Get Auto Insurance Card Form in PDF

When driving in the United States, having an Auto Insurance Card is not just a good practice; it’s a legal requirement in many states. This card serves as proof of insurance and includes essential information that can be critical in the event of an accident. Key details on the card include the insurance company’s name, the policy number, and the effective and expiration dates of the coverage. Additionally, it lists the year, make, and model of the insured vehicle, along with the Vehicle Identification Number (VIN). The issuing agency or company is also noted on the card. It is crucial to keep this card in the insured vehicle at all times, as it must be presented upon demand during traffic stops or accidents. In case of an incident, the card also reminds drivers to report the accident to their insurance agent as soon as possible and to gather important information from all parties involved. Furthermore, the card features an artificial watermark for security purposes, which can be viewed by holding the document at an angle. Understanding the importance and contents of the Auto Insurance Card can help ensure compliance with state laws and provide peace of mind on the road.

Dos and Don'ts

When filling out the Auto Insurance Card form, there are important guidelines to follow. Here’s a list of what you should and shouldn't do:

- Do ensure all fields are filled out completely and accurately.

- Do double-check the insurance policy number for correctness.

- Do include the effective and expiration dates.

- Do write down the vehicle identification number (VIN) clearly.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless specified.

- Don't use abbreviations that may cause confusion.

- Don't forget to sign the form if required.

- Don't provide false information or estimates.

- Don't ignore the important notice on the reverse side.

Following these guidelines will help ensure that your Auto Insurance Card form is completed correctly and efficiently.

Document Attributes

| Fact Name | Description |

|---|---|

| Insurance Identification Card | This document serves as proof of auto insurance coverage. |

| Company Number | The unique identifier assigned to the insurance company. |

| Policy Number | This number identifies the specific insurance policy. |

| Effective Date | The date when the insurance coverage begins. |

| Expiration Date | The date when the insurance coverage ends. |

| Vehicle Information | Includes year, make/model, and vehicle identification number (VIN). |

| Issuing Agency/Company | The name of the agency or company that issued the card. |

| Legal Requirement | This card must be kept in the insured vehicle and presented upon demand. |

Key takeaways

When filling out and using the Auto Insurance Card form, it is essential to keep several key points in mind. Understanding these aspects can help ensure compliance and provide peace of mind while driving.

- Accurate Information: Ensure that all fields on the form are completed accurately. This includes the company number, policy number, effective date, and expiration date.

- Vehicle Details: Fill in the year, make, model, and vehicle identification number (VIN) correctly. This information is crucial for identifying your vehicle in the event of an accident.

- Agency Information: Include the name of the agency or company issuing the card. This detail helps in contacting the right entity if any issues arise.

- Keep It Accessible: Always keep the insurance card in the vehicle. It must be presented upon demand in case of an accident or traffic stop.

- Report Accidents Promptly: In the event of an accident, report it to your insurance agent or company as soon as possible. Timely reporting can facilitate a smoother claims process.

- Gather Necessary Information: If involved in an accident, collect the names and addresses of all drivers, passengers, and witnesses. Also, note the insurance details for each vehicle involved.

By following these takeaways, you can navigate the responsibilities associated with your auto insurance card more effectively. Remember, being prepared is key to ensuring a safer driving experience.

Other PDF Templates

Dr Excuse for School - The form confirms that the patient was incapacitated during the specified period.

6 Team Single Elimination Bracket With Consolation - The journey through the bracket will be unforgettable.

In addition to the essential details outlined in the Texas Operating Agreement form, it is advisable for LLC members to refer to resources like Texas Forms Online, which provide templates and additional guidance on forming an effective agreement that meets legal requirements and protects the interests of all parties involved.

Soccer Training Session Plan - Enhance endurance with conditioning activities.

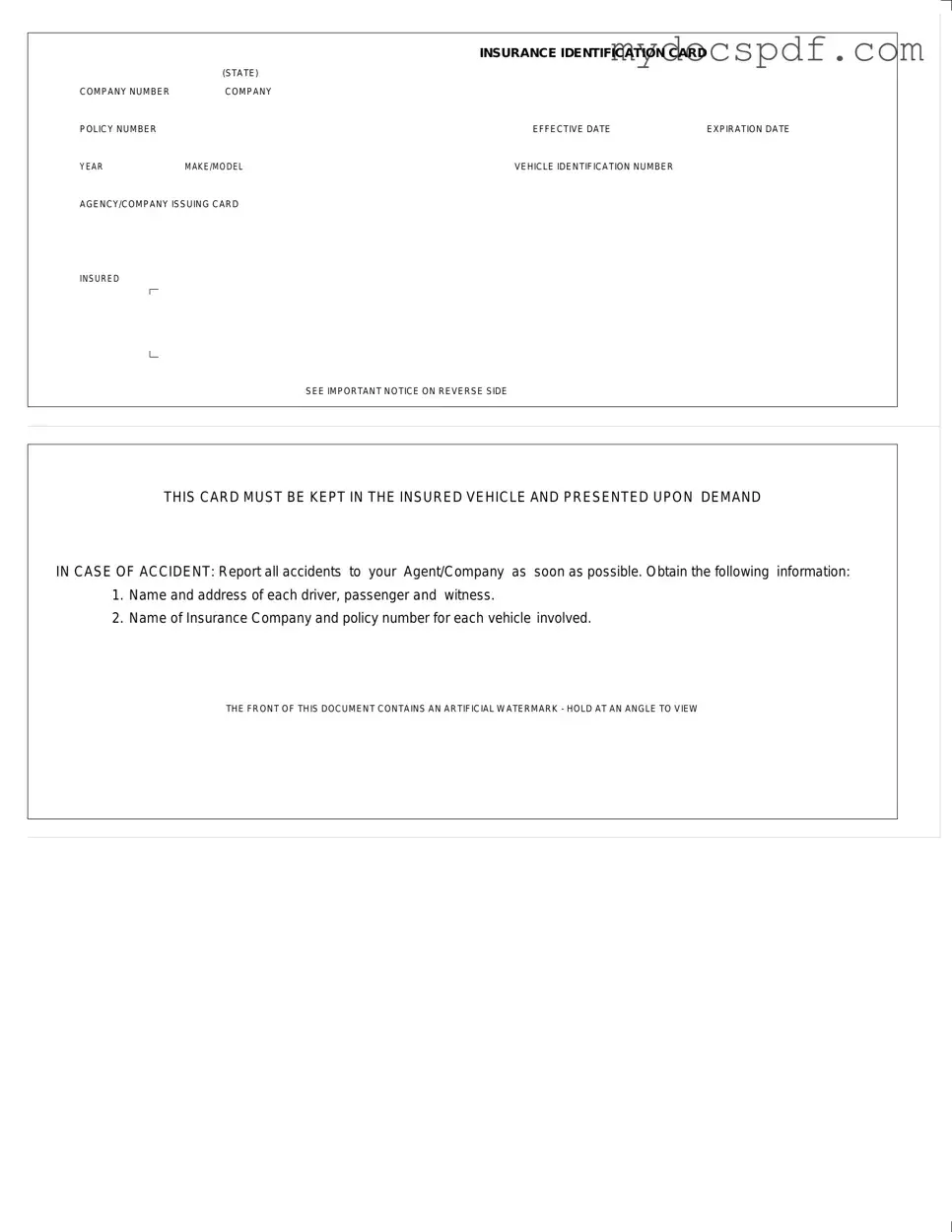

Example - Auto Insurance Card Form

|

|

INSURANCE IDENTIFICATION CARD |

|

|

(STATE) |

|

|

COMPANY NUMBER |

COMPANY |

|

|

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

|

AGENCY/COMPANY ISSUING CARD

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

Detailed Instructions for Writing Auto Insurance Card

Filling out the Auto Insurance Card form is a straightforward process. This card serves as proof of your insurance coverage and must be kept in your vehicle at all times. Ensure that all information is accurate and complete, as it may be required during an accident or when requested by law enforcement.

- Locate the INSURANCE IDENTIFICATION CARD (STATE) section at the top of the form.

- Fill in the COMPANY NUMBER provided by your insurance company.

- Enter your COMPANY POLICY NUMBER in the designated space.

- Indicate the EFFECTIVE DATE of your insurance policy.

- Provide the EXPIRATION DATE of your policy.

- Write the YEAR of your vehicle.

- Fill in the MAKE/MODEL of your vehicle.

- Input the VEHICLE IDENTIFICATION NUMBER (VIN).

- Specify the AGENCY/COMPANY ISSUING CARD.

- Review all entries to ensure accuracy before finalizing the form.

Once completed, keep the card in your vehicle. Familiarize yourself with the important notice on the reverse side, as it outlines necessary steps to take in case of an accident.

Documents used along the form

When you have an Auto Insurance Card, it's often accompanied by several other important documents. Each of these documents plays a crucial role in ensuring you are covered and compliant with state laws. Here’s a brief overview of some commonly used forms alongside your Auto Insurance Card.

- Insurance Policy Document: This comprehensive document outlines the specifics of your coverage, including the types of protection offered, limits, deductibles, and any exclusions. It serves as the official agreement between you and your insurance provider.

- Proof of Insurance Certificate: Similar to the Auto Insurance Card, this certificate serves as evidence that you have an active insurance policy. It may be required by law when registering your vehicle or during traffic stops.

- Claim Form: If you need to file a claim after an accident, this form will be essential. It collects information about the incident, the parties involved, and the damages sustained. Completing this form accurately is vital for a smooth claims process.

- Accident Report Form: In many states, you may need to file an official accident report with local authorities. This form documents the details of the accident, including the date, time, location, and any injuries or damages incurred.

- NYCERS F170 Form: Emergency Medical Technicians (EMTs) who are members of Tier 1, Tier 2, or Tier 4 should complete this critical document to elect participation in the 25-Year Retirement Program. More information can be found at newyorkform.com/free-nycers-f170-template/.

- Vehicle Registration: This document proves that your vehicle is registered with the state. It typically includes details like the vehicle identification number (VIN) and the owner's information. Keeping this document in your vehicle is often required by law.

- Driver’s License: A valid driver’s license is essential for operating a vehicle legally. It serves as proof of your identity and driving qualifications. Always keep it handy when driving, as you may need to present it alongside your insurance documents.

Having these documents organized and accessible can make a significant difference in managing your auto insurance needs. Whether you are filing a claim, proving your coverage, or simply driving your vehicle, being prepared is key to a smooth experience.