Attorney-Approved Business Purchase and Sale Agreement Template

When engaging in the sale or purchase of a business, a Business Purchase and Sale Agreement serves as a crucial document that outlines the terms and conditions of the transaction. This agreement typically covers essential aspects such as the purchase price, payment terms, and the assets being transferred. It also delineates the responsibilities of both the buyer and the seller, ensuring clarity on what is included in the sale, whether it's inventory, equipment, or intellectual property. Additionally, the agreement addresses any liabilities that may be assumed by the buyer and includes provisions for due diligence, allowing the buyer to investigate the business's financial health and operational status before finalizing the deal. Importantly, it may contain clauses related to confidentiality, non-compete agreements, and dispute resolution, all of which are designed to protect the interests of both parties involved. Understanding these components is vital for anyone looking to navigate the complexities of business transactions effectively.

Dos and Don'ts

When filling out the Business Purchase and Sale Agreement form, there are important guidelines to follow. Here are four things you should do and four things you should avoid.

Things You Should Do:

- Read the entire agreement carefully before filling it out.

- Provide accurate information about the business being sold.

- Ensure all parties involved sign the agreement.

- Consult with a professional if you have any questions.

Things You Shouldn't Do:

- Do not rush through the form; take your time to avoid mistakes.

- Never leave blank spaces; fill in all required fields.

- Avoid using unclear or vague language in the agreement.

- Do not ignore any local laws or regulations related to the sale.

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business is sold or purchased. |

| Key Components | This agreement typically includes details such as the purchase price, payment terms, and the assets being sold. |

| Governing Law | The agreement is subject to the laws of the state in which the business operates, such as California Business and Professions Code. |

| Due Diligence | Parties are encouraged to conduct due diligence before finalizing the agreement to ensure all aspects of the business are accurately represented. |

| Confidentiality Clause | Many agreements include a confidentiality clause to protect sensitive information shared during negotiations. |

| Dispute Resolution | Provisions for dispute resolution, such as mediation or arbitration, may be included to address potential conflicts post-sale. |

Key takeaways

Filling out and using a Business Purchase and Sale Agreement (BPSA) is a crucial step in the process of buying or selling a business. Here are ten key takeaways to consider:

- Understand the Purpose: The BPSA serves as a formal contract that outlines the terms and conditions of the sale, protecting both the buyer and the seller.

- Identify the Parties: Clearly identify the buyer and seller, including their legal names and contact information, to avoid any confusion.

- Describe the Business: Provide a detailed description of the business being sold, including its assets, liabilities, and any relevant operational details.

- Specify the Purchase Price: Clearly state the total purchase price and outline how it will be paid, whether in full upfront or through installments.

- Include Contingencies: Consider adding contingencies, such as financing approval or satisfactory due diligence, to protect both parties.

- Outline Closing Procedures: Detail the steps required to finalize the sale, including any necessary documents and timelines.

- Address Representations and Warranties: Both parties should make representations about their authority to enter into the agreement and the condition of the business.

- Consider Confidentiality: If sensitive information is involved, include a confidentiality clause to protect proprietary information.

- Review Legal Obligations: Ensure compliance with local, state, and federal laws that may impact the sale of the business.

- Seek Professional Guidance: It is advisable to consult with legal and financial professionals to review the agreement and ensure all aspects are covered.

By following these key takeaways, individuals can navigate the complexities of a Business Purchase and Sale Agreement more effectively, ensuring a smoother transaction process.

Other Documents

Writing a Character Letter for Court - This reference illustrates the strong bond between the parent and child, showcasing affection and care.

In order to ensure a smooth transaction and protect the interests of both parties, it is recommended to use a General Bill of Sale form, which can be found at toptemplates.info/bill-of-sale/general-bill-of-sale/. This form serves as a legal document that records the transfer of ownership of personal property from a seller to a buyer, acting as proof of purchase and indicating that the seller has transferred all rights to the property to the buyer.

Power of Attorney Example - Authorize someone to sign documents related to real estate transactions in your name.

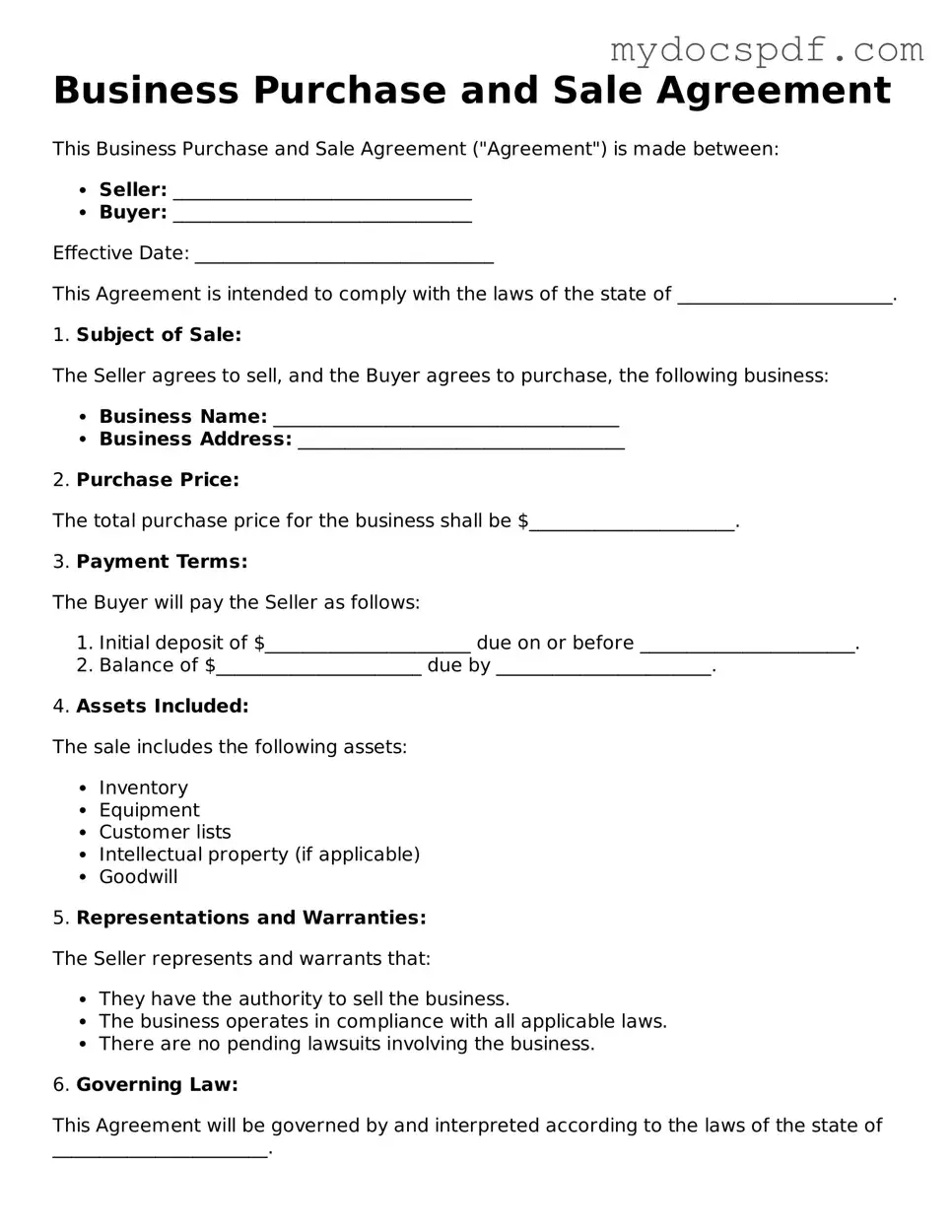

Example - Business Purchase and Sale Agreement Form

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement ("Agreement") is made between:

- Seller: ________________________________

- Buyer: ________________________________

Effective Date: ________________________________

This Agreement is intended to comply with the laws of the state of _______________________.

1. Subject of Sale:

The Seller agrees to sell, and the Buyer agrees to purchase, the following business:

- Business Name: _____________________________________

- Business Address: ___________________________________

2. Purchase Price:

The total purchase price for the business shall be $______________________.

3. Payment Terms:

The Buyer will pay the Seller as follows:

- Initial deposit of $______________________ due on or before _______________________.

- Balance of $______________________ due by _______________________.

4. Assets Included:

The sale includes the following assets:

- Inventory

- Equipment

- Customer lists

- Intellectual property (if applicable)

- Goodwill

5. Representations and Warranties:

The Seller represents and warrants that:

- They have the authority to sell the business.

- The business operates in compliance with all applicable laws.

- There are no pending lawsuits involving the business.

6. Governing Law:

This Agreement will be governed by and interpreted according to the laws of the state of _______________________.

7. Entire Agreement:

This document represents the entire Agreement between the parties concerning this transaction.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

___________________________ (Seller)

___________________________ (Buyer)

Date: ______________________

Detailed Instructions for Writing Business Purchase and Sale Agreement

Filling out a Business Purchase and Sale Agreement form is an important step in the process of transferring ownership of a business. This form captures essential details about the transaction, ensuring that both parties understand their rights and obligations. Follow these steps carefully to complete the form accurately.

- Identify the Parties: Begin by entering the names and addresses of both the seller and the buyer. Make sure to include any business entities involved.

- Describe the Business: Provide a clear description of the business being sold. Include its name, location, and any relevant details that define its operations.

- Outline the Purchase Price: Specify the total purchase price for the business. Break down any deposits or payment schedules if applicable.

- Detail Included Assets: List all assets included in the sale, such as equipment, inventory, and intellectual property. Be thorough to avoid misunderstandings.

- State Terms and Conditions: Clearly outline any specific terms or conditions that must be met for the sale to proceed. This could include financing arrangements or contingencies.

- Signatures: Ensure that both parties sign and date the agreement. Include spaces for witnesses if required by your state’s laws.

Once you have completed these steps, review the agreement for accuracy. Both parties should retain a copy for their records. If needed, consult with a legal professional to ensure that all aspects of the agreement are compliant with local laws.

Documents used along the form

When engaging in the process of buying or selling a business, several important documents accompany the Business Purchase and Sale Agreement. Each of these documents serves a specific purpose and helps ensure that the transaction proceeds smoothly and legally. Below is a list of commonly used forms and documents in such transactions.

- Letter of Intent (LOI): This document outlines the preliminary agreement between the buyer and seller. It typically includes the proposed terms of the sale and serves as a starting point for negotiations.

- Confidentiality Agreement (NDA): Before sharing sensitive information about the business, both parties often sign this agreement. It protects proprietary information and ensures that details about the business remain confidential.

- Due Diligence Checklist: This is a comprehensive list that helps the buyer assess the business's value and risks. It typically includes financial records, legal documents, and operational information that the buyer needs to review.

- Asset Purchase Agreement: If the sale involves specific assets rather than the entire business entity, this document details which assets are being sold, their value, and any liabilities that may be transferred.

- Bill of Sale: This document serves as proof of the transfer of ownership of assets from the seller to the buyer. It includes details about the assets being sold and the agreed-upon purchase price.

- Employment Agreements: If key employees will remain with the business after the sale, new employment agreements may be drafted. These outline the terms of employment, including salary, benefits, and responsibilities.

- Non-Compete Agreement: This document prevents the seller from starting a competing business within a specified timeframe and geographical area after the sale. It protects the buyer's investment by limiting competition.

- Motorcycle Bill of Sale: This legal document records the sale and transfer of ownership of a motorcycle. It serves as proof of the transaction, detailing important information about the buyer, seller, and the motorcycle itself. For more details, you can refer to Texas Forms Online.

- Closing Statement: This document summarizes all financial transactions involved in the sale. It details the final purchase price, any adjustments, and the distribution of funds at closing.

- Transfer of Ownership Documents: These documents are necessary for legally transferring ownership of the business entity. They may include amendments to corporate documents or filings with state authorities.

- Escrow Agreement: If part of the purchase price is held in escrow, this agreement outlines the terms under which the funds will be held and released. It ensures that both parties fulfill their obligations before the funds are distributed.

Understanding these documents is crucial for both buyers and sellers. Each plays a vital role in the transaction process, helping to protect interests and ensure compliance with legal requirements. Familiarity with these forms can facilitate a smoother transaction and lead to a successful business transfer.