Get California Affidavit of Death of a Trustee Form in PDF

In California, the passing of a trustee can have significant implications for a trust and its beneficiaries. When a trustee dies, it is essential to address this change promptly to ensure the smooth administration of the trust. The California Affidavit of Death of a Trustee form serves as a crucial legal document in this process. This form allows the successor trustee or a beneficiary to officially notify relevant parties, including banks and financial institutions, about the trustee's death. By providing necessary details such as the deceased trustee's name, date of death, and pertinent trust information, this affidavit helps to clarify the trust's current management. Additionally, it may serve as a means to update property titles and ensure that the trust assets are handled according to the deceased trustee's wishes. Completing this form accurately is vital to avoid potential disputes among beneficiaries and ensure the trust continues to operate smoothly. Understanding the importance and implications of this form is critical for anyone involved in managing or benefiting from a trust in California.

Dos and Don'ts

When completing the California Affidavit of Death of a Trustee form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do ensure that all information is accurate and up-to-date.

- Do include the date of death of the trustee.

- Do sign and date the affidavit in the appropriate section.

- Do provide any required supporting documents, such as a death certificate.

- Do keep a copy of the completed affidavit for your records.

- Don't leave any sections blank; fill in all required fields.

- Don't use white-out or make alterations on the form.

- Don't forget to check for any specific local requirements that may apply.

- Don't submit the form without double-checking for errors.

- Don't delay in filing the affidavit after the trustee's death, as timely filing is crucial.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The California Affidavit of Death of a Trustee form is used to officially document the death of a trustee in a trust. |

| Governing Law | This form is governed by the California Probate Code, specifically sections related to trusts and trustee responsibilities. |

| Filing Requirement | It is not mandatory to file this affidavit with the court, but it may be required by financial institutions or other entities managing trust assets. |

| Signatories | The affidavit must be signed by the successor trustee or another interested party who can verify the death of the original trustee. |

| Information Included | The form typically includes the name of the deceased trustee, date of death, and details about the trust. |

| Impact on Trust | Filing this affidavit allows the successor trustee to take over management of the trust without needing to go through probate. |

| Notarization | While notarization is not always required, it can add an extra layer of authenticity to the document. |

| Access to Assets | This affidavit can facilitate access to trust assets, enabling the successor trustee to act on behalf of the trust without delay. |

Key takeaways

When filling out and using the California Affidavit of Death of a Trustee form, it is essential to understand several key points to ensure a smooth process. Below are important takeaways to consider:

- The form is used to officially declare the death of a trustee in a trust.

- Accurate information is crucial. Include the deceased trustee's full name, date of death, and trust details.

- All relevant parties must sign the affidavit. This typically includes the remaining trustee or successor trustee.

- Supporting documents, such as a death certificate, may be required to validate the affidavit.

- The completed affidavit should be filed with the county recorder's office where the trust property is located.

- Once filed, the affidavit serves as a public record, allowing the trust to be administered according to its terms.

- Consulting with a legal professional can provide additional guidance and ensure compliance with all requirements.

Other PDF Templates

Alabama Sports Physical Form - The form requires details on any past surgeries, current medications, and specific health issues, ensuring comprehensive evaluations.

In order to formalize the rental arrangement, both the landlord and tenant should consider utilizing resources such as the NY Templates, which provide templates that can simplify the creation of a comprehensive lease agreement.

Imm 5645 - Only include siblings living, or those deceased with their details.

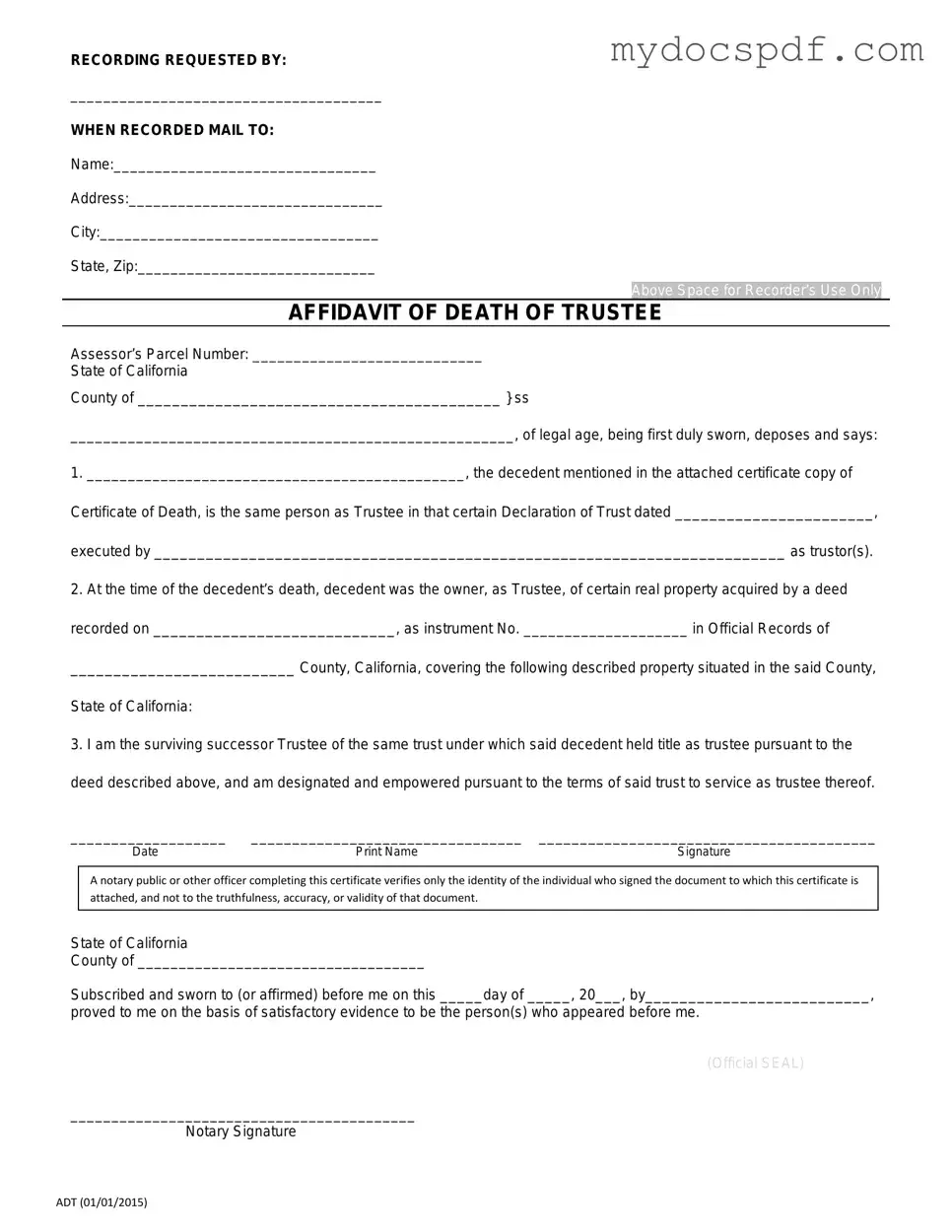

Example - California Affidavit of Death of a Trustee Form

RECORDING REQUESTED BY:

______________________________________

WHEN RECORDED MAIL TO:

Name:________________________________

Address:_______________________________

City:__________________________________

State, Zip:_____________________________

Above Space for Recorder’s Use Only

AFFIDAVIT OF DEATH OF TRUSTEE

Assessor’s Parcel Number: ____________________________

State of California

County of __________________________________________ } ss

______________________________________________________, of legal age, being first duly sworn, deposes and says:

1.______________________________________________, the decedent mentioned in the attached certificate copy of Certificate of Death, is the same person as Trustee in that certain Declaration of Trust dated _______________________, executed by _________________________________________________________________________ as trustor(s).

2.At the time of the decedent’s death, decedent was the owner, as Trustee, of certain real property acquired by a deed recorded on ____________________________, as instrument No. ____________________ in Official Records of

__________________________ County, California, covering the following described property situated in the said County,

State of California:

3.I am the surviving successor Trustee of the same trust under which said decedent held title as trustee pursuant to the deed described above, and am designated and empowered pursuant to the terms of said trust to service as trustee thereof.

___________________ |

_________________________________ |

_________________________________________ |

Date |

Print Name |

Signature |

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not to the truthfulness, accuracy, or validity of that document.

State of California

County of ___________________________________

Subscribed and sworn to (or affirmed) before me on this _____day of _____, 20___, by__________________________,

proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

(Official SEAL)

__________________________________________

Notary Signature

ADT (01/01/2015)

Detailed Instructions for Writing California Affidavit of Death of a Trustee

After completing the California Affidavit of Death of a Trustee form, you will need to file it with the appropriate court or office. This step is crucial to ensure that the trust administration process continues smoothly and legally. Follow these steps to accurately fill out the form.

- Obtain the Form: Download the California Affidavit of Death of a Trustee form from a reliable source or acquire it from a local courthouse.

- Identify the Trustee: Fill in the full name of the deceased trustee in the designated space.

- Provide Date of Death: Enter the date of death of the trustee. This information is essential for the affidavit.

- Trust Information: Include the name of the trust and the date it was created. This identifies the trust associated with the deceased trustee.

- List Successor Trustees: If applicable, provide the names and addresses of any successor trustees who will take over the responsibilities.

- Sign the Affidavit: The affidavit must be signed by the person filling it out. Ensure that the signature is dated.

- Notarization: Have the affidavit notarized. This step is often required to validate the document.

- Make Copies: Before filing, make several copies of the completed and notarized affidavit for your records and for any interested parties.

- File the Affidavit: Submit the original affidavit to the appropriate court or office. Be sure to check for any specific filing requirements or fees.

Documents used along the form

When dealing with the California Affidavit of Death of a Trustee form, there are several other documents that may be necessary to ensure a smooth process. Each of these documents serves a specific purpose and can help clarify the situation surrounding the trust and its administration.

- Trust Agreement: This document outlines the terms of the trust, including the roles and responsibilities of the trustee and beneficiaries. It is essential for understanding how the trust should be managed after the trustee's death.

- Death Certificate: A certified copy of the trustee's death certificate is often required. This official document verifies the trustee's passing and is necessary for legal processes.

- Notice to Beneficiaries: This notice informs all beneficiaries of the trust about the trustee's death and any changes in the management of the trust. It ensures transparency and keeps everyone informed.

- Dirt Bike Bill of Sale: This document is essential when buying or selling a dirt bike in New York, as it serves as legal proof of the transaction. For additional information or templates, you can refer to newyorkform.com/free-dirt-bike-bill-of-sale-template.

- Certificate of Trust: This document summarizes the trust's key details without revealing its entire contents. It can be used to prove the trust's existence and the authority of the successor trustee.

- Successor Trustee Acceptance Form: This form is used by the new trustee to formally accept their role. It may need to be filed with the court or kept with the trust documents for record-keeping.

Having these documents ready can make the transition smoother for all parties involved. It's always a good idea to consult with a legal professional to ensure that everything is in order and that all necessary steps are taken.