Attorney-Approved Business Bill of Sale Template

The Business Bill of Sale form serves as a crucial document in the transfer of ownership for various types of business assets. This form not only facilitates the sale of tangible items, such as equipment and inventory, but also encompasses intangible assets like intellectual property and customer lists. By clearly outlining the details of the transaction, including the purchase price, payment terms, and the identities of both the seller and buyer, this document provides a legal framework that protects all parties involved. Additionally, it often includes warranties and representations made by the seller, ensuring that the buyer is fully informed about the condition and legality of the assets being sold. The form is essential for maintaining transparency and accountability in business dealings, thereby fostering trust between the buyer and seller. Understanding its components and implications can significantly enhance the security and smoothness of the transaction process.

Dos and Don'ts

When filling out a Business Bill of Sale form, it’s essential to ensure that the document is accurate and complete. Here are five important dos and don'ts to consider:

- Do include all relevant details about the business being sold, such as its name, address, and type of business.

- Do specify the sale price clearly, along with any payment terms or conditions.

- Do ensure that both the seller and buyer sign the document to validate the transaction.

- Don't leave any sections blank. Every part of the form should be filled out to avoid confusion.

- Don't forget to keep a copy of the signed Bill of Sale for your records.

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose | A Business Bill of Sale form is used to document the sale of a business or its assets. It serves as proof of the transaction between the buyer and the seller. |

| Components | The form typically includes details such as the names of the buyer and seller, the date of the sale, a description of the business or assets sold, and the purchase price. |

| State-Specific Forms | Some states have specific requirements for a Bill of Sale. For example, in California, the form must comply with the California Commercial Code. |

| Legal Considerations | While a Bill of Sale is generally straightforward, it is important to ensure that all terms are clear and agreed upon to avoid disputes later. |

| Record Keeping | Both the buyer and seller should keep a copy of the Bill of Sale for their records. This document may be needed for tax purposes or in case of future legal issues. |

Key takeaways

When it comes to transferring ownership of a business, a Business Bill of Sale form is an essential document. Here are some key takeaways to keep in mind while filling it out and using it:

- Understand the Purpose: A Business Bill of Sale is a legal document that records the sale of a business. It serves as proof of the transaction and outlines the terms agreed upon by both parties.

- Include Accurate Information: Ensure that all details, such as the names of the buyer and seller, the business name, and the sale price, are accurate and complete. This helps prevent disputes later on.

- Describe the Business: Provide a thorough description of the business being sold. This may include assets, inventory, and any liabilities that the buyer will assume.

- Consider Additional Terms: If there are specific conditions tied to the sale, such as payment terms or warranties, include these in the document to clarify expectations.

- Signatures Matter: Both the buyer and seller must sign the document. This signifies their agreement to the terms laid out in the Bill of Sale.

- Keep Copies: After the form is completed and signed, make sure to keep copies for both parties. This provides a record of the transaction for future reference.

- Check Local Laws: Business sale requirements can vary by state. It’s important to be aware of any local regulations that may affect the sale.

- Consult Professionals: If you have any doubts or questions, consider consulting a legal professional or a business advisor to ensure everything is in order.

By following these key takeaways, you can navigate the process of filling out and using a Business Bill of Sale with confidence. This document plays a crucial role in facilitating a smooth transition of ownership, protecting both the buyer and seller.

Popular Business Bill of Sale Documents:

Snowmobile Bill of Sale Template - Facilitates easy tracking of sales for tax purposes.

For those looking to navigate the complexities of personal property transactions, understanding the specific requirements of a California bill of sale might be beneficial. You can find the necessary forms and guidelines on our website, ensuring a straightforward process for both buyers and sellers. Visit this link for more details about the California bill of sale form options.

Bill of Sale for Farm Equipment - Assists in the financial record-keeping related to asset sales.

Example - Business Bill of Sale Form

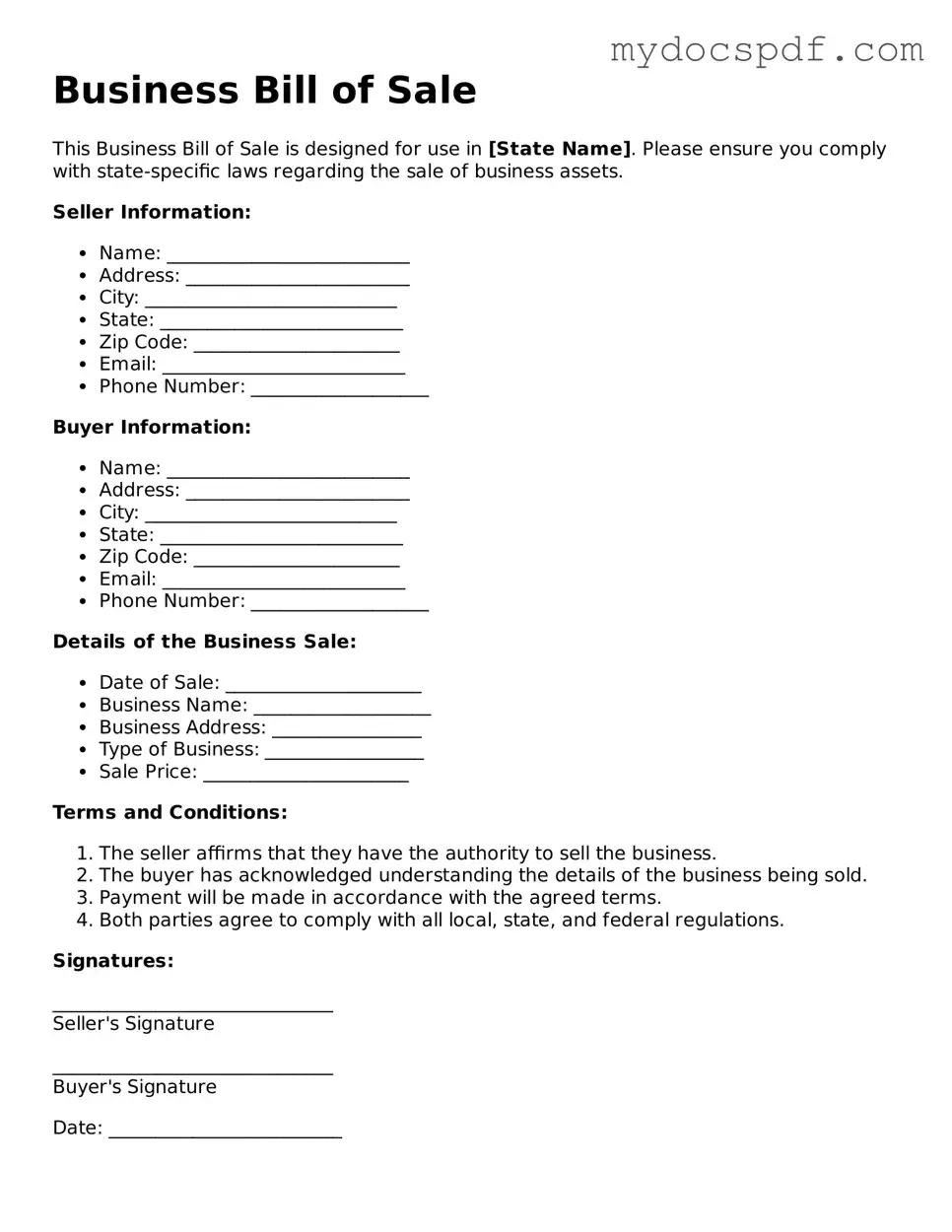

Business Bill of Sale

This Business Bill of Sale is designed for use in [State Name]. Please ensure you comply with state-specific laws regarding the sale of business assets.

Seller Information:

- Name: __________________________

- Address: ________________________

- City: ___________________________

- State: __________________________

- Zip Code: ______________________

- Email: __________________________

- Phone Number: ___________________

Buyer Information:

- Name: __________________________

- Address: ________________________

- City: ___________________________

- State: __________________________

- Zip Code: ______________________

- Email: __________________________

- Phone Number: ___________________

Details of the Business Sale:

- Date of Sale: _____________________

- Business Name: ___________________

- Business Address: ________________

- Type of Business: _________________

- Sale Price: ______________________

Terms and Conditions:

- The seller affirms that they have the authority to sell the business.

- The buyer has acknowledged understanding the details of the business being sold.

- Payment will be made in accordance with the agreed terms.

- Both parties agree to comply with all local, state, and federal regulations.

Signatures:

______________________________

Seller's Signature

______________________________

Buyer's Signature

Date: _________________________

Detailed Instructions for Writing Business Bill of Sale

Completing the Business Bill of Sale form is an important step in transferring ownership of a business. After filling out the form, both parties should keep a copy for their records. This document serves as proof of the transaction and outlines the details of the sale.

- Start by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller. This identifies the current owner of the business.

- Next, enter the full name and address of the buyer. This is the individual or entity purchasing the business.

- Clearly describe the business being sold. Include its name, location, and any relevant details that define the business.

- State the sale price of the business. Be specific about the amount being exchanged.

- If applicable, list any included assets, such as equipment, inventory, or intellectual property. This clarifies what is part of the sale.

- Both the seller and buyer should sign and date the form. This signifies agreement to the terms outlined.

- Finally, make copies of the completed form for both parties to keep for their records.

Documents used along the form

A Business Bill of Sale is a crucial document in the process of transferring ownership of a business. However, it is often accompanied by other important forms and documents that help ensure a smooth transition. Here are four commonly used documents that work in tandem with the Business Bill of Sale.

- Asset Purchase Agreement: This document outlines the specific assets being sold, such as equipment, inventory, and intellectual property. It details the terms of the sale, including payment structure and any liabilities that may be transferred.

- Non-Disclosure Agreement (NDA): An NDA is essential for protecting sensitive information during the sale process. It ensures that both parties agree not to disclose proprietary information, trade secrets, or other confidential data related to the business.

- Transition Services Agreement: This agreement provides for support during the transition period after the sale. It may include training for the new owner or assistance with operations to ensure a smooth handover of the business.

- Bill of Sale: This is a crucial document that finalizes the sale and provides legal proof of the transaction, ensuring both parties are protected. For more information, you can refer to Arizona PDF Forms.

- Bill of Sale for Equipment: If the business includes significant equipment, a separate bill of sale may be required to document the transfer of ownership for those specific assets. This document provides clarity on the condition of the equipment and any warranties associated with it.

Understanding these additional documents is essential for anyone involved in buying or selling a business. Each plays a vital role in protecting the interests of both parties and ensuring that the transaction is completed smoothly and legally.