Get Acord 50 WM Form in PDF

The Acord 50 WM form plays a crucial role in the world of insurance, specifically in the context of workers' compensation. This form serves as a standardized document that streamlines the process of reporting and managing claims related to workplace injuries. By consolidating essential information, it ensures that both employers and insurance providers have a clear understanding of the incident and the necessary steps for resolution. Key elements of the Acord 50 WM form include details about the injured employee, the nature of the injury, and relevant employer information. Additionally, it outlines the coverage details and any applicable policy numbers. By utilizing this form, stakeholders can facilitate timely communication and decision-making, ultimately enhancing the efficiency of the claims process.

Dos and Don'ts

When filling out the Acord 50 WM form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do read the instructions carefully before starting.

- Do provide accurate and complete information.

- Do double-check your entries for any errors.

- Do sign and date the form where required.

- Don’t leave any required fields blank.

- Don’t use abbreviations or jargon that may confuse the reader.

Following these tips will help ensure your form is processed smoothly and efficiently.

Document Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Acord 50 WM form is used for workers' compensation insurance applications and renewals. |

| Governing Laws | This form is governed by state-specific workers' compensation laws, which vary by state. |

| Usage | Insurance agents and brokers typically use this form to gather necessary information from employers. |

| Importance | Completing the Acord 50 WM form accurately is essential for ensuring proper coverage and compliance with state regulations. |

Key takeaways

The Acord 50 WM form is an important document used in the insurance industry. Below are key takeaways regarding its completion and use.

- The Acord 50 WM form is primarily used for workers' compensation insurance.

- It is essential to provide accurate information to avoid delays in processing.

- Ensure that all required fields are completed; missing information can lead to rejection.

- Double-check the policyholder's details for accuracy, including names and addresses.

- Include the correct effective dates for the insurance coverage.

- Review the classification codes carefully; they determine the premium rates.

- Signature of the authorized representative is mandatory for validation.

- Submit the form through the appropriate channels, whether electronically or via mail.

- Keep a copy of the completed form for your records.

- Be aware of any state-specific requirements that may affect the form's use.

Other PDF Templates

Power of Attorney Dmv - Using this form ensures that all vehicle-related matters are handled legally and appropriately.

Amazing Goodwill Donation Receipt - This acknowledgment serves as an important reminder of the role you play in societal change.

When engaging in a vehicle sale in Texas, it's important to utilize the proper documentation to facilitate the transfer of ownership. One reliable resource for obtaining necessary forms is Texas Forms Online, which provides access to the essential Motor Vehicle Bill of Sale template. This document not only safeguards the interests of both the buyer and seller but also ensures compliance with state regulations.

Bill of Ladings - The form can provide detailed descriptions of the shipped goods, including their quantity and weight.

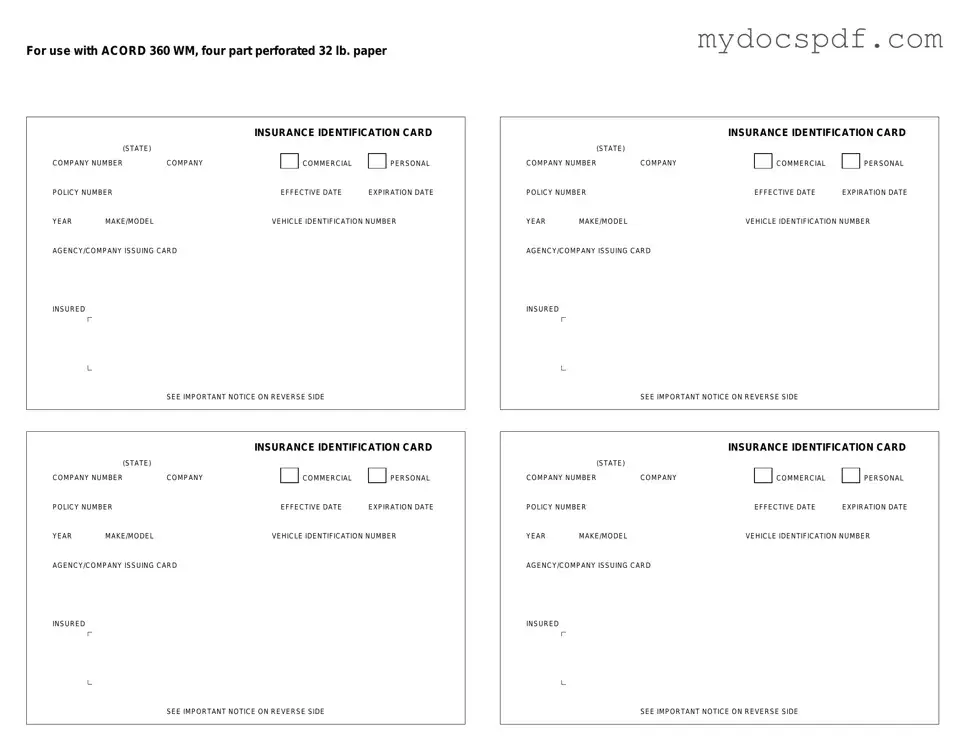

Example - Acord 50 WM Form

For use with ACORD 360 WM, four part perforated 32 lb. paper

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

Detailed Instructions for Writing Acord 50 WM

Filling out the Acord 50 WM form is an important step in the insurance process. This form collects essential information that helps in assessing risks and determining coverage. Below are the steps to complete the form accurately.

- Start with the Applicant Information section. Provide the name of the individual or business seeking insurance coverage.

- Fill in the Contact Information. Include the address, phone number, and email of the applicant.

- In the Policy Information section, indicate the type of coverage being requested. Be clear about the specific needs.

- Complete the Property Information section. List all properties that will be covered under the policy, including their addresses and descriptions.

- Provide details in the Coverage Limits section. Specify the desired limits for each type of coverage.

- Fill out the Loss History section. Disclose any past claims or losses related to the properties listed.

- Review the Signature section. Ensure the applicant signs and dates the form to validate the information provided.

After completing the form, double-check all entries for accuracy. This ensures a smooth submission process and helps avoid delays in obtaining coverage.

Documents used along the form

The Acord 50 WM form is commonly used in the insurance industry, particularly for workers' compensation insurance. When completing this form, several other documents may also be required to ensure a comprehensive submission. Below is a list of some of these essential forms and documents, each serving a specific purpose in the insurance process.

- Acord 25: This is the Certificate of Liability Insurance. It provides proof of insurance coverage and details the types of coverage in place, including limits and effective dates.

- Acord 130: This is the Commercial General Liability Application. It gathers information about the applicant's business operations, which helps insurers assess risk and determine coverage options.

- Acord 126: This is the Commercial Property Application. It collects details about the property being insured, including its location, structure, and value, to evaluate potential risks.

- Loss Runs: These are reports that outline a business's claims history. Insurers review loss runs to understand past claims and evaluate future risk.

- Residential Lease Agreement: A https://newyorkform.com/free-residential-lease-agreement-template outlines the terms and conditions of renting residential property, ensuring both landlord and tenant rights are protected.

- Employee Classification Code: This document categorizes employees based on their job duties. It plays a crucial role in determining the premium rates for workers' compensation insurance.

- Insurance Policy Declarations Page: This page summarizes the key elements of an insurance policy, including coverage limits, deductibles, and the insured parties. It serves as a quick reference for policy details.

Having these documents ready can streamline the process and help ensure that all necessary information is provided to the insurer. Being well-prepared ultimately contributes to a smoother application experience and better coverage outcomes.