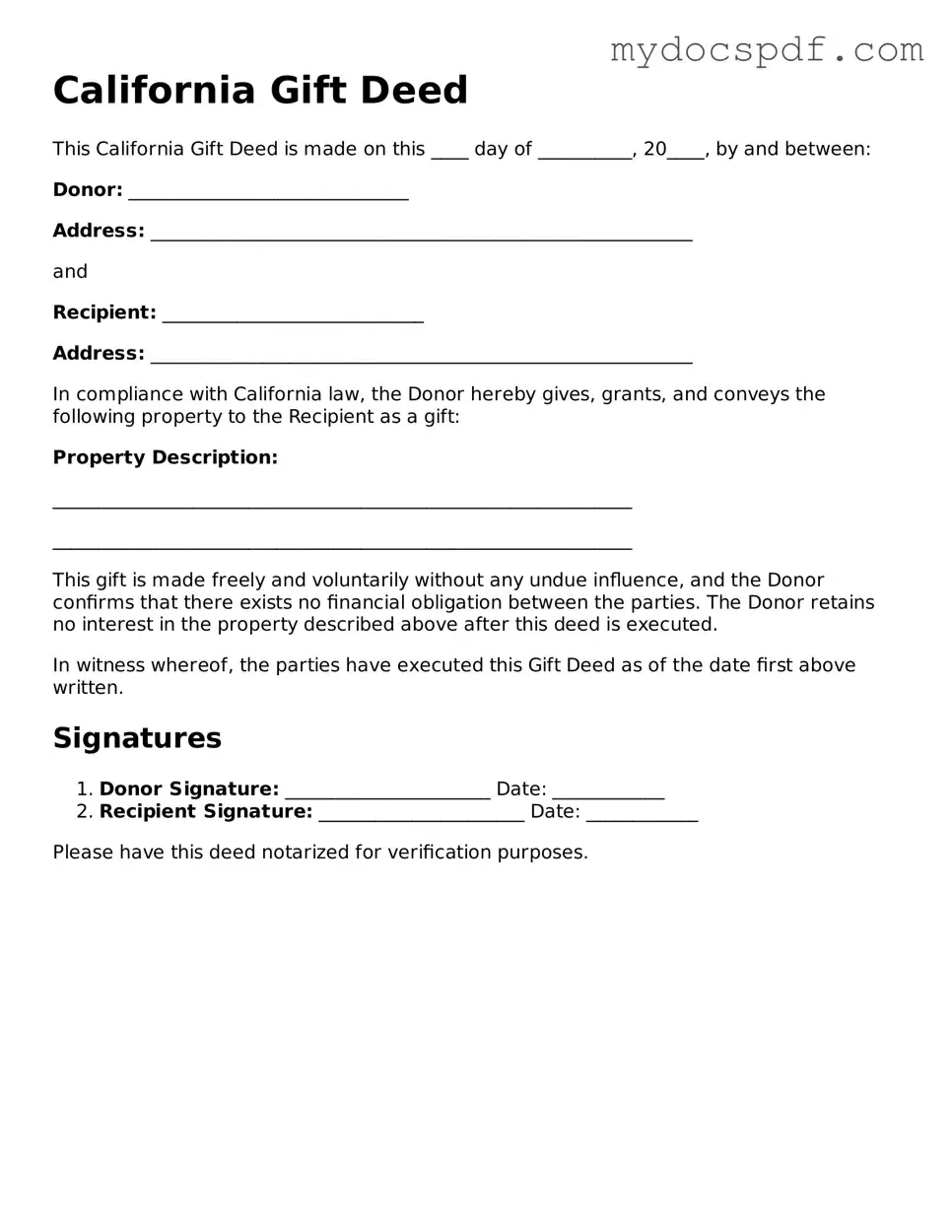

California Gift Deed

This California Gift Deed is made on this ____ day of __________, 20____, by and between:

Donor: ______________________________

Address: __________________________________________________________

and

Recipient: ____________________________

Address: __________________________________________________________

In compliance with California law, the Donor hereby gives, grants, and conveys the following property to the Recipient as a gift:

Property Description:

______________________________________________________________

______________________________________________________________

This gift is made freely and voluntarily without any undue influence, and the Donor confirms that there exists no financial obligation between the parties. The Donor retains no interest in the property described above after this deed is executed.

In witness whereof, the parties have executed this Gift Deed as of the date first above written.

Signatures

- Donor Signature: ______________________ Date: ____________

- Recipient Signature: ______________________ Date: ____________

Please have this deed notarized for verification purposes.

Detailed Instructions for Writing California Gift Deed

Once you have the California Gift Deed form ready, it’s time to fill it out carefully. Make sure to have all necessary information at hand, such as the names of the parties involved and property details. Follow these steps to complete the form accurately.

- Title the Document: Write “Gift Deed” at the top of the form.

- Identify the Grantor: Enter the full name and address of the person giving the gift.

- Identify the Grantee: Write the full name and address of the person receiving the gift.

- Describe the Property: Provide a detailed description of the property being gifted. Include the address and any relevant legal descriptions.

- State the Gift: Clearly indicate that the property is being given as a gift without any exchange of money.

- Sign the Document: The grantor must sign the form. If there are multiple grantors, all must sign.

- Notarize the Document: Have the signature notarized to ensure it is legally binding.

- File the Document: Submit the completed Gift Deed to the county recorder’s office where the property is located.

After filling out the form, ensure all details are correct before signing and notarizing. This will help avoid any issues later on. Once filed, the Gift Deed will be part of public records, confirming the transfer of property ownership.

Documents used along the form

A California Gift Deed is a legal document used to transfer property ownership without any exchange of money. When completing this process, several other forms and documents may be required to ensure a smooth transfer and compliance with state laws. Below are some commonly used documents associated with the Gift Deed.

- Preliminary Change of Ownership Report: This form is often required by the county assessor's office. It provides information about the property and the parties involved in the transfer, helping to assess property taxes accurately.

- Grant Deed: Although the Gift Deed itself serves as a transfer of property, a Grant Deed may also be used to convey ownership. This document provides a warranty that the grantor holds clear title to the property.

- Property Tax Exemption Claim: If the gift qualifies for a property tax exemption, this form can be submitted to claim that exemption. It helps ensure that the new owner does not incur unnecessary tax liabilities.

- ATV Bill of Sale: Similar to the gift process, a newyorkform.com/free-atv-bill-of-sale-template is essential for legally documenting the sale of an All-Terrain Vehicle, ensuring both parties have proof of ownership and transaction details.

- Title Insurance Policy: While not mandatory, obtaining a title insurance policy is advisable. This document protects the new owner from potential claims or disputes regarding the property’s title.

These documents play a crucial role in the property transfer process, ensuring that all legal requirements are met and protecting the interests of both the giver and the recipient. Properly completing and filing these forms can help avoid complications in the future.