Fillable California Deed Document

When it comes to transferring property ownership in California, the California Deed form plays a crucial role in ensuring that the process is both clear and legally binding. This form serves as a written document that outlines the details of the transaction, including the names of the parties involved, the description of the property being transferred, and the type of deed being utilized, such as a grant deed or quitclaim deed. Each type has its own implications for the rights and responsibilities of the parties. Additionally, the form requires signatures from both the grantor, who is transferring the property, and the grantee, who is receiving it. Proper execution of the deed is vital, as it must also be notarized and recorded with the county to provide public notice of the change in ownership. Understanding the nuances of the California Deed form is essential for anyone looking to buy or sell real estate in the state, as it helps protect the interests of all parties involved and ensures a smooth transaction process.

Dos and Don'ts

When filling out the California Deed form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do double-check all property details for accuracy.

- Do include the full names of all parties involved in the transaction.

- Do sign the deed in front of a notary public.

- Do provide a clear legal description of the property.

- Do keep a copy of the completed deed for your records.

- Don't leave any sections blank; fill in all required information.

- Don't use abbreviations or nicknames for names.

- Don't forget to check local recording requirements.

- Don't submit the deed without proper notarization.

- Don't rush the process; take your time to review everything carefully.

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose | The California Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include Grant Deed, Quitclaim Deed, and Warranty Deed, each serving different purposes in property transfer. |

| Governing Law | The form is governed by California Civil Code Sections 880.010 to 882.050. |

| Signature Requirements | The deed must be signed by the grantor (the person transferring the property) and notarized to be valid. |

| Recording | To provide public notice of the transfer, the deed should be recorded with the county recorder's office where the property is located. |

| Tax Implications | Property transfers may be subject to documentary transfer taxes, which vary by county in California. |

Key takeaways

Filling out and using the California Deed form can seem daunting, but understanding a few key points can simplify the process. Here are some important takeaways:

- Know the Purpose: A deed is a legal document that transfers ownership of property from one person to another. It is essential for establishing clear title to the property.

- Accurate Information: Ensure that all names, addresses, and property descriptions are correct. Errors can lead to complications in the transfer process.

- Signatures Required: The deed must be signed by the person transferring the property. Depending on the situation, a notary public may also need to witness the signatures.

- File with the County: After completing the deed, it must be filed with the county recorder's office where the property is located. This step is crucial for the transfer to be legally recognized.

Popular State-specific Deed Forms

How to Get House Deed - The Deed must be recorded with local government to protect the title.

Florida Home Deed - A quitclaim deed transfers rights without guaranteeing the title's validity.

Georgia Quit Claim Deed - Deeds are sometimes questioned for authenticity in disputes.

When engaging in the sale of a motor vehicle, both buyers and sellers should utilize the appropriate documentation to formalize the agreement. One efficient way to access the necessary forms is through Texas Forms Online, which provides a comprehensive Motor Vehicle Bill of Sale template that ensures all required information is correctly captured, facilitating a seamless transfer of ownership.

Warranty Deed Form Idaho - Digital signatures are increasingly accepted in the creation of Deeds.

Example - California Deed Form

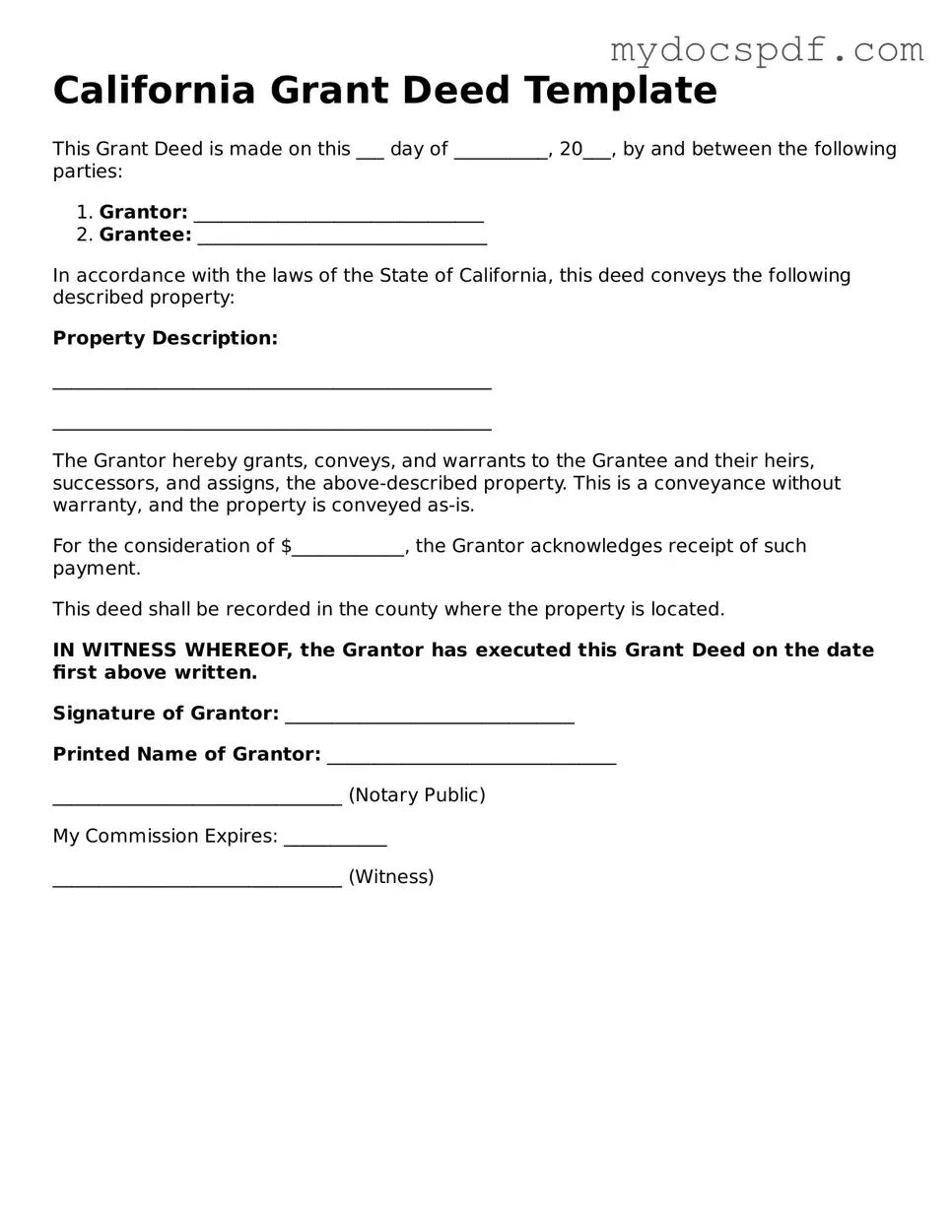

California Grant Deed Template

This Grant Deed is made on this ___ day of __________, 20___, by and between the following parties:

- Grantor: _______________________________

- Grantee: _______________________________

In accordance with the laws of the State of California, this deed conveys the following described property:

Property Description:

_______________________________________________

_______________________________________________

The Grantor hereby grants, conveys, and warrants to the Grantee and their heirs, successors, and assigns, the above-described property. This is a conveyance without warranty, and the property is conveyed as-is.

For the consideration of $____________, the Grantor acknowledges receipt of such payment.

This deed shall be recorded in the county where the property is located.

IN WITNESS WHEREOF, the Grantor has executed this Grant Deed on the date first above written.

Signature of Grantor: _______________________________

Printed Name of Grantor: _______________________________

_______________________________ (Notary Public)

My Commission Expires: ___________

_______________________________ (Witness)

Detailed Instructions for Writing California Deed

Once you have the California Deed form ready, you'll need to fill it out carefully to ensure all necessary information is accurately provided. After completing the form, it will need to be signed and recorded with the appropriate county office.

- Begin by entering the date at the top of the form.

- Identify the parties involved. Write the full names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide the property description. This should include the address and legal description of the property being transferred.

- Indicate the type of deed. Specify whether it is a grant deed, quitclaim deed, or another type.

- Fill in the consideration amount. This is the value exchanged for the property, often represented as a dollar amount.

- Include any additional clauses or terms if necessary. This may involve specific conditions regarding the property transfer.

- Sign the form. The grantor must sign the deed in the designated area.

- Have the signature notarized. This step is crucial for the deed to be legally valid.

- Make copies of the completed deed for your records.

- Submit the original deed to the county recorder's office for filing.

Documents used along the form

When transferring property in California, the Deed form is a crucial document. However, several other forms and documents often accompany it to ensure a smooth transaction. Here’s a look at five important documents that may be used alongside the California Deed form.

- Preliminary Change of Ownership Report: This form provides the county assessor with information about the property transfer. It helps determine if reassessment of property taxes is necessary.

- Grant Deed: A specific type of deed that guarantees the property has not been sold to anyone else and that there are no undisclosed encumbrances. It’s commonly used for transferring ownership between parties.

- Dog Bill of Sale Form: When transferring dog ownership, ensure you have the thorough Dog Bill of Sale instructions to protect both parties involved in the transaction.

- Quitclaim Deed: This document allows one party to transfer their interest in a property to another party without making any guarantees about the title. It’s often used in divorce settlements or to clear up title issues.

- Title Report: Issued by a title company, this report provides details about the property’s ownership history, liens, and any other claims against it. It ensures that the buyer knows what they are purchasing.

- Escrow Instructions: These are detailed guidelines that outline the responsibilities of all parties involved in the transaction. They help ensure that the sale proceeds smoothly and that all conditions are met before the property changes hands.

Understanding these documents can make the property transfer process clearer and more efficient. Each plays a unique role in protecting the interests of both buyers and sellers, ensuring a successful transaction in California’s real estate market.