Attorney-Approved Affidavit of Gift Template

The Affidavit of Gift form serves as an important document for individuals looking to formally declare a gift of property or assets. This form is particularly useful when transferring ownership without any exchange of money, ensuring that both the giver and the recipient have a clear understanding of the transaction. By completing this affidavit, the donor affirms their intent to gift the item, which can include anything from real estate to personal belongings. Additionally, the form may require details such as the description of the gift, its value, and the relationship between the donor and the recipient. It also typically includes a statement confirming that the gift is made voluntarily and without any expectation of compensation. This process helps to prevent any future disputes regarding ownership and provides legal clarity for both parties involved. Understanding the nuances of the Affidavit of Gift form is essential for anyone considering a significant transfer of assets, as it lays the groundwork for a smooth and legally sound transaction.

Dos and Don'ts

When filling out the Affidavit of Gift form, it is essential to follow specific guidelines to ensure accuracy and compliance. Below is a list of ten do's and don'ts that can help streamline the process.

- Do read the instructions carefully before beginning the form.

- Do provide accurate and complete information about the donor and recipient.

- Do sign and date the affidavit in the appropriate section.

- Do keep a copy of the completed form for your records.

- Do consult a legal expert if you have questions about the form.

- Don't leave any sections blank unless instructed to do so.

- Don't use white-out or any correction fluid on the form.

- Don't submit the form without reviewing it for errors.

- Don't forget to include any required supporting documents.

- Don't rush through the process; take your time to ensure accuracy.

Affidavit of GiftTemplates for Particular US States

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | An Affidavit of Gift is a legal document used to declare that a gift has been made, often for tax purposes. |

| Purpose | This form helps to clarify the intent of the giver and can be important for estate planning and tax documentation. |

| Notarization | Typically, the affidavit must be notarized to be considered valid. This adds a layer of authenticity to the document. |

| State Variations | Different states may have specific requirements for the Affidavit of Gift, so it's important to check local laws. |

| Tax Implications | Filing an Affidavit of Gift may have tax implications for both the giver and the recipient, particularly regarding gift tax limits. |

| Governing Law | In the United States, the Uniform Probate Code often governs the use of Affidavits of Gift, but specific state laws apply. |

| Contents | The affidavit generally includes details about the gift, the parties involved, and the date of the gift. |

| Legal Advice | It is advisable to seek legal counsel when preparing an Affidavit of Gift to ensure compliance with applicable laws. |

Key takeaways

Filling out and using the Affidavit of Gift form is an important step in documenting the transfer of property or assets. Here are some key takeaways to keep in mind:

- Understand the Purpose: The Affidavit of Gift serves to formally declare that a gift has been made, helping to clarify ownership and tax implications.

- Complete Accuracy is Crucial: Ensure all information is filled out accurately. Any discrepancies can lead to complications in the future.

- Identify the Donor and Recipient: Clearly list the names and addresses of both the person giving the gift and the person receiving it.

- Specify the Gift: Describe the gift in detail, including its value and any relevant identification numbers, such as serial numbers for tangible items.

- Signatures Matter: Both the donor and the recipient should sign the affidavit. This adds legitimacy and can prevent disputes later on.

- Notarization May Be Required: In some cases, having the affidavit notarized can provide additional legal protection and credibility.

- Keep Copies: Always retain copies of the completed affidavit for your records. This is essential for future reference or in case of any legal inquiries.

- Consult a Professional: If you are unsure about any aspect of the form or the gifting process, consider seeking advice from a legal professional.

By following these guidelines, you can ensure that the Affidavit of Gift is completed correctly and serves its intended purpose effectively.

Popular Affidavit of Gift Documents:

Self-proving Affidavit - The increased validity can offer peace of mind to both testators and heirs.

The Texas Real Estate Sales Contract form is a standardized document used in real estate transactions within the state of Texas. This form outlines the terms and conditions agreed upon by the buyer and seller regarding the sale of property, including details about the property, financing, and closing procedures. To begin the process, fill out the form by clicking the button below or access the Texas Real Estate Sales Contract form directly.

Who Is the Petitioner in Form I-751 - A personal testimony about the couple's emotional connection and support.

Affidavit of Service Sample - Providing an Affidavit of Service helps to establish a timeline for legal proceedings.

Example - Affidavit of Gift Form

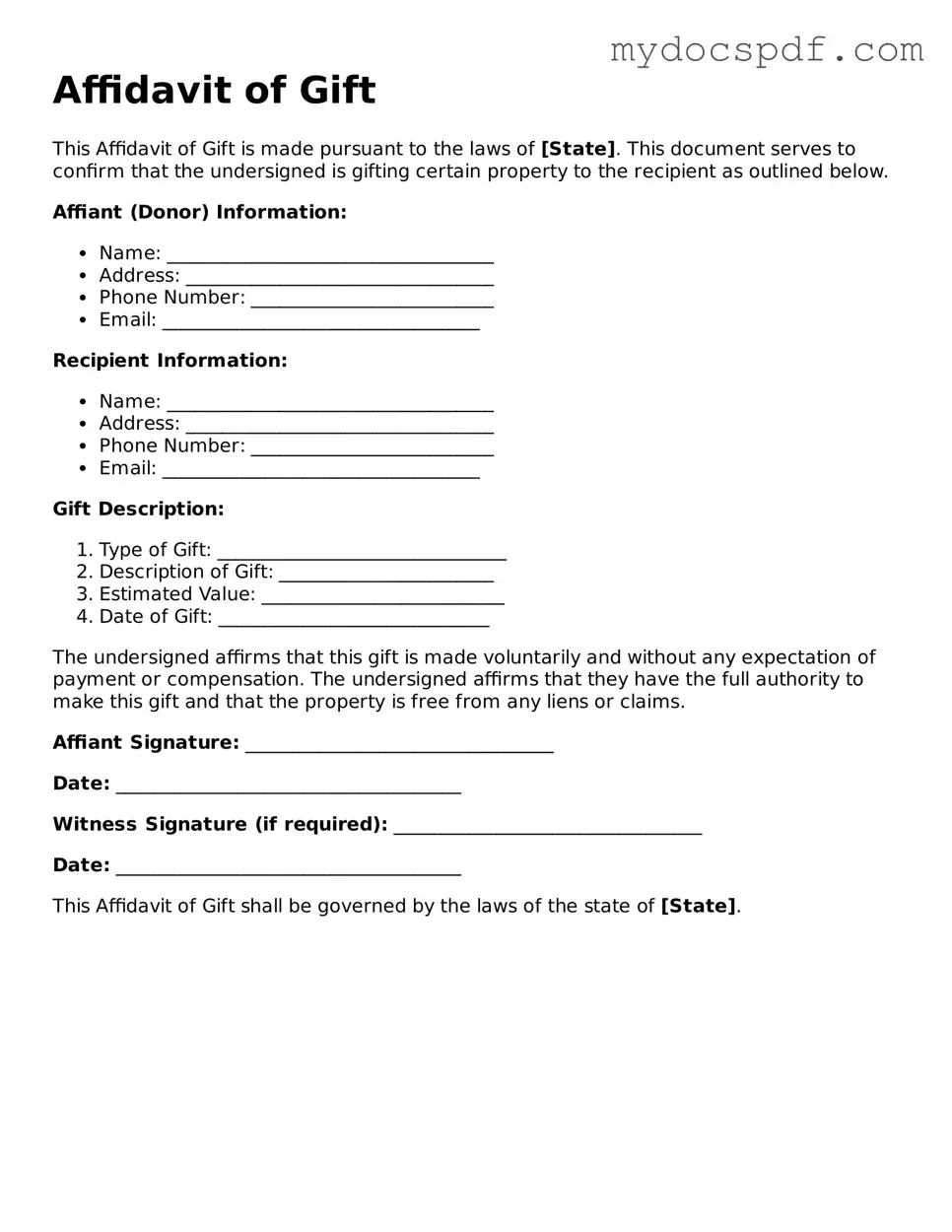

Affidavit of Gift

This Affidavit of Gift is made pursuant to the laws of [State]. This document serves to confirm that the undersigned is gifting certain property to the recipient as outlined below.

Affiant (Donor) Information:

- Name: ___________________________________

- Address: _________________________________

- Phone Number: __________________________

- Email: __________________________________

Recipient Information:

- Name: ___________________________________

- Address: _________________________________

- Phone Number: __________________________

- Email: __________________________________

Gift Description:

- Type of Gift: _______________________________

- Description of Gift: _______________________

- Estimated Value: __________________________

- Date of Gift: _____________________________

The undersigned affirms that this gift is made voluntarily and without any expectation of payment or compensation. The undersigned affirms that they have the full authority to make this gift and that the property is free from any liens or claims.

Affiant Signature: _________________________________

Date: _____________________________________

Witness Signature (if required): _________________________________

Date: _____________________________________

This Affidavit of Gift shall be governed by the laws of the state of [State].

Detailed Instructions for Writing Affidavit of Gift

Once you have the Affidavit of Gift form in hand, it’s time to complete it accurately. This form is crucial for documenting the transfer of property or assets as a gift. Following these steps will help ensure that you fill it out correctly and avoid any potential issues.

- Gather necessary information: Before starting, collect all required details about the donor and the recipient, including full names, addresses, and any relevant identification numbers.

- Fill in the donor's information: In the designated section, write the full name and address of the person giving the gift.

- Provide recipient details: Next, enter the full name and address of the person receiving the gift.

- Describe the gift: Clearly describe the item or property being gifted. Include specifics like the type of asset, its value, and any identifying details.

- State the date of the gift: Enter the date on which the gift is being given.

- Sign the form: The donor must sign the form to validate the gift. Ensure that the signature matches the name provided earlier.

- Have the form notarized: To finalize the affidavit, take it to a notary public. They will verify the identities of the signatories and notarize the document.

After completing the form, keep a copy for your records. You may need to present it for tax purposes or when transferring ownership of the gifted asset. Be sure to follow any additional instructions specific to your situation or local regulations.

Documents used along the form

The Affidavit of Gift form is often accompanied by several other documents that help establish the context and legality of the gift being made. These additional forms provide necessary information and support the claims made in the affidavit. Below is a list of commonly used documents that may be relevant when completing an Affidavit of Gift.

- Gift Tax Return (Form 709): This form is used to report gifts that exceed the annual exclusion limit set by the IRS. It helps to document any taxable gifts and ensures compliance with federal tax regulations.

- Letter of Intent: A letter of intent outlines the donor's intentions regarding the gift. It can clarify the purpose of the gift and any conditions attached to it, providing additional context for the recipient.

- Hold Harmless Agreement: This document is crucial when engaging in activities that carry inherent risks. It ensures that one party is protected from legal claims made by another. For more information on how to draft this agreement, visit Texas Forms Online.

- Donor's Identification: A copy of the donor's identification, such as a driver's license or passport, may be required to verify the identity of the person making the gift. This helps prevent fraud and ensures that the gift is legitimate.

- Recipient's Acknowledgment: A document signed by the recipient acknowledging the receipt of the gift can serve as proof that the gift was accepted. This can be important for record-keeping and tax purposes.

- Property Deed or Title Transfer Documents: If the gift involves real estate or other significant assets, documentation such as a property deed or title transfer documents may be necessary to legally transfer ownership from the donor to the recipient.

Including these documents alongside the Affidavit of Gift can help ensure that the gift is properly documented and legally recognized. It is advisable to review all requirements based on specific circumstances to ensure compliance with applicable laws and regulations.