Get Adp Pay Stub Form in PDF

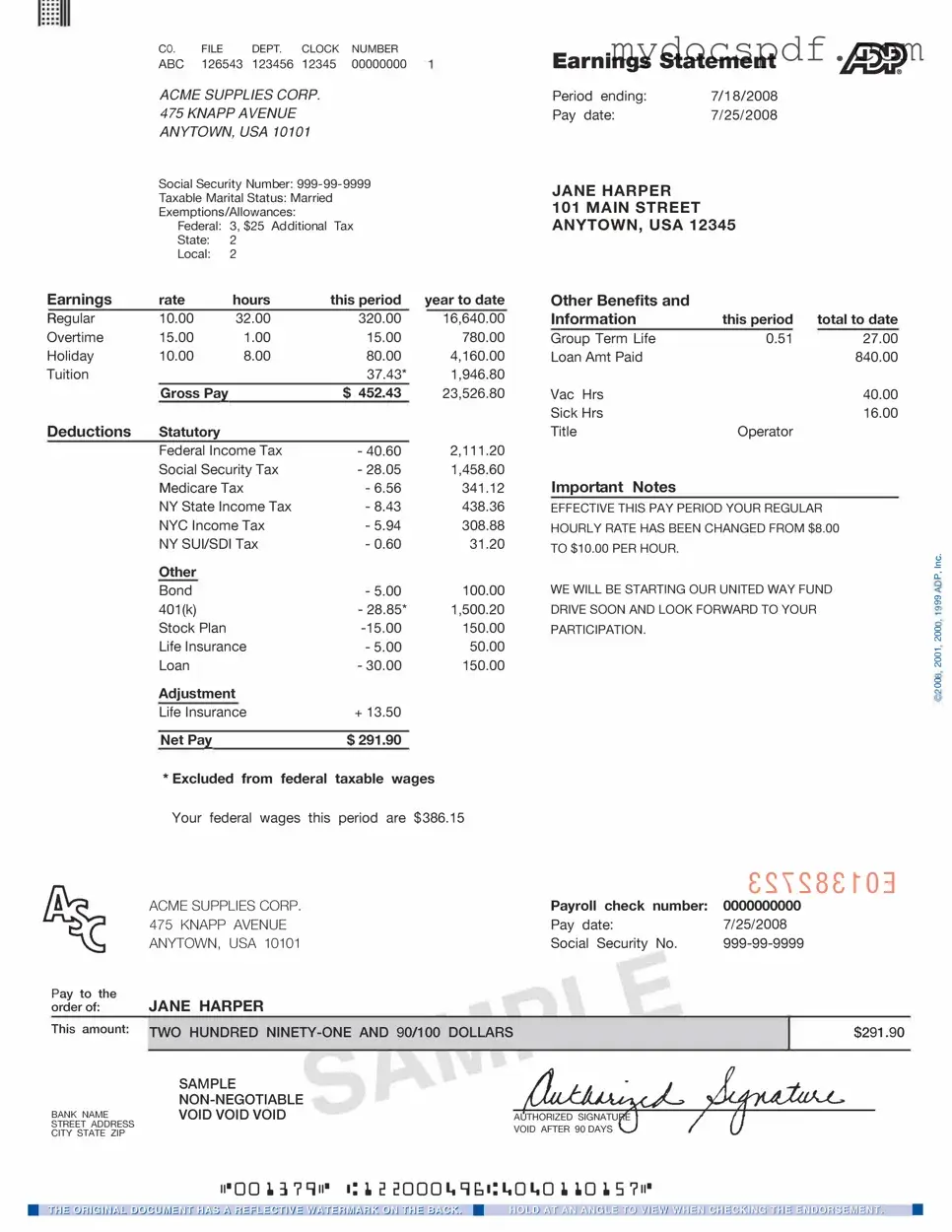

The ADP Pay Stub form is an essential document for employees, providing a detailed breakdown of earnings and deductions for each pay period. This form typically includes key information such as gross pay, net pay, and various deductions like taxes, retirement contributions, and health insurance premiums. Understanding the components of the pay stub is crucial for employees to verify their compensation and ensure accuracy in their financial records. Additionally, the ADP Pay Stub form often contains information about year-to-date earnings, which helps employees track their income over time. With this form, employees can also identify discrepancies in their pay, making it easier to address any issues with their employer. Overall, the ADP Pay Stub serves as a vital tool for financial transparency and personal financial management.

Dos and Don'ts

When filling out the ADP Pay Stub form, it’s essential to be careful and thorough. Here are some important dos and don’ts to keep in mind:

- Do double-check your personal information for accuracy.

- Do ensure that your hours worked are correctly reported.

- Don’t leave any required fields blank.

- Don’t forget to review your deductions and contributions.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings and deductions for each pay period. |

| Components | The form typically includes gross pay, net pay, taxes withheld, and other deductions like health insurance or retirement contributions. |

| Frequency | Pay stubs are usually generated with each paycheck, whether weekly, bi-weekly, or monthly. |

| Accessibility | Employees can often access their pay stubs online through the ADP portal or receive them in paper form. |

| State-Specific Forms | Some states may have specific requirements for pay stubs, such as California, which mandates itemized deductions as per California Labor Code Section 226. |

| Tax Information | The pay stub provides essential information for employees to understand their tax withholdings and contributions to Social Security and Medicare. |

| Record Keeping | Employees should keep their pay stubs for personal records and for future reference, especially during tax season. |

| Employer Responsibility | Employers are generally required to provide pay stubs to their employees, ensuring transparency in compensation. |

| Discrepancies | If there are discrepancies in the pay stub, employees should report them to their employer or HR department promptly. |

| Confidentiality | Pay stubs contain sensitive information, so employees should handle them with care to protect their personal data. |

Key takeaways

Understanding how to fill out and use the ADP Pay Stub form is crucial for both employees and employers. Here are some key takeaways to keep in mind:

- Accurate Information: Ensure that all personal and employment details are correct. This includes your name, address, and Social Security number.

- Breakdown of Earnings: Review the earnings section carefully. It should detail your gross pay, deductions, and net pay, allowing you to see how much you actually take home.

- Deductions Matter: Pay attention to the deductions listed. This may include taxes, retirement contributions, and health insurance premiums. Understanding these can help you manage your finances better.

- Accessing Your Pay Stub: You can typically access your pay stub online through the ADP portal. Make sure to log in regularly to keep track of your earnings and deductions.

- Keep Records: Retain copies of your pay stubs for your records. They are important for tax purposes and can be useful if you need to verify your income.

By following these guidelines, you can effectively navigate the ADP Pay Stub form and ensure that you have a clear understanding of your earnings and deductions.

Other PDF Templates

Blank Ada Claim Form - List the tooth numbers involved in the procedure.

To facilitate a smooth transaction, it is recommended to utilize the Bill of Sale for a Boat, which provides a comprehensive framework for the necessary details involved in the sale and transfer of ownership.

Profits or Loss From Business - This form must be submitted by the tax return deadline to avoid penalties or interest.

Example - Adp Pay Stub Form

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90

Detailed Instructions for Writing Adp Pay Stub

Filling out the ADP Pay Stub form is straightforward. You will need to gather your personal information and any relevant pay details. Once you have everything ready, follow the steps below to complete the form accurately.

- Start by entering your name in the designated field.

- Provide your employee ID number, if applicable.

- Fill in your address, including street, city, state, and zip code.

- Next, input your pay period dates. Make sure to specify the start and end dates clearly.

- Indicate your hourly rate or salary in the appropriate section.

- List any deductions that apply, such as taxes or benefits.

- Finally, review all the information for accuracy before submitting the form.

Documents used along the form

When managing payroll and employee compensation, various documents accompany the ADP Pay Stub form. Each document serves a specific purpose, ensuring that both employers and employees have clear records of earnings, deductions, and other important financial details. Below is a list of common forms that are often used alongside the ADP Pay Stub.

- W-2 Form: This is an annual tax form that employers must send to employees and the IRS. It details the employee's total wages and the taxes withheld throughout the year.

- W-4 Form: Employees fill out this form to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from an employee's paycheck.

- Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their pay directly into their bank account, providing convenience and security.

- Pay Rate Change Form: When an employee's pay rate changes, this form documents the new rate and the effective date, ensuring transparency and proper record-keeping.

- Trailer Bill of Sale: The Trailer Bill of Sale form is essential for officially transferring ownership of a trailer and includes important transaction details for both the buyer and seller.

- Time Sheet: This form records the hours worked by an employee during a specific pay period. It is essential for calculating overtime and ensuring accurate pay.

- Employee Benefits Enrollment Form: Employees use this form to enroll in or make changes to their benefits, such as health insurance or retirement plans, which can affect their overall compensation.

- Leave of Absence Request Form: This document is submitted by employees seeking time off from work. It helps employers manage staffing and payroll during an employee's absence.

- Payroll Deduction Authorization Form: Employees complete this form to authorize specific deductions from their paychecks, such as contributions to retirement plans or health savings accounts.

Having these documents organized and readily available alongside the ADP Pay Stub form is crucial for both employers and employees. They facilitate transparency and ensure that all parties have a clear understanding of compensation and benefits, promoting a harmonious workplace environment.