Fillable California Deed in Lieu of Foreclosure Document

In the face of financial hardship, many homeowners in California find themselves seeking alternatives to foreclosure, and one such option is the Deed in Lieu of Foreclosure. This legal document allows a homeowner to voluntarily transfer the title of their property to the lender, effectively settling the mortgage debt without the lengthy and often stressful foreclosure process. By executing this deed, homeowners can potentially avoid the negative impact on their credit scores that comes with foreclosure. The form typically requires the homeowner's signature, as well as that of the lender, and may include important details such as the property description and the terms of the agreement. It is crucial for homeowners to understand that while this option can provide a fresh start, it also carries implications, including the potential for tax consequences and the need to negotiate any remaining balance on the mortgage. Overall, the Deed in Lieu of Foreclosure serves as a significant tool for those looking to navigate their financial difficulties while minimizing the repercussions associated with losing their home.

Dos and Don'ts

When filling out the California Deed in Lieu of Foreclosure form, it's important to follow certain guidelines. Here are some things you should and shouldn't do:

- Do ensure all information is accurate and complete. Double-check names, addresses, and property details.

- Do consult with a legal professional if you have questions. This can help avoid mistakes that could delay the process.

- Don't rush through the form. Take your time to understand each section before signing.

- Don't ignore any additional documentation that may be required. Ensure you submit everything needed for the process.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal process where a borrower voluntarily transfers the title of their property to the lender to avoid foreclosure. |

| Governing Laws | This process is governed by California Civil Code Sections 1475-1480. |

| Eligibility | Homeowners must demonstrate financial hardship and inability to make mortgage payments to qualify for this option. |

| Benefits | It can help borrowers avoid the lengthy foreclosure process and may result in less damage to their credit score. |

| Process | The borrower must provide the lender with the deed to the property, along with any required documentation, to complete the transfer. |

Key takeaways

When considering the California Deed in Lieu of Foreclosure form, it's essential to understand several key aspects. This process can be a viable option for homeowners facing financial difficulties. Here are nine important takeaways:

- Understanding the Purpose: The Deed in Lieu of Foreclosure allows homeowners to voluntarily transfer their property to the lender to avoid foreclosure.

- Eligibility Criteria: Not all homeowners qualify. Lenders typically require that the mortgage is in default and that the property is owner-occupied.

- Impact on Credit Score: This option may still affect your credit score, but it is generally less damaging than a foreclosure.

- Documentation Required: Homeowners must provide necessary financial documents, including income statements and a hardship letter.

- Consultation with a Professional: It is advisable to consult with a real estate attorney or housing counselor before proceeding.

- Tax Implications: Homeowners should be aware of potential tax consequences related to debt forgiveness.

- Timing Considerations: The process can take time. Homeowners should be prepared for negotiations with the lender.

- Property Condition: The property should be in good condition, as lenders may conduct an inspection before accepting the deed.

- Future Homeownership: After a Deed in Lieu, homeowners may face challenges in obtaining a new mortgage for several years.

Being informed about these factors can help homeowners make better decisions regarding their financial futures.

Popular State-specific Deed in Lieu of Foreclosure Forms

Deed in Lieu of Foreclosure Sample - A designated legal process precedes the execution of this document to ensure clarity for both parties.

In order to create a comprehensive understanding of the rental process, landlords and tenants may find it beneficial to refer to templates like the one provided by NY Templates, which can assist in drafting a clear and effective lease agreement that meets the legal requirements and protects both parties' interests.

Foreclosure in Georgia - Signing a Deed in Lieu can result in faster resolution and closure for the homeowner.

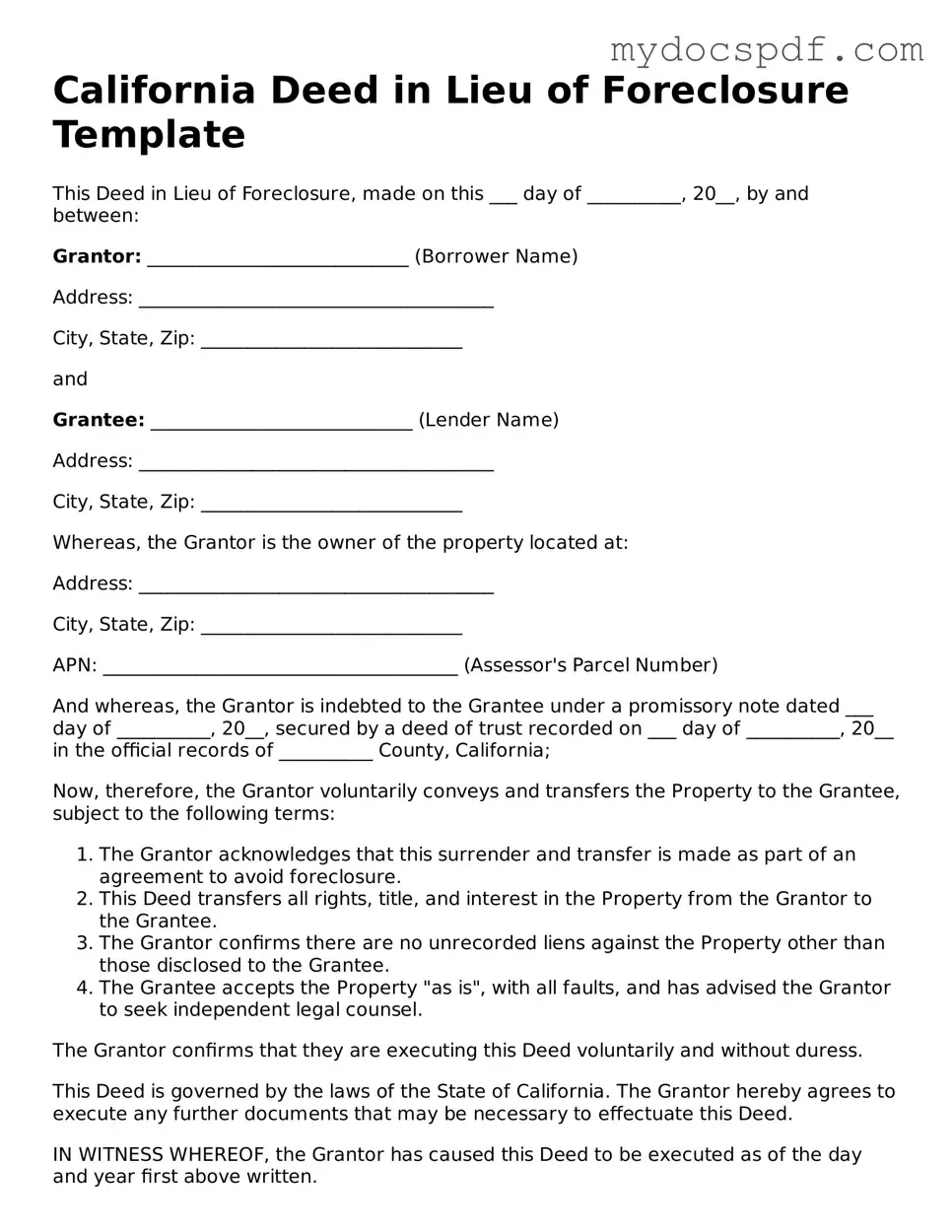

Example - California Deed in Lieu of Foreclosure Form

California Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure, made on this ___ day of __________, 20__, by and between:

Grantor: ____________________________ (Borrower Name)

Address: ______________________________________

City, State, Zip: ____________________________

and

Grantee: ____________________________ (Lender Name)

Address: ______________________________________

City, State, Zip: ____________________________

Whereas, the Grantor is the owner of the property located at:

Address: ______________________________________

City, State, Zip: ____________________________

APN: ______________________________________ (Assessor's Parcel Number)

And whereas, the Grantor is indebted to the Grantee under a promissory note dated ___ day of __________, 20__, secured by a deed of trust recorded on ___ day of __________, 20__ in the official records of __________ County, California;

Now, therefore, the Grantor voluntarily conveys and transfers the Property to the Grantee, subject to the following terms:

- The Grantor acknowledges that this surrender and transfer is made as part of an agreement to avoid foreclosure.

- This Deed transfers all rights, title, and interest in the Property from the Grantor to the Grantee.

- The Grantor confirms there are no unrecorded liens against the Property other than those disclosed to the Grantee.

- The Grantee accepts the Property "as is", with all faults, and has advised the Grantor to seek independent legal counsel.

The Grantor confirms that they are executing this Deed voluntarily and without duress.

This Deed is governed by the laws of the State of California. The Grantor hereby agrees to execute any further documents that may be necessary to effectuate this Deed.

IN WITNESS WHEREOF, the Grantor has caused this Deed to be executed as of the day and year first above written.

Grantor: ____________________________

_________________________ (Signature)

Date: _______________________________

Witness:

_________________________ (Witness Name)

_________________________ (Witness Signature)

Date: _______________________________

NOTARY ACKNOWLEDGMENT

State of California

County of ____________________________

On __________, before me, _______________________, Notary Public, personally appeared ___________, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that (he/she/they) executed the same in (his/her/their) authorized capacity(ies), and that by (his/her/their) signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

WITNESS my hand and official seal.

Signature: ___________________________

Notary Public for the State of California

Detailed Instructions for Writing California Deed in Lieu of Foreclosure

After completing the California Deed in Lieu of Foreclosure form, you will need to submit it to the appropriate parties, typically the lender and the county recorder's office. Ensure you keep copies for your records. The next steps will involve waiting for the lender's acknowledgment and confirming the transfer of ownership.

- Obtain the California Deed in Lieu of Foreclosure form from a reliable source.

- Fill in your name and address in the designated fields as the property owner.

- Provide the lender's name and address in the appropriate sections.

- Include the property description, including the address and any legal descriptions required.

- State the reason for the deed in lieu of foreclosure in the specified area.

- Sign the form in the presence of a notary public to validate your signature.

- Have the notary complete their section, confirming your identity and signature.

- Make copies of the signed and notarized form for your records.

- Submit the original form to your lender and the county recorder's office.

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a borrower to transfer ownership of their property to the lender to avoid foreclosure. When engaging in this process, several other forms and documents may be necessary to ensure a smooth transaction. Below is a list of commonly used documents that accompany the California Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines changes to the original loan terms, potentially making payments more manageable for the borrower.

- Property Inspection Report: A report detailing the current condition of the property, often required by lenders to assess its value and any needed repairs.

- Title Search Report: A document that confirms the ownership of the property and identifies any liens or encumbrances that may exist.

- Affidavit of Title: A sworn statement by the borrower affirming their ownership of the property and disclosing any claims against it.

- Release of Liability: This document releases the borrower from further obligations related to the mortgage after the transfer of the property.

- Settlement Statement: A detailed account of the financial aspects of the transaction, including any fees or costs associated with the deed transfer.

- Affidavit of Correction: This essential form allows individuals to rectify errors in public records, ensuring accuracy and integrity in official documents. For more information, you can visit Texas Forms Online.

- Power of Attorney: A legal document that allows one person to act on behalf of another in financial or legal matters, which may be necessary if the borrower cannot be present.

- Notice of Default: A formal notification to the borrower indicating that they have defaulted on their mortgage payments, often a precursor to foreclosure proceedings.

- Release of Mortgage: A document that officially states that the mortgage has been paid off or is no longer in effect after the deed transfer.

Understanding these documents is crucial for anyone considering a Deed in Lieu of Foreclosure. Each plays a specific role in the process and ensures that both parties are protected and informed throughout the transaction.