Fillable California Durable Power of Attorney Document

The California Durable Power of Attorney form is a crucial legal document that allows individuals to designate someone they trust to make financial and legal decisions on their behalf. This form is particularly important for planning ahead, as it remains effective even if the person who created it becomes incapacitated. By appointing an agent, or attorney-in-fact, individuals can ensure their affairs are managed according to their wishes, whether it involves handling bank transactions, paying bills, or managing real estate. The form requires specific information, including the names of the principal and agent, and it must be signed and dated to be valid. Importantly, the durable power of attorney can be tailored to fit individual needs, allowing for broad or limited powers as desired. Understanding this form can empower individuals to take control of their financial future and provide peace of mind for themselves and their loved ones.

Dos and Don'ts

When filling out the California Durable Power of Attorney form, it is crucial to approach the process with care. Here are some important dos and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do ensure that you understand the powers you are granting to your agent.

- Do choose a trustworthy person as your agent.

- Do sign the document in front of a notary public if required.

- Don't leave any sections blank; fill out all necessary information.

- Don't rush the process; take your time to ensure accuracy.

- Don't forget to provide a copy to your agent and any relevant parties.

Following these guidelines can help ensure that your Durable Power of Attorney is valid and effective when needed.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A California Durable Power of Attorney allows an individual to designate someone to make financial and legal decisions on their behalf if they become incapacitated. |

| Governing Law | This form is governed by the California Probate Code, specifically Sections 4000 to 4545. |

| Durability | The term "durable" means that the power of attorney remains effective even if the principal becomes mentally incapacitated. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent. |

| Agent's Authority | The agent can be granted broad or limited powers, depending on the specific wishes of the principal outlined in the document. |

Key takeaways

Filling out and using the California Durable Power of Attorney form is an important step in planning for future needs. Here are some key takeaways to keep in mind:

- The form allows you to designate someone you trust to make decisions on your behalf if you become unable to do so.

- It is crucial to choose an agent who is responsible and understands your wishes.

- Make sure to sign the form in front of a notary public or two witnesses to ensure its validity.

- Clearly outline the powers you are granting to your agent, as this will guide their actions.

- Keep a copy of the signed document in a safe place and provide copies to your agent and any relevant institutions.

- Review and update the document periodically to reflect any changes in your situation or preferences.

- Understand that this document becomes effective immediately unless you specify otherwise.

- Remember that you can revoke the Durable Power of Attorney at any time, as long as you are mentally competent.

Popular State-specific Durable Power of Attorney Forms

Power of Attorney Form Idaho - It can cover decisions about banking, real estate, and investments.

The Aaa International Driving Permit Application form is a vital document that allows U.S. residents to drive legally in many foreign countries. This permit translates your driving credentials into several languages, making it easier for local authorities to recognize your right to drive. To start your journey toward obtaining your permit, click the button below and fill out the form! For more resources, check out the Document Templates Hub.

What's the Difference Between Power of Attorney and Durable Power of Attorney - With this form, you can designate someone to handle real estate transactions on your behalf.

Example - California Durable Power of Attorney Form

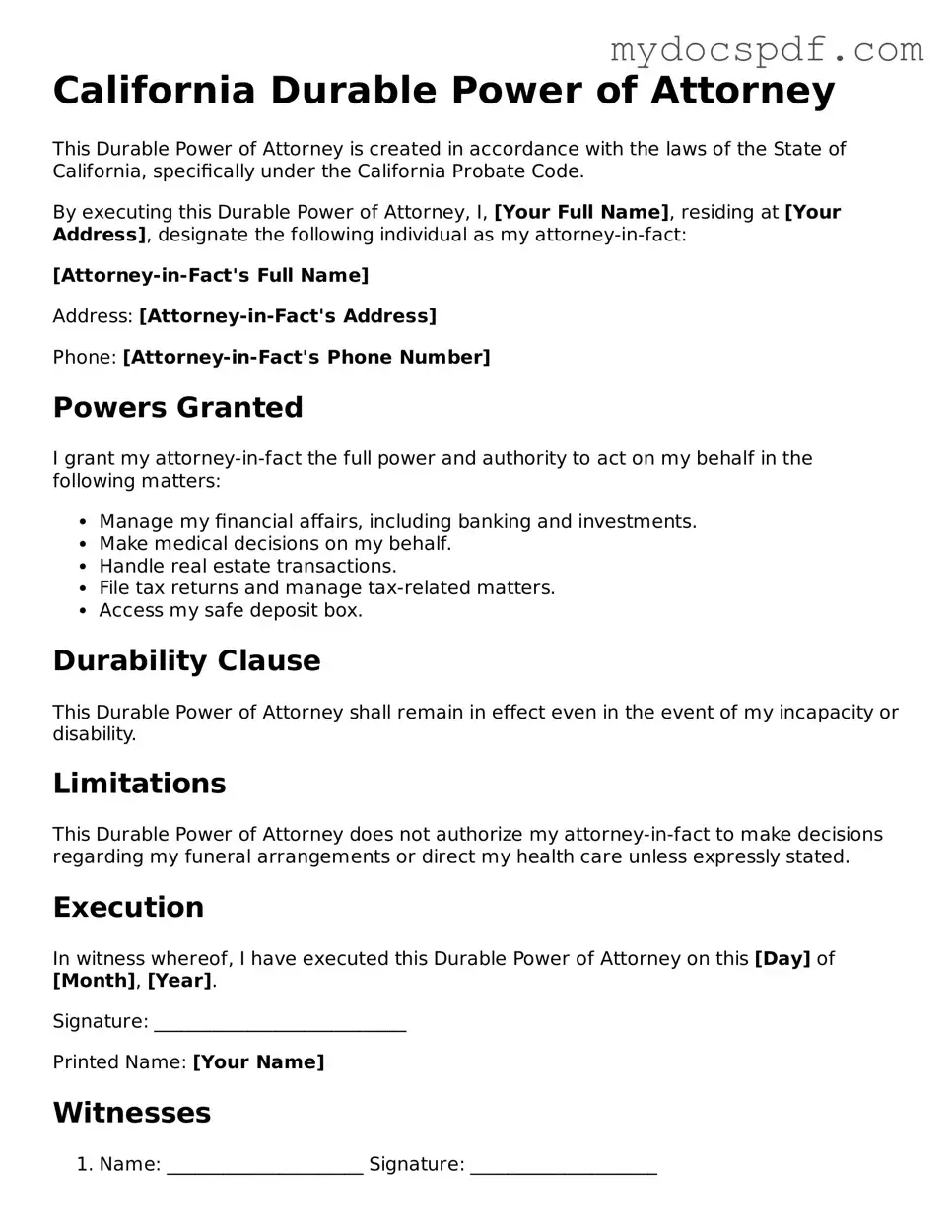

California Durable Power of Attorney

This Durable Power of Attorney is created in accordance with the laws of the State of California, specifically under the California Probate Code.

By executing this Durable Power of Attorney, I, [Your Full Name], residing at [Your Address], designate the following individual as my attorney-in-fact:

[Attorney-in-Fact's Full Name]

Address: [Attorney-in-Fact's Address]

Phone: [Attorney-in-Fact's Phone Number]

Powers Granted

I grant my attorney-in-fact the full power and authority to act on my behalf in the following matters:

- Manage my financial affairs, including banking and investments.

- Make medical decisions on my behalf.

- Handle real estate transactions.

- File tax returns and manage tax-related matters.

- Access my safe deposit box.

Durability Clause

This Durable Power of Attorney shall remain in effect even in the event of my incapacity or disability.

Limitations

This Durable Power of Attorney does not authorize my attorney-in-fact to make decisions regarding my funeral arrangements or direct my health care unless expressly stated.

Execution

In witness whereof, I have executed this Durable Power of Attorney on this [Day] of [Month], [Year].

Signature: ___________________________

Printed Name: [Your Name]

Witnesses

- Name: _____________________ Signature: ____________________

- Name: _____________________ Signature: ____________________

Please note that it is advisable to consult with a legal professional to ensure this document meets all your specific needs.

Detailed Instructions for Writing California Durable Power of Attorney

Filling out the California Durable Power of Attorney form is a straightforward process. This document allows you to designate someone to make decisions on your behalf regarding financial and legal matters if you become unable to do so yourself. Follow these steps to ensure that the form is completed correctly.

- Obtain the California Durable Power of Attorney form. You can find it online or at a local legal office.

- Read through the entire form to understand what information is required.

- Fill in your name and address in the designated section as the principal.

- Designate an agent by writing their name and address. This person will act on your behalf.

- If desired, you can name an alternate agent. This is optional but can be useful if your first choice is unavailable.

- Specify the powers you wish to grant your agent. Be clear and specific about the authority you are giving.

- Include any limitations or conditions you want to apply to the agent's authority.

- Sign and date the form in the appropriate section. Make sure to do this in front of a notary public.

- Have the form notarized. This step is crucial for the document to be legally binding.

- Distribute copies of the signed and notarized form to your agent, alternate agent (if applicable), and any relevant institutions.

Documents used along the form

When creating a California Durable Power of Attorney, it’s essential to consider additional documents that can support your intentions and provide clarity in various situations. Below is a list of other forms and documents that are often used alongside the Durable Power of Attorney.

- Advance Healthcare Directive: This document allows individuals to outline their medical preferences and appoint someone to make healthcare decisions on their behalf if they become unable to do so.

- Living Will: A living will specifies the types of medical treatments and life-sustaining measures a person wishes to receive or avoid in case of terminal illness or incapacitation.

- HIPAA Release Form: This form permits healthcare providers to share an individual's medical information with designated persons, ensuring that loved ones can access necessary health data.

- Revocation of Power of Attorney: This document formally cancels a previously granted Power of Attorney, ensuring that the authority no longer applies.

- Will: A will outlines how a person's assets and affairs should be handled after their death, providing direction for the distribution of property and care of dependents.

- Trust Document: A trust can hold assets for the benefit of individuals or entities, allowing for more control over how and when those assets are distributed.

- Last Will and Testament: For those planning their estate, our comprehensive Last Will and Testament preparation guide provides essential insights for ensuring your wishes are honored.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document specifically grants authority to manage financial matters, which may include banking, investments, and property management.

These documents work together to create a comprehensive plan for managing personal, medical, and financial affairs. Consider consulting with a professional to ensure that all documents align with your wishes and legal requirements.