Get Business Credit Application Form in PDF

The Business Credit Application form serves as a crucial tool for businesses seeking to establish credit with suppliers and financial institutions. This form typically requires essential information about the business, including its legal name, address, and type of ownership. Applicants must provide details about their financial history, such as annual revenue, existing debts, and credit references. The form often includes sections for personal guarantees from business owners, ensuring that lenders have recourse in the event of default. Additionally, businesses may need to disclose their tax identification number and relevant licenses or permits. By completing this application, companies not only demonstrate their creditworthiness but also facilitate the decision-making process for lenders. Accurate and thorough completion of the form can significantly impact the approval of credit, making it a vital step in managing a business's financial relationships.

Dos and Don'ts

When filling out a Business Credit Application form, attention to detail is crucial. Here are ten important dos and don’ts to consider:

- Do provide accurate and complete information.

- Do double-check all numbers and figures for accuracy.

- Do include all required documentation, such as financial statements.

- Do be honest about your business's credit history.

- Do clearly state the purpose of the credit request.

- Don't leave any sections blank unless specified.

- Don't provide misleading information.

- Don't forget to sign and date the application.

- Don't rush through the application; take your time.

- Don't ignore the terms and conditions associated with the credit.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is used to assess the creditworthiness of a business applying for credit or financing. |

| Information Required | Typically, the form requires details such as business name, address, ownership structure, and financial information. |

| Governing Law | In most states, the application is governed by the Uniform Commercial Code (UCC), which regulates commercial transactions. |

| Confidentiality | Information submitted is generally kept confidential and used solely for credit evaluation purposes. |

| Signature Requirement | A signature from an authorized representative of the business is usually required to validate the application. |

| Credit History Check | Submitting the application often permits the lender to conduct a credit history check on the business and its owners. |

| State-Specific Forms | Some states may have specific requirements or forms; for example, California has additional disclosures under the California Consumer Privacy Act. |

| Approval Process | The approval process may vary based on the lender’s criteria, which can include credit score, revenue, and industry type. |

| Renewal and Updates | Businesses may need to update their application periodically or upon significant changes in their financial status. |

Key takeaways

When filling out and using the Business Credit Application form, it is essential to keep several key points in mind to ensure a smooth process.

- Accuracy is crucial. Double-check all information provided, including business name, address, and tax identification number.

- Provide complete information. Incomplete applications can lead to delays in processing or even denial of credit.

- Include financial statements. Many lenders require recent financial statements to assess the creditworthiness of the business.

- Understand the terms. Familiarize yourself with the credit terms and conditions before submitting the application.

- List all owners. Include information about all business owners or partners, as their credit history may be considered.

- Review the privacy policy. Ensure you understand how your information will be used and protected by the lender.

- Follow up. After submission, it is wise to follow up with the lender to check on the status of the application.

These takeaways can help streamline the application process and improve the chances of obtaining business credit successfully.

Other PDF Templates

Corrective Deed California - The affidavit can be an important step in ensuring compliance with state and local laws.

Creating a robust estate plan is vital, and having a complete Last Will and Testament is a key component. This document not only clarifies your wishes for asset distribution but also ensures that your family's future is safeguarded. For guidance in drafting this important legal instrument, you can refer to a comprehensive resource on the Last Will and Testament template.

What Is Auto Consignment - The Consignee's responsibility for advertising and marketing drives customer interest.

How to Make a Rental Lease Agreement - It creates essential guidelines that govern the behavior and responsibilities of tenants.

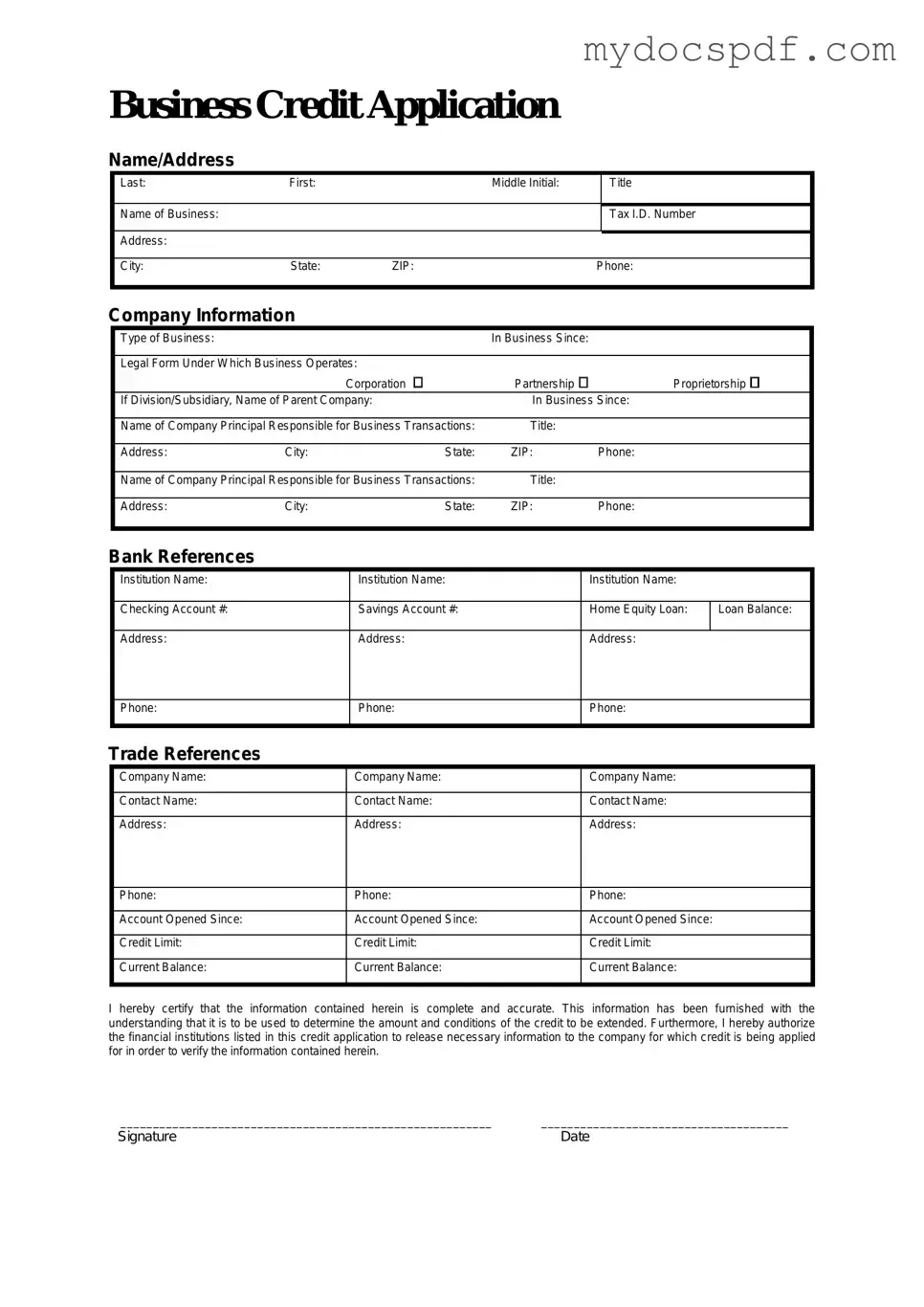

Example - Business Credit Application Form

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |

Detailed Instructions for Writing Business Credit Application

Once you have the Business Credit Application form in front of you, it’s time to complete it accurately. This process is essential for establishing a credit relationship with a lender or supplier. Follow these steps to ensure you fill out the form correctly.

- Begin by entering your business name at the top of the form.

- Provide your business address, including street, city, state, and zip code.

- List your business phone number and email address for contact purposes.

- Indicate the type of business entity (e.g., corporation, LLC, sole proprietorship).

- Fill in the date your business was established.

- Include the name and title of the primary contact person for the application.

- Provide the Social Security Number or Employer Identification Number (EIN) for your business.

- List your business’s annual revenue and number of employees.

- Detail any trade references, including company names, contact persons, and phone numbers.

- Sign and date the application to certify that the information is accurate.

After completing the form, review all entries for accuracy. Submit the application to the designated lender or supplier as instructed. They will evaluate your information and respond accordingly.

Documents used along the form

When applying for business credit, several forms and documents are often required alongside the Business Credit Application form. Each of these documents serves a specific purpose and helps lenders assess the creditworthiness of a business. Below is a list of commonly used documents in this process.

- Personal Guarantee: This document is signed by the business owner, agreeing to take personal responsibility for the business's debts. It provides additional security for lenders.

- Financial Statements: These include balance sheets and income statements. They give lenders a clear picture of the business's financial health and performance over time.

- Tax Returns: Typically, lenders request the last two to three years of tax returns. This information helps verify income and business profitability.

- Business Plan: A comprehensive business plan outlines the company’s goals, strategies, and financial projections. It can demonstrate the business’s potential for success.

- Bill of Sale: To document the transfer of ownership of goods, it's essential to complete a Bill of Sale form accurately. You can find a helpful resource for this at Free Business Forms to ensure clarity in transactions.

- Trade References: These are contacts from suppliers or vendors who can vouch for the business's payment history and creditworthiness. They provide insight into the business's reliability.

- Certificate of Incorporation: This document proves that the business is legally registered and recognized by the state. It is essential for establishing the legitimacy of the business.

Providing these documents can streamline the credit application process and enhance the chances of approval. Being well-prepared with the necessary paperwork reflects professionalism and readiness to engage in a financial relationship.